(Bloomberg) --

Credit Suisse Group AG's riskiest bonds rose sharply as traders bet that UBS Group AG's deal to buy the troubled lender would spare holders significant losses.

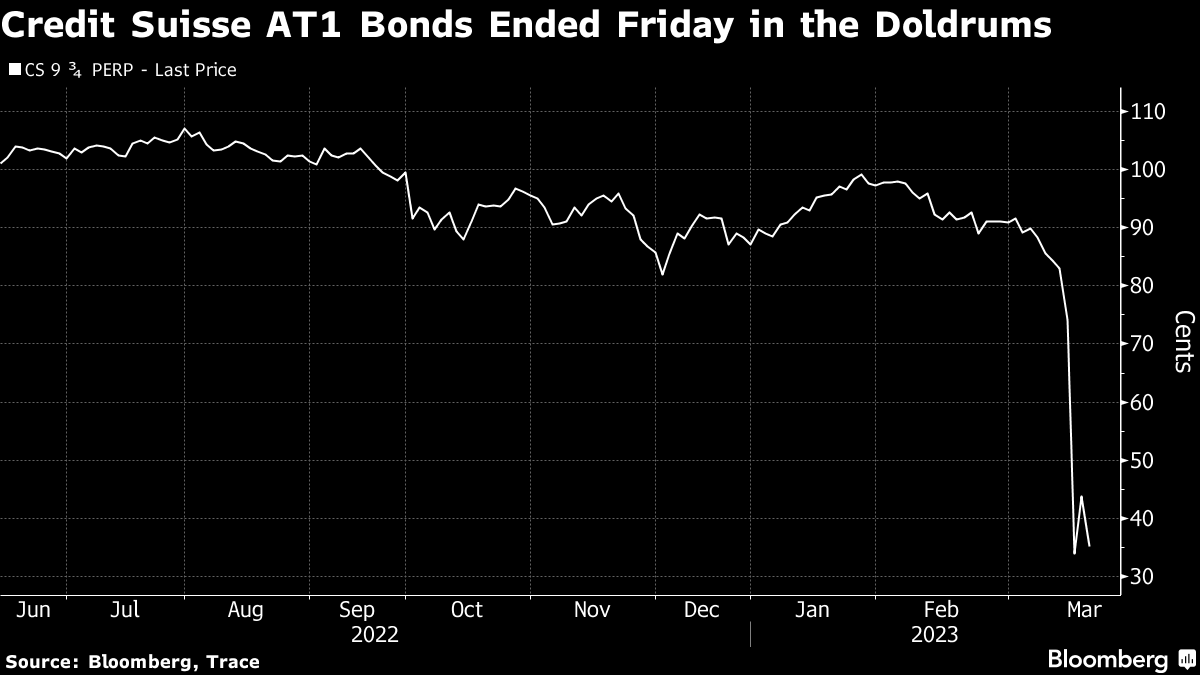

Additional Tier 1 notes were quoted between 50 and 70 cents on the dollar in the wake of the deal announcement, up from the mid 20s to high-40s earlier in the day, according to people with knowledge of the matter, asking not to be named because price quotes in the over-the-counter market are private.

Earlier in the day, pricing fluctuated as traders weighed two contrasting scenarios: either the regulator would nationalize part or the whole bank, possibly writing off Credit Suisse's AT1 bonds entirely, or a UBS buyout with potentially no losses for bondholders.

Traders are still waiting for guidance on whether the deal would involve any so-called burden-sharing, which would impose losses on holders of the $17.3 billion stack of additional tier 1 bonds. The Swiss government is set to hold a press conference on the deal at 7:30 p.m. local time.

The securities, introduced after the global financial crisis, are designed to help banks bolster capital to meet regulations designed to prevent failure. They can be written off if a bank's capital levels fall below a specified level. In Credit Suisse's case its common equity tier 1 would need to fall below 7% of its risk-weighted assets.

Several banks including Goldman Sachs, Morgan Stanley and Jefferies Financial Group have kept their bond sales and trading desks open through the weekend for Credit Suisse bonds, a rare occurrence except in times of stress.

(Updates with latest quotes on AT1 bonds throughout)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.