Nomura has upgraded Zydus Lifesciences Ltd. to a 'buy' from its earlier 'neutral' stance, raising the target price to Rs 1,140 from Rs 1,030, implying a potential upside of 16%. Robust earnings growth, favourable currency movement, and strategic partnerships in the US market are key growth drivers, the brokerage said.

Zydus Lifesciences recently inked an agreement with CVS Caremark, the largest pharmacy benefit manager in the US, which manages about 34% of total prescriptions. Starting January 2025, CVS will replace the innovator brands Januvia and Janumet with Zydus' Sitagliptin 505(b)(2) brands on its formulary.

The Sitagliptin market, valued at $300–500 million, presents a significant revenue opportunity for Zydus, estimated at $100–150 million annually until May 2026, when generic competition is expected, said the brokerage.

Zydus also plans to expand into federal government contracts for Sitagliptin, providing a steady revenue stream beyond the patent expiry, added the note.

Nomura raised its earnings estimates for fiscal 2025 by 1%, and 2026 and 2027 by 6%, driven by:

Higher US sales from Sitagliptin.

Favourable currency movements, given that 77% of Zydus' exports in fiscal 2027 will come from the US.

Zydus' domestic businesses are expected to contribute 44% of Ebitda by fiscal 2027, said Nomura, supported by investments in vaccines and specialty drugs, alongside potential for value-accretive acquisitions.

Nomura's revised target price of Rs 1,140 apiece is based on 30 times the fiscal 2027 earnings per share value.

The company's expanding product pipeline and strong fundamentals make it a compelling play in the pharmaceutical sector, the brokerage said.

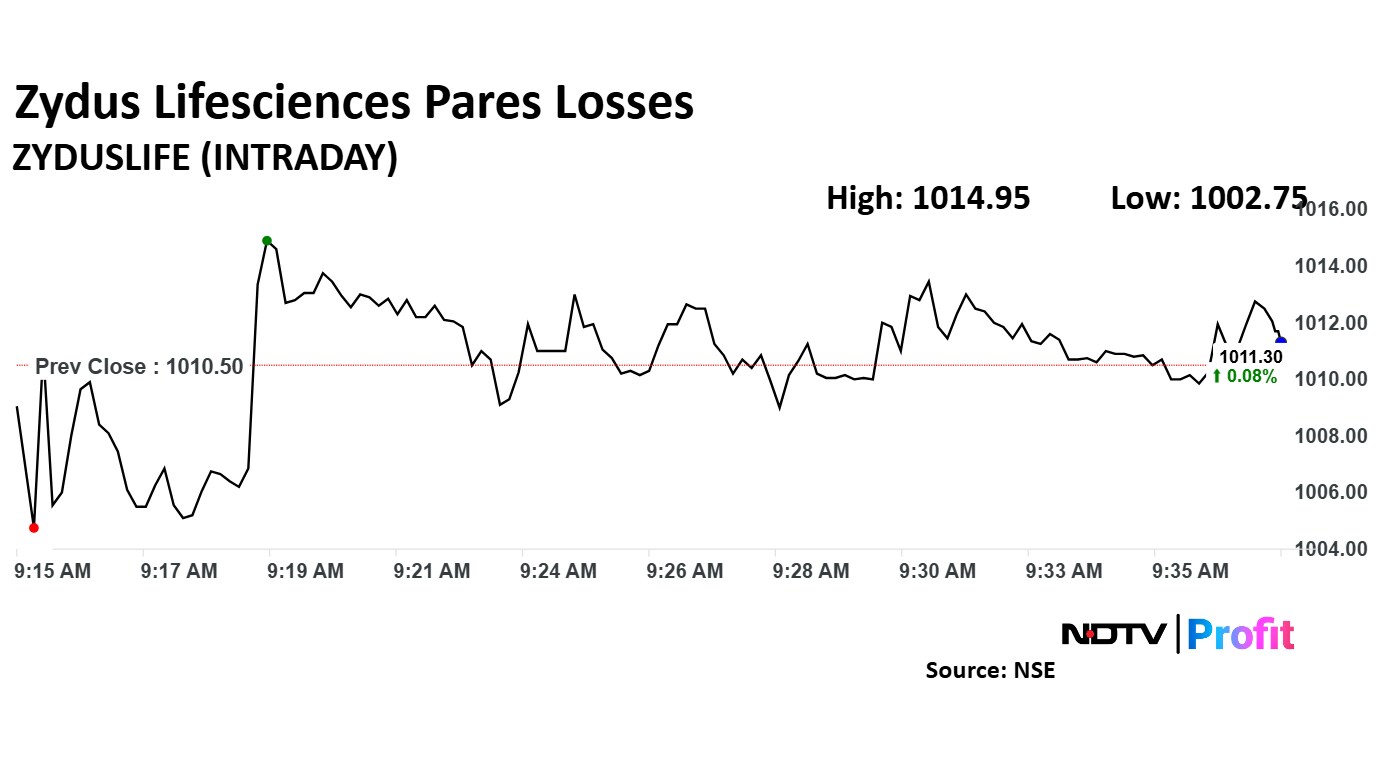

Zydus Lifesciences Share Price Today

Share price of Zydus Lifesciences fell as much as 0.77% to Rs 1,002.75 apiece, the lowest level since Jan. 8, 2025. It pared loss to trade 0.07% higher at Rs 1,011.25 apiece, as of 9:33 a.m. This compares to a 0.04% decline in the NSE Nifty 50.

The stock has risen 43.05% in the last 12 months. The relative strength index was at 58.54.

Out of 33 analysts tracking the company, 17 maintain a 'buy' rating, 10 recommend a 'hold' and six suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.