The promoter entity of Fortis Healthcare Ltd. has sold a large chunk of its holdings in the open market, according to the insider trading data available and disclosed to the stock exchanges. Since the start of this month, Fortis Healthcare Holdings Pvt Ltd (FHH), a promoter group entity has sold nearly 1.66 crore shares.

Big Chunk Sold This Week

The promoter holding via FHH at the start of the month was 47.81 percent which now stands at 43.74 percent.

This means that the promoter group holding stands reduced by 4.07 percent in less than one month.

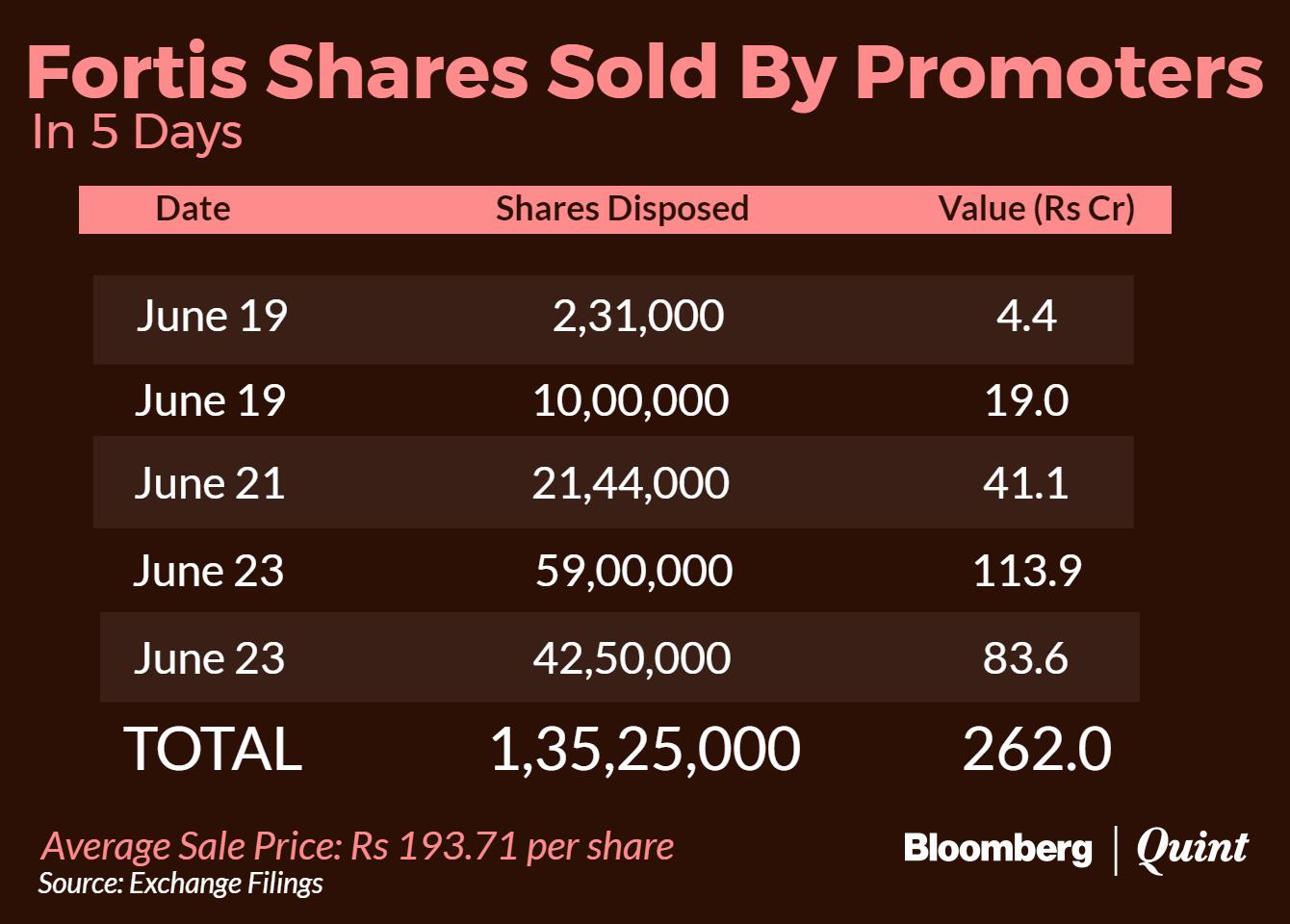

Within the last five trading sessions, FHH sold shares worth Rs 262 crore at an average price of Rs 193.71 per share.

FHH Selling Shares Heavily Since April

The exchange filing for shareholding in the company reveals that FHH held 52.2 percent stake as on March 31, 2017. Simultaneously, as of March 2017, 85.78 percent of FHH's shareholding was pledged to various financial institutions, as per stock exchange filings.

The latest disclosure to the stock exchanges shows that FHH's shareholding is now 8.46 percent lower than it was in March 2017.

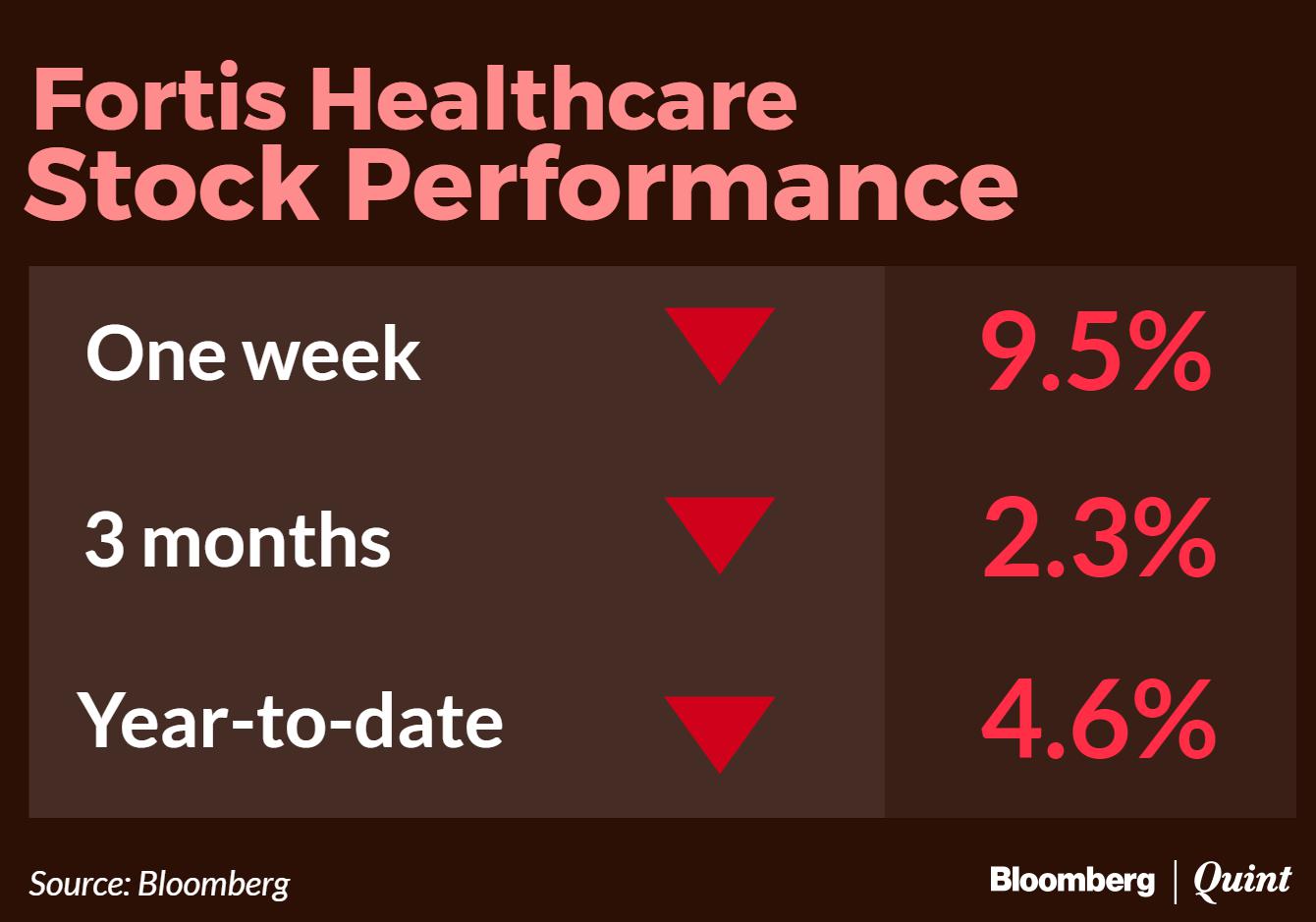

Promoter's Sale Adds To Selling Pressure

There had been news reports earlier suggesting that Integrated Healthcare Holdings (IHH) of Singapore may look to buy the promoter stake in Fortis Healthcare, which had fueled rally in the stock. However, towards the end of the week, IHH issued a statement saying that the firm was nowhere close to concluding a deal with Fortis Healthcare and its promoter. Post that clarification late on Thursday, shares of Fortis closed over 12 percent lower on Friday. The company's promoters are yet to respond to an e-mail query sent by BloombergQuint.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.