Shares of Narayana Hrudayalaya Ltd. hit record high on Wednesday after its second-quarter profit beat analysts' estimates.

The company's net profit rose 34.2% year-on-year to Rs 226.7 crore in the quarter ended September, according to an exchange filing. That compares with Bloomberg estimate of Rs 178.8 crore.

Health City Cayman Islands continues to contribute significantly to the overall performance, also supported by the new radiation oncology block which continues to see good traction, the company said in a press release.

"The new entity Narayana Health Integrated Care has delivered strong growth this quarter led by significantly higher patient transactions and increased collections, remaining on track as per the plan," the company said.

Narayana Hrudayalaya Q2 FY24 (Consolidated, YoY)

Revenue up 14.3% at Rs 1,305.2 crore. (Bloomberg estimate: Rs 1,293.1 crore).

Ebitda up 26.4% at Rs 308.1 crore. (Bloomberg estimate: Rs 288.5 crore).

Margin at 23.6% vs 21.34% (Bloomberg estimate: 22.30%).

Net profit up 34.2% at Rs 226.7 crore. (Bloomberg estimate: Rs 178.8 crore).

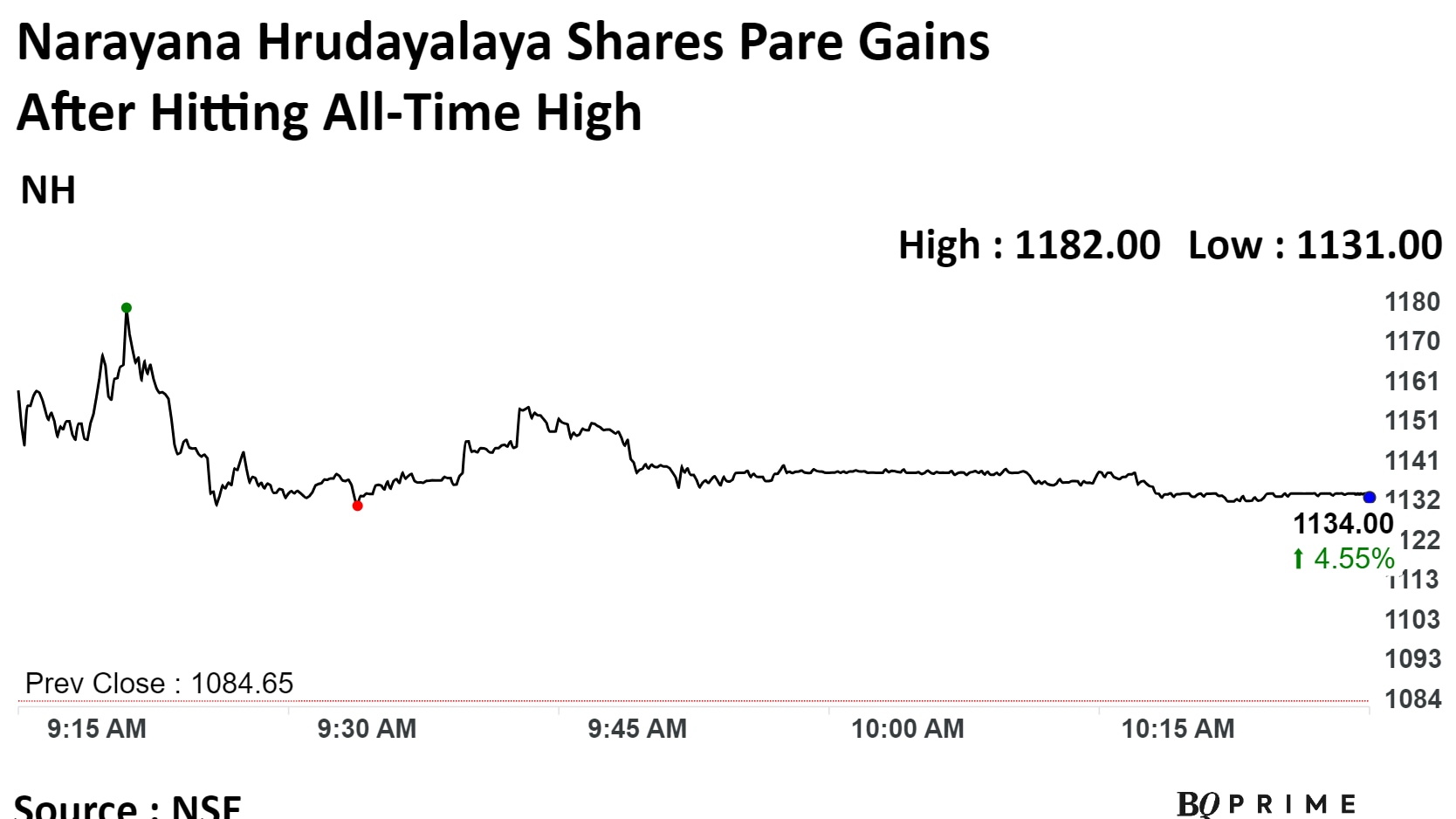

Shares of the company surged 9% to record high of Rs 1,182 apiece. It pared gains to trade 4.3% higher at Rs 1,131.20 apiece as of 10:50 a.m. This compares to an 1% advance in the NSE Nifty 50 Index.

It has risen 48.83% on a year-to-date basis. Total traded volume so far in the day stood at 14 times its 30-day average. The relative strength index was at 67.67.

Out of eight analysts tracking the company, seven maintain a 'buy' rating and one suggests a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.13%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.