Bond yields remained steady on Thursday after a surge in the previous session. The Reserve Bank of India's decision to keep interest rates unchanged had pushed up bond yield by 20 basis points on Wednesday as the market had expected atleast a 25 basis point cut in rates.

The lack of a rate cut and the statement from the monetary policy committee (MPC) which showed that upside risks to inflation remain, albeit lower than before, have changed rate expectations in the markets.

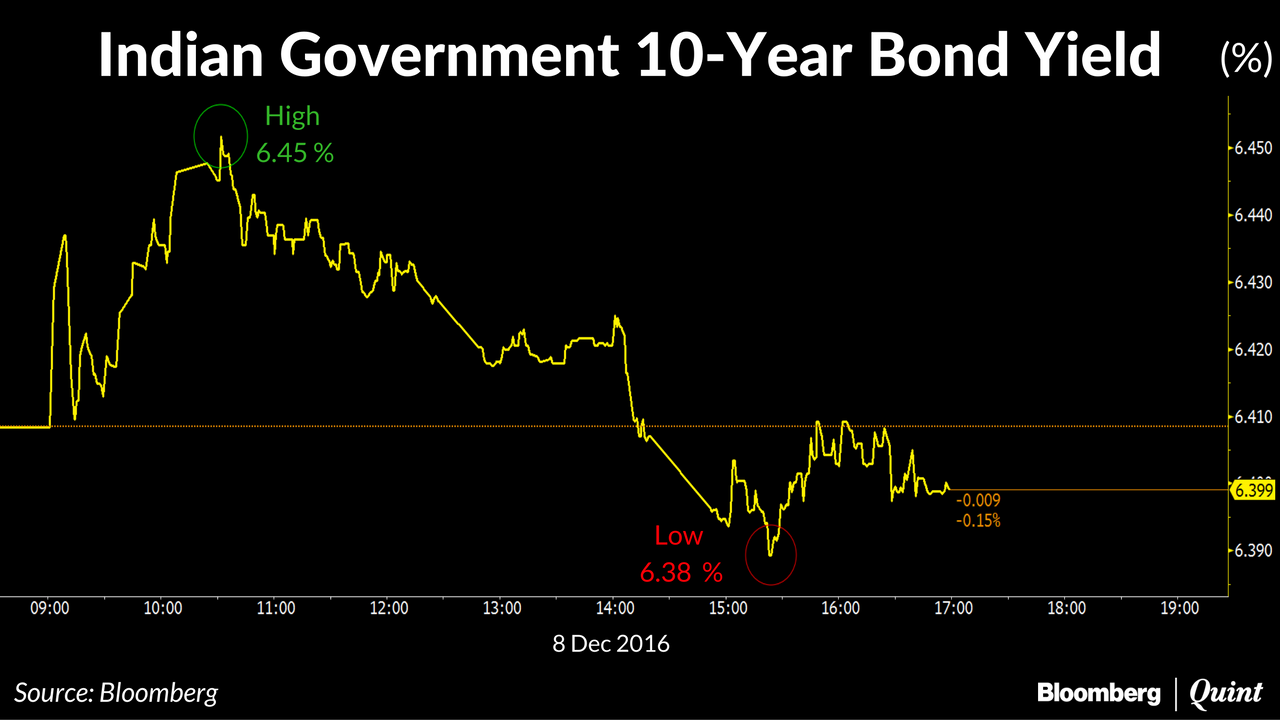

The benchmark 10-year bond ended the Thursday trading session at 6.40 percent compared to its previous close of 6.20 percent. Intraday, yields touched a high of 6.45 percent.

From here on, traders will be watching the global markets for direction along with the monthly dose of economic data. The Federal Open Market Committee (FOMC) will meet on December 13-14 and is widely expected to hike interest rates. While a 25 basis point rate hike seems to be prices in, markets will be watching for clues on the pace of future rate hikes.

Back home in India, October industrial output data will be released on December 9, followed by the consumer price inflation numbers on December 13.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.