Mahindra and Mahindra Ltd. on Monday announced dividend of Rs 25.3 per equity share for the fourth quarter of fiscal 2025. The company announced distribution of Rs 3,146.13 crore to shareholders in the fourth quarter of this fiscal.

The board has fixed July 4 as the record date for the purpose of dividend payment, the company said in an exchange filing on Monday.

In comparison, the company had issued a final dividend of Rs 21.10 apiece on July 4, 2024 and a dividend of Rs 16.25 on July 14, 2023.

Mahindra and Mahindra's standalone net profit rose 22% year-on-year to Rs 2,437.14 crore in the three months ended March 31, 2025. The company's bottom line was in line with the consensus estimate of Rs 2,490 crore of analysts tracked by Bloomberg.

The auto maker's revenue during the fourth quarter rose 24.3% to Rs 31,608.67 crore in the January-March period, as against Rs 25,433.77 crore over the same period last year. Operating income, or earnings before interest, taxes, depreciation, and amortisation, rose 23% year-on-year to Rs 4,219.25 crore. The Ebitda margin was at 13.3% versus 13.5%.

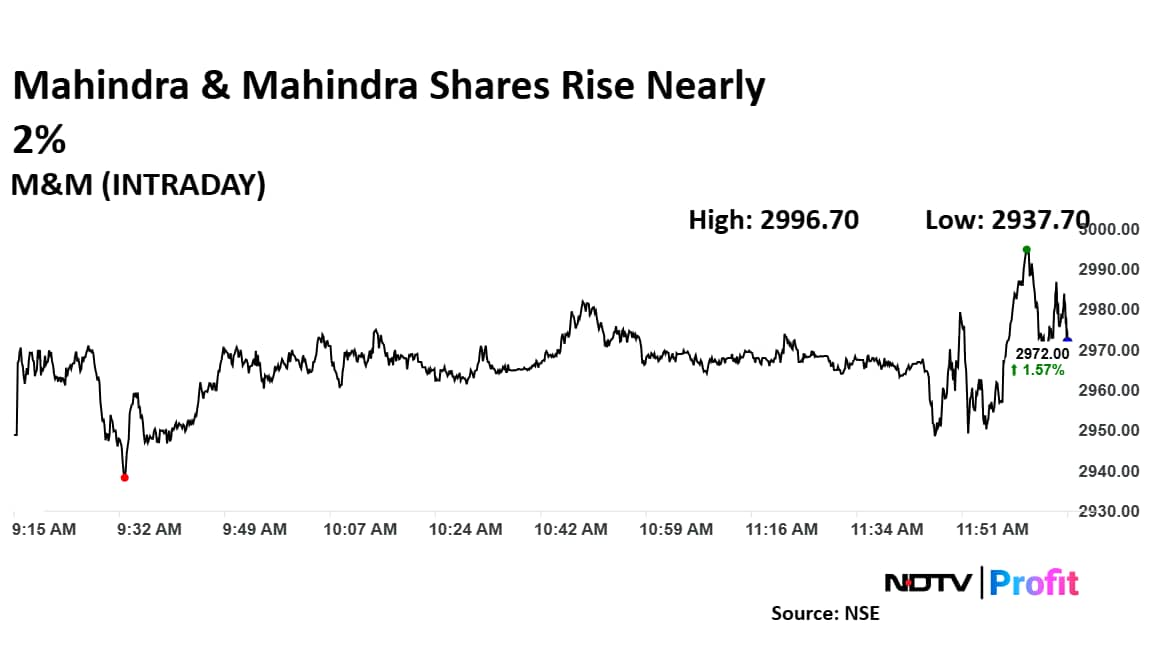

Mahindra and Mahindra Share Price Rise

Shares of Mahindra and Mahindra pared gains after rising nearly 2% on Monday. The shares rose as much as 2.02% during the day to Rs 2,985.40 apiece on the NSE. They were trading 1.14% higher at Rs 2,959.70 apiece, as of 12:04 p.m. This compares to a 0.45% advance in the NSE Nifty 50.

The stock has risen 33.45% in the last 12 month and fallen 3% year-to-date. The relative strength index was at 67.

Out of 41 analysts tracking the company, 39 maintain a 'buy' rating and two suggest 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 15.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.