(Bloomberg) --

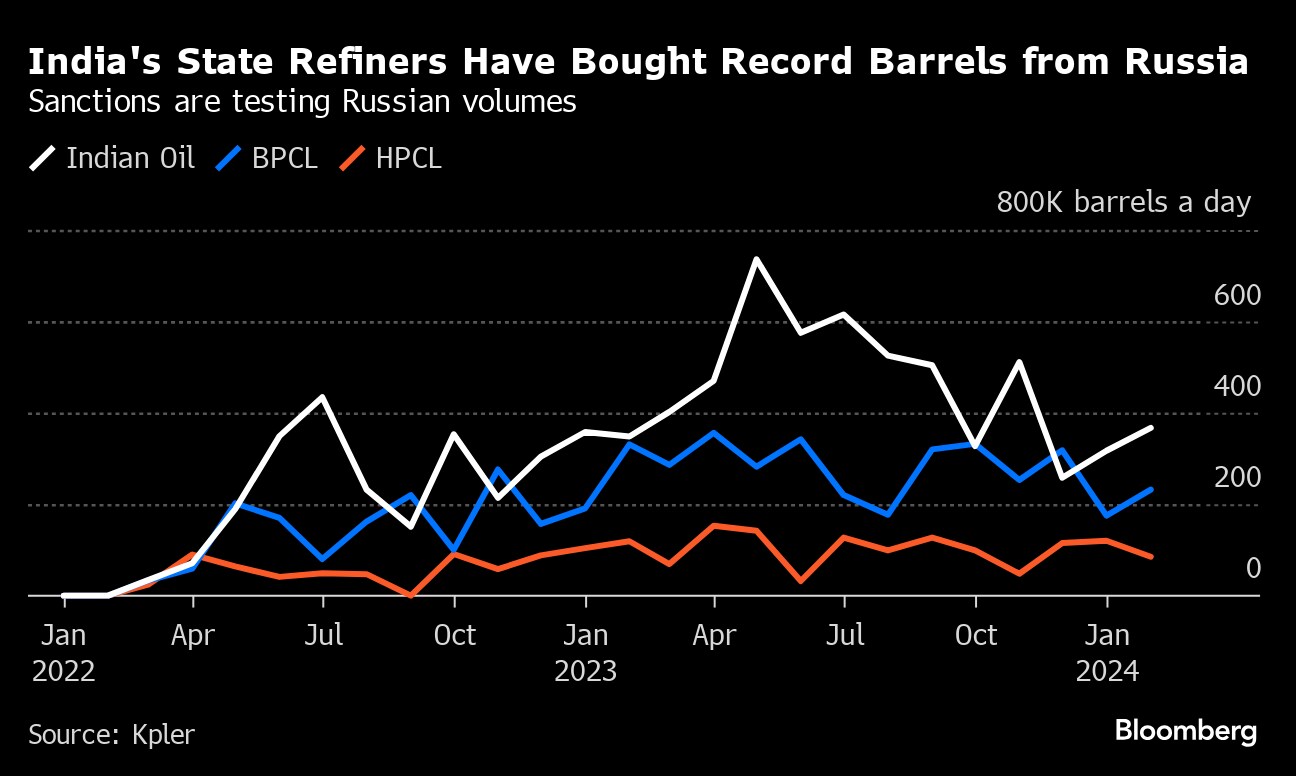

India's state-run oil refiners are shying away from contracted Russian crude supply as the once-booming trade becomes much harder under tighter enforcement of US sanctions.

The biggest state-owned refiner Indian Oil Corp. will likely reduce the amount of crude received under so-called term supply, while Bharat Petroleum Corp. and Hindustan Petroleum Corp. have decided against making firm commitments to take contracted oil next financial year, six people familiar with the matter said, asking not to identified because the information is private.

The three refiners had been in talks with Russia's Rosneft PJSC to secure about 500,000 barrels a day — equivalent to a third of India's daily imports — to try and reduce reliance on one-off purchases that can often be more expensive. The lukewarm response to a suggested contract clause that would address supply disruptions added to the caution from Indian refiners, the people said.

Indian Oil has an existing long-term deal with Rosneft, but contracted supply would have been a first for HPCL and BPCL.

Russia is still the biggest supplier to India, but there are signs refiners are buying more from other producers, including Saudi Arabia. The state-owned companies are also seeking contracted crude from the Middle East and West Africa, but the deals are likely to be more expensive than Russian oil, the people said.

State refiners are expected to meet 40% of their crude needs in the financial year starting April 1 through one-off purchases, or spot deals, meaning big volumes of oil from Russia could still flow to India, four of the people said.

Last year, Indian Oil entered into a series of deals with Rosneft, Sakhalin-1 LLC and Gazprom Neft PJSC to take 24.5 million tons, or 492,000 barrels a day, for the year ending March 31, two of the people said. That compares with a pre-war contract with Rosneft in 2021 to take 2 million tons over a year.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.