Introducing Election Soundtrack, a daily podcast that'll get you up to speed with everything that you need to know about Elections 2019.

Here is a roundup of the day's top stories in brief.

1. Supreme Court Quashes RBI's Feb. 12 Circular

The Supreme Court struck down the Reserve Bank of India's Feb. 12 circular on the grounds that the regulator can give directions to banks on stressed assets only upon the central government's authorisation and in case of a specific default.

- The direction has to be only for specific cases of default by specific debtors and not issuance of directions to banking companies generally, the apex court said in its order.

- The judgment interprets provisions—sections 35AA and 35AB—under the Banking Regulation Act and section 45L of the RBI Act, which were relied upon by the regulator to issue the Feb. 12 circular.

- The circular had attempted to lay down a rule-based stressed asset framework which asked banks to resolve stress in large accounts within 180 days or refer them for insolvency proceedings.

- “The net result of this is the following — in the legal ecosystem, the absolute discretion to take a debtor into the insolvency system or to wind the debtor down is with the banks and it is the banks that must take that decision based on rational considerations,” said senior advocate Sajjan Poovayya who appeared for the petitioners.

The circular was among the thorny issues that emerged between the RBI and the government last year leading to Urjit Patel's exit.

2. What Supreme Court's Order Means For Banks

With the circular now struck down, banks will have greater discretion in referring accounts for insolvency. However, with no clear RBI-approved restructuring schemes in place, banks will need to devise their own restructuring schemes, said experts that BloombergQuint spoke to.

- As such, there will be no immediate impact on bad loans or on provisions for the banks. However, the expectation of resolution within a certain time frame will now change, said Anil Gupta, head of financial sector ratings at ICRA Ltd.

- For accounts that are in default by one-day or more, banks can continue to try and work out resolution plans.

- However, since earlier restructuring schemes like Strategic Debt Restructuring and the Scheme For Sustainable Structuring of Stressed assets have been withdrawn, banks will need to devise their own restructuring plans.

The broader impact though will perhaps be on the inroads that banks had made in improving the credit culture.

3. Congress' Five Bets To Win Elections 2019

India's main opposition Congress party has pledged to tackle unemployment and poverty as it seeks to wrest power from Prime Minister Narendra Modi's ruling coalition just days out from a national election.

- Led by Rahul Gandhi, the party released its election manifesto in New Delhi on Tuesday, promising to rid India of poverty by 2030, waive farm loans, introduce a single sales tax and reserve a third of government jobs for women.

- Finance Minister Arun Jaitley said Congress' promises were "unimplementable."

- He told a press conference in New Delhi the Congress manifesto indicates some costs of the income support program will be borne by the states and the rest will be generated by rationalising some subsidy schemes.

Ideas in #CongressManifesto are positively dangerous and an agenda for balkanisation of India, says Finance Minister @arunjaitley. pic.twitter.com/tE4CK5j3v0

Here's more on what the Congress manifesto says about economic expansion, GST, and national security.

4. Sensex Closes Above 39,000, Dow Drops

India's equity benchmark clocked gains for the fourth consecutive trading session, to close above the 39,000 mark for the first time.

- The S&P BSE Sensex index rose 0.5 percent on Tuesday, closing above the 38,896 level that was required to make a fresh record closing high.

- India is the first among markets valued at more than a $1 trillion to hit a peak this year.

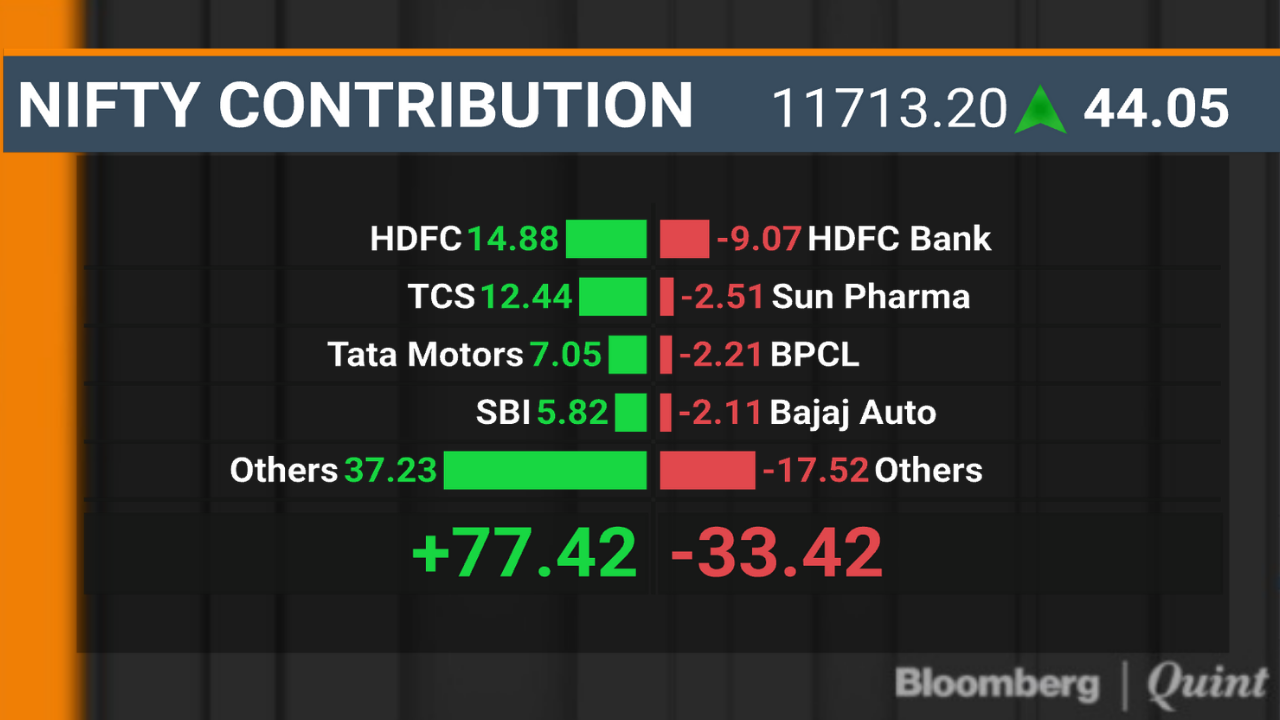

- The NSE Nifty 50 settled above 11,700 after gaining 0.38 percent.

- The broader market index represented by the NSE Nifty 500 Index ended 0.19 percent higher.

- Seven out of 11 sectoral gauges compiled by NSE advanced, led by the NSE Nifty Realty Index's 2.3 percent rally.

Follow the day's trading action here.

U.S. equities pushed lower and European shares climbed as investors took stock of the strong rally that started the week.

- The Dow was dragged down by Walgreens Boots Alliance Inc. after lower pharmacy reimbrusements hurt earnings at the drugstore chain.

- Real estate and consumer staples companies were the biggest sector decliners in the S&P 500.

- Treasuries rose, while the pound weakened after Britain's parliament once again failed to reach a consensus on Brexit.

- West Texas Intermediate rose 0.9 percent to $62.15 a barrel.

Get your daily fix of global markets here.

5. Zee Promoters Have Been Selling

Two promoter entities of Zee Entertainment Enterprises Ltd. sold shares worth Rs 332 crore of the media conglomerate in the last two months.

- Cyquator Media Services Pvt. Ltd. sold 53.1 lakh shares worth Rs 227 crore between Feb. 13 and March 29, according to the company's exchange notification.

- The shares were sold at an average price of Rs 427.30 apiece.

- Essel Corporate LLP sold 23.2 lakh shares between March 13 and March 25, at an average price of Rs 453.10 apiece.

- The shares sold in both the transactions amount to nearly 0.8 percent of the Subhash Chandra-led company's equity and 1.9 percent of the promoter holding.

Do the promoter sales affect the standstill agreement with lenders? Find out here.

6. HFC's Pain = Banks' Gain

Six months after debt defaults by Infrastructure Leasing and Financial Services Ltd. hit the markets, non-bank lenders including housing finance companies, continue to face tight liquidity conditions. The result is far slower growth in disbursements from these lenders and a shift towards banks.

- Disbursements from two large HFCs — Dewan Housing Finance Ltd. and Indiabulls Housing Finance Ltd. — have remained weak in the January-March quarter, said bankers and financiers familiar with market conditions.

- In the case of Indiabulls Housing Finance, disbursements fell 65 percent in the third quarter over the previous three months. The company saw an improvement in the January-March quarter, but disbursements still remain below normal.

- In this liquidity-constrained environment, Credit Suisse expects disbursement growth for the top HFCs to remain below last year's levels, it noted in a report issued last month.

Here's how this has created an advantage for banks.

7. Tata, Thyssenkrupp Look To Win Deal Approval

Thyssenkrupp AG said it has offered concessions to regulators to win antitrust approval for a European steel joint venture with Tata Steel Ltd.

- Thyssenkrupp didn't publicly disclose what steps it plans to take to ease concerns among European regulators that the combined company would have too much control over market supply and prices.

- Handelsblatt reported that the companies are prepared to sell part of car body sheet production, including Thyssenkrupp's Spanish unit Galmed.

- The newspaper, citing anonymous sources, said the proposal had packaging steel assets including plants in Belgium and the U.K.

- They also offered to give customers access to raw steel production.

The European Commission is expected to make a decision by June 5.

8. Navi Mumbai Airport's Takeoff Delayed... Again

A cloud of dust hovers as workers control-blast the hillock to pave the way for Mumbai's second airport. They need to flatten the ground before the construction of terminals and runways can begin. While the work is on in full swing, the project, already behind schedule, is unlikely to meet its latest deadline.

- The first phase of the Rs 16,240-crore project, which includes operation of cargo flights, was earlier expected to be ready by December this year.

- The deadline was further extended to mid-2020. But as of now, it's only a possibility, according to Rajendra Dhayatkar, chief engineer at Navi Mumbai International Airport.

- “We have completed 87 percent of the pre-development work and our aim is to complete it by May,” he told BloombergQuint.

Read BloombergQuint's ground report from the Navi Mumbai airport site.

9. New iPhones Could Be Made In India

Foxconn Technology Group is within weeks of starting trial production of the latest iPhones in India as Apple Inc. seeks to revive its fortunes in the country, people familiar with the matter told Bloomberg News.

- The trial run of the iPhone X range of devices would come before Foxconn starts full-scale assembly at its factory outside the southern city of Chennai, the people said, asking not to be identified as the plans are private.

- Wistron Corp. already produces older models, such as the iPhone 6s, iPhone SE and iPhone 7, at a plant in Bangalore.

- Apple has become a minor player in India with about 1 percent of the country's shipments as its higher prices deter customers in the world's fastest growing major market.

Production in India would help Apple avoid import duties and allow it to open its own stores in the country.

10. Decoding Modi's Tweet Storm

Prime Minister Narendra Modi's personal Twitter handle, @narendramodi, tweeted 2,143 times between October 2018 and March 2019, averaging one tweet every two hours and mentioning the handle of his political party, @BJP4India, the most--31 times.

- The 2,143 tweets had around 7.7 million retweets and 32.4 million likes.

- Of the PM's last six months' tweets, two subjects attracted the maximum retweets from followers--those related to Pulwama attack; and his national campaign ‘Main Bhi Chowkidar'.

- PM Modi mentioned or tagged other Twitter handles a total of 539 times, of which BJP4India, got the maximum tags.

- The Twitter handles of BJP for the states of Rajasthan, Chhattisgarh and Madhya Pradesh also made the top 10. All three of them had elections in December 2018.

Republic TV is the only news channel PM Modi retweeted, nine times, during these six months.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.