Shares of Cartrade Tech Ltd. rose the most in a week after Kotak Institutional Equities initiated coverage on the marketplace for used vehicles with an 'add'.

Cartrade will be a direct beneficiary of rising automotive sales resulting in higher ad spends by original equipment makers, as well as higher share of digital advertising, the brokerage said in an April 13 report.

Rising smartphone and internet penetration, along with improved vehicle sales, will boost Cartrade's classifieds business comprising CarWale and BikeWale, it said.

Cartrade is one of the only two players focused on automotive classifieds, and Kotak sees the "most value" in this segment. "Its rich content, multi-vehicle offering and strong brand and high proportion of organic traffic lead us to believe that this can be a steady growth business with opportunities for margin expansion."

The brokerage pegged the fair value of the stock at Rs 650 apiece, implying a potential upside of 6%.

The bulk of the stock's value can be attributed to the classifieds business. Shriram Automall India Ltd. or SAMIL, a platform for car auctions in which Cartrade has a 51% stake, is a profitable offline business, the report said.

"Cartrade is one of the few players in the offline auction business and we believe the auction volumes will increase at least in line with overall auto industry growth for the next several years."

SAMIL, Kotak said, can sustain mid-teen revenue growth rates even in the medium term as Cartrade would supplement the offline business with its online business. Large value creation from Absure (buying and selling pre-owned cars), however, may be "some time away".

The brokerage expects Cartrade's revenue to grow at an annualised rate of 22% over FY22-25, boosted by growth in core businesses (advertising and SAMIL), as well as incremental contribution from Absure.

Cartrade has a "strong balance sheet with negligible debt", and the company could have a net cash of Rs 940 crore by March 2024, the report said.

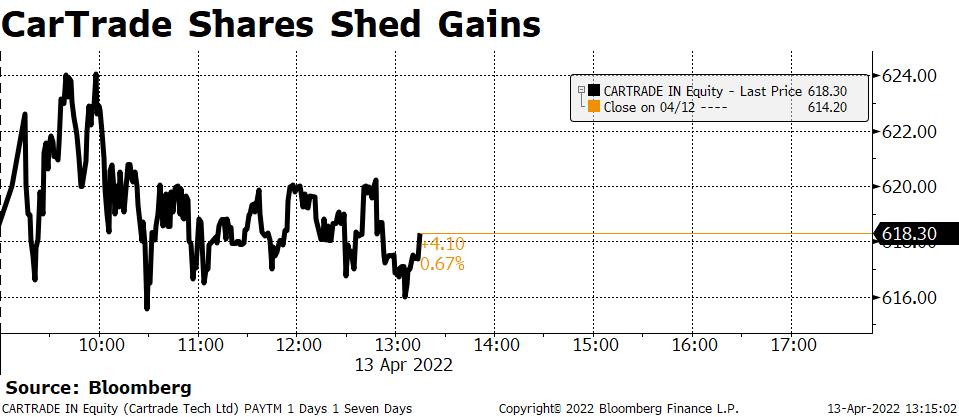

Shares of the company rose as much as 2.6% to Rs 630 apiece, before shedding gains to trade 0.5% higher as of 1:15 p.m. on Wednesday. That's still about 60% lower than its IPO price of Rs 1,618 in August last year.

The stock had tumbled amid a global tech selloff earlier this year, which saw listed internet companies such as Zomato Ltd., FSN E-Commerce Ventures Ltd. (parent of Nykaa), One97 Communications Ltd. (parent of Paytm) and PB Fintech Ltd. (parent of Policybazaar) slump below their listing price.

All the three analysts tracking Cartrade Tech suggest a 'buy', according to Bloomberg data. The average of the 12-month price targets implies an 82.5% upside.

Key risk factors cited by Kotak:.

Public health threat such as Covid-19, in the future, could dampen demand and operations.

Higher discounting and attractive financing by original equipment manufacturers/dealers.

Rise in preference for ride-hailing and vehicle rental services.

Adverse regulations.

Technological obsolescence.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.