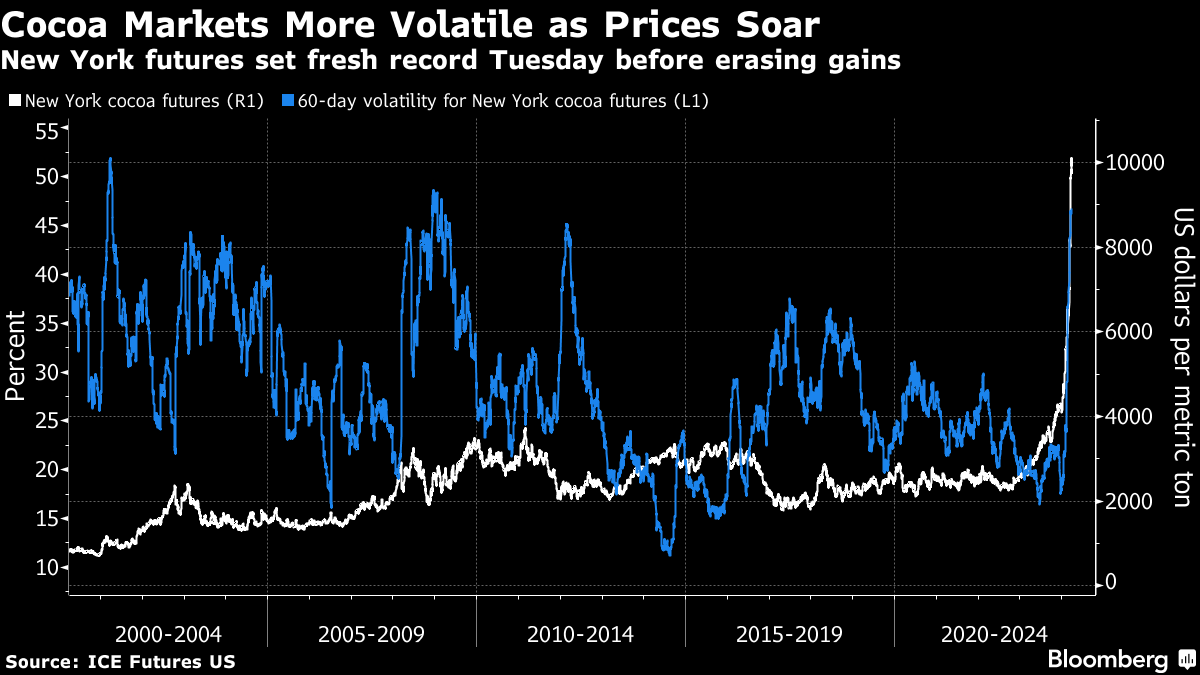

(Bloomberg) -- Cocoa futures took a dip lower after hitting a fresh record earlier on Tuesday. This year's dizzying rally combined with lower open interest has left the market more vulnerable to volatility.

The most-active contract in New York fell as much as 2.5%, erasing earlier gains to an intraday record of $10,324 a metric ton. Cocoa prices have more than doubled this year on lower West African production. Recently, the market has become more choppy, with a 60-day measure of volatility at its highest in about 15 years.

Meanwhile, total combined open interest for futures hasn't been this low since 2021, exchange data show.

Read More: Cocoa Market Risks Breaking Point as Wild Moves Show Stress

Still, there is “no indication of a top” amid worries over top grower Ivory Coast's mid-crop harvest, according to a Tuesday note from the Hightower Report. The smaller of two annual harvests is expected to lag at least 100,000 tons below the prior season, Bloomberg reported last month.

“Weather reports out of West Africa continue to bode poorly for the mid-crop,” analysts at the Hightower Report said in a Tuesday note, adding that some farmers have described the heat as “unbearable.”

While some rain reached cocoa areas in parts of the region over the weekend, more will be needed to ease dryness facing crops, forecaster Maxar said in a note.

Meanwhile, farmers in the country will be paid 1,500 CFA francs a kilogram for the mid-crop, marking a 50% increase from the main-crop harvest. Prices are still well below the global market, but the raise could encourage more deliveries for processing and exporting.

Higher pay could also boost production in the longer-term by allowing farmers to reinvest in their crops. But markets remain focused on the near future, said John Goodwin, a senior commodity analyst at ArrowStream Inc.

“The cocoa market is extremely short-sighted right now, so we probably won't see a price reaction until the higher farm-level pricing bears fruit — literally and figuratively — in the form of higher shipments out, and it's far from a guarantee that one will lead to the other,” Goodwin said.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.