Diversified conglomerate Amber Group will acquire Israel-based industrial technology company Unitronics Ltd. for around Rs 400 crore to broaden its product portfolio in industrial applications.

ILJIN Electronics (India) Pvt., a material subsidiary of Amber Group, has entered into definitive agreements for taking a controlling stake of 40.24% or about 5,624,591 shares in Unitronics at NIS 27.75 per share, Amber Enterprises India Ltd. said in a stock exchange filing on Monday. The aggregate purchase price of the shares is NIS 156 million.

One New Israeli Shekel equals 25.79 Indian Rupees.

The deal is expected to be completed in two months.

About Unitronics

Unitronics offers a range of industrial automation products designed to meet the unique requirements of different applications including design, development, manufacturing, marketing, sale and support of products.

These include PLCs (Programmable logic controllers), HMIs (Human-Machine Interface), PLCs with integrated HMIs, VFDs (Variable Frequency Drives), Servo Drives, SaaS solutions like UniCloud, and Industrial Internet of Things (IIoT) with built-in business intelligence, supported by its all-in-one software for machine and process control across various industries.

The company had a turnover of NIS 192 million or about Rs 495 crore in the financial year ending Dec. 31, 2024.

The company is listed on the Tel Aviv Stock Exchange.

Amber's Acquisition Goal

"The acquisition aligns with Amber Electronic Division's strategy to expand its product portfolio in industrial applications," Amber said in a press statement.

"The combined strength lays a strong foundation for accelerated growth by localizing manufacturing through backward integration, enhancing competitiveness in India, and gaining access to global markets like the US and Europe amid rising demand for Industry 4.0 and real-time data technologies," it added.

Amber plans to broaden its portfolio from consumer durables, hearables and wearables, telecom, automotive, energy meters, and defence into the industrial electronics segment with global access.

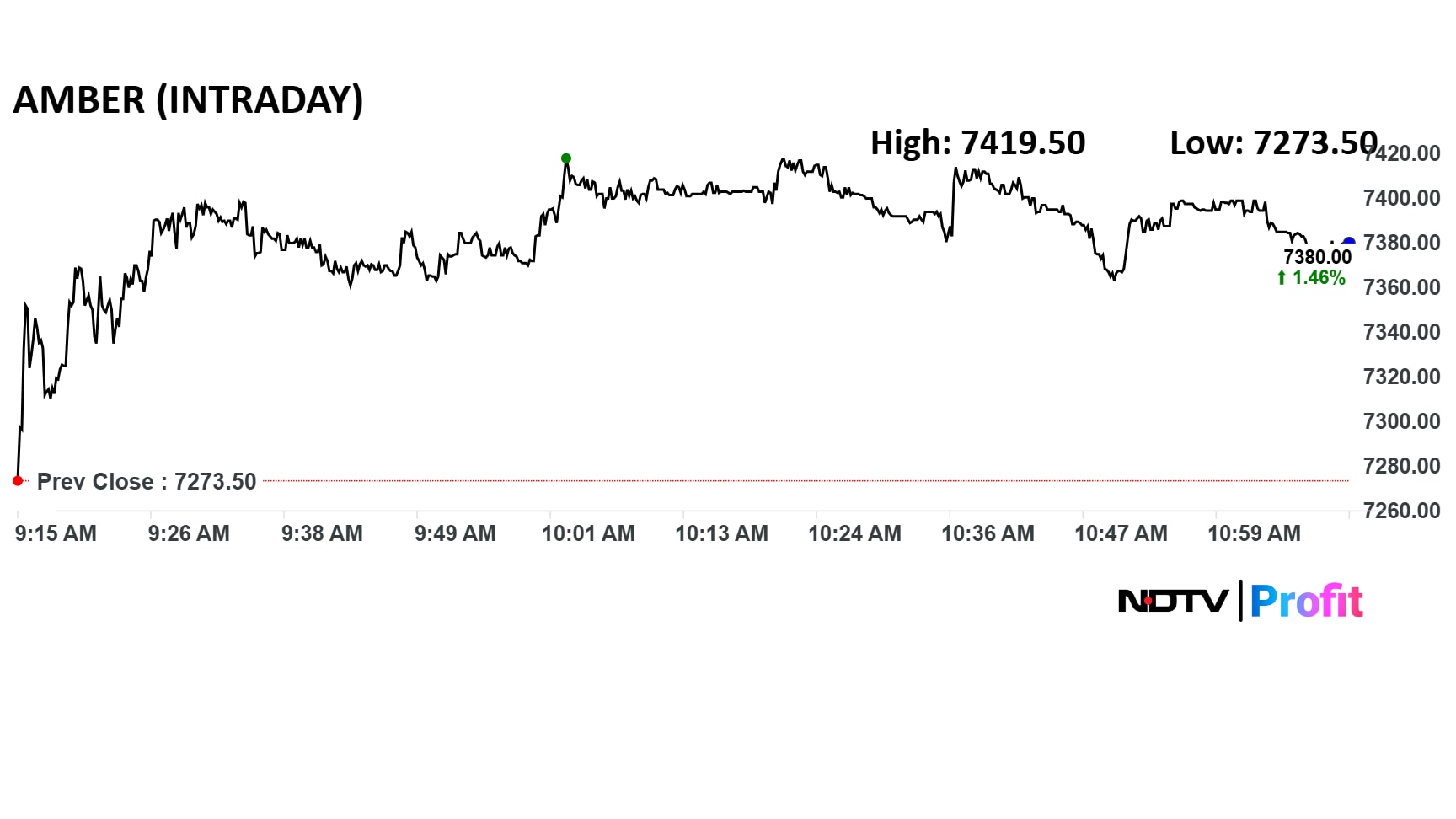

Amber Enterprises Share Price Movement

Shares of Amber Enterprises traded 1.5% higher at Rs 7,380 apiece on the NSE.

Shares of Amber Enterprises traded 1.5% higher at Rs 7,380 apiece on the NSE, after the announcement, compared to a 0.1% decline in the benchmark Nifty 50.

The stock has risen 69% in the last 12 months but is flat on a year-to-date basis.

Out of the 29 analysts tracking, 23 have a 'buy' rating on the stock, five recommend a 'hold' and one suggests a 'sell', according to Bloomberg data. The average of 12-month analyst price target of Rs 7,641 implies a potential upside of 3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.