Key highlights (Consolidated, QoQ)

Revenue up 12.92% at Rs 559 crore versus Rs 495 crore.

Ebitda up 53.87% at Rs 73.4 crore versus Rs 47.7 crore.

Ebitda margin up 349 bps at 13.13% versus 9.63%.

Net profit up 101.21% at Rs 33 crore versus Rs 16.4 crore.

Key highlights (Consolidated, QoQ)

Revenue rises 4% to Rs 935 crore versus Rs 898 crore.

Net profit declines 7% to Rs 142 crore versus Rs 152 crore.

EBIT up 3.3% to Rs 184 crore versus Rs 178 crore.

Margin at 19.6% versus 19.8%.

Key highlights (Consolidated, YoY)

Revenue rises 58.5% to Rs 151 crore versus Rs 95 crore.

Net profit up 39.5% at Rs 24.9 crore versus Rs 17.8 crore.

Ebitda increases 29.1% to Rs 38 crore versus Rs 29.4 crore.

Margin at 25.2% versus 31%.

Will return to the board with a comprehensive succession plan within six months.

NIM guidance flat for fiscal 2026, with a 5–10 basis points positive bias.

Credit cost expected at 185–195 basis points for fiscal 2026.

Second quarter credit cost to remain flat; decline expected from third quarter onwards.

Exit from 2W/3W to save 5–7 bps annually on credit cost.

Loan composition to remain largely unchanged, except for 2W/3W segment.

Key highlights (Consolidated, YoY)

Revenue up 15.4% to Rs 274.06 crore versus Rs 237.56 crore.

Net Profit up 14% to Rs 77.26 crore versus Rs 68.07 crore.

Ebitda up 14% to Rs 113.86 crore versus Rs 99.67 crore.

Margin at 41.5% versus 42%.

FINAI (Finance Meets AI) rolled out nationwide, including in digital assets.

Heavy reliance on bonds and ECBs over next 12 months to lower cost of funds.

Consumer leverage remains elevated; cautious stance continues.

Credit cost high in 2W/3W segment, which is being wound down.

MSME business under stress since February; growth to be slow this year.

Two-wheeler or three-wheeler book to reduce to below Rs 3,000–4,000 crore by March 2026.

Rajeev Jain returns to operating role to ensure stability.

Succession planning discussions expected closer to March 2028.

Source: Con call

The company lowered volume guidance for fiscal 2026 to 10-15% from earlier guided 20%.

APL Apollo expects Ebitda tonne for financial year 2026 at Rs 4600-Rs 5000/ tonne.

Employee cost including ESOP impacted Ebitda/tonne by Rs 300 tonne in the first quarter.

The first quarter witnessed a decline in volume from elevated geopolitical tensions.

The company expects fiscal 2027 to be better than fiscal 2026.

First quarter performance sets an optimistic tone for the full year.

Strong traction observed in individual new business premium.

Agency and bancassurance channels have helped expand reach.

Maintained private market share in individual rated premium at 22.3%.

Group protection new business rose 40% year-on-year.

Protection business contributed 12% of total APE.

Key highlights (Consolidated, QoQ)

Revenue rises 1.6% to Rs 1,041 crore versus Rs 1,024 crore.

Net profit up 0.9% at Rs 118 crore versus Rs 117 crore.

Ebitda inches up 0.3% to Rs 164 crore versus Rs 163 crore.

Margin at 15.8% versus 16%.

Key highlights (Consolidated, YoY)

Revenue rises 5.4% to Rs 953 crore versus Rs 904 crore.

Net profit up 3.5% at Rs 241 crore versus Rs 233 crore.

Ebitda grows 6.3% to Rs 564 crore versus Rs 531 crore.

Margin at 59.2% versus 58.7%.

Rajesh Kulkarni re-appointed as Whole-Time Director for five years.

Key highlights (Consolidated, YoY)

Revenue rises 25.6% to Rs 592 crore versus Rs 472 crore.

Net profit up 38.3% at Rs 126 crore versus Rs 91 crore.

Ebitda climbs 46.3% to Rs 151 crore versus Rs 103 crore.

Margin at 25.4% versus 21.8%.

Key highlights (Standalone, YoY)

Revenue up 13.3% to Rs 139.99 crore versus Rs 123.56 crore.

Net Profit up 21% to Rs 113.04 crore versus Rs 93.42 crore.

Ebitda up 14% to Rs 113.90 crore versus Rs 100.03 crore.

Margin at 81.4% versus 81.0%

Key highlights (Consolidated, YoY)

Revenue declines 14.4% to Rs 853 crore versus Rs 996 crore.

Net profit down 57.8% at Rs 15.3 crore versus Rs 36.15 crore.

Ebitda falls 35.6% to Rs 36.4 crore versus Rs 56.6 crore.

Margin at 4.3% versus 5.7%.

Key highlights (Consolidated, QoQ)

Revenue down 10.3% to Rs 1,711.80 crore versus Rs 1,909.20 crore.

Net Profit down 10% to Rs 153.80 crore versus Rs 170.40 crore.

EBIT down 31% to Rs 162.70 crore versus Rs 234.80 crore.

Margin at 9.5% versus 12.3%.

Key highlights (Consolidated, YoY)

Revenue declines 2.1% to Rs 1,707 crore versus Rs 1,743 crore.

Net profit up 89.8% at Rs 140 crore versus Rs 73.7 crore.

EBITDA rises 31.5% to Rs 289 crore versus Rs 220 crore.

Margin at 16.9% versus 12.6%.

Board approves raising up to Rs 500 crore via NCDs.

Key highlights (Consolidated, QoQ)

Revenue rises 45.5% to Rs 547 crore versus Rs 376 crore.

Net Profit at Rs 237 crore versus Rs 87.5 crore.

Key highlights (Consolidated, YoY)

Revenue rises 42.3% to Rs 256 crore versus Rs 180 crore.

Net profit up 57.2% at Rs 47 crore versus Rs 29.9 crore.

Ebitda advances 87.2% to Rs 80.7 crore versus Rs 43.1 crore.

Margin at 31.5% versus 23.9%.

Key highlights (Consolidated, YoY)

Revenue rises 10.9% to Rs 117 crore versus 105 crore.

Net Profit up 27.6% at Rs 6.7 crore versus Rs 5.2 crore.

Ebitda advances 38.4% to 17.4 crore versus Rs 12.5 crore.

Margin at 14.8% versus 11.9%.

Key highlights (Consolidated, YoY)

Revenue up 12.7% to Rs 14,737.45 crore versus Rs 13,078.66 crore.

Net Profit up 29% to Rs 4,465.71 crore versus Rs 3,469.19 crore.

Ebitda up 17% to Rs 14,520.76 crore versus Rs 12,361.61 crore.

Margin at 98.5% versus 94.5%.

Key highlights (YoY)

Net Premium Income rises 13.7% at Rs 17,179 crore versus Rs 15,105 crore.

Solvency Ratio Flat At 1.96% (QoQ)

61st Month Persistency Ratio at 59.16% versus 61.51% (QoQ).

13th Month Persistency Ratio At 84.23% versus 86.64% (QoQ) .

Net Profit rises 14.4% at Rs 594 crore verus Rs 520 crore.

VNB Margin down 300 basis points at 27.46% vs 30.46% (QoQ).

APE up at 9% at Rs 3,970 crore versus Rs 3,640 crore.

VNB up 12.3% at Rs 1090 crore versus Rs 970 crore.

Key highlights (YoY)

Net Profit up 22% to Rs 4,133.08 crore versus Rs 3,401.54 crore.

Impairments on financial instruments rose to Rs 2,120 crore as against Rs 1.684 crore.

NII ries 21% at Rs 12,610 crore versus Rs 10,418 crore.

GNP ratio rose to 1.03% versus 0.96% (QoQ).

Net NPA ratio rose to 0.50% versus 0.44% (QoQ).

Key highlights

Ebitda/ton down 4% quarter-on-quarter at Rs 4,683 versus Rs 4,864.

Sales volume decreased 7% quarter-on-quarter.

The company proposed capacity expansion to 6.8 Mn ton fiscal 2028 (Existing capacity 4.5 Mn Ton).

Key highlights (YoY)

Provisions down 26.8% to Rs 118 crore versus Rs 161 crore. (QoQ)

Provisions falls 11.1% to Rs 118 crore versus Rs 133 crore.

Operating Profit falls 58.2% to Rs 806 crore versus Rs 1,927 crore.

Net Interest Income rises 5% to Rs 1,079 crore versus Rs 1,027 crore.

Gross NPA at 0.66% versus 0.76% (QoQ).

Net NPA at 0.19% versus 0.2% (QoQ).

Net Profit rises 13.7% at Rs 521 crore versus Rs 459 crore.

Key highlights (Consolidated, YoY)

Net profit falls 19.1% to Rs 237 crore versus Rs 293 crore.

Revenue declines 6.2% to Rs 5,170 crore versus Rs 5,509 crore.

Ebitda falls 10.1% to Rs 372 crore versus Rs 414 crore.

Margin at 7.2% versus 7.5%.

Key highlights (Consolidated, YoY)

Net Profit at Rs 539 crore versus loss Of Rs 1,191 crore.

Revenue rises 26.8% to Rs 6,819 crore versus Rs 5,379 crore.

Ebitda rises 3% to Rs 2,315 crore versus Rs 2,244 crore.

Margin at 33.9% versus 41.7%.

Bajaj Finance will also be reporting its results for the quarter on Thursday. The company is likely to report a net profit of Rs 4,634 crore and total income of Rs 12,629 crore.

Key highlights (Consolidated, YoY)

Revenue up 29.2% to Rs 2,878.05 crore versus Rs 2,227.52 crore.

Net Profit up 12% to Rs 269.23 crore versus Rs 241.24 crore.

Ebitda up 17% to Rs 381.22 crore versus Rs 327.09 crore.

Margin at 13.2% versus 14.7%.

Key highlights (Consolidated, YoY)

Revenue up 19.0% to Rs 2,463.92 crore versus Rs 2,070.51 crore.

Net Profit up 10% to Rs 168.50 crore versus Rs 153.17 crore.

Ebitda up 10% to Rs 265.42 crore versus Rs 240.90 crore.

Margin at 10.8% versus 11.6%.

Key highlights (Consolidated, YoY)

Revenue up 48.9% to Rs 7,042.30 crore versus Rs 4,728.83 crore.

Net Profit up 62% to Rs 505.01 crore versus Rs 310.97 crore.

Ebitda up 55% to Rs 782.12 crore versus Rs 505.77 crore.

Margin at 11.1% versus 10.7%.

To Acquire additional 17.69% stake in Baobab Mining for $7.7 million.

Approves capex plan to set up bagging plant at Kakinada for Rs 137 crore.

Key highlights (QoQ)

Provisions falls 15% to Rs 225 crore versus Rs 265 crore.

Provisions at Rs 225 crore versus Rs 110 crore.

Operating Profit falls 29.3% to Rs 360 crore versus Rs 510 Cr (YoY).

Net Interest Income falls 9% to Rs 856 crore versus Rs 941 Cr (YoY).

Net NPA at 0.7% versus 0.49%.

Gross NPA at 2.52% versus 2.18%.

Net Profit falls 65.7% to Rs 103 crore versus Rs 301 Cr (YoY).

Key highlights (Consolidated, QoQ)

Net Profit rises 21.5% to Rs 277 crore versus Rs 228 crore.

Total Income rises 12.9% to Rs 565 crore versus Rs 501 crore.

Key highlights (Consolidated, YoY)

Net Profit rises 23.7% to Rs 2,973 crore versus Rs 2,403 crore.

Gross NPA at 3.01% versus 3.09% (QoQ)

Net NPA at 0.18% versus 0.19% (QoQ)

Net Interest Income rises 2.9% to Rs 6,359 crore versus Rs 6,178 crore.

Operating Profit rises 6% to Rs 4,770 crore versus Rs 4,502 crore.

Provisions falls 13% to Rs 691 crore versus Rs 795 crore (QoQ).

Provisions falls 45% to 691 crore versus Rs 1,258 crore.

Key highlights (Consolidated, YoY)

Revenue up 18% at Rs 6,036 crore versus Rs 5,113 crore.

Ebitda up 22.6% at Rs 727 crore versus Rs 593 crore.

Margin at 12.1% versus 11.6%.

Net profit rises 4.4% to Rs 375 crore versus Rs 360 crore.

Key highlights (YoY)

Revenue up 12.6% at Rs 885 crore versus Rs 786 crore.

Ebitda up 27.5% at Rs 126 crore versus Rs 99 crore.

Margin at 14.3% versus 12.6%.

Net profit rises 177.7% to Rs 33.6 crore versus Rs 12.1 crore.

Key highlights (YoY)

Provisions rise 3% to Rs 2,351 crore versus Rs 2,282 crore.

Operating Profit rises 12.3% to Rs 8,553 crore versus Rs 7,616 crore.

Net NPA at 0.63% versus 0.7% (QoQ)

Gross NPA at 2.69% versus 2.94% (QoQ)

Net Profit rises 21.7% to Rs 4,752 crore versus Rs 3,905 crore.

Key highlights (Consolidated, YoY)

Net profit at Rs 1,156 crore versus loss of Rs 63.2 crore.

NII rises to Rs 2,449 crore versus Rs 910 crore.

Key highlights (Consolidated, YoY)

Revenue down 1% at Rs 2,609 crore versus Rs 2,636 crore.

Ebitda down 17.7% at Rs 319 crore versus Rs 388 crore.

Margin at 12.2% versus 14.7%.

Net profit falls 26% to Rs 202 crore versus Rs 273 crore.

Bajaj Finance will be reporting its results for the quarter on Thursday. The company is likely to report a net profit of Rs 4,634 crore and total income of Rs 12,629 crore.

Airtel Africa Q1FY26 Result

Revenue up 7.4% to $1415 million versus $1317 million

EBITDA up 12% to $673 million versus $602 million

EBITDA margin at 47.6% versus 45.7%

Net profit up 95% to $156 million versus $80 million

Note: Airtel Africa is subsidiary of Bharti Airtel

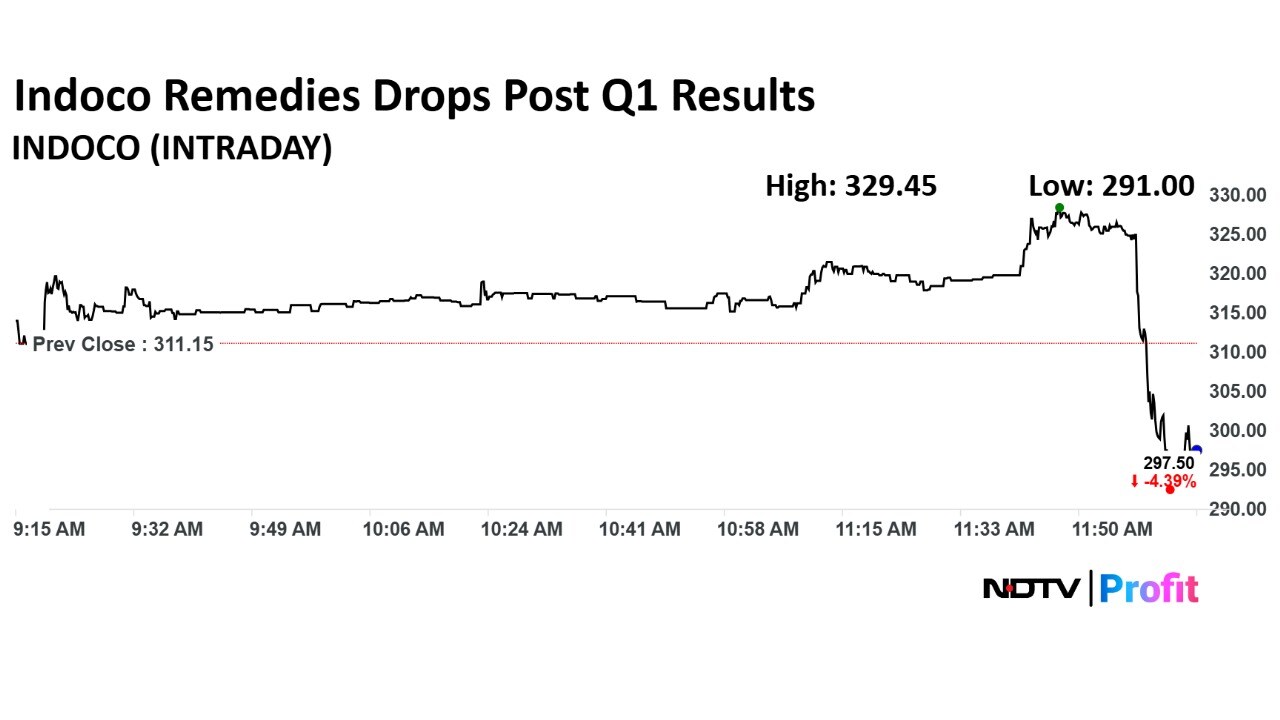

Share price of Indoco Remedies Ltd. fell 6.48% at intraday but later recovered losses to trade higher after Q1 results.

Share price of Indoco Remedies Ltd. fell 6.48% at intraday but later recovered losses to trade higher after Q1 results.

Key highlights (Consolidated, YoY)

Revenue up 1.5% at Rs 438 crore versus Rs 431 crore

EBITDA down 63.4% at Rs 17.5 crore versus Rs 47.8 crore

Margin at 4% versus 11.1%

Net Loss of Rs 35.8 crore versus Profit of Rs 2.6 crore

Bajaj Finance, Canara Bank, Adani Energy Solutions, Indian Bank, ACC wille be reporting their first quarter earnings shortly.

Other companies reporting their June quarter financials include Coromandel International, Cyient, Indian Energy Exchange, Mphasis, Phoenix Mills, REC, SBI Life Insurance Co, Supreme Industries and more.

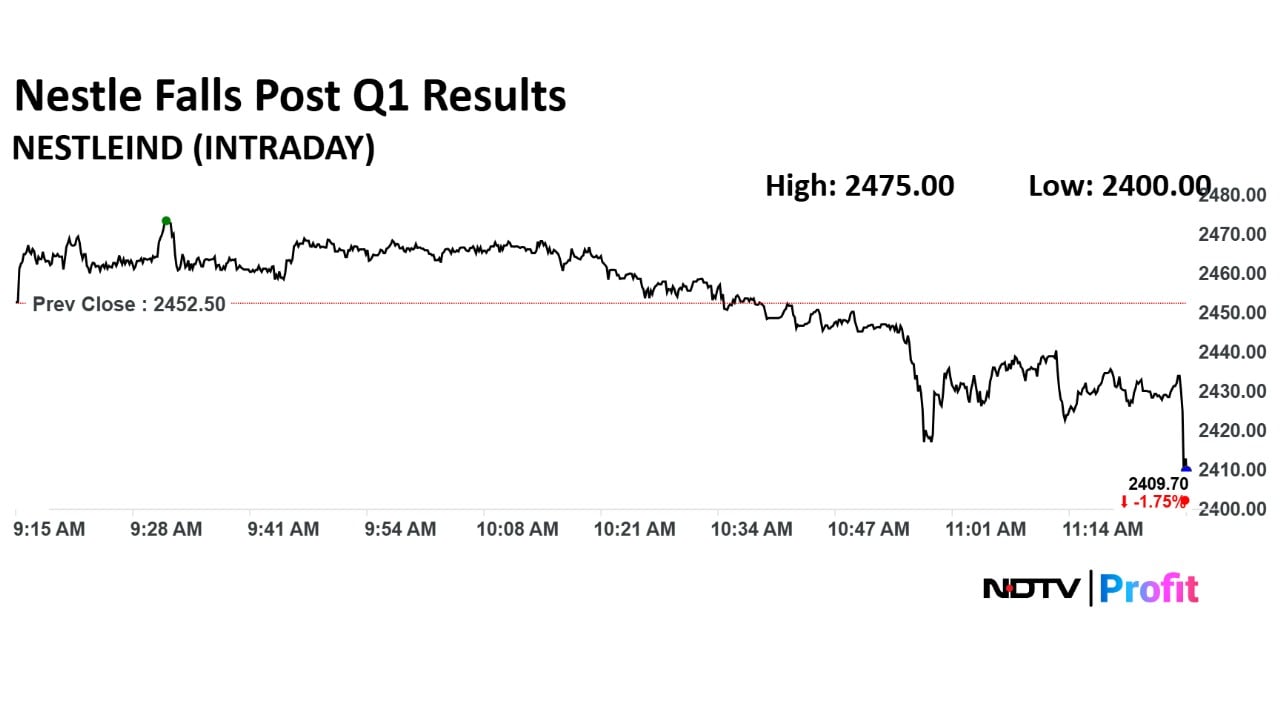

The company reported a its first quarter earning for financial year 2026 and the shares fell 5.19% post announcement.

The company reported a its first quarter earning for financial year 2026 and the shares fell 5.19% post announcement.

Key highlights (Standalone, YoY)

Revenue up 5.9% to 5,096 crore versus 4,814 crore (Bloomberg Estimate: Rs 5,103 crore)

Ebitda down 1.3% to Rs 1,100.2 crore versus Rs 1,114.3 crore (Estimate: Rs 1,181 crore)

Margin at 21.6% versus 23.1% (Estimate: 23.1%)

Profit down 11.7% to Rs 659.2 crore versus 746.6 crore. (Estimate: Rs 751 crore)

Read more about it here

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.