That brings us to the end of all the fourth quarter earnings for the day and thanks for following along.

Catch all the live updates tomorrow as big names like Hyundai and Bharat Heavy Electronics Ltd., are set to announce their fourth quarter results.

Kaynes Tech Q4 Highlights (Consolidated, QoQ)

Revenue up 48.9% to Rs 984.48 crore versus Rs 661.17 crore.

Ebitda up 79% to Rs 167.78 crore versus Rs 93.97 crore.

Margin at 17.0% versus 14.2%.

Net profit up 74.6% to Rs 116.20 crore versus Rs 66.46 crore.

GR Infraprojects Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue down 8.4% at Rs 2,275 crore versus Rs 2,485 crore

Ebitda up 0.9% at Rs 545 crore versus Rs 540 crore

Margin at 24% versus 21.7%

Net Profit down 27% at Rs 404 crore versus Rs 554 crore

Allied Blenders recommended a final dividend of Rs 3.6 per equity shares for FY25, subject to the approval of the shareholders at the ensuing AGM. The dividend upon approval by the shareholders will be paid within 30 days of the date of AGM.

The company has fixed June 27 as the record date for determining the entitlement of members for the final dividend.

Allied Blenders Q4 FY25 Earnings Highlights (Consolidated, YoY)

Revenue up 20% at Rs 921 crore versus Rs 768 crore

Ebitda up at Rs 136 crore versus Rs 60 crore

Margin at 14.8% versus 7.8%

Net profit at Rs 78.6 crore versus loss of Rs 2.4 crore

Signature Global Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue down 25% at Rs 520 crore versus Rs 694 crore

Ebitda up at Rs 43.4 crore versus Rs 20 crore

Margin at 8.3% versus 3%

Net profit up 48% at Rs 61 crore versus Rs 41.2 crore

PB Fintech Q4 FY25 Results Highlights (Consolidated, QoQ)

Revenue up 17% at Rs 1,508 crore versus Rs 1,292 crore (Bloomberg estimate: Rs 1,472 crore)

Net profit up 139.2% to Rs 171 crore versus Rs 71.5 crore (Bloomberg estimate: Rs 134 crore)

Ebitda at Rs 113 crore versus Rs 28 crore

Margin at 7.5% versus 2.1%

Total Insurance Premium for the quarter was Rs 7,030 crore, up 37% YoY, led by growth in new health.

Patanjali Foods Q4 FY25 Results Highlights (Standalone, YoY)

Revenue up 17.8% at Rs 9,692 crore versus Rs 8,228 crore

Ebitda up 37% at Rs 516 crore versus Rs 377 crore

Margin at 5.3% versus 4.6%

Net Profit up 74% at Rs 358.5 crore versus Rs 206.3 crore

Patanjali Foods Q4 FY25 Results Highlights (Consolidated, QoQ)

Revenue up 6.3% at Rs 9,692 crore versus Rs 9,120 crore

Ebitda down 7.4% at Rs 516 crore versus Rs 558 crore

Margin at 5.3% versus 6.1%

Net Profit down 3.3% at Rs 358.5 crore versus Rs 370.8 crore

NOCIL Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue down 4.7% at Rs 340 crore versus Rs 356.5 crore

Ebitda down 23.4% at Rs 34.2 crore versus Rs 44.6 crore

Margin at 10.1% versus 12.5%

Net profit down 50% at Rs 20.8 crore versus Rs 41.5 crore

Alivus Life Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 21% at Rs 649 crore versus Rs 536 crore

Ebitda up 40.3% at Rs 198 crore versus Rs 141 crore

Margin at 30.5% versus 26.3%

Net profit up 44.8% at Rs 142 crore versus Rs 97.9 crore

Balrampur Chini Mills Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 4.8% at Rs 1,504 crore versus Rs 1,434 crore (Bloomberg estimate: Rs 1,481 crore)

Ebitda up 6% at Rs 365 crore versus Rs 345 crore (Bloomberg estimate: Rs 353 crore)

Margin at 24.3% versus 24% (Bloomberg estimate: 23.8%)

Net Profit up 13% at Rs 229 crore versus Rs 203 crore (Bloomberg estimate: Rs 222 crore)

IFCI Q4 FY25 Earnings Highlights (YoY)

Total income down 49% at Rs 223 crore versus Rs 436 crore

Net profit up 26.5% at Rs 273 crore versus Rs 216 crore

Endurance Tech Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 10.4% at Rs 2,963 crore versus Rs 2,685 crore (Bloomberg estimate: Rs 2970 crore)

Ebitda up 8.5% at Rs 422 crore versus Rs 389 crore (Bloomberg estimate: Rs 402 crore)

Margin at 14.3% versus 14.5% (Bloomberg estimate: 13.6%)

Net Profit up 16.6% at Rs 245 crore versus Rs 210 crore (Bloomberg estimate: Rs 203 crore)

The board recommended dividend of Rs 10 per equity share for the financial year 2024-25.

INOX India Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 34% at Rs 369 crore versus Rs 276.5 crore

EBITDA up 53.4% at Rs 81.6 crore versus Rs 53.2 crore

Margin at 22.1% versus 19.2%

Net Profit up 48.6% at Rs 65.5 crore versus Rs 44.1 crore

The board recommended a dividend of Rs 2 per share for FY25, subject to the approval o shareholders in the Annual General Meeting.

Bombay Burmah Q4 Highlights (Consolidated, YoY)

Revenue up 8.6% to Rs 4,518.82 crore versus Rs 4,161.69 crore.

Ebitda up 5% to Rs 802.30 crore versus Rs 762.81 crore.

Margin at 17.8% versus 18.3%.

Net profit up 8.7% to Rs 308.60 crore versus Rs 284.15 crore.

The board is set to pay dividend of Rs 10 per share.

Source: Exchange filing

LIC Housing Finance Q4 Highlights (YoY)

Total Income up 5% to Rs 7,283 crore versus Rs 6,937 crore.

Net profit up 25.4% to Rs 1,368 crore versus Rs 1,091 crore. (Bloomberg estimate: Rs 1,348 crore)

Abbott India Q4 Highlights (YoY)

Revenue up 11.5% to Rs 1,605 crore versus Rs 1,439 crore.

Ebitda up 29.8% to Rs 428.5 crore versus Rs 330 crore.

Margin at 26.7% versus 22.9%.

Net profit up 27.9% to Rs 367 crore versus Rs 287 crore.

Bikaji Foods Q4 Highlights (Consolidated, YoY)

Revenue flat at Rs 614 crore.

Ebitda down 53.9% to Rs 74.3 crore versus Rs 161 crore.

Margin at 12% versus 26.2%.

Net profit down 61.6% to Rs 44.6 crore versus Rs 116 crore.

JSW Energy recommended a dividend of Rs 2 per share for FY25, subject to the approval o shareholders in the Annual General Meeting.

JSW Energy Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 15.7% to Rs 3,189 crore versus Rs 2,756 crore (Bloomberg estimate: Rs 3,459 crore)

Ebitda up 3.1% to Rs 1,204.5 crore versus Rs 1,168.5 crore (Bloomberg estimate: Rs 1,315 crore)

Margin at 37.8% versus 42.4% (Bloomberg estimate: 38%)

Net Profit up 16% to Rs 408 crore versus Rs 351 crore (Bloomberg estimate: Rs 295 crore)

Godrej Industries Q4 FY25 segment-wise revenue

Real estate: Rs 2,675 crore

Animal Feed: Rs 1,146 crore

Chemicals: Rs 951 crore

Finance and investments: Rs 651 crore

Dairy: Rs 384 crore

Vegetable oils: Rs 330 crore

Godrej Industries Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 26.5% at Rs 5,780 crore versus Rs 4,567 crore

Ebitda up 29.4% at Rs 593.5 crore versus Rs 458.5 crore

Margin at 10.3% versus 10%

Net Profit at Rs 183 crore versus loss of Rs 312 crore

Godfrey Phillips Q4 FY25 Earnings Highlights (Consolidated, YoY)

Revenue up 70.6% at Rs 1,888 crore versus Rs 1,107 crore

Net Profit up 30.4% at Rs 279 crore versus Rs 214 crore

EBITDA up 41.2% at Rs 269 crore versus Rs 191 crore

Margin at 14.3% versus 17.2%

The board recommended a final dividend of Rs 60 per share for FY25.

ZF Commercial Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 5.6% at Rs 1,012 crore versus Rs 957 crore

EBITDA up 20% at Rs 175 crore versus Rs 146 crore

Margin at 17.3% versus 15.2%

Net Profit up 26.5% at Rs 127 crore versus Rs 100 crore

The board recommended a final dividend of Rs 19 per share for FY25.

Kennametal Q4 FY25 Results Highlights (YoY)

Revenue up 7.7% at Rs 290 crore versus Rs 269 crore

Ebitda down 11% at Rs 40 crore versus Rs 45 crore

Margin at 13.8% versus 16.7%

Net Profit down 36% at Rs 24.4 crore versus Rs 38.3 crore

The board recommended a final dividend of Rs 40 per share for FY25.

Datamatics Global Services Q4 FY25 Results Highlights (Consolidated, QoQ)

Revenue up 17% at Rs 497 crore versus Rs 425 crore

EBIT up 22% at Rs 54.5 crore versus Rs 45 crore

Margin at 11% versus 10.5%

Net Profit down 40% at Rs 45 crore versus Rs 74 crore

The board recommended a final dividend of Rs 5 per share for FY25.

Garware Technical Q4 Highlights (Consolidated, YoY)

Revenue up 13.4% to Rs 433 crore versus Rs 382 crore.

Ebitda up 7.7% to Rs 98 crore versus Rs 91 crore.

Margin at 22.7% versus 23.9%.

Net profit up 1.4% to Rs 71 crore versus Rs 70 crore.

Medi Assist Q4 Highlights (Consolidated, YoY)

Revenue up 13.2% to Rs 189 crore versus Rs 167 crore.

Ebitda up 10% to Rs 40.7 crore versus Rs 37 crore.

Margin at 21.6% versus 22.1%.

Net profit down 14.4% to Rs 21.4 crore versus Rs 25 crore.

Websol Energy System Q4 Highlights (YoY)

Revenue up 592% to Rs 173 crore versus Rs 25 crore.

Ebitda of Rs 78.5 crore versus an Ebitda loss of Rs 3.2 crore.

Net profit of Rs 48.3 crore versus a net loss of Rs 58.6 crore.

Global Health Q4 Highlights (Consolidated, YoY)

Revenue up 15.1% to Rs 931 crore versus Rs 809 crore. (Bloomberg estimate: Rs 925 crore)

Ebitda up 25.7% to Rs 225 crore versus Rs 179 crore.

Margin at 24.1% versus 22.2%.

Net profit down 20.5% to Rs 101 crore versus Rs 127 crore. (Bloomberg estimate: Rs 136 crore)

After posting the fourth quarter results, the board is set to pay a dividend of Rs 3 per share.

Source: Exchange filing

Crompton Greaves Q4 Highlights (Consolidated, YoY)

Revenue up 5.1% to Rs 2,061 crore versus Rs 1,961 crore. (Bloomberg estimate: Rs 2,160 crore)

Ebitda up 29.4% to Rs 264 crore versus Rs 204 crore.

Margin at 12.8% versus 10.4%.

Net profit up 22.5% to Rs 169 crore versus Rs 138 crore. (Bloomberg estimate: Rs 160 crore)

After posting fourth quarter results, the board of the company is set to pay a final dividend of Rs 12 per share.

Source: Exchange filing

Neuland Laboratories Q4 Highlights (Consolidated, YoY)

Revenue down 14.8% to Rs 328 crore versus Rs 385 crore.

Ebitda down 52.3% to Rs 51 crore versus Rs 107 crore.

Margin at 15.6% versus 27.8%.

Net profit down 58.8% to Rs 28 crore versus Rs 68 crore.

After posting fourth quarter results, the board of the company is set to pay a final dividend of Rs 2 per share.

Source: Exchange filing

Tega Industries Q4 Highlights (Consolidated, YoY)

Revenue up 5.7% to Rs 536 crore versus Rs 507 crore.

Ebitda up 7.9% to Rs 150 crore versus Rs 139 crore.

Margin at 28% versus 27.4%.

Net profit up 14.6% to Rs 102 crore versus Rs 89 crore.

LT Foods Q4 FY25 Earnings Highlights (Consolidated, YoY)

Revenue up 7.4% at Rs 2,228 crore versus Rs 2,075 crore

EBITDA up 5.4% at Rs 258 crore versus Rs 245 crore

Margin at 11.6% versus 11.8%

Net Profit up 7.9% at Rs 161 crore versus Rs 149 crore

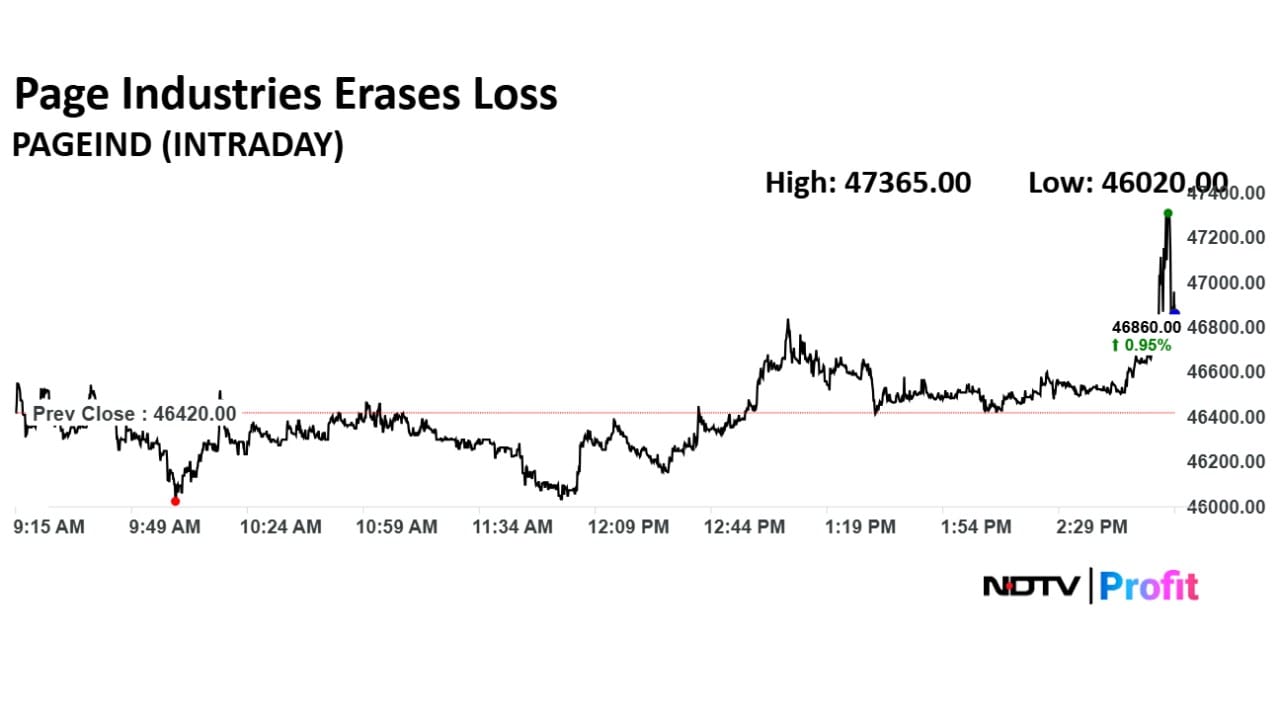

The Page Industries board recommended a fourth interim dividend of Rs 200 per share. The record date fixed for the payment of interim dividend is May 21. The date fixed for payment of dividend is on or before June 13.

Page Industries Q4 FY25 Results Highlights (YoY)

Revenue up 10.7% to Rs 1,098 crore versus Rs 992 crore (Bloomberg estimate: Rs 1,081 crore)

Ebitda up 43.4% to Rs 235 crore versus Rs 164 crore (Bloomberg estimate: Rs 199 crore)

Margin at 21.4% versus 16.5% (Bloomberg estimate: 18.9%)

Net Profit up 51.9% to Rs 164 crore versus Rs 108 crore (Bloomberg estimate: Rs 129 crore)

Page Industries Q4 FY25 Results Highlights (YoY)

Revenue up 10.7% to Rs 1,098 crore versus Rs 992 crore (Bloomberg estimate: Rs 1,081 crore)

Ebitda up 43.4% to Rs 235 crore versus Rs 164 crore (Bloomberg estimate: Rs 199 crore)

Margin at 21.4% versus 16.5% (Bloomberg estimate: 18.9%)

Net Profit up 51.9% to Rs 164 crore versus Rs 108 crore (Bloomberg estimate: Rs 129 crore)

Welspun Enterprises Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 24% at Rs 1,021 crore versus Rs 823 crore

Ebitda up 35% at Rs 153 crore versus Rs 113 crore

Margin at 15% versus 13.7%

Net Profit up 29.6% at Rs 100 crore versus Rs 77.4 crore

The board recommended a final dividend of Rs 3 per share for FY25.

Welspun Enterprises Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 24% at Rs 1,021 crore versus Rs 823 crore

Ebitda up 35% at Rs 153 crore versus Rs 113 crore

Margin at 15% versus 13.7%

Net Profit up 29.6% at Rs 100 crore versus Rs 77.4 crore

The board recommended a final dividend of Rs 3 per share for FY25.

Steel Strips Wheels Q4 Highlight (Consolidated, YoY)

Revenue up 15.4% to Rs 1,233.93 crore versus Rs 1,069.67 crore.

Net Profit down 88% to Rs 60.66 crore versus Rs 515.56 crore.

Ebitda up 21% to Rs 134.20 crore versus Rs 110.89 crore.

Margin at 10.9% versus 10.4%.

Tube Investments Q4 Highlight (Consolidated, YoY)

Revenue up 14.7% to Rs 5,149.96 crore versus Rs 4,490.11 crore.

Net Profit down 76% to Rs 46.53 crore versus Rs 191.09 crore.

Ebitda down 25% to Rs 336.64 crore versus Rs 451.24 crore.

Margin at 6.5% versus 10.0%.

Vinati Organics Q4 Highlight (Consolidated, YoY)

Revenue up 17.8% to Rs 648.46 crore versus Rs 550.31 crore.

Net Profit up 18% to Rs 123.04 crore versus Rs 104.15 crore.

Ebitda up 20% to Rs 180.42 crore versus Rs 149.90 crore.

Margin at 27.8% versus 27.2%.

Gujarat Mineral Developmental Corp. Q4 Highlight (Consolidated, YoY)

Revenue up 4.8% to Rs 786.29 crore versus Rs 750.27 crore.

Net Profit up 21% to Rs 226.22 crore versus Rs 187.24 crore.

Ebitda up 3% to Rs 193.57 crore versus Rs 188.55 crore.

Margin at 24.6% versus 25.1%.

Indian Hotels Q4 Highlight (Consolidated, QoQ)

Revenue up 4.5% to Rs 1,060.62 crore versus Rs 1,015.40 crore.

Net profit up 20% to Rs 256.90 crore versus Rs 214.97 crore.

Ebitda up 8% to Rs 412.29 crore versus Rs 380.59 crore.

Margin at 38.9% versus 37.5%.

South Indian Bank Q4 Highlight (YoY)

Net Profit rises 57.6% at Rs 683 crore versus Rs 434 crore.

Provisions at Rs 224 crore versus Rs 66 crore (QoQ).

Provisions at Rs 224 crore versus Rs 41 crore.

Gross NPA at 3.20% versus 4.30% (QoQ).

Net NPA at 0.92% versus 1.25% (QoQ).

NII down 1% to Rs 868 crore versus Rs 875 crore.

Net Profit up 19% to Rs 342 crore versus Rs 288 crore.

Cochin Shipyard Q4 Highlight (Consolidated, YoY)

Revenue up 36.6% to Rs 1,757.65 crore versus Rs 1,286.95 crore.

Net Profit up 11% to Rs 287.19 crore versus Rs 258.88 crore.

Ebitda down 8% to Rs 265.78 crore versus Rs 289.19 crore.

Margin at 15.1% versus 22.5%.

CESC Q4 Highlight (Consolidated, YoY)

Revenue up 14.5% to Rs 3,877.00 crore versus Rs 3,387.00 crore.

Net Profit down 7% to Rs 373.00 crore versus Rs 400.00 crore.

Ebitda up 98% to Rs 812.00 crore versus Rs 410.00 crore.

Margin at 20.9% versus 12.1%.

Thangamayil Jewellery Q4 Highlight (Consolidated, YoY)

Revenue up 40.7% to Rs 1,380.50 crore versus Rs 981.16 crore.

Net Profit up 11% to Rs 31.40 crore versus Rs 28.24 crore.

Ebitda up 18% to Rs 57.14 crore versus Rs 48.31 crore.

Margin at 4.1% versus 4.9%.

Announces dividend of Rs 12.50.

Caplin Point Laboratories Q4 Highlight (Consolidated, YoY)

Revenue up 10.9% to Rs 502.45 crore versus Rs 453.22 crore.

Net Profit up 17% to Rs 142.57 crore versus Rs 121.59 crore.

Ebitda up 16% to Rs 168.06 crore versus Rs 145.23 crore.

Margin at 33.4% versus 32.0%.

Arvind Q4 Highlight (Consolidated, YoY)

Revenue up 7.0% to Rs 2,220.69 crore versus Rs 2,074.51 crore.

Net Profit up 53% to Rs 151.04 crore versus Rs 99.03 crore

Ebitda up 1% to Rs 245.57 crore versus Rs 242.83 crore.

Margin at 11.1% versus 11.7%.

Endurance Technologies may post a revenue of Rs 2,970 crore and a net profit of Rs 203 crore.

Saregama India Q4 Highlight (Consolidated, YoY)

Revenue down 8.5% to Rs 240.82 crore versus Rs 263.05 crore.

Net Profit up 12% to Rs 60.13 crore versus Rs 53.80 crore.

Ebitda up 15% to Rs 80.32 crore versus Rs 70.02 crore.

Margin at 33.4% versus 26.6%.

RP-Sanjiv Goenka Group company CESC revenue is expected to rise 8% to Rs 3,614 crore, accompanied by an Ebitda of Rs 895 crore and a margin of 24.8%, leading to a net profit of Rs 360 crore.

PB Fintech, popularly known as PolicyBazaar, operates as an online platform for insurance and lending products, is projected to report a revenue of Rs 4,909 crore and a profit of Rs 304 crore.

JSW Energy is likely to generate a revenue of Rs 3,459 crore, a 25% jump over the corresponding period last year. The Ebitda is expected to be Rs 1,315 crore, yielding a margin of 38% and a net profit of Rs 295 crore.

For the fourth quarter, LIC Housing Finance is expected to report a net interest income of Rs 2,069 crore and a net profit of Rs 1,348 crore on a standalone basis.

JSW Energy Ltd., LIC Housing Finance Ltd., PB Fintech Ltd., Cochin Shipyard Ltd., South Indian Bank, ITC Hotels Ltd., Bikaji Foods Ltd. and others are set to post their fourth quarter results on Thursday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.