.jpg?downsize=773:435)

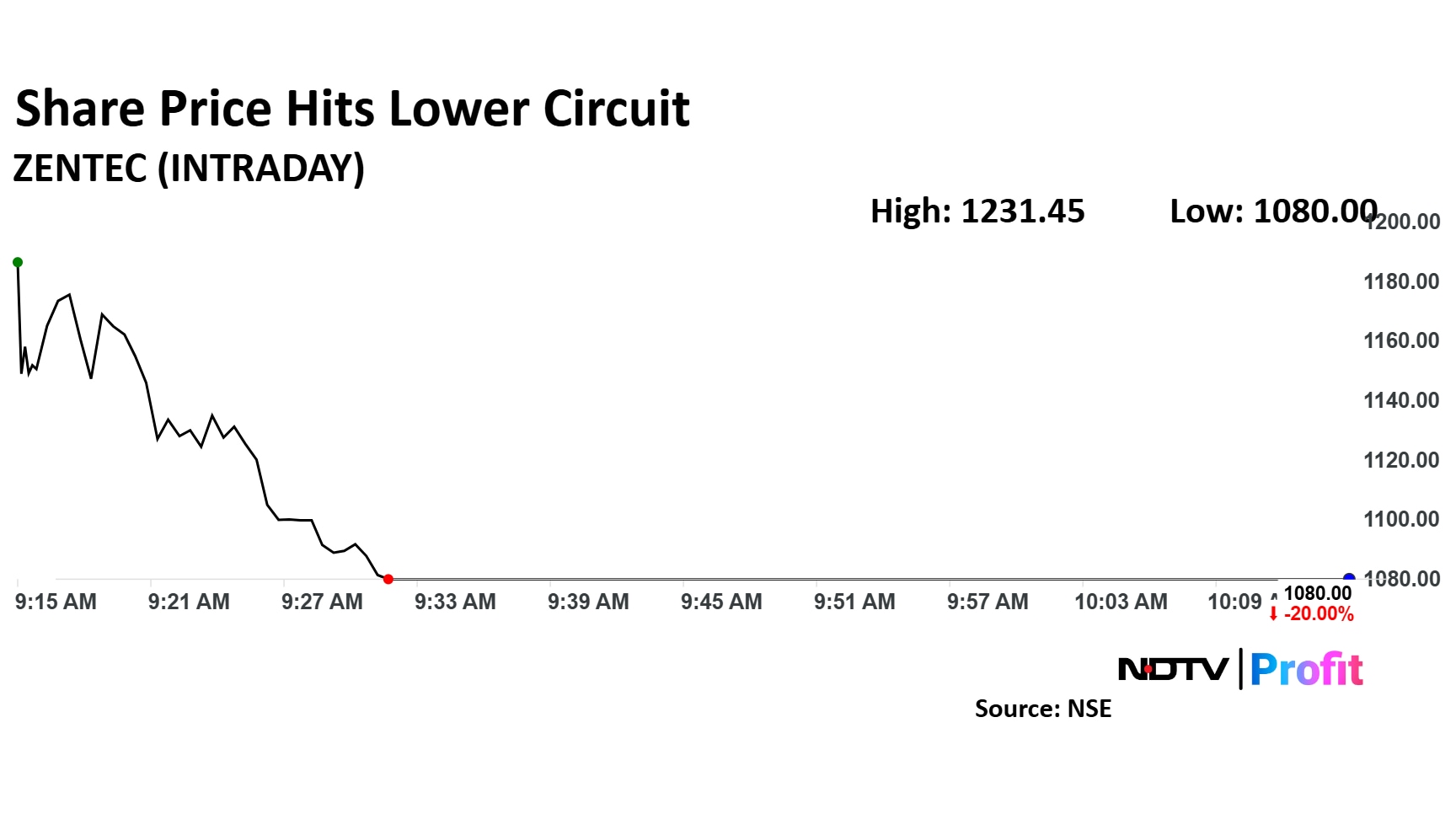

Zen Technologies Ltd.'s share price plummeted to hit 20% lower circuit on Monday, following the announcement of its third-quarter earnings, which fell short of analysts' expectations.

The company's revenue for the quarter grew by 52.9% year-on-year to Rs 152 crore, up from Rs 99.5 crore in the same period last year. However, this was below the estimated revenue of Rs 231.6 crore.

Zen Technologies, a leading provider of defence training solutions, reported an Ebitda of Rs 44.2 crore, a modest increase of 4% from Rs 42.5 crore year-on-year. This figure also missed the market estimate of Rs 100.5 crore. The company's Ebitda margin contracted to 29% from 42.7% in the previous year.

Net profit for the quarter stood at Rs 39.7 crore, marking a 29.9% increase from Rs 30.6 crore in the same period last year. Despite this growth, the net profit fell short of the estimated Rs 73.2 crore.

Zen Technologies has been a prominent player in the defence sector, known for its innovative training solutions and simulators. The company has been expanding its product portfolio and market reach, aiming to capitalise on the growing demand for advanced defence training systems.

Zen Technologies Share Price Today

Shares of Zen Technologies fell as much as 20% to Rs 1,080 apiece. It was trading at the same level as of 10:11 a.m. This compares to a 0.64% decline in the NSE Nifty 50.

The stock has risen 34.05% in the last 12 months. Total traded volume so far in the day stood at 2.07 times its 30-day average. The relative strength index was at 17.

All four analysts tracking the company maintain a 'buy' rating on the stock, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 114.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.