- Zepto raised $348 million privately, boosting valuation to $7 billion before planned IPO in 2026

- Zepto leads quick commerce but trails larger rivals Swiggy and Blinkit in cash reserves and scale

- Competitors like Flipkart and Amazon are rapidly expanding dark stores, intensifying market competition

At the start of 2025, Zepto was on a high. It pivoted to a marketplace model, allowing sellers to list their products on its platform; the Cafe business hit one lakh orders per day; and of course there was talk of an IPO launch by mid-2025.

Instead of hitting the buzzing public markets, the company raised four rounds of private equity/venture funds – three in Series G amounting to around $48 million and another Series H round amounting to $300 million – which boosted its valuation to around $7 billion.

For a pandemic-born company in a pandemic-born sector, it's a great boost in value. But, for a company so close to the public markets, its value might become a bane as well. To receive a public market premium, experts say that it has to show consistent store-level profitability, controlled cash burn, and a visible path to company-level Ebitda before public market can assign it a premium.

“At a $7 billion valuation, expectations are already set very high. The next five to six quarters will be critical in deciding whether Zepto lists as a proven category leader or faces valuation pressure at the public market door,” comments Ponmudi R, CEO of Enrich Money, a wealth tech platform.

The First Mover Disadvantage?

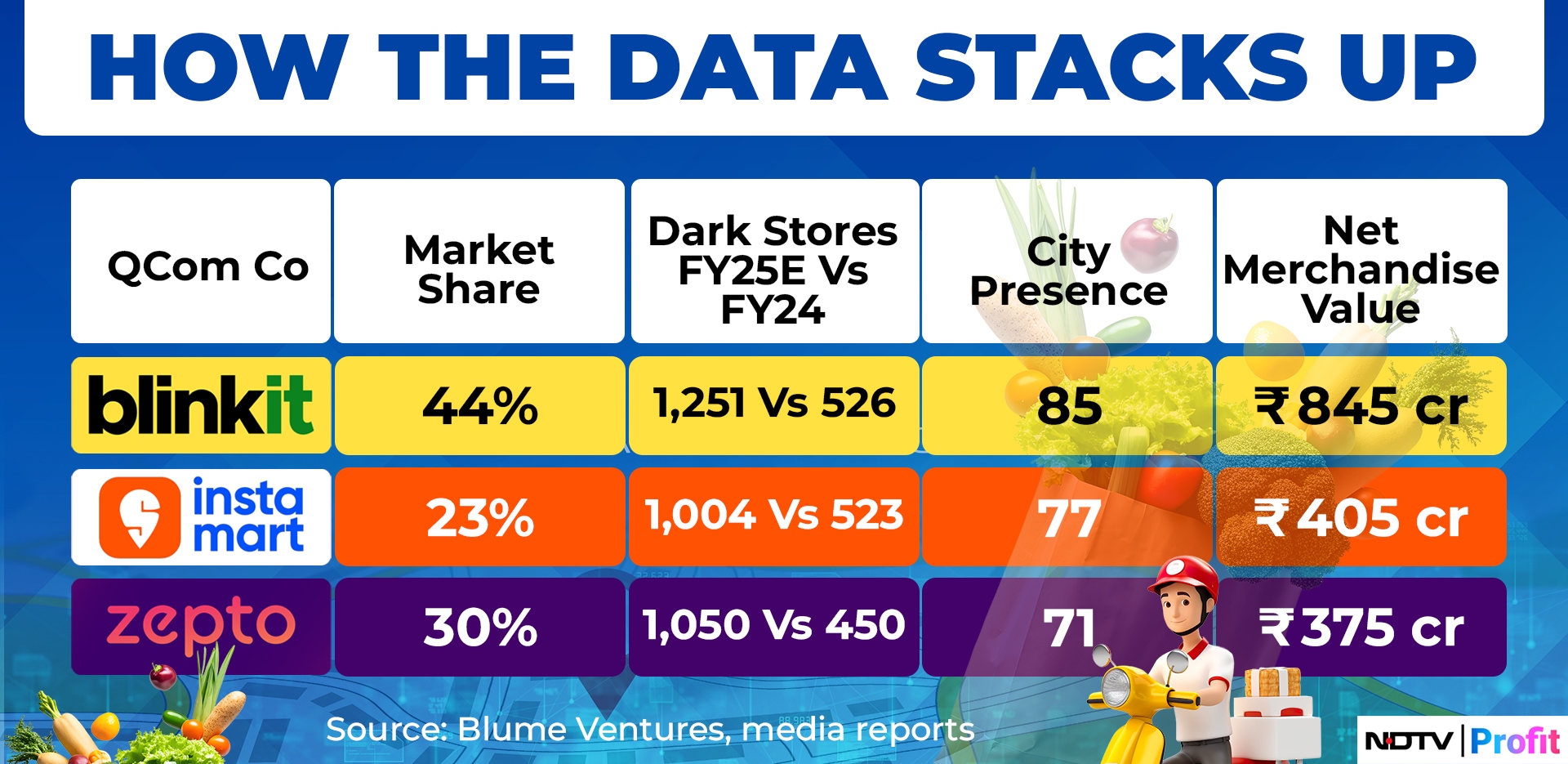

Zepto has hastened the quick commerce business in India by introducing the 10-minute delivery schedule. While it did kickstart the sector, as many as ten players jumped into the bandwagon. Many also faded as fast as they entered, leaving the sector with Blinkit (Zomato/Eternal), Instamart (Swiggy) and Zepto. But Zepto had to concede the leadership position to its stronger, bigger listed peers.

Zepto's market share is discussed extensively and even as its founder Aadit Palicha claims that its net merchandise value (NMV) is bigger than its closest competitor, many reports seem to suggest that it runs neck to neck with Swiggy.

But it's not on par with its competitors as Eternal and Swiggy, grocery delivery is one of the many sectors, but for Zepto, it's a mainstay. And every innovative step it takes, others seem to join in, with ease. Take for example the Café business it launched in 2022 saw the other two players expanding these businesses albeit with very different strategies.

“Quick food delivery (QFD) is still in an early stage with Zepto Café leading innovation. Zepto management disclosed the Café business revenue run-rate of $100mn-plus in February 2025, highlighting the demand and an opportunity to scale up. However, it has scaled down since then to focus on profitability,” says a report by Nuvama.

After all, when it comes to food delivery – Zomato and Swiggy are leaders. Swiggy as Bolt where its restaurant partners deliver ‘quick' food; and it contributes 10–12% to Swiggy's food delivery volumes and is expanding rapidly. It also has an app called Snacc with bite sized foods and homestyle heat and eat meals.

Zomato is also focusing directly in this business under Bistro, with a dedicated app and its own cloud kitchen network. The gap between meal delivery and other snack items like coffee and more such exists – as Zepto has pointed out – and others are scaling fast.

Bang With The Buck

What advantage do followers have over the pioneer; is more money. Even with a swollen valuation, the funds Zepto raised fall short. As per a report by Nuvama, Zepto's cash reserves, after the recent fundraise, stands at around $900 million. It's competitors however are sitting on billions.

“The two listed players also benefit from cash flows generated by their food-delivery businesses, which support Q-commerce investments—and from multi-year customer data on consumption, spending, and ordering behaviour,” says Keyur Majmudar, managing partner and chief investment officer at an investment firm Bay Capital.

Eternal's cash reserves are at $2 billion. Swiggy is planning to raise $1.1 billion via a qualified institutional placement (QIP) and also has $500 million in cash in its books, and received $270 million by selling its stake in Rapido.

“Zepto's goal is not to fight for market share by burning more cash, rather it will try to grow by keeping losses in check,” surmises Nuvama, adding that Zepto was burning $150–200 million per quarter in the beginning of the year, but has scaled down its burn rate meaningfully to prioritise sustainable growth. And, there is no such pressure on the other two.

“The sector is also facing the reality that India rarely supports more than two leaders in a category. Blinkit and Instamart are part of listed companies with stronger balance sheets. This puts pressure on the number three player. It becomes difficult to close the gap when burn rates stay high and when vendors begin to lose confidence,” comments Anirudh A Damani, managing partner at Artha Venture Fund.

E-Comm Gets Fast & Furious

Along with two larger players ahead of it, Zepto also has to contend with larger players entering at a quicker pace. Most of the new entrants also boast of deeper balance sheets and more.

Flipkart Minutes has plans to scale up fast from 300 stores in mid-2025 to 800 by the end of the year. Amazon too entered the sector in 2025 and has plans to operate as many as 300 dark stores by end of 2025. Reliance Jio too plans to capitalize on its network of over 3,000 retail stores with hyperlocal deliveries and also has 600 dark stores.

Experts are divided on how the competitive intensity will play out. “Our assessment is that the ecosystem can at best accommodate 3-4 players and the existing incumbents have built significant moats so as not to get significantly disrupted by new challengers; even though they may have a lot of capital,” says Majumdar.

The competition is expected to get much more intense and there could be consolidation, observe experts. “Based on experience from China where Meituan merged with rivals to create one giant company, I see most of these players merging as soon as cash runs out. That can create a profitable enterprise. But they'll all plan to list before that and maximize PE exit returns,” says Anurag Singh, managing partner, Ansid Capital.

The Costly Pivot To Profitability

The quick commerce business in general is tough to turn profitable, with wafer thin margins. Profitability in quick-commerce depends on a constellation of factors such as, order density, operational scale, category-mix, fulfilment efficiency, and competitive intensity.

“Much like horizontal e-commerce players that required several years to move toward sustainable unit economics, quick-commerce firms also operate in a structurally high-cost environment where breakeven depends less on time and more on how effectively these fundamentals mature,” says Neha Singh, co-founder of Tracxn.

Zepto on its part has been trying to cut down costs by automating some of its dark stores, launched a paid subscription service called Zepto Atom offering brands highlights of sales trends and also entered the pharmaceutical delivery sector; which has not yielded much to older players in the business.

What's More In 10 Mins?

Most quick commerce players expanded their horizons to electronics, apparel, gifting items, beauty and personal care products. Not only does it help boost average order values but also diversifies revenue streams beyond staples, and of course has better margins.

But it also means they'd have to spend more on expanding dark stores, logistics and more which could put more pressure on margins – a costly gamble for players like Zepto which is looking to pivot to profitability.

Also, a lot more thought has to go while expanding to newer categories, warn experts. “Zepto's expansion into cafés, private labels, small-ticket electronics and essentials-led apparel will certainly help improve average order value and customer stickiness. But 10-minute delivery works best only for high-frequency, low-return-risk items. It cannot be a one-size-fits-all solution for fashion or large electronics. In quick commerce, urgency defines what truly scales,” adds Ponmudi.

In addition to sectoral issues, Zepto has been at the thick of the controversy with its dark patterns as well. The patterns which interfere with consumer autonomy; also prices items differently for differently priced smartphones; which. It also lost licence for one of its dark stores in Dharavi in Mumbai over expired products and more.

“Zepto can correct course. But trust takes time to rebuild. Investors, regulators, and customers will watch for consistent payments, transparent governance, and a stable path to profitability before an IPO becomes viable,” says Damani.

Disclaimer: The views expressed in this article are solely those of the author and do not necessarily reflect the opinion of NDTV Profit or its affiliates. Readers are advised to conduct their own research or consult a qualified professional before making any investment or business decisions.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.