Shares of Hindustan Unilever Ltd. slipped 4% after the company reported a fourth-quarter profit that met expectations, but offered little to cheer beyond that.

The standalone net profit rose 4% year-on-year to Rs 2,493 crore in the March quarter, in line with the Rs 2,482 crore estimate compiled by Bloomberg. While volumes picked up slightly, up 2% compared to flat growth in the previous quarter, margins came under pressure due to rising raw material costs.

Shares had opened higher after the results but quickly reversed as investors found no major surprises or improvement in the company's business segments.

The company which is a bellwether for the consumer space has not wowed investors and subsequently, the Nifty FMCG gauge and nine out of its 15 constituents are declining in trade.

Abneesh Roy, executive director and FMCG analyst at Nuvama Institutional Equities, said the company is expected to focus on offering better value to consumers in the financial year 2025–26. This, he said, could result in slightly lower gross and operating margins, partly offset by a reduction in advertising spends.

“In our view, the company's key priority will be to regain 4–5% volume growth during the year,” Roy said.

Hindustan Unilever Q4 Highlights (Standalone, YoY)

Revenue rose 2.4% to Rs 15,214 crore versus Rs 14,857 crore. (Bloomberg estimate: Rs 15,200 crore).

Ebitda up 1% to Rs 3,466 crore versus Rs 3,435 crore. (Bloomberg estimate: Rs 3,409 crore).

Ebitda margins contracted to 22.8% versus 23.1%. (Bloomberg estimate: 22.4%).

Net profit up 4% to Rs 2,493 crore versus Rs 2,406 crore. (Bloomberg estimate: Rs 2,482 crore).

Final dividend of Rs 24 per share for financial year 2025.

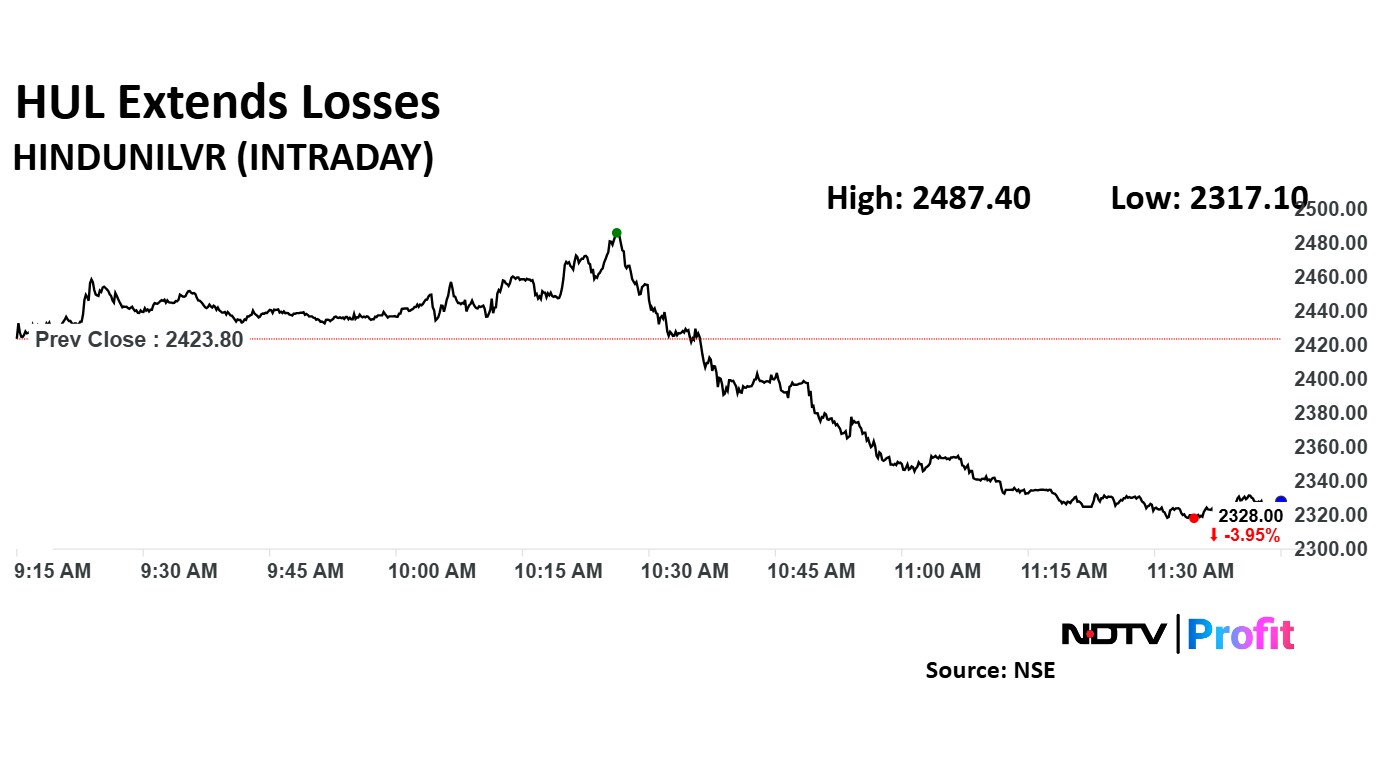

HUL Share Price Today

HUL stock fell as much as 4.12% during the day to Rs 2,324 apiece on the NSE. It was trading 4.13% lower at Rs 2,323.60 apiece, compared to an 0.27% decline in the benchmark Nifty 50 and 0.84% decline in Nifty FMCG as of 11:36 a.m.

It has risen 3.13% in the last 12 months and 0.19% on a year-to-date basis. The total traded volume so far in the day stood at 4.6 times its 30-day average. The relative strength index was at 53.34.

Twenty-nine out of the 35 analysts tracking HUL have a 'buy' rating on the stock, 12 recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 2,584.26, implying a upside of 10.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.