A tech-powered approach to bond trading that helps firms move hundreds of securities in one go has just posted its best year yet.

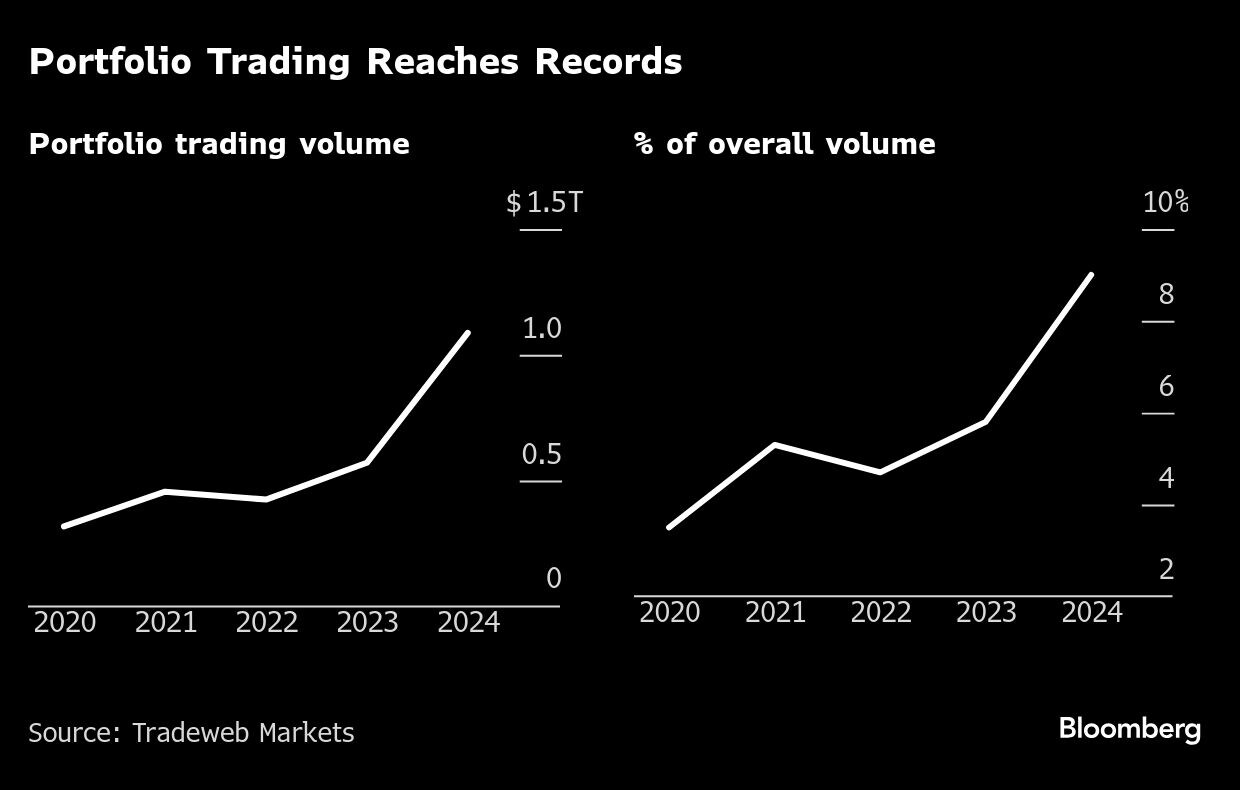

Portfolio trades, in which large baskets of debt are bought and sold in one swoop, accounted for about 9% of total US corporate bond volume in 2024, according to data from Tradeweb Markets Inc. That's a record level of activity, which propelled the value of all transactions using the method past $1 trillion for the first time.

Portfolio trading has boomed in recent years thanks to a combination of the rapid growth of credit ETFs — which help facilitate the trades — and the increased electronification of the debt markets. That has pushed down trading costs and given rise to much larger bond deals, with transactions of more than $500 million accounting for an increasing share of activity.

The trajectory “reflects increased adoption from new firms and expanded usage by existing clients,” Tradeweb US credit managing director Ted Husveth wrote in a Thursday report.

Portfolio trading accounted for 11.4% of overall trading in December, according to Tradeweb, which said the number of clients using the approach on its platform increased by 21% in 2024. Bloomberg LP, the parent company of Bloomberg News, offers its own fixed-income trading services.

The number of credit ETFs in the US has mushroomed since the pandemic, with assets swelling to a record $370 billion in 2024, according to Bloomberg Intelligence data. As a result, portfolio trading has become an increasingly important force in bond markets, according to Katie Stiner of Citadel Securities.

“As ETFs grow and bring in balances, it requires people to trade the bonds to deliver them into the ETF issuers,” Stiner said at Bloomberg Intelligence's ETFs In Depth conference last month. “So, bond PT is an incredibly natural fit for anyone managing an ETF that holds fixed income, and we expect it to continue to be a larger and increasing portion of trade volume in credit.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.