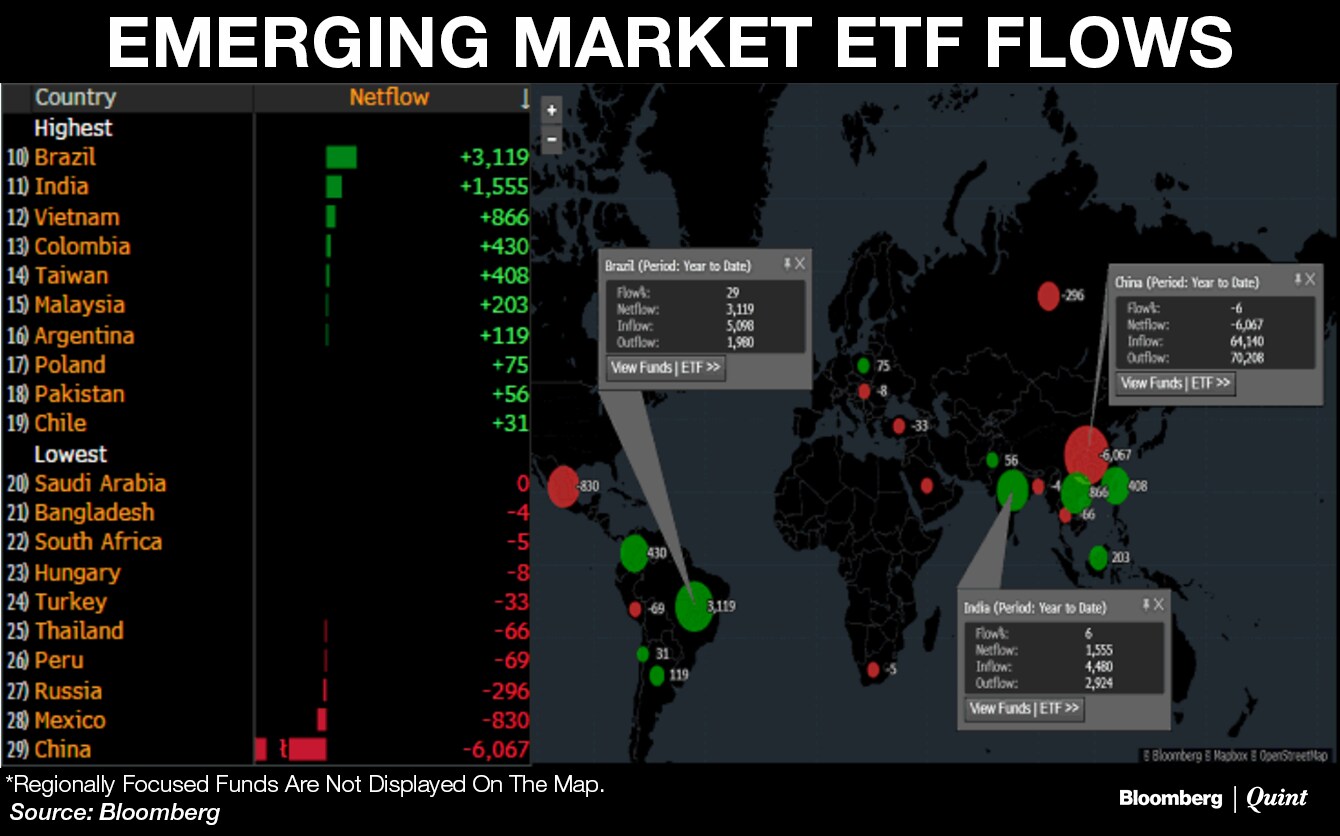

Inflows from emerging market exchange-traded funds rose to their highest in three years for Brazil and India at the expense of China.

Brazil led with $3.2-billion inflows followed by India at $1.6 billion. That compares with $6-billion outflows from China, according to Bloomberg data. Emerging market ETFs' Brazil assets rose 29 percent followed by a 6 percent growth in India. Their Chinese investments shrank 6 percent.

That reflects in the equity benchmarks of the three countries. India's Nifty 50 has returned about 28 percent this year, making it the second best performer among the top global indices after Hong Kong's Hang Seng. Brazil's Bovespa follows with 25 percent gains. China's Shanghai Composite has returned about 5 percent in 2017.

All India-focused ETFs have $25.3 billion in assets, giving an average return of 26.5 percent.

- Equity funds manage $24.1 billion in India with a net inflow of $1.6 billion at an average return of 34.2 percent.

- Commodity ETFs' total assets stand at $782 million after an outflow of $24.4 million. They returned average gains of 1.1 percent.

- Fixed income ETFs manage $295.5 million after an outflow of $1.23 billion. They returned 4.4-percent.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.