UltraTech Cement Ltd.'s quarterly profit rose as energy costs fell. Still, it missed estimates.

Net profit rose 48.6 percent year-on-year to Rs 643.15 crore in the quarter ended December, according to an exchange filing. That compares with the Rs 783.22-crore consensus estimate of analysts tracked by Bloomberg.

The rise in profit was mostly aided by a 15 percent year-on-year fall in energy costs, according to an investor presentation. Raw material costs, however, rose 2 percent over last year to Rs 501 a tonne.

“UltraTech delivered good numbers for the quarter (inline with our estimates) due to a mix of better pricing scenario and softer input costs,” Kunal Shah, research analyst at Yes Securities, told BloombergQuint.

The company's “unique ability of asset integration” reflects in the earnings, he said, as Century Cements assets were ramped up to 79 percent in December 2019 while it has operated the Nathdwara assets at an ebitda/tonne of more than Rs 1,500.

“We structurally remain positive on the stock, and UltraTech remains our top pick with target price of Rs 5,221,” Shah said.

The cement maker's revenue rose 0.4 percent over last year to Rs 9,981.75 crore, compared with the Rs 10,326.99-crore estimate. Sales volume fell 3 percent to 19.4 million tonnes.

Adjusted earnings before interest, tax, depreciation and amortisation stood at Rs 1,919.3 crore, 25 percent higher than last year. That compares with the Rs 2,023-crore estimated. “UltraTech has provided a one-time expense of Rs 133 crore as part of other expenditure, against various disputed and contingent liabilities,” the filing said.

The cement maker's margin widened to 17.4 percent from 15.4 percent a year ago.

“Signs of revival were visible in some markets during the latter part of third quarter of FY20. This, together with the government's firm commitment to revive the economy and the thrust on infrastructure spending augur well for the growth of cement demand,” the company said in the filing.

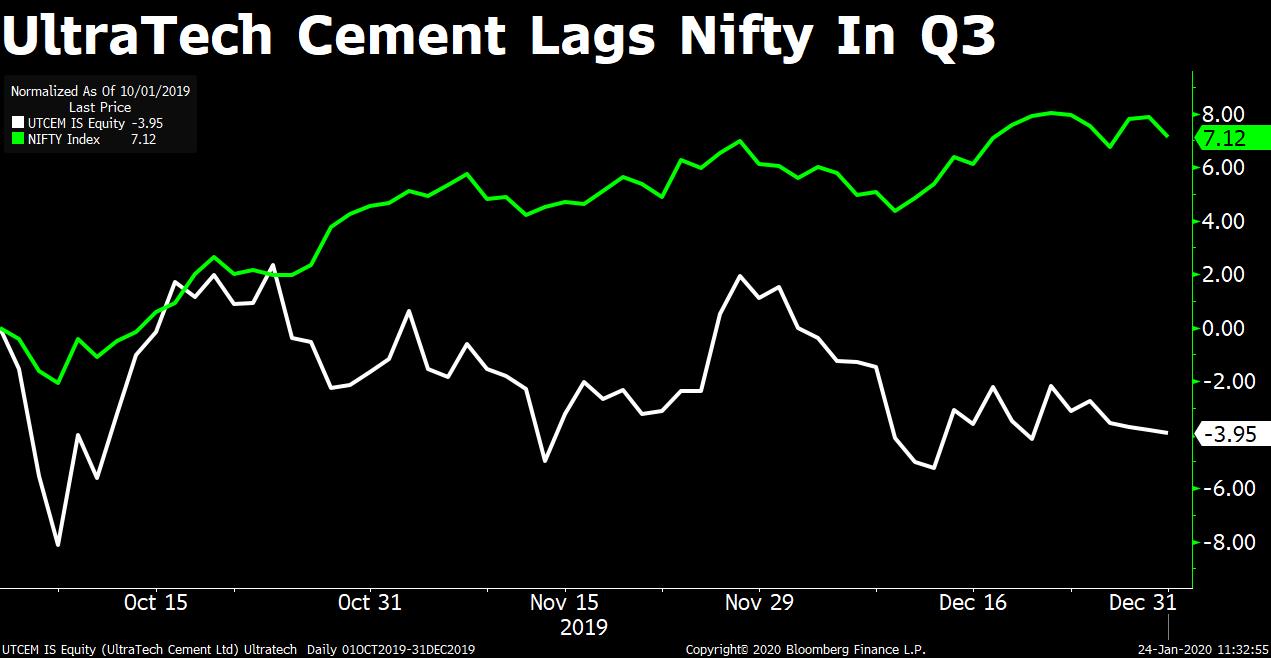

On Friday, UltraTech Cement's shares rose 2.58 percent to Rs 4,643.00 apiece on the NSE while the benchmark Nifty 50 gained 0.56 percent to end the day at 12,248.25 points.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.