Inflows into equity and equity-linked mutual funds fell the most in seven months in November amid rising volatility and uncertainty ahead of the state election outcome.

Equity inflows fell nearly 33 percent over the previous month to Rs 8,414 crore in November, according to data released by the Association of Mutual Funds in India.

Here's what India's top three asset managers bought and sold in November:

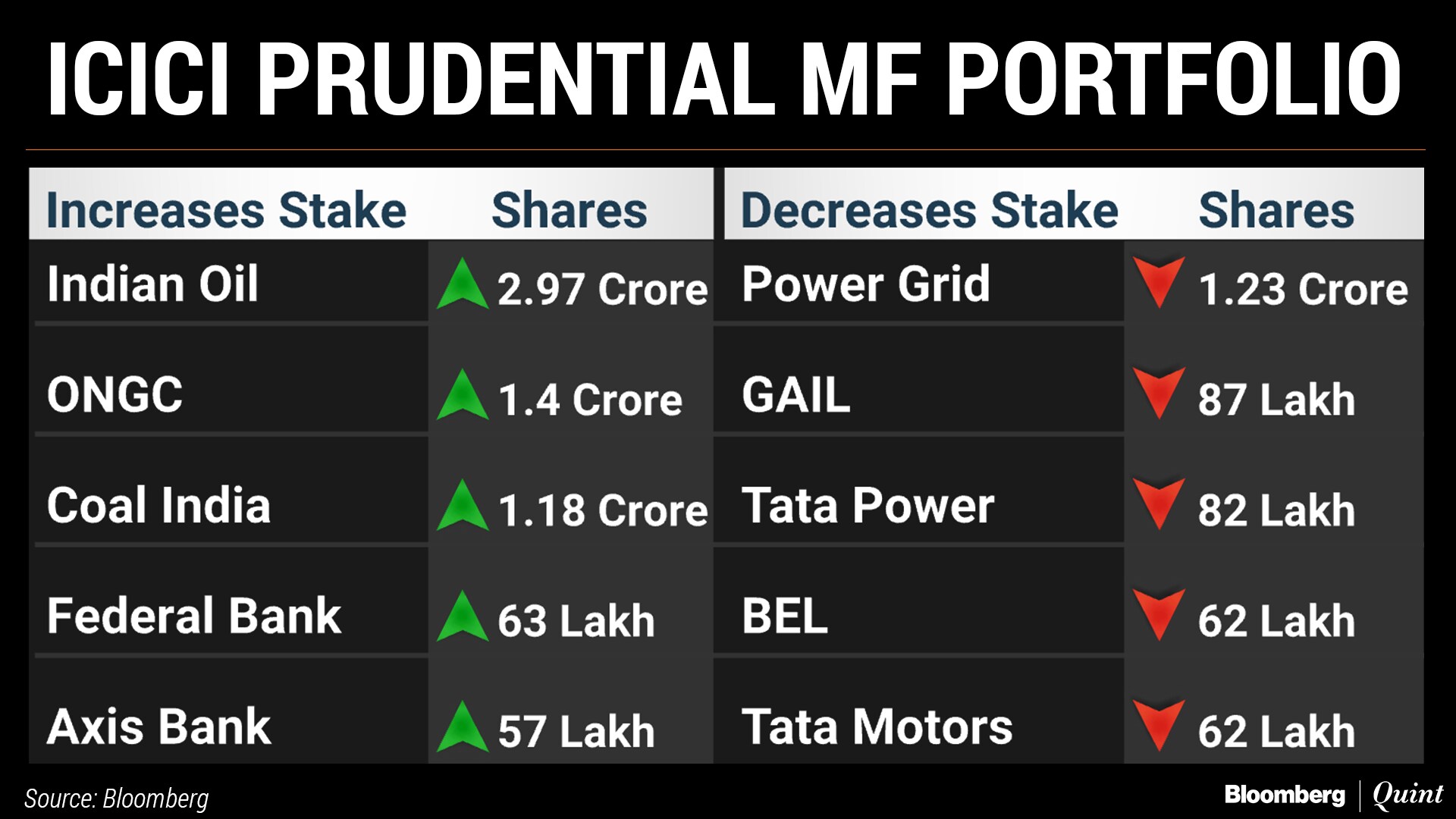

ICICI Prudential Mutual Fund

India's largest asset manager neither made any new purchases nor exited any company. It has assets worth more than Rs 1.1 lakh crore invested in a portfolio of 625 stocks. Its largest exposures is to financials (26.2 percent) followed by materials (10 percent).

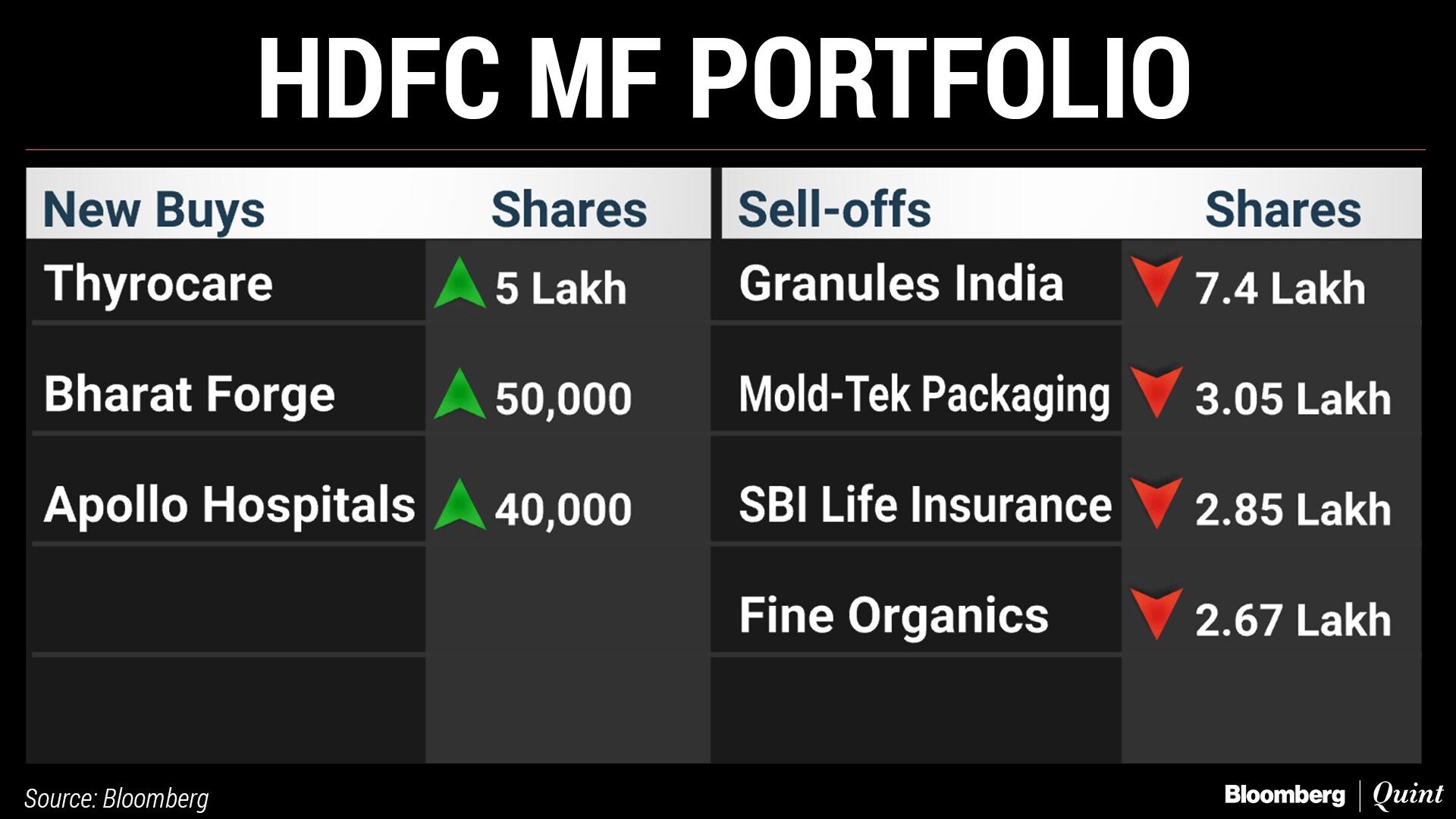

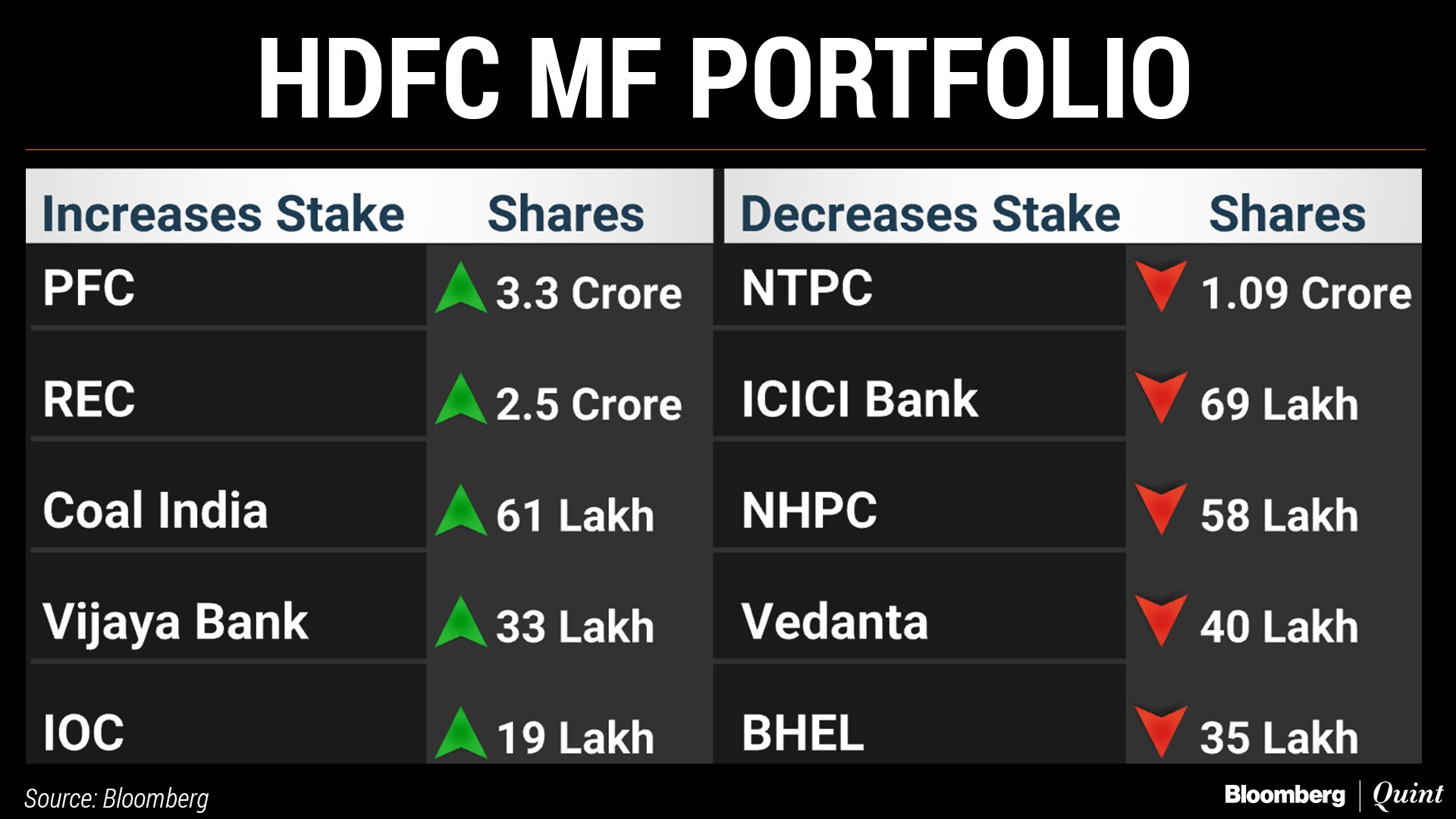

HDFC Mutual Fund

The fund house manages assets over Rs 1.3 lakh crore across 382 securities. It has allocated 31.2 percent of the portfolio to financials and 13.9 percent to industrials.

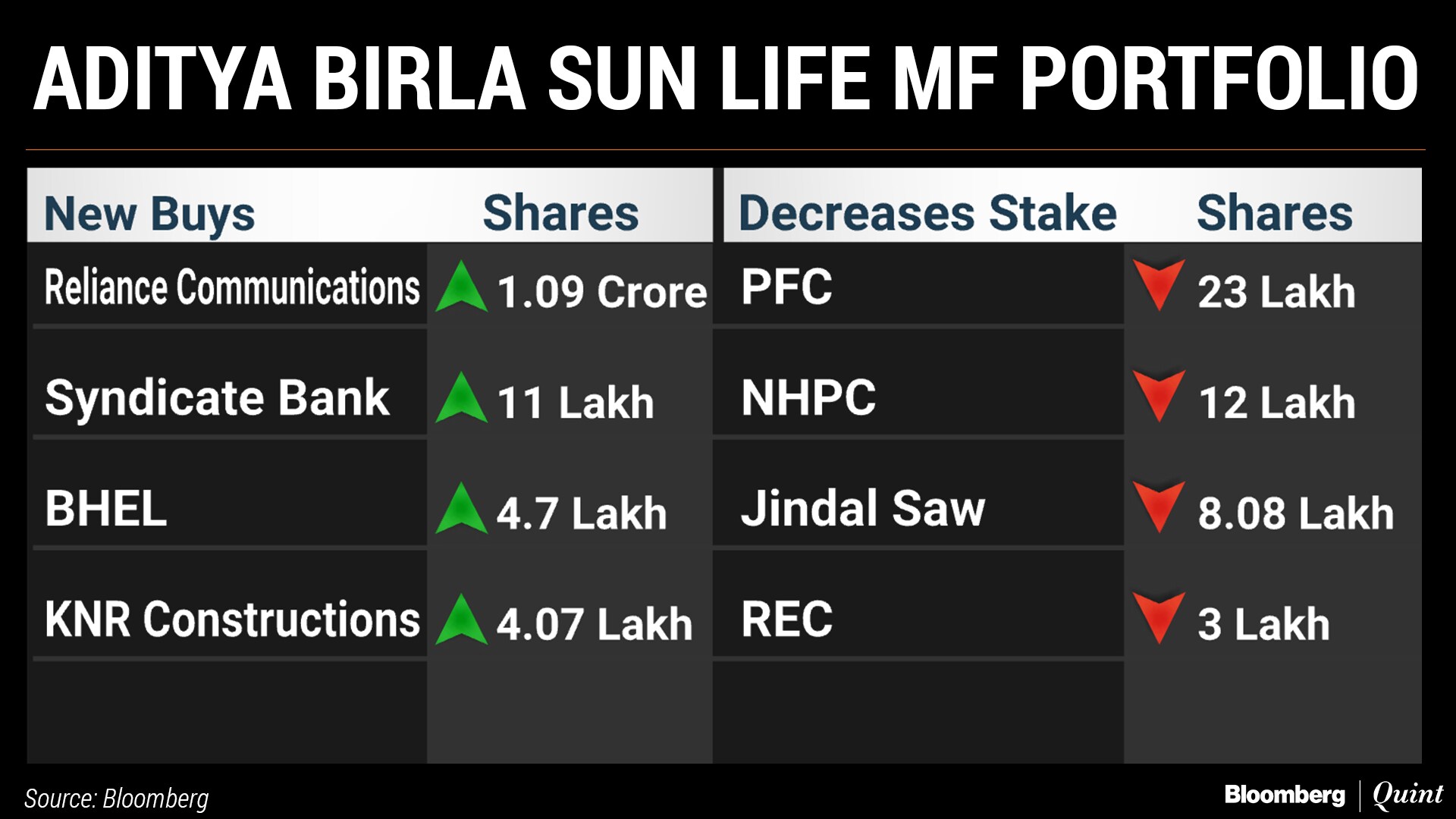

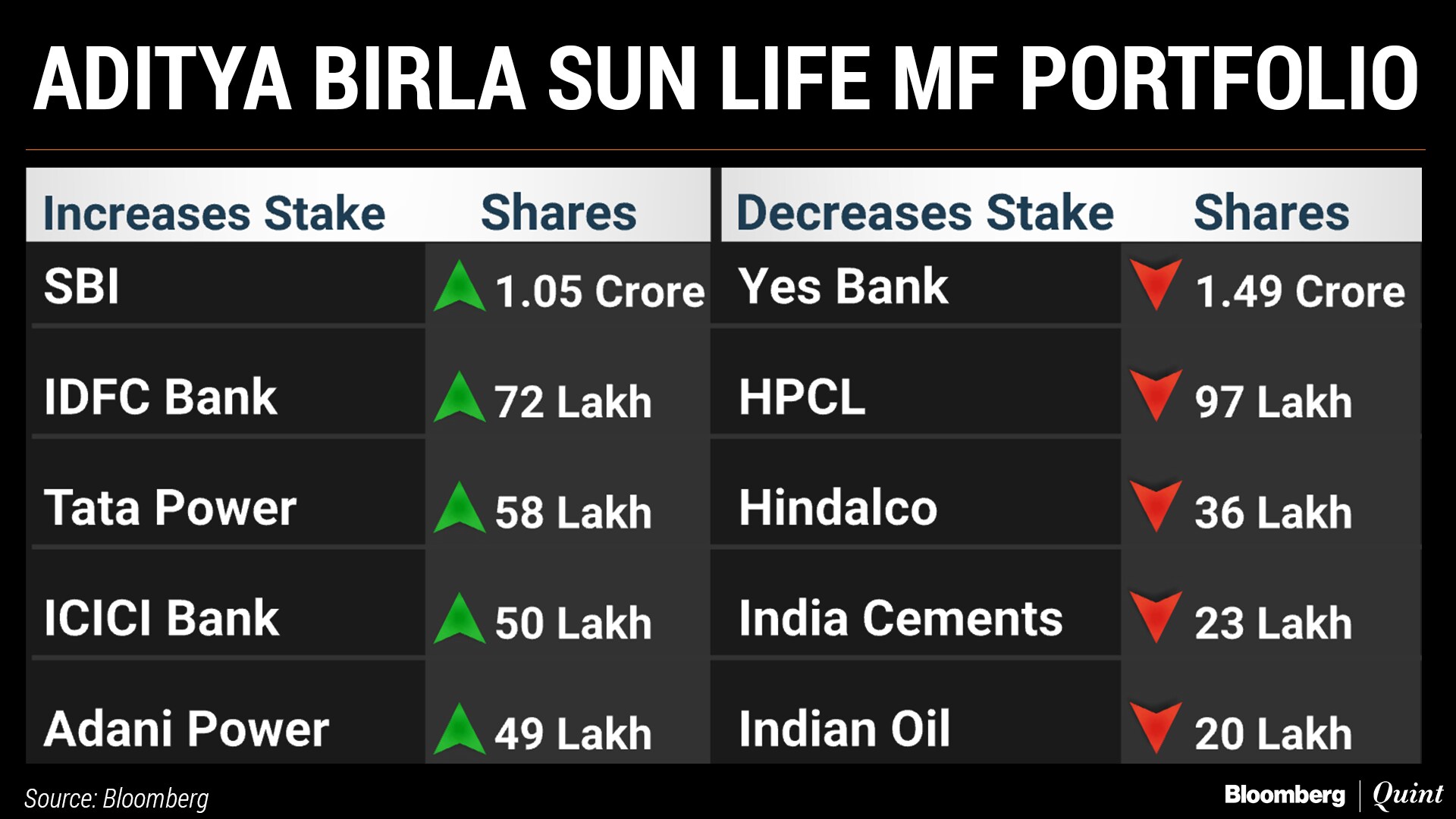

Aditya Birla Sun Life Mutual Fund

The fund house's equity assets worth more than Rs 76,000 crore are invested in 504 securities. Its highest exposure is towards financials at 31.1 percent, followed by materials at 13 percent.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.