(Bloomberg) -- European stocks deepened declines, following Thursday's brief respite, as investors focus on a crucial US jobs report that will help gauge the timing and pace of Federal Reserve interest-rate cuts.

The Stoxx Europe 600 Index extended declines to 1.1% by 10:55 a.m. in London, dragged lower by the retail and consumer products and services sectors. LVMH and Remy Cointreau fell after China announced an anti-dumping probe on European liquor products from Friday.

Sentiment was also dampened by Euro-zone inflation picking up in December, highlighting the rocky path back to 2% foreseen by the European Central Bank as governments remove support for lofty energy costs.

Traders have pared bets on interest-rate cuts from the ECB, with markets pricing 149 basis points in borrowing cost reductions in the euro area in 2024. It's the first time since mid-December that traders bet on fewer than six quarter-point cuts.

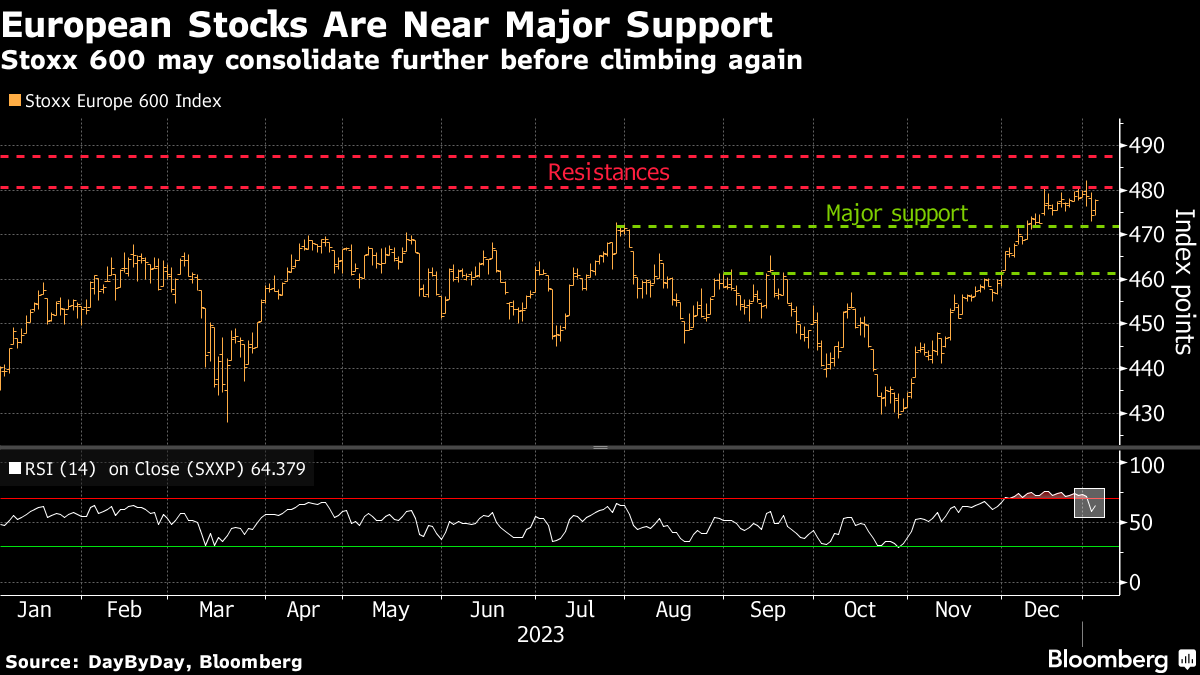

The Stoxx 600 appears set to snap a multiweek run of gains, with volatility on the rise, and some traders rotating into cheaper and more defensive shares. The benchmark index has slid toward some key support levels, which analysts say must hold if it's to stage a bounce.

“Markets are in the process of pushing back expectations for a very early start to rate hikes after the Fed minutes and the most recent inflation data in France and Germany,” said Joachim Klement, a strategist at Liberum.

“The market also needs to consolidate from recent overbought extremes before they can embark on another leg up,” he added, as he expects markets to continue to move sideways for the next week.

Among other single stocks, Endeavour Mining shares slumped after it announced the firing of CEO Sébastien de Montessus for serious misconduct with immediate effect.

SECTORS IN FOCUS:

- Shares of retailers could be active after one of the wettest Decembers on record could have had an impact as fewer shoppers visited stores in the run-up to Christmas.

For more on equity markets:

- Bulls Bruised By New Year Rout Now Eye Technicals: Taking Stock

- M&A Watch Europe: Byggfakta, EDP, Saras, Antofagasta

- US Stock Futures Rise

- Next Bumps Profit Outlook … Again: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.