Singatureglobal Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 116.1% to Rs 865.67 crore versus Rs 400.61 crore.

Net Profit up 408% to Rs 34.42 crore versus Rs 6.77 crore.

Ebitda at Rs 33.18 crore versus loss of Rs 1.48 crore.

Margin at 3.8%.

NLC India Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 13.2% to Rs 3,825.61 crore versus Rs 3,378.17 crore.

Net Profit up 43% to Rs 797.59 crore versus Rs 559.42 crore.

Ebitda down 13% to Rs 936.76 crore versus Rs 1,082.12 crore.

Margin at 24.5% versus 32.0%.

Greenlam Industries Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue rises 11.4% to Rs 674 crore versus Rs 605 crore.

Net loss at Rs 15.4 crore versus Profit of Rs 20.3 crore.

Ebitda fell 31.2% to Rs 44.1 crore versus Rs 64 crore.

Margin at 6.5% versus 10.6%.

Biocon Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 14.8% to Rs 3,941.90 crore versus Rs 3,432.90 crore.

Net Profit down 95% to Rs 31.40 crore versus Rs 659.70 crore.

Ebitda up 21% to Rs 748.90 crore versus Rs 620.40 crore.

Margin at 19.0% versus 18.1%

GIC Q1 Earnings Key Highlights (Consolidated, YoY)

Net Profit rises 80.7% to Rs 2,531 crore versus Rs 1,401 crore.

Net Premium Income up 11.6% to Rs 11,274 crore versus Rs 10,098 crore.

LIC's goal is to improve VNB margins as well as volumes.

We will re-focus on the par products, and they will come back in the near future.

There was a saturation in par product segment.

Employee costs have come down since significant number of employees have retired.

Employee costs coming down is also a conscious call to undertake expense saving.

Source: Con call

KRBL Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue rises 32% to Rs 1,584 crore versus Rs 1,199 crore.

Net Profit rises 74% to Rs 151 crore versus Rs 86.4 crore.

Ebitda rises 64.4% to Rs 193 crore versus Rs 117 crore.

Margin at 12.2% versus 9.8%.

PTC India Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue declines 12% to Rs 4,009 crore versus Rs 4,555 crore.

Net Profit rises 44.2% to Rs 195 crore versus Rs 135 crore.

Ebitda up 18.2% to Rs 288 crore versus Rs 244 crore.

Margin at 7.2% versus 5.4%.

Max Financial Q1 Earnings Key Highlights (Consolidated, YoY)

Net Profit declines 45.3% to Rs 69.6 crore versus Rs 127 crore.

Impairment loss at Rs 4 lakh versus loss of Rs 7 lakh.

Calculated NII rises 17% to Rs 132 crore versus Rs 113 crore.

Repco Home Finance Q1 Earnings Key Highlights (Consolidated, YoY)

Net profit rises 2.4% to Rs 108 crore versus Rs 105 crore.

Calculated NII rises 8.3% to Rs 182 crore versus Rs 168 crore.

Impairment Loss at Rs 2.7 crore versus profit of Rs 1.4 crore.

Datta Patterns Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue down 4.6% to Rs 99.33 crore versus Rs 104.08 crore.

Net Profit down 22% to Rs 25.50 crore versus Rs 32.79 crore.

Ebitda down 14% to Rs 32.08 crore versus Rs 37.18 crore.

Margin at 32.3% versus 35.7%.

Indigo Paints Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue declines 0.7% to Rs 309 crore versus Rs 311 crore.

Net Profit falls 1% to Rs 25.9 crore versus Rs 26.2 crore.

Ebitda falls 6.4% to Rs 44.3 crore versus Rs 47.4 crore.

Margin at 14.3% versus 15.2%.

Pitti Engineering Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 16.6% to Rs 456.56 crore versus Rs 391.45 crore.

Net Profit up 18% to Rs 22.88 crore versus Rs 19.36 crore.

Ebitda up 30% to Rs 75.34 crore versus Rs 58.02 crore.

Margin at 16.5% versus 14.8%.

DCX Systems Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 60.9% to Rs 222.16 crore versus Rs 138.08 crore.

Net Profit up 38% to Rs 4.06 crore versus Rs 2.94 crore.

Ebitda at Rs 0.27 crore versus loss of Rs 4.81 crore.

Margin at 0.1%.

Shree Renuka Sugars Q1 Earnings Key Highlights (Consolidated, YoY)

Net Loss of Rs 263 crore versus loss of Rs 166 crore.

Ebitda loss of Rs 76.9 crore versus profit of Rs 84.7 crore.

Revenue declines 34.2% at Rs 2,010 crore versus Rs 3,054 crore.

The Ramco Cement Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue down 0.9% to Rs 2,074.02 crore versus Rs 2,093.55 crore.

Net Profit up 129% to Rs 85.03 crore versus Rs 37.16 crore.

Ebitda up 24% to Rs 397.53 crore versus Rs 320.17 crore.

Margin at 19.2% versus 15.3%.

KSB Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue rises 3.2% to Rs 667 crore versus Rs 646 crore.

Ebitda rises 0.9% to Rs 91.4 crore versus Rs 90.6 crore.

Margin at 13.7% versus 14%.

Net profit rises 3.4% to Rs 70.4 crore versus Rs 68.1 crore.

BSE Q1 Earnings Key Highlights (Consolidated, QoQ)

Revenue up 13.1% to Rs 1,037.45 crore versus Rs 916.97 crore.

Net Profit up 9% to Rs 539.41 crore versus Rs 494.42 crore.

Ebitda up 27% to Rs 704.99 crore versus Rs 554.54 crore.

Margin at 68.0% versus 60.5%.

Cummins India Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 26.2% to Rs 2,906.82 crore versus Rs 2,304.19 crore.

Net Profit up 40% to Rs 589.27 crore versus Rs 419.80 crore.

Ebitda up 33% to Rs 623.50 crore versus Rs 467.33 crore.

Margin at 21.4% versus 20.3%.

Innova Captab Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue rises 19.5% to Rs 352 crore versus Rs 294 crore.

Ebitda rises 23.5% to Rs 52.1 crore versus Rs 42.2 crore.

Margin at 14.8% versus 14.3%.

Net profit rises 5.2% to Rs 31 crore versus Rs 29.5 crore.

CE Info Systems Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue down 15.3% to Rs 121.61 crore versus Rs 143.55 crore.

Net Profit down 5% to Rs 46.11 crore versus Rs 48.57 crore.

Ebitda down 9% to Rs 48.99 crore versus Rs 54.00 crore.

Margin at 40.3% versus 37.6%.

Metro Brands Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 9.1% to Rs 628.24 crore versus Rs 576.08 crore.

Net Profit up 7% to Rs 98.51 crore versus Rs 91.73 crore.

Ebitda up 8% to Rs 193.90 crore versus Rs 180.37 crore.

Margin at 30.9% versus 31.3%.

India Shelter Finance Q1 Earnings Key Highlights (Consolidated, YoY)

Impairment rises 54.2% to Rs 10.2 crore versus Rs 6.6 crore.

Calculated NII up 35% to Rs 179 crore versus Rs 133 crore.

Net Profit rises 43% to Rs 119 crore versus Rs 83.5 crore.

India Glycols Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 7.4% to Rs 1,040.46 crore versus Rs 968.64 crore.

Net Profit up 21% to Rs 73.25 crore versus Rs 60.38 crore.

Ebitda up 19% to Rs 149.64 crore versus Rs 125.56 crore.

Margin at 14.4% versus 13.0%.

HPCL Q1 Earnings Key Highlights (Standalone, QoQ)

Revenue up 1.2% to Rs 1,10,767.40 crore versus Rs 1,09,492.37 crore.

Net Profit up 30% to Rs 4,370.87 crore versus Rs 3,354.98 crore.

Ebitda up 31% to Rs 7,601.77 crore versus Rs 5,803.76 crore.

Margin at 6.9% versus 5.3%.

LIC Q1 Earnings Key Highlights (Consolidated, YoY)

Net premium income up 4.71% at Rs 1.20 lakh crore versus Rs 1.14 lakh crore.

Profit up 4.11% at Rs 10,985 crore versus Rs 10,551 crore.

13th month persistency ratio at 70.9% vs 68.62% (QoQ).

61st month persistency ratio at 58.31% vs 58.54% (QoQ).

APE grew by 9.45% to Rs 12, 652 crore vs 11,560 crore.

Value of New Business grew by 20.75% to Rs 1,944 crore versus 1,610 crore.

VNB Margin at 15.4% vs 13.9%.

Titan Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 24.6% to Rs 16,523.00 crore versus Rs 13,266.00 crore.

Net Profit up 53% to Rs 1,091.00 crore versus Rs 715.00 crore.

Ebitda up 47% to Rs 1,830.00 crore versus Rs 1,247.00 crore.

Margin at 11.1% versus 9.4%.

Global Health Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 19.7% to Rs 1,030.84 crore versus Rs 861.08 crore.

Net Profit up 50% to Rs 159.01 crore versus Rs 106.29 crore.

Ebitda up 22% to Rs 226.99 crore versus Rs 186.33 crore.

Margin at 22.0% versus 21.6%.

Schneider Electric Infrastructure Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 4.8% to Rs 621.63 crore versus Rs 592.91 crore.

Net Profit down 15% to Rs 41.24 crore versus Rs 48.48 crore.

Ebitda down 15% to Rs 69.33 crore versus Rs 81.72 crore.

Margin at 11.2% versus 13.8%.

Linde India Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue down 12.6% to Rs 571.08 crore versus Rs 653.23 crore.

Net Profit down 6% to Rs 107.19 crore versus Rs 113.69 crore.

Ebitda up 7% to Rs 197.03 crore versus Rs 184.25 crore.

Margin at 34.5% versus 28.2%.

Metropolis Healthcare Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 23.2% to Rs 386.06 crore versus Rs 313.36 crore.

Net Profit up 19% to Rs 45.06 crore versus Rs 37.95 crore.

Ebitda up 14% to Rs 89.76 crore versus Rs 78.81 crore.

Margin at 23.3% versus 25.1%.

Gujarat State Fertilizers & Chemicals Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 1.0% to Rs 2,184.41 crore versus Rs 2,162.53 crore.

Net Profit up 59% to Rs 138.55 crore versus Rs 87.31 crore.

Ebitda up 76% to Rs 192.86 crore versus Rs 109.89 crore.

Margin at 8.8% versus 5.1%.

HCC Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue down 39.9% to Rs 1,091.33 crore versus Rs 1,815.95 crore.

Net profit at Rs 50.73 crore versus loss of Rs 2.46 crore.

Ebitda up 18% to Rs 179.47 crore versus Rs 152.42 crore.

Margin at 16.4% versus 8.4%.

GMM Pfaudler Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 1.2% to Rs 794.55 crore versus Rs 785.20 crore.

Net Profit down 52% to Rs 11.15 crore versus Rs 23.22 crore.

Ebitda up 14% to Rs 100.99 crore versus Rs 88.53 crore.

Margin at 12.7% versus 11.3%.

Sun TV Network Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue down 1.8% to Rs 1,290.28 crore versus Rs 1,313.55 crore.

Net Profit down 5% to Rs 529.10 crore versus Rs 559.32 crore.

Ebitda down 14% to Rs 619.35 crore versus Rs 718.84 crore.

Margin at 48.0% versus 54.7%.

Titan is likely to post net profit of Rs 936.7 crore and revenue of Rs 14,913.3 crore for the quarter ended June, according to a survey of analysts' estimates done by Bloomberg. Its earnings before interest, taxes, depreciation and amortisation seen at Rs 1,533.9 crore, and margin is expected at 10.29%.

Kalpataru Projects International Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 34.5% to Rs 6,171.17 crore versus Rs 4,586.60 crore.

Net Profit up 130% to Rs 213.62 crore versus Rs 92.83 crore.

Ebitda up 39% to Rs 525.05 crore versus Rs 378.80 crore.

Margin at 8.5% versus 8.3%.

Crompton Greaves Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue down 6.5% to Rs 1,998.34 crore versus Rs 2,137.69 crore.

Net Profit down 19% to Rs 122.29 crore versus Rs 151.72 crore.

Ebitda down 18% to Rs 191.70 crore versus Rs 232.37 crore.

Margin at 9.6% versus 10.9%.

Godrej Consumer Products Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 9.9% to Rs 3,661.88 crore versus Rs 3,331.58 crore.

Net Profit flat at Rs 452.45 crore versus Rs 450.69 crore.

Ebitda down 4% to Rs 694.58 crore versus Rs 724.43 crore.

Margin at 19.0% versus 21.7%.

Kalyan Jewellers Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 31.5% to Rs 7,268.48 crore versus Rs 5,527.82 crore.

Net Profit up 49% to Rs 264.08 crore versus Rs 177.77 crore.

Ebitda up 38% to Rs 508.03 crore versus Rs 368.37 crore.

Margin at 7.0% versus 6.7%.

Birlasoft Q1 Earnings Key Highlights (Consolidated, QoQ)

Revenue down 2.4% to Rs 1,284.90 crore versus Rs 1,316.89 crore.

Net Profit down 13% to Rs 106.43 crore versus Rs 122.11 crore.

Ebitda down 9% to Rs 133.07 crore versus Rs 146.43 crore.

Margin at 10.4% versus 11.1%.

NALCO Q1 Earnings Key Highlights (Consolidated, QoQ)

Revenue down 27.7% to Rs 3,806.94 crore versus Rs 5,267.83 crore.

Net Profit down 49% to Rs 1,049.48 crore versus Rs 2,067.23 crore.

Ebitda down 46% to Rs 1,492.14 crore versus Rs 2,753.88 crore.

Margin at 39.2% versus 52.3%.

Solar Industries Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 27.9% to Rs 2,154.45 crore versus Rs 1,684.80 crore.

Net Profit up 18% to Rs 338.70 crore versus Rs 286.46 crore.

Ebitda up 19% to Rs 534.85 crore versus Rs 449.38 crore.

Margin at 24.8% versus 26.7%.

Navneet Education Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 82.9% to Rs 794.00 crore versus Rs 434.00 crore.

Net Profit up 227% to Rs 157.00 crore versus Rs 48.00 crore.

Ebitda up 187% to Rs 227.00 crore versus Rs 79.00 crore.

Margin at 28.6% versus 18.2%.

Apollo Pipes Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue down 10.9% to Rs 275.00 crore versus Rs 308.50 crore.

Net Profit down 35% to Rs 8.14 crore versus Rs 12.49 crore.

Ebitda down 29% to Rs 20.68 crore versus Rs 28.97 crore.

Margin at 7.5% versus 9.4%.

Lumax Auto Technologies Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 35.8% to Rs 1,026.37 crore versus Rs 755.93 crore.

Net Profit up 31% to Rs 41.42 crore versus Rs 31.70 crore.

Ebitda up 42% to Rs 124.88 crore versus Rs 88.03 crore.

Margin at 12.2% versus 11.6%.

NBCC Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 11.6% to Rs 2,391.19 crore versus Rs 2,142.53 crore.

Net Profit up 26% to Rs 132.13 crore versus Rs 104.62 crore.

Ebitda up 20% to Rs 110.16 crore versus Rs 91.63 crore.

Margin at 4.6% versus 4.3%.

Varroc Engineering Q1 Earnings Key Highlights (Consolidated, YoY)

Net Profit rose 224.1% to Rs 105 crore versus Rs 32.4 crore

Revenue rose 6.8% to Rs 2,028 crore versus Rs 1,899 crore

Ebitda rose 11.9% to Rs 195 crore versus Rs 174 crore

Margin at 9.6% versus 9.2%

After posting first quarter results, the company is set to pay an interim dividend of Rs 150 per share.

Page Industries Q1 Highlights (Cons, YoY)

Revenue up 3.1% to Rs 1,316 crore versus Rs 1,277 crore

Ebitda up 20.6% to Rs 293 crore versus Rs 243 crore

Margin at 22.3% versus 19.0%

Net profit up 21.2% to Rs 200 crore versus Rs 165 crore

Carborundum Universal Q1 Highlights (Cons, YoY)

Revenue up 1.8% to Rs 1,219 crore versus Rs 1,197 crore.

Ebitda down 37.4% to Rs 121 crore versus Rs 194 crore.

Margin at 9.9% versus 16.2%.

Net Profit down 45.2% to Rs 61.9 crore versus Rs 113 crore.

IOL Chemicals Q1 Highlights (Cons, YoY)

Revenue up 9.8% to Rs 551 crore versus Rs 502 crore.

Ebitda up 22% to Rs 61 crore versus Rs 50 crore.

Margin at 11.1% versus 10.0%.

Net profit up 13.8% to Rs 33 crore versus Rs 29 crore.

FDC Q1 Highlights (Cons, YoY)

Revenue up 1.6% to Rs 648 crore versus Rs 638 crore.

Ebitda down 4.3% to Rs 140 crore versus Rs 147 crore.

Margin at 21.6% versus 23%.

Net Profit up 2% to Rs 121 crore versus Rs 119 crore.

Edelweiss Financial Services Q1 Highlights (Cons, YoY)

Total Income down 2% to Rs 2,246 crore versus Rs 2,293 crore.

Net Profit up 13.4% to Rs 66.8 crore versus Rs 58.9 crore.

Sandhar Tech Q1 Highlights (Cons, YoY)

Revenue up 19.5% to Rs 1,090 crore versus Rs 913 crore.

Ebitda down 3.8% to Rs 82.4 crore versus Rs 85.6 crore.

Margin down to 7.6% versus 9.4%.

Net profit down 3.6% to Rs 28.01 crore versus Rs 29 crore.

Century Plyboards Q1 Highlights (Cons, YoY)

Revenue up 16.3% to Rs 1,169 crore versus Rs 1,005 crore.

Ebitda up 15.3% to Rs 128 crore versus Rs 111 crore.

Margin slightly down to 11% versus 11.1%.

Net profit up 50.6% to Rs 51.8 crore versus Rs 34.4 crore.

Re-appoints Sajjan Bhajanka as Chairman and MD for 5 more years.

Emcure Pharma Q1 Highlights (Cons, YoY)

Revenue up 15.7% to Rs 2,101 crore versus Rs 1,815 crore.

Ebitda up 23.8% to Rs 417 crore versus Rs 337 crore.

Margin up to 19.8% versus 18.5%.

Net profit up 43.6% to Rs 207 crore versus Rs 144 crore.

3M Q1 Highlights (YoY)

Revenue up 14.3% at Rs 1,196 crore versus Rs 1,047 crore.

Ebitda contracted 3.3% to Rs 454.01 crore versus Rs 469.55 crore.

Margin at 38% versus 44.9%.

Net Profit up 13% to Rs 178 crore versus Rs 157 crore.

Bajaj Electricals Q1 Highlights (Cons, YoY)

Revenue down 7.8% to Rs 1,065 crore versus Rs 1,155 crore.

Ebitda down 55.8% to Rs 33.3 crore versus Rs 75.4 crore.

Margin at 3.1% versus 6.5%.

Net Profit down 96.8% to Rs 91 lakh versus Rs 28 crore.

Exceptional loss of Rs 6.68 crore in Q1.

Rategain Travel Q1 Highlights (Cons, YoY)

Revenue up 5% to Rs 273 crore versus Rs 260 crore.

Ebitda down 0.2% to Rs 49.6 crore versus Rs 49.7 crore.

Margin at 18.2% versus 19.1%.

Net Profit up 3.4% to Rs 46.9 crore versus Rs 45.4 crore.

Caplin Point Q1 Highlights (Cons, YoY)

Revenue up 11.2% to Rs 510 crore versus Rs 459 crore.

Ebitda up 17% to Rs 178 crore versus Rs 152 crore.

Margin up to 34.8% versus 33%.

Net profit up 23.3% to Rs 153 crore versus Rs 124 crore.

Announces final dividend of Rs 3 per share.

Prism Johnson Q1 Highlights (Cons, YoY)

Revenue up 10% to Rs 1,922 crore versus Rs 1,747 crore.

Ebitda up 27.4% to Rs 168 crore versus Rs 132 crore.

Margin at 8.8% versus 7.6%.

Net loss of Rs 5.6 crore versus loss of Rs 18.2 crore.

Titan is likely to post net profit of Rs 936.7 crore and revenue of Rs 14,913.3 crore for the quarter ended June, according to a survey of analysts' estimates done by Bloomberg. Its earnings before interest, taxes, depreciation and amortisation is seen at Rs 1,533.9 crore, and margin is expected at 10.29%.

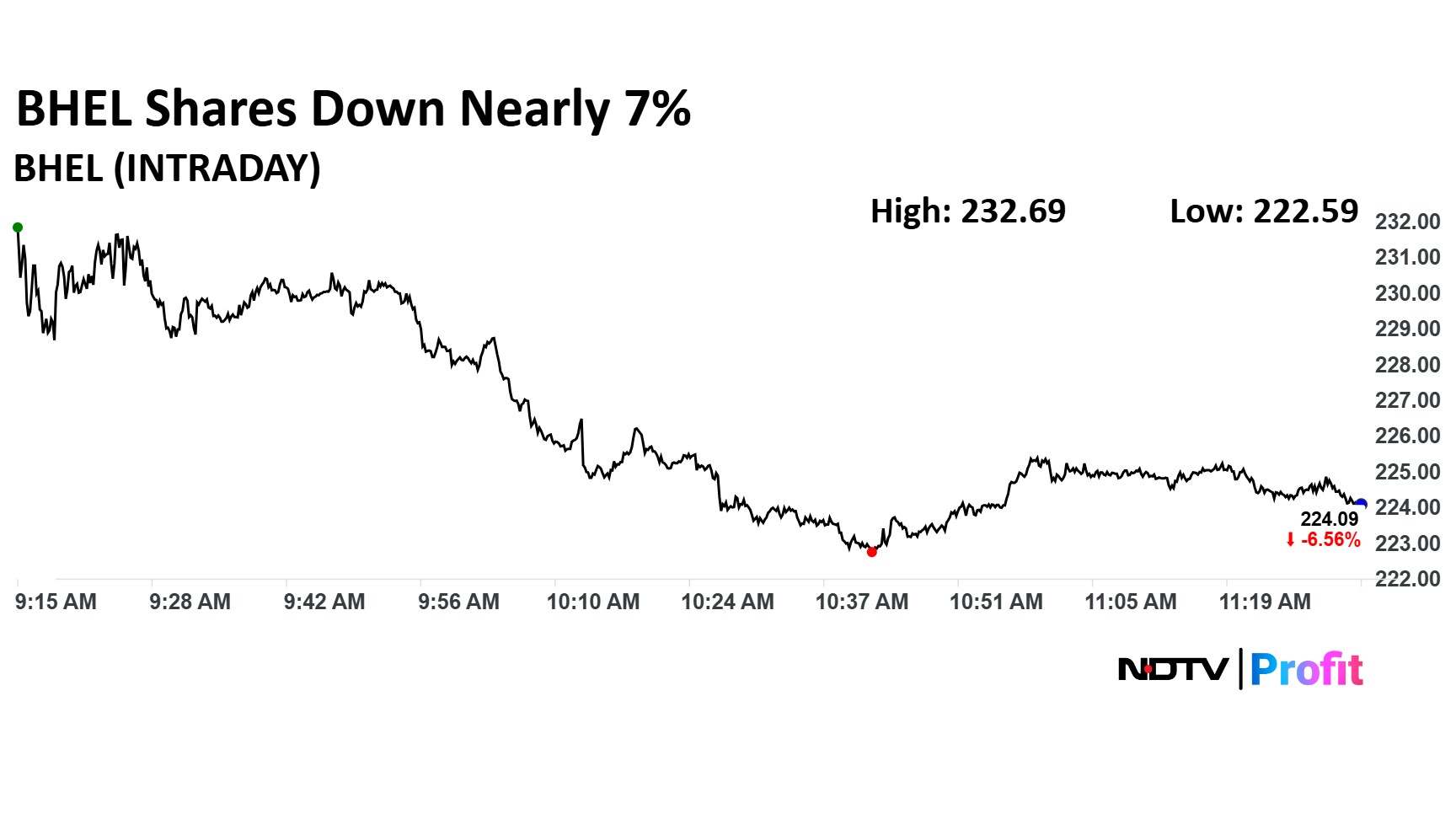

Bharat Heavy Electricals Ltd. shares dipped over 7% during trade so far after the company reported an increase in its net loss for the first quarter of fiscal year 2026.

The 6% plunge compares to a 0.59% decline in the benchmark index Nifty 50 at 12:10 p.m.

Bharat Heavy Electricals Ltd. shares dipped over 7% during trade so far after the company reported an increase in its net loss for the first quarter of fiscal year 2026.

The 6% plunge compares to a 0.59% decline in the benchmark index Nifty 50 at 12:10 p.m.

LIC is likely to report a net profit of Rs 11,338.7 crore and total income of Rs 1,24,491.60 crore for the first quarter, according to estimates.

Godrej Consumer Products is likely to report a net profit of Rs 499.7 crore and total revenue of Rs 3,629.80 crore for the first quarter, as per the estimates. Its Ebitda is seen at Rs 750.2 crore, and margins are likely to be at 20.67%.

BSE is likely to report a net profit of Rs 475.6 crore and total revenue of Rs 949.6 crore for the first quarter, according to estimates. Its Ebitda is seen at Rs 624.9 crore, and margin is expected at 65.81%.

Life Insurance Corp., BSE Ltd., Titan Co. and Godrej Consumer Products Ltd. are among the top names that will announce their earnings for the first quarter today.

This is your front-row seat to the earnings action, so stay with us for real-time updates, analysis of the numbers, and all the key details that companies will be putting out through the day!

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.