Shares of Adani Ports & Special Economic Zone Ltd. rose after India's largest private ports developer reported a jump in cargo volumes.

The Adani Group flagship handled 29.3 million metric tonnes of cargo in August, an increase of 18% over the year earlier, according to an exchange filing. The average cargo run rate for April-August stood at 30.3 MMT.

While dry bulk cargo volume grew 44% year-on-year, container volume rose 8% in August.

In a record 49 days, the company achieved a cargo throughput of 50 MMT (YTD cargo volume increasing from 100 MMT to 150 MMT).

In the initial five months of FY23, the company managed 151.4 MMT of cargo, an 11% increase over the corresponding year-ago period, that benefitted from post-Covid volume surge, the filing said.

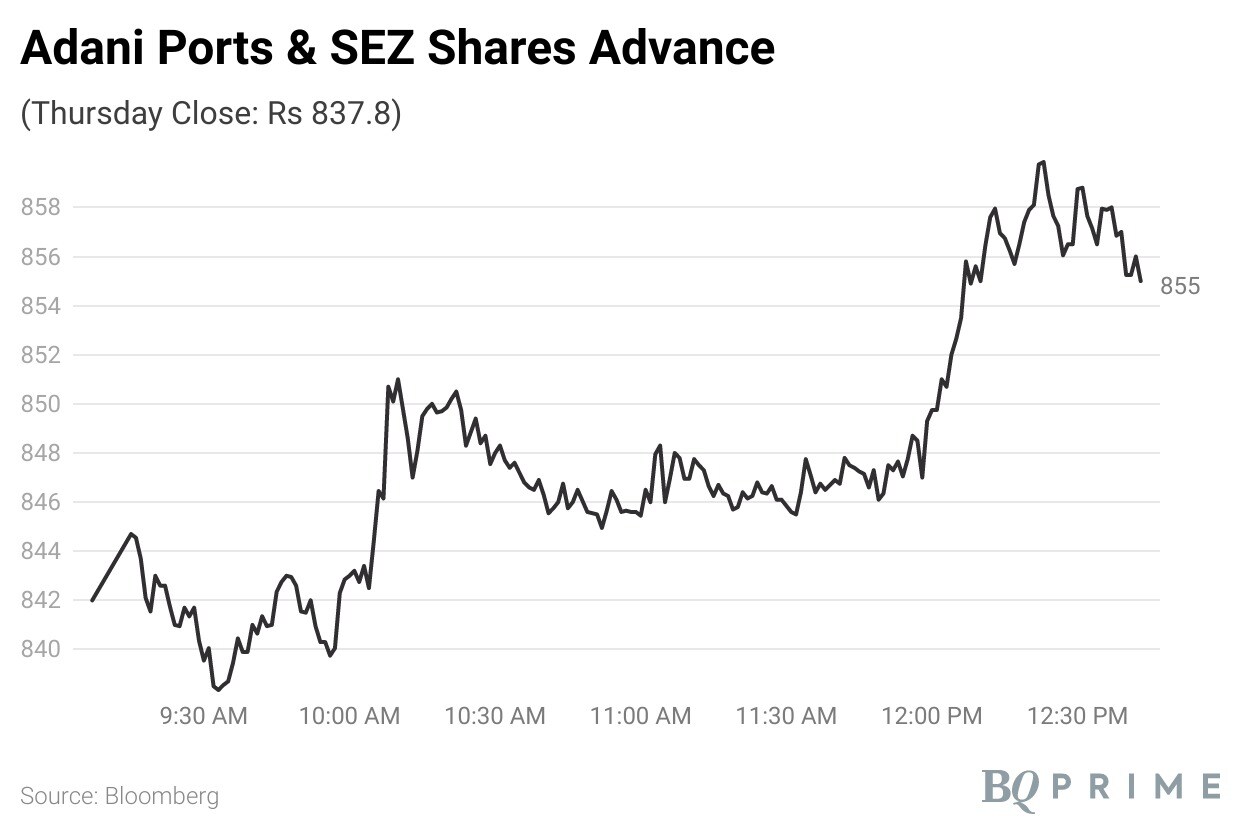

Adani Ports & SEZ Shares Advance

Shares of Adani Ports rose nearly 2.8% to Rs 860.9 apiece as of 1 p.m. on Friday. The trading volume was nearly 1.5 times the 30-day average.

Of the 24 analysts tracking the company, 21 maintain a ‘buy', two recommend a ‘hold' and one suggests a ‘sell', according to Bloomberg data. The 12-month consensus price target implies an upside of 5.1%.

Disclaimer: Adani Enterprises is in the process of acquiring a 49% stake in Quintillion Business Media Ltd., the owner of BQ Prime.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.