The shares of Tata Motors Ltd. fell over 5% on Monday after it signalled that its unit Jaguar Land Rover's free cash flow for the year is likely to be close to zero, raising concerns over near-term profitability and cash generation.

Additionally, Jaguar Land Rover shared a muted outlook for the current financial year. It has also sharply reduced EBIT margin guidance to 5–7%, down from its earlier expectation of 10%.

The downward revision is primarily attributed to challenging conditions in the China premium passenger vehicle market, where a mix of fierce competition and aggressive discounting has taken a toll. So far in calendar year 2024, over 215 models have seen price cuts, and the number of retailers in the PV segment has dropped by 4,400, leading to a 15% decline in the premium vehicle segment. These pressures are expected to weigh on volumes and margins in the short term.

Despite these revisions, Tata Motors maintained that JLR is expected to show year-on-year improvement in financial year 2027 and fiscal 2028, supported by strategic investment and operational streamlining. The company remains committed to its investment roadmap, with capital expenditure of approximately Rs 2.09 lakh crore (18 billion pounds) planned between fiscal 2024 and fiscal 2028.

To offset these headwinds and reclaim margin strength, Tata Motors has reaffirmed its commitment to the Enterprise Mission, which aims to progressively deliver around Rs 16,332 crore (£1.4 billion) in annual efficiencies, excluding tariffs. The long-term goal is to bring JLR back to its 10% EBIT margin target, although that recovery is now expected to be more gradual.

Looking ahead, JLR is preparing for the launch of the first model under the Freelander brand in the second half of the financial year ending March 2026, which could serve as a new growth driver.

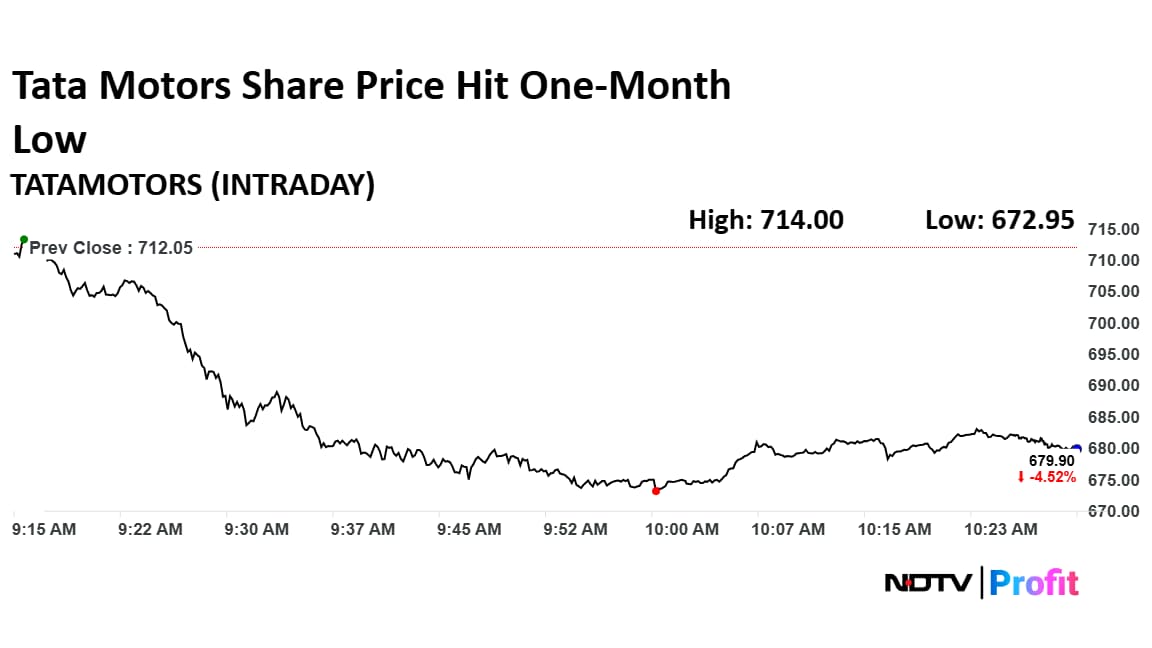

Tata Motors Share Price

The shares of Tata Motors fell as much as 5.49% to Rs 672.95 apiece, the lowest level since May 9. It pared losses to trade 4.49% lower at Rs 681.95 apiece, as of 10:25 a.m. This compares to a 0.32% advance in the NSE Nifty 50 Index.

It has fallen 31.32% in the last 12 months and 7.82% year-to-date. Total traded volume so far in the day stood at 1.2 times its 30-day average. The relative strength index was at 34.59.

Out of 35 analysts tracking the company, 18 maintain a 'buy' rating, 11 recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside/upside of 10.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.