(Bloomberg) -- Electric vehicles have swiftly gone from a bright spot in the global climate fight to cause for concern, leading BloombergNEF to slash sales estimates and warn that the auto industry is falling further off the track toward decarbonization.

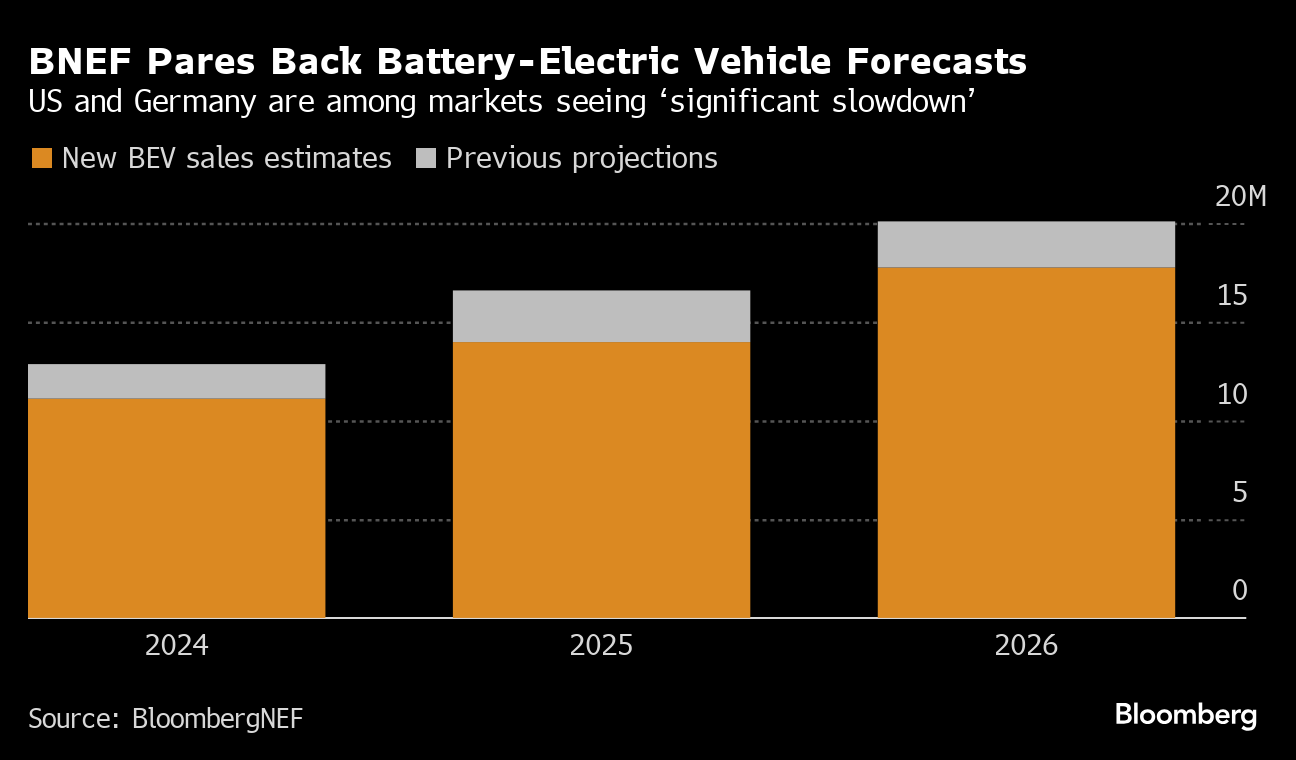

In its annual Electric Vehicle Outlook, BNEF reduced its battery-electric sales projections by 6.7 million vehicles through 2026. While the demand deceleration isn't universal across countries and EVs will be buoyed somewhat by the resurgence of plug-in hybrids, a few Nordic countries and the state of California are the only places on pace to eliminate passenger vehicle fleet emissions by 2050.

“Some markets are experiencing a significant slowdown and many automakers have pushed back their EV targets,” BNEF analysts led by Colin McKerracher wrote in the report released Wednesday. “The window for achieving net-zero emissions in road transport is closing quickly and there is no room left for complacency.”

The outlook for fully electric vehicles has markedly deteriorated in the past year. BNEF began the 2023 edition of its EV Outlook by highlighting the profound transformation sweeping the auto sector and the rapid spread of electrification across almost all vehicle types. This year, the researcher recaps how several of the world's largest manufacturers — including Ford Motor Co., General Motors Co., Volkswagen AG and even Tesla Inc. — have dialed back ambitions in recent months.

BNEF sees China continuing to dominate EVs, batteries and the global supply chains for raw materials and components, spurring pushback by Washington and Brussels in the form of higher tariffs. Indeed, the European Union is poised to slap new levies on EV imports from manufacturers including BYD Co. and Geely Automobile Holdings Ltd. Calls for a level playing field have fallen on deaf ears in Beijing, where the government spent decades doling out what likely amounted to tens of billions of dollars in subsidies.

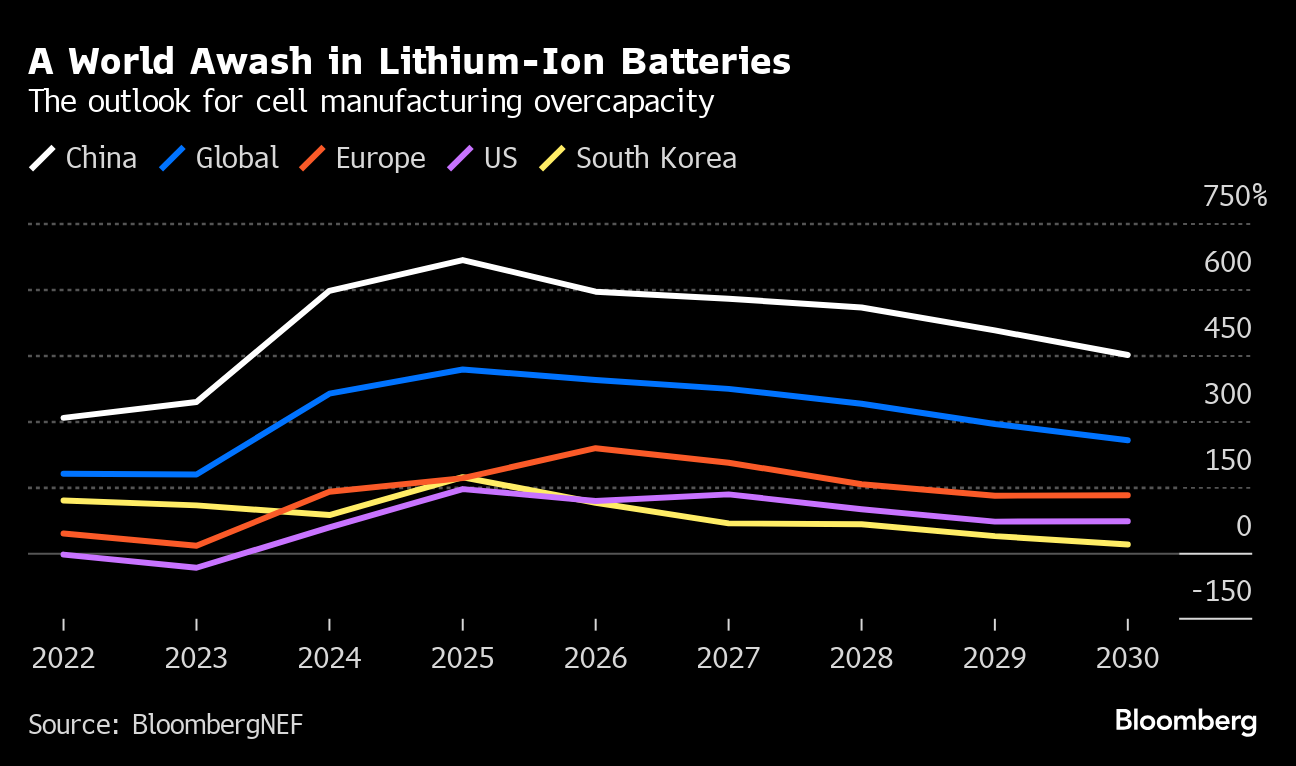

China can now make far more batteries than it needs, which is driving down prices in dramatic fashion. The nation's cell manufacturing capacity already was more than three times domestic demand last year and will rise to more than six times in 2025, if all factories planned for the country come online.

This has helped drive prices for China's lithium iron phosphate battery cells — a cheaper chemistry rapidly gaining adoption — down to $53 per kilowatt hour, roughly half the global average. As a result, the nation is “the only large auto market that has reached the point of consumer-led takeoff for EV sales,” BNEF said.

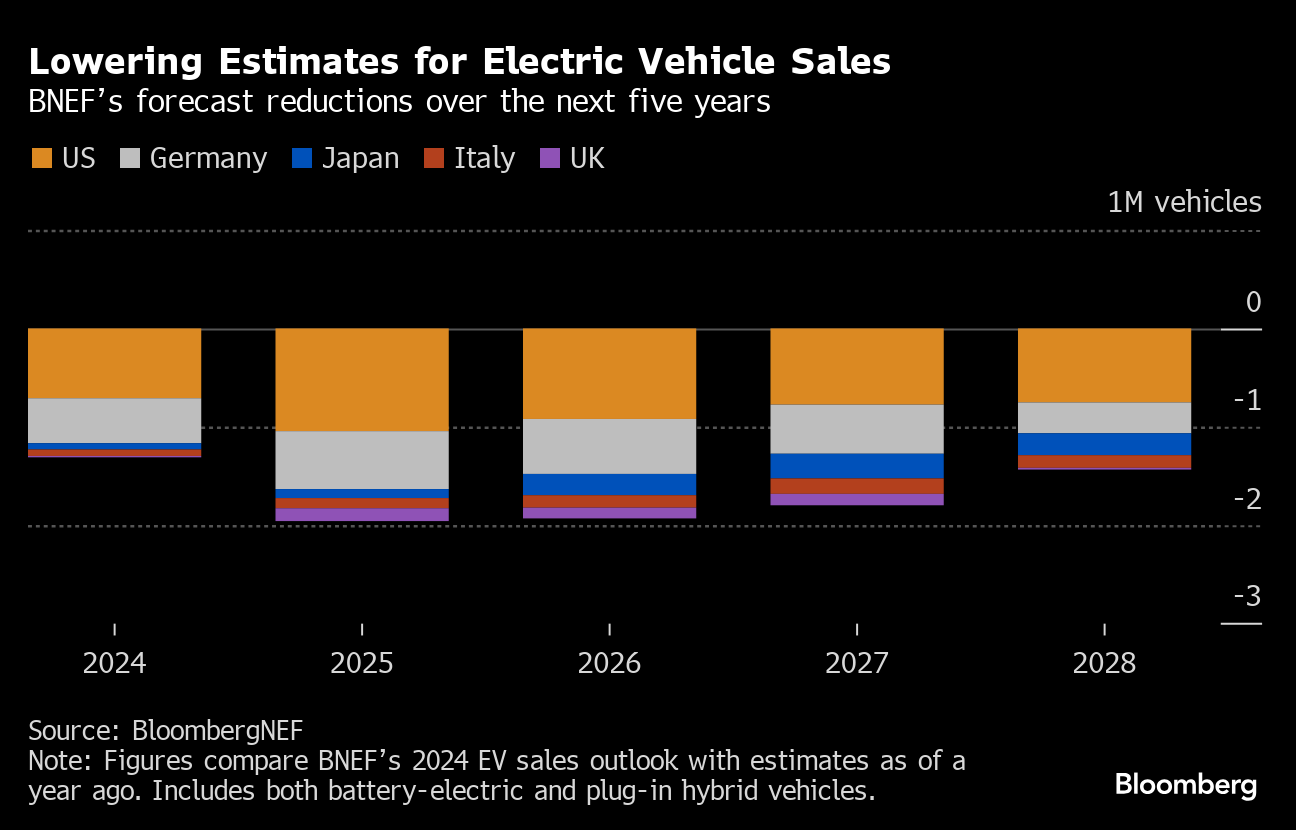

Battery price declines haven't been nearly as steep in other major markets, contributing to BNEF cutting its overall EV sales projections — which include plug-in hybrids — for this year and each of the next four years in the US, Germany, Japan, Italy and the UK.

The reasons BNEF cites for the reductions across five members of the Group of Seven vary by country:

- Ford and GM's “lackluster” performance, Tesla's aging lineup and uncertainty about the US presidential election

- Germany abruptly ending subsidies in December and the country's challenging economic conditions

- A lack of commitment to EVs among Japan's major carmakers and few new electric models in the nation's minicar segment

- Inconsistent regulatory support in Italy and the UK

“The transformation might take longer than expected,” Mercedes-Benz Group AG Chief Executive Officer Ola Källenius said at the carmaker's annual meeting last month. The maker of S-Class sedans and G-Wagon SUVs now expects to continue making combustion-engine and hybrid vehicles well into the 2030s, backing off a goal to go all-electric in some markets by the end of the decade.

Before Mercedes altered its targets, Volkswagen scrapped plans for a €2 billion ($2.15 billion) EV factory in Germany; Ford, GM and Tesla pumped the brakes on plant investments; and Tata Motors Ltd.'s Jaguar Land Rover announced a slower rollout of battery-electric models, citing surprise at the level of demand for its plug-in hybrids.

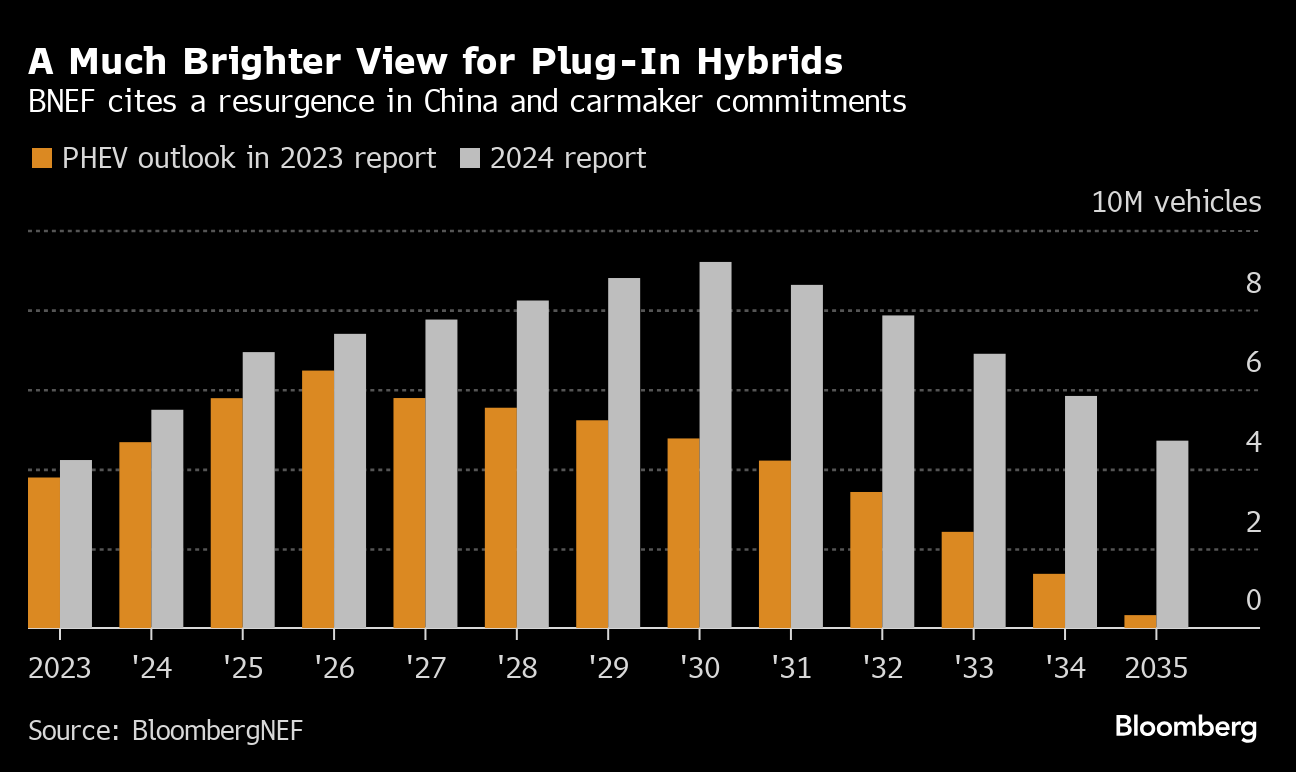

JLR is far from alone in this regard. One of the more upbeat themes of BNEF's report is the boom in demand for plug-in hybrid electric vehicles, or PHEVs.

In response to PHEV sales rising at a faster rate than battery-electric or conventional hybrid vehicles since 2019, BNEF dramatically increased its estimates for sales through the middle of the next decade. As of last year, the researcher expected sales to top out just shy of 6.5 million vehicles by 2026, then fade to around 325,000 by 2035. Now, BNEF sees a peak of almost 9.2 million in 2030, and for more than 4.7 million to be sold in 2035.

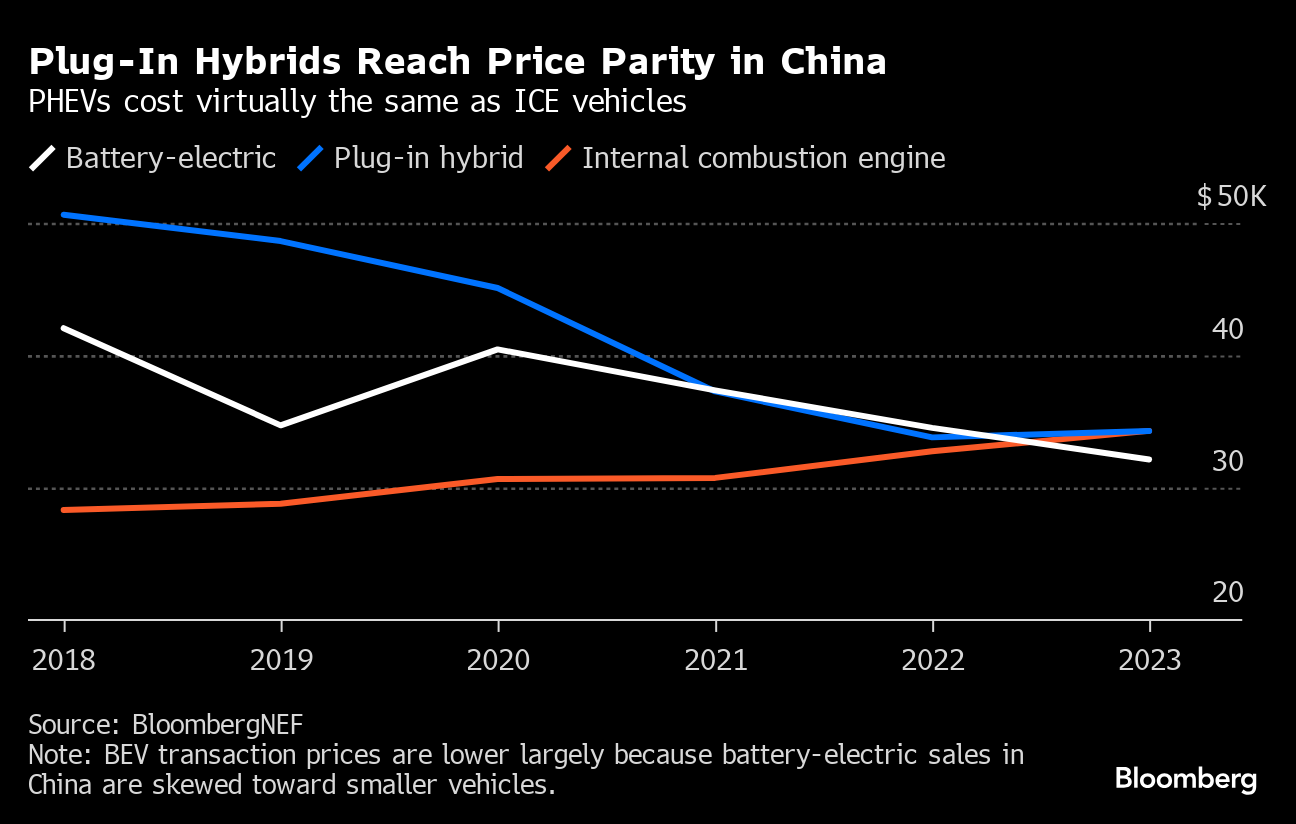

China became the world's top market for PHEVs in 2022, thanks to the introduction of affordable models from BYD and Li Auto Inc. PHEVs now sell for virtually the same average price in China as vehicles running entirely on internal combustion engines.

“It's a well-conceived move by the Chinese automakers to use this technology to try to tempt the more resistant consumers in those not-yet-saturated parts of China,” said Aleksandra O'Donovan, who leads BNEF's Electrified Transport research team. “It's a big country.”

But BNEF's positivity about PHEVs comes with a caveat.

Studies by the nonprofit International Council on Clean Transportation and the advocacy group Transport & Environment have found that PHEVs emit more in real-world driving than in tests used for regulatory compliance and ratings advertised to consumers. This is largely because the procedures assume vehicle owners will drive in electric mode more than they actually do.“There's a bit of risk in putting too much faith in PHEVs,” O'Donovan said. “How decarbonization-friendly they are will depend on how much they're charged, and the evidence so far on that front is not great.”

While the uptick in PHEV demand helps keeps BNEF's forecast for 2024 electric vehicle sales broadly in line with what was expected in previous years, the rate of growth in the next four years is expected to average 21% annually, compared to 61% between 2020 and 2023.

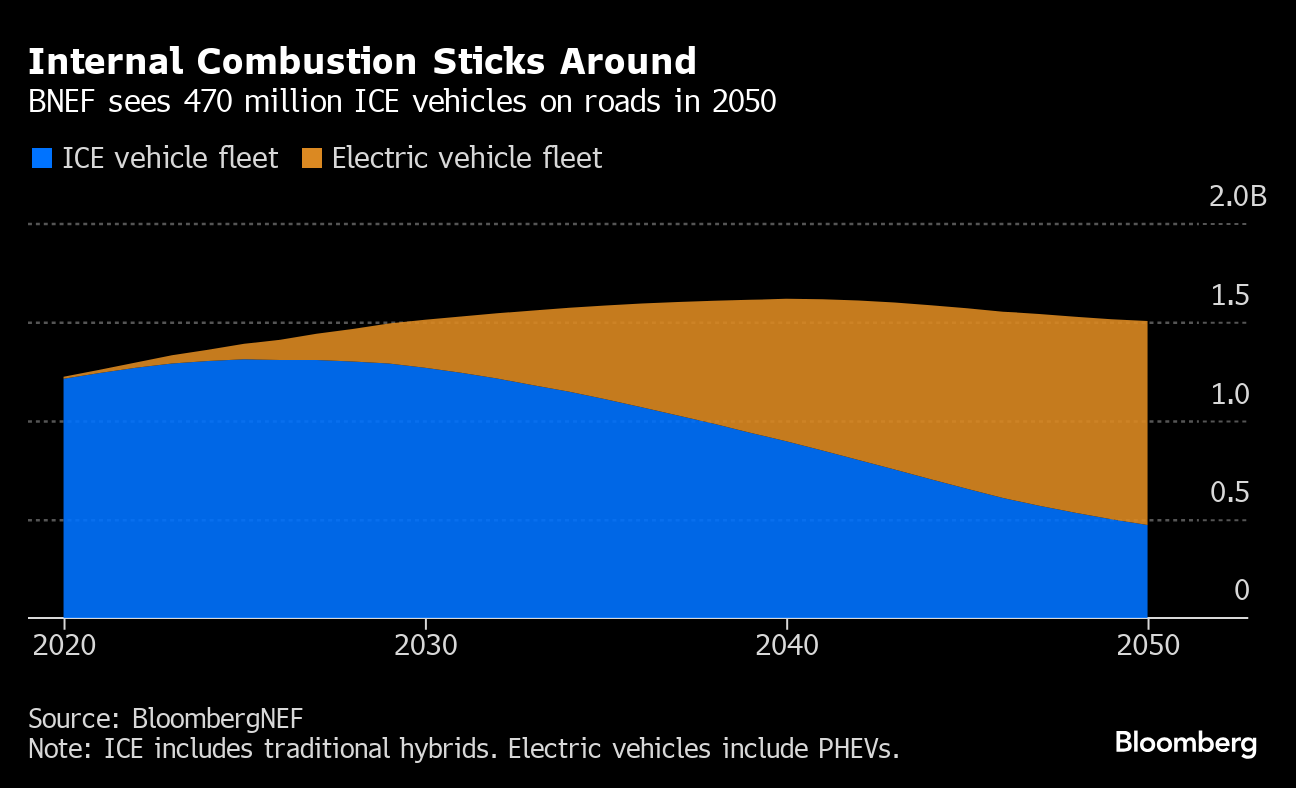

The global fleet of internal combustion engine vehicles is expected to peak next year, but sales would need to end altogether by around 2038 for the world to get to a completely zero-emission fleet by 2050.

Only Nordic countries, including Norway, are on pace to fully phase out ICE vehicle sales in the necessary time frame, BNEF said.

--With assistance from Wilfried Eckl-Dorna.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.