- Gold fell below $4,900 an ounce amid Lunar New Year closures in Asia

- Spot gold dropped 3% Tuesday, hitting a one-week intraday low

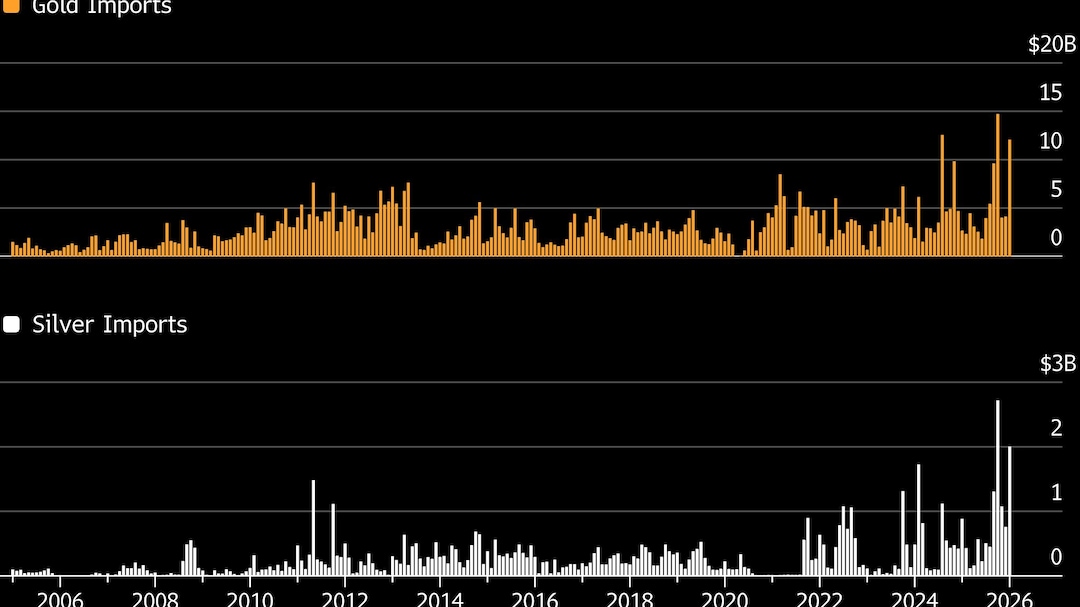

- India reported near-record gold and silver imports through January

Gold fell below $4,900 an ounce, with much of Asia, the top consuming region, closed for the Lunar New Year. Silver also retreated.

Spot gold fell as much as 3% on Tuesday, reaching its lowest intraday level in more than a week. The move followed a 1% drop in the previous session.

Bullion has been on a powerful multiyear rally that accelerated through January, before an abrupt sell-off at the end of that month. From a peak above $5,595 an ounce, bullion snapped back to near $4,400 in two days. It has since regained some ground, though prices remain volatile.

Robust retail demand in China and India, the two biggest markets for physical bullion, has been a key support for prices in recent months.

Indian import data showed near-record gold and silver imports through January. The country shipped in more than $12 billion of gold over the period, the third-highest monthly total on record. Silver imports surged above $2 billion

Elsewhere, many banks — including BNP Paribas SA, Deutsche Bank AG and Goldman Sachs Group Inc. — have forecast that prices will resume their upward trend, with the factors that underpinned gold's steady ascent set to persist.

“We continue to see two main supportive macro factors for gold: inflation and dollar debasement,” analysts at Jefferies including Fahad Tariq wrote in a note, raising their 2026 price forecast to $5,000 an ounce from $4,200. Investors and central banks concerned about these factors “have only really one option: hard assets,” they said.

The US rate path remains in focus following the slower-than-expected inflation print on Friday. US markets will return later Tuesday after observing the Presidents' Day holiday, and traders will be watching for the minutes of the Fed's January meeting — due Wednesday — for a fresh read on the economy.

Silver, meanwhile, plunged as much as 5.4% before paring some losses. The white metal has always been subject to more violent swings than gold, due to its smaller market and lower liquidity. Still, recent moves – the most volatile since 1980 – have stood out for their scale and speed.

Spot gold fell 1.9% to $4,895.62 an ounce as of 9:16 a.m. in New York. Silver slipped 3.18% to $74.17. Platinum and palladium both declined. The Bloomberg Dollar Spot Index, a gauge of the US currency, rose 0.25%.

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.