(Bloomberg) -- Diverging views on oil's outlook has prompted debate ahead of an OPEC+ meeting in the final weekend of November. China and the the US agreed to step up joint action to tackle climate change in the lead up to a key United Nations meeting. Copper trades are signaling a shaky 2024, while cocoa is soaring. And a UK summit is set to shine a light on food security when hundreds of millions of people worldwide suffer from undernourishment.

Here are five notable charts to consider in commodity markets as the week gets underway.

Crude

Signs that oil markets won't be as tight as expected are emerging, just as the Organization of Petroleum Exporting Countries and its allies are set to gather in Vienna next Sunday. The International Energy Agency's latest monthly report anticipates a roughly 30% smaller supply shortfall than previously forecast, helped by strong production growth in the US and Brazil. The IEA now sees demand running ahead of supply by about 900,000 barrels a day — a disconnect from the 3 million barrels-a-day shortfall expected by OPEC's analysts. On the supply side, Energy Information Administration data last week shows a large build in US crude inventories that lifted stockpiles to the highest level since August.

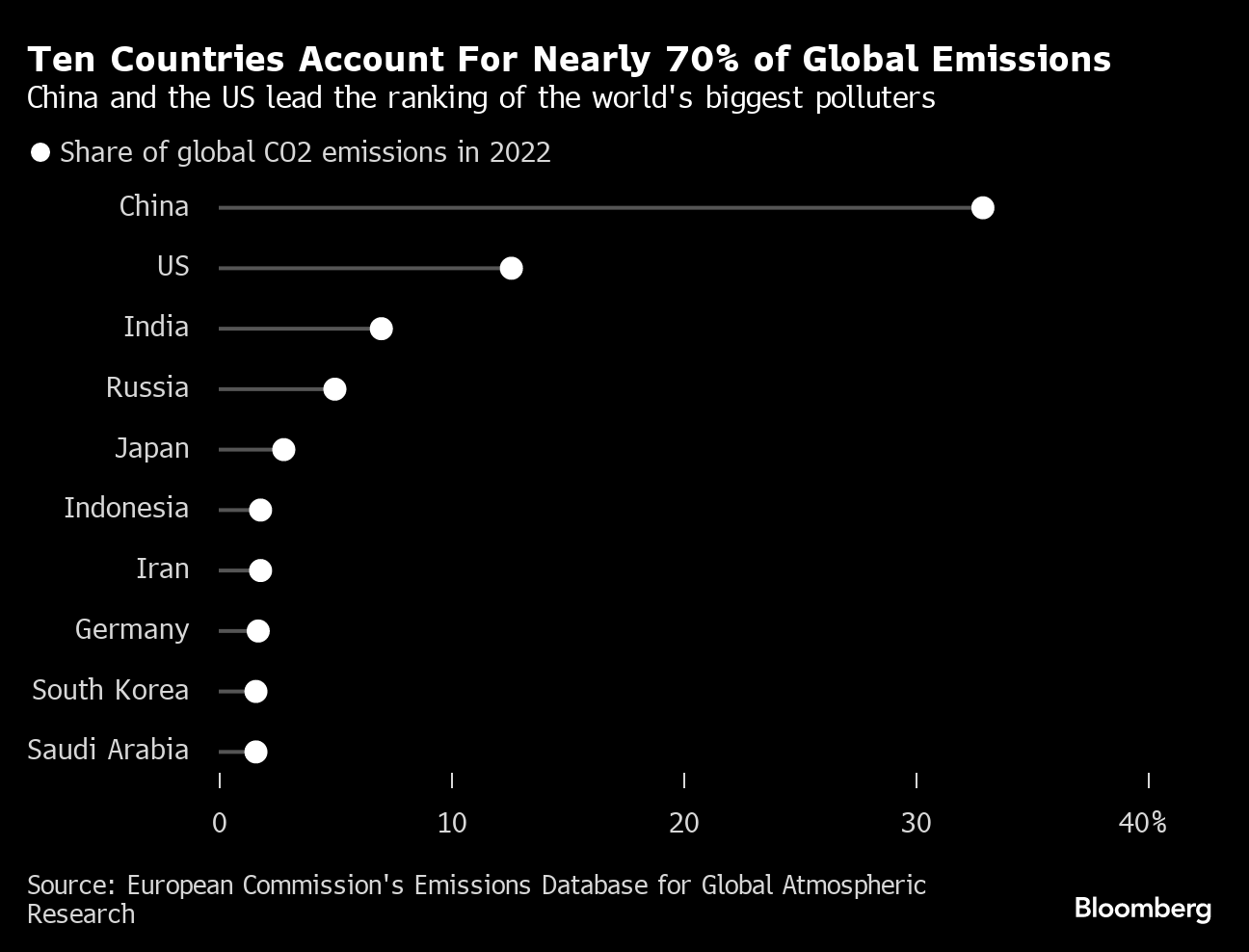

Climate

The US and China, the world's biggest polluters, have promised to revive collaboration in the fight against climate change in advance of United Nations talks in Dubai opening later this month. The top of the agenda at the COP28 climate summit will be a global assessment on efforts to meet the 2015 Paris Agreement, which promised to keep global warming to well below 2C and strive for 1.5C. It's expected to conclude that countries haven't done enough to meet the Paris goals and that they need to pledge more ambitious targets in 2025.

Copper

The global copper market is sending a clear warning over its shaky prospects for next year, with a closely watched pricing pattern widening further in a sign of ample prompt supply of the bellwether commodity. Cash metal changed hands at a discount of $98.80 a metric ton to the benchmark three-month contract Friday on the London Metal Exchange. That's the widest gap on a closing basis in data going back to the 1990s. The structure, known as contango, indicates there's enough metal to feed immediate demand. At a major industry event in Shanghai last week, sentiment for 2024 was mixed, with many market players expecting a growing surplus of refined metal even as output from mines is under pressure.

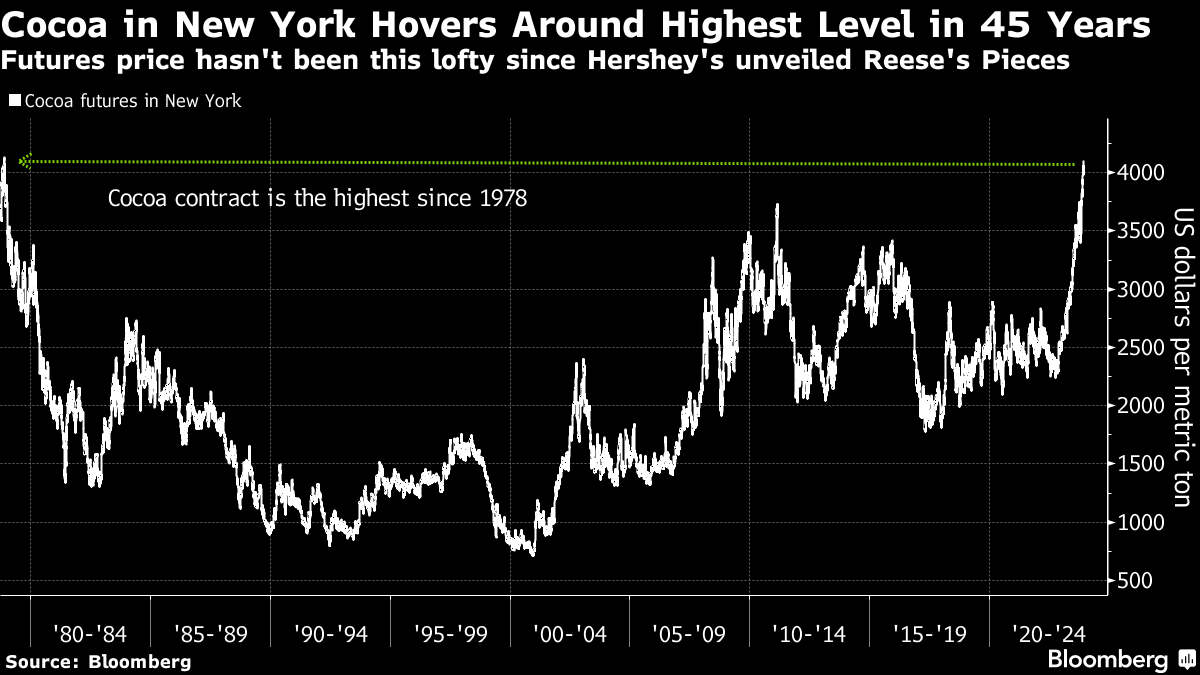

Cocoa

Cocoa in New York is trading around its highest level in 45 years as the global market enters a third year of shortages for the key chocolate-making ingredient. Prices haven't been this lofty since Hershey Co. introduced Reese's Pieces in 1978. The start of the harvest in Ivory Coast and Ghana — the biggest cocoa producers — is lagging behind last season's pace, raising fears of a supply shortfall and pushing the market higher. Elevated prices are giving Latin America's biggest producer, Ecuador, a helping hand in its push to overtake Ghana as the second-largest grower.

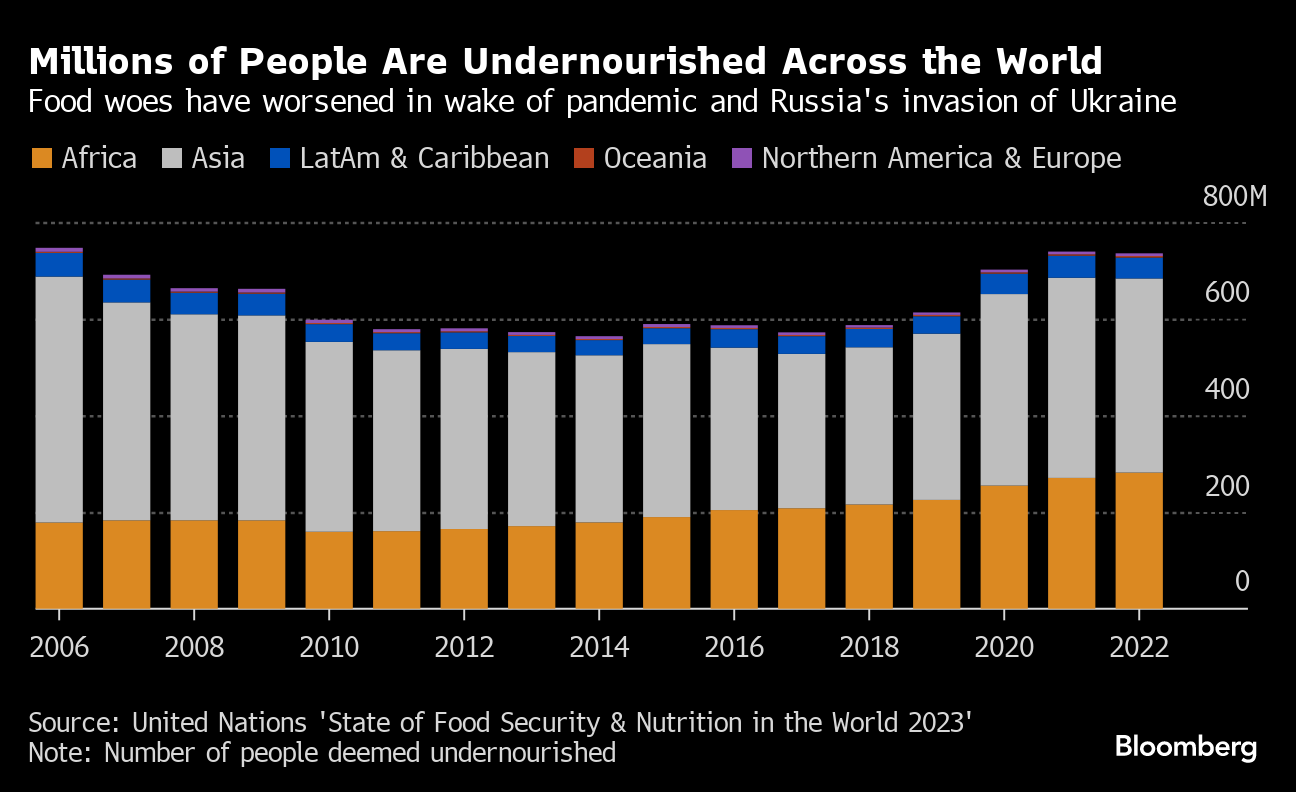

Food Security

A deepening crisis around access to food will likely be a key topic for attendees of the Global Food Security Summit on Monday in London. The UK gathering comes as agricultural goods are affected by the impacts of drought, Russia's lingering war in Ukraine, supply chain disruptions and crop shortfalls, contributing to elevated food prices across the world. About 735 million people — or 9.2% of the global population — were undernourished last year, according to UN agencies, leaving the world far from a target of eradicating hunger by the end of this decade.

--With assistance from Ilena Peng, Agnieszka de Sousa, Eric Roston and Brian Eckhouse.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.