Restaurant Brands Asia Ltd.'s board of directors approved on Friday a plan to raise up to Rs 500 crore through a qualified institutions placement, according to the exchange filing.

The operator of popular chains like Tim Hortons, Burger King and Popeyes in India will issue equity shares or other eligible securities in one or more tranches as per the applicable regulations. The decision was taken at a board meeting, it said.

The total number of stock options proposed to be granted under the scheme shall not exceed approximately 1.05 crore. The proposed fundraising will be executed under the Securities and Exchange Board of India Regulations, and other applicable laws, the filing stated.

The company stated that the funds would be utilised for growth initiatives and general corporate purposes, subject to necessary shareholder and regulatory approvals. A dedicated committee of the board has been authorised to oversee and execute the fundraising process.

According to the company's website, it is one of the world's largest quick service restaurant companies with over 30,000 restaurants in more than 120 countries and territories.

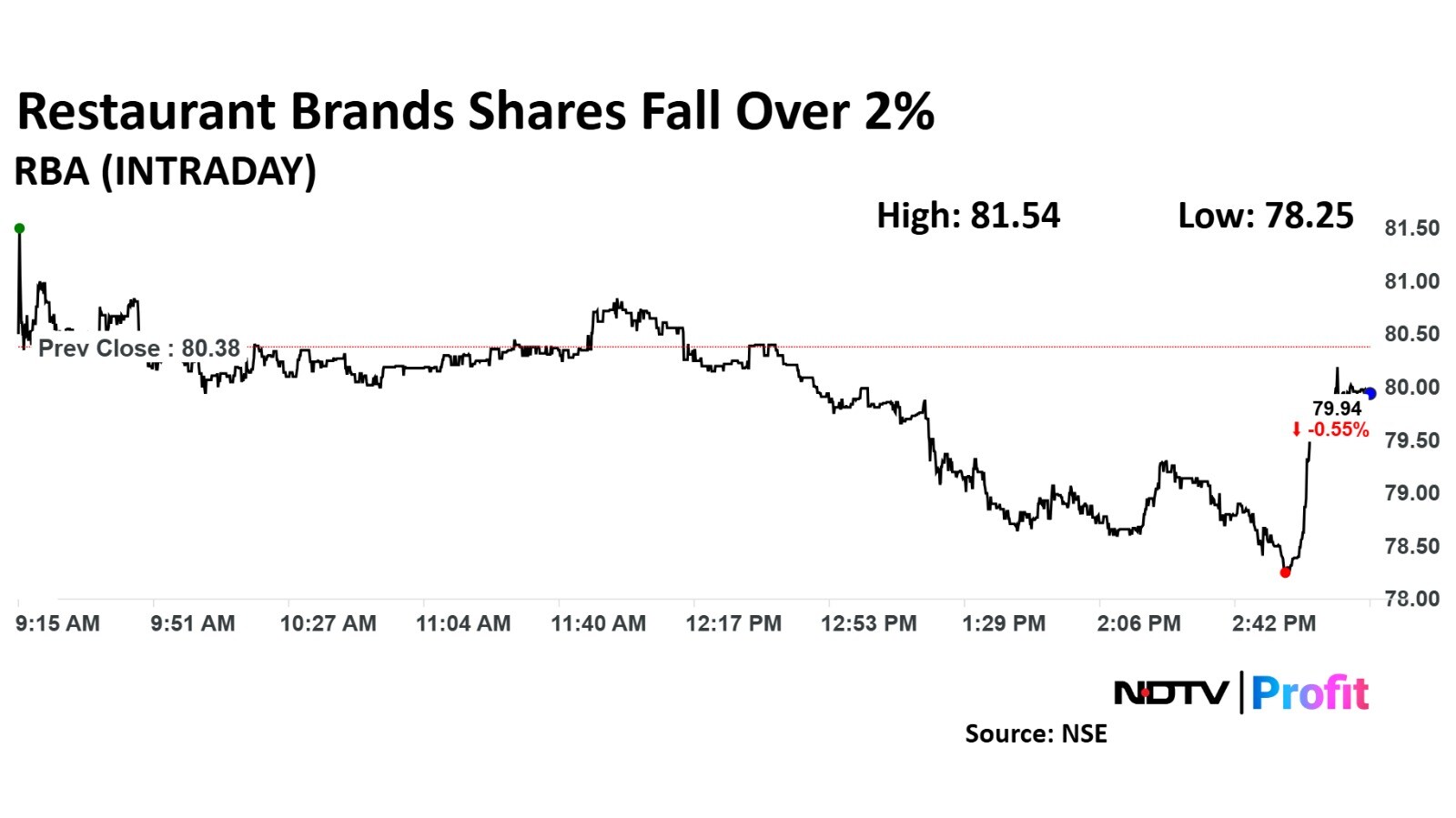

Shares of Restaurant Brands fell as much as 2.65% during the day to Rs 78.25 apiece on the NSE. It was trading 0.52% lower at Rs 79.96 apiece, compared to an 1.63% decline in the benchmark Nifty 50 as of 3:15 p.m.

The share price has fallen 27.43% in the last 12 months and 28.49% on a year-to-date basis. The total traded volume so far in the day stood at 0.7 times its 30-day average. The relative strength index was at 32.03.

Five out of the 12 analysts tracking the QSR handler have a 'buy' rating on the stock, four recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 107.92, implying a upside/downside of 37.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.