A worsening earnings picture is darkening the outlook for Chinese equities, leaving investors wary that Lunar New Year holiday spending may not be enough to reignite a rally.

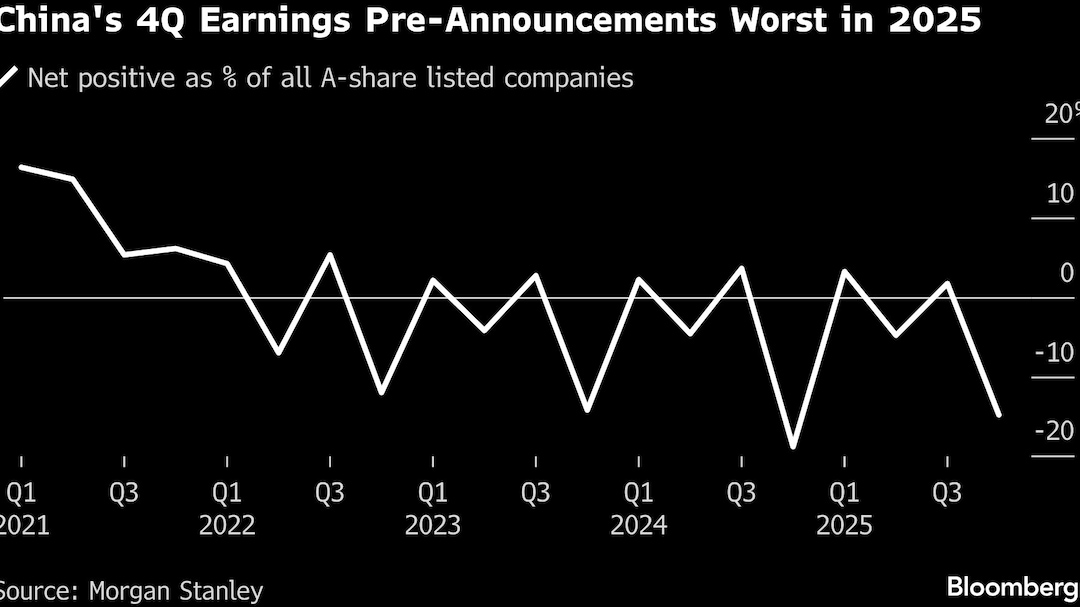

Corporate profit pre-announcements have shown a “major deterioration” for the last quarter of 2025, a Morgan Stanley analysis shows. The latest economic indicators underscore weak consumer demand as some government stimulus programs are scaled back, according to Nomura Holdings Inc.

These factors are fueling concern the nine-day holiday will fail to deliver its typical boost to earnings as the economic uncertainty continues to erode consumer spending.

“Sentiment on Chinese stocks is going through a weak patch,” said Vey-Sern Ling, managing director at Union Bancaire Privee in Singapore. That's “partly because investors are unwilling to take risks before the long holidays, and also because of a lack of new catalysts, seemingly heightened regulatory scrutiny recently, and continued intense competition.”

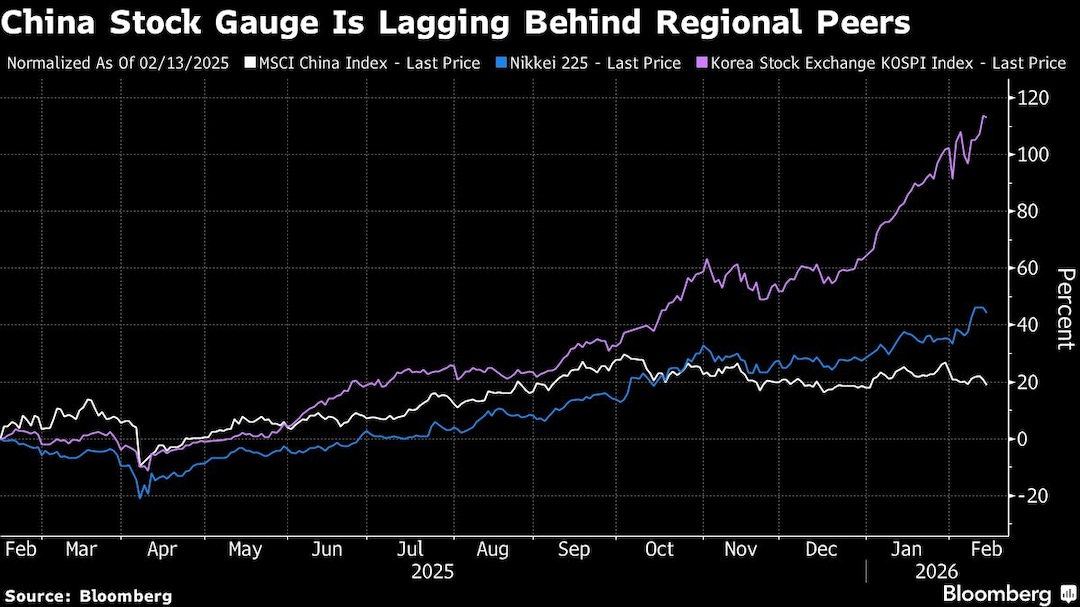

The MSCI China Index has risen just 0.8% this year, while the MSCI All World Index has gained 2.8%. The contrast is starker within Asia: South Korea's key gauge has surged 31% and Taiwan's has jumped 16%.

China's earnings season is already shaping up as a disappointment. Fourth-quarter pre-announcements from more than 2,000 mainland-listed A-share companies show negative alerts outnumber positive ones by 14.8%, versus a net negative 4.8% in the second quarter, according to Morgan Stanley. Smaller firms fared worst — particularly in real estate and consumer-focused sectors — strategists including Chloe Liu and Laura Wang wrote in a note this month.

Slowing economic growth is a key drag on profits. China's growth cooled to 4.5% last quarter, from a year earlier, the weakest pace since the country reopened from Covid lockdowns in late 2022. Producer prices fell 1.4% in January from a year ago, extending a deflationary streak that began in late 2022, while purchasing managers' indexes signaled an unexpected slowdown.

“The significant miss in both manufacturing and non-manufacturing PMIs suggests insufficient underlying demand,” Lu Ting, chief China economist at Nomura in Hong Kong, said this month. “Consumption is facing clear headwinds from the scaled-back trade-in stimulus program this year.”

Economic data may take a back seat in the coming weeks as the statistics bureau typically combines January and February figures to smooth out distortions caused by the irregular timing of the Lunar New Year holiday. Major policy announcements are also unlikely before the National People's Congress in March.

Increased regulatory intervention is adding to market caution. Authorities last month tightened margin financing rules in an effort to curb speculative trading and reduce the risk of future boom-and-bust cycles.

Diverging Growth

At the same time, earnings are diverging sharply across industries, complicating stock selection.

Metal miners are benefiting from surging prices, while companies in the artificial intelligence supply chain and firms supported by the government's campaigns to rein in a price war are also gaining favor, according to a report from China Merchants Securities Co.

Miner CMOC Group Ltd. said last month its preliminary net income jumped about 50% for the full year, while software maker Iflytek Co. reported a gain of between 40% and 70% for the same period. In contrast, shares of electric-vehicle makers BYD Co. and Great Wall Motor Co. both slumped following lackluster January sales numbers.

Read more: China National Team's $68 Billion Exit Alters Stock Playbook

Overall A-share earnings are expected to have grown about 6.5% year-on-year for 2025, compared with a drop of 3% for 2024, according to China International Capital Corp. China Merchants Securities also predicts single-digit growth.

The profit increase is “largely attributable to policy support and cyclical factors, rather than signaling a fundamental or structural shift in market conditions,” said Shen Meng, a director at Beijing-based investment bank Chanson & Co.

ALSO READ: Huang Cancels India AI Impact Summit: Here's Three Big Names You Can Still Look Forward To

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.