(Bloomberg) -- The sudden demise of Apple Inc.'s electric vehicle program is a bleak sign for the car market. It's also a welcome boon for automakers themselves.

Tesla Inc. and Detroit's automakers can breathe a sigh of relief after the electronics giant scrapped its car program, eliminating a threat in an EV market where growth is slowing and providing a pool of engineers and other talent who may be out of a job.

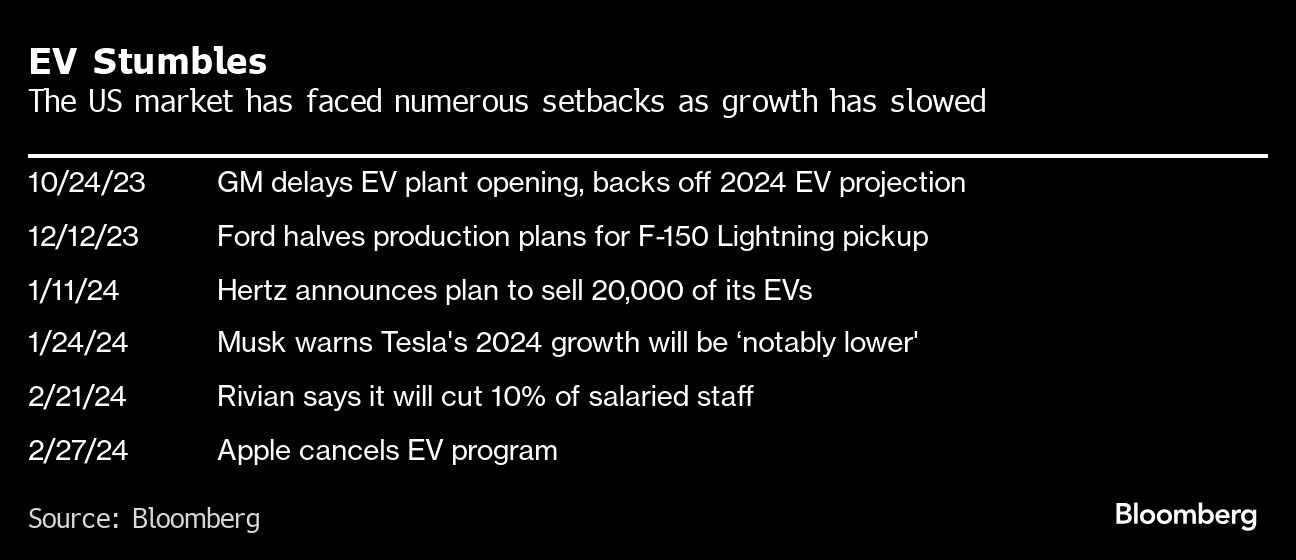

In the past year, Elon Musk's company has cut prices and warned of slumping demand, while established carmakers like General Motors Co. and Ford Motor Co. have delayed investment and pulled back production plans. Now they have one fewer competitor to worry about in a crowded and uncertain arena, especially a tech company with $61 billion in cash to throw around.

“They're probably relieved,” said Gartner Inc. analyst Mike Ramsey. “Apple getting in the market scared people early on.”

Apple exiting the EV market before it really revved up underscores just how tough the business has become. The cars are still too expensive for most consumers and charging is patchy in the US. EV sales are expected to rise just 9% this year, after growing at a compounded annual rate of 65% over the past three years, according to a forecast by Bloomberg Intelligence.

That means every company standing will be fighting over about 10% of new buyers in the US market.

Read More: Apple Cancels Work on Electric Car, Ending Decadelong Effort

EV startups are already struggling amid meager sales and heavy cash burn. Rivian Automotive Inc. forecast flat production this year and said it would lay off workers, sending its shares to their biggest ever decline. Lucid Group Inc. will only make 9,000 vehicles this year, putting it on weaker financial footing.

Hertz Global Holdings Inc. last month revealed plans to sell 20,000 plug-in vehicles — a third of its US EV fleet — due to weak demand, rapid depreciation in value and high repair costs. It marked a sharp reversal from Hertz's earlier embrace of EVs from Tesla and other automakers.

While GM is having a hard time building EVs due to production problems, Ford has seen demand fall and has reined in investment plans. GM delayed plans to open an electric pickup plant outside Detroit. Germany's Mercedes-Benz has backed off its plan to sell only EVs by 2030.

Auto Market Disruption

This is another example of the tech sector underestimating how difficult it is to disrupt the auto sector, said Jeff Schuster, global vice president of automotive research at consultant GlobalData.

“Everybody from that world just looks at it and thinks, ‘Oh, these dinosaurs, we can come in, this is easy, what could be so difficult? We manufacture phones and we have all this technology, we can take it over,'” Schuster said in an interview. “Nine times out of 10, most find it a little more challenging and certainly more dynamic and complex than they expect.”

Tesla may benefit the most from Apple's about-face. The last thing Musk wanted a year after cutting prices on his vehicles by 25% or more was a Silicon Valley rival with the same kind of high-tech appeal, Ramsey said.

“They certainly had the most downside,” he said. “Tesla benefits big time from being a status vehicle. And an Apple EV definitely would be a status vehicle.”

Celebrating the move, Musk on Tuesday sent a post on X with a saluting emoji and a cigarette.

Automakers will now also be looking to snap up some of that talent, said Brad Holden, a founder of the executive search firm Holden Richardson.

“There will be great talent on the street so it will be picked up,” Holden said.

Read More: Big Auto's EV Revolution Is a Tough Sell for Ordinary Americans

--With assistance from Keith Naughton and Mark Gurman.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.