Waaree Energies Ltd. share price declined nearly 8% during early trade on Wednesday, as the second lock-in period for anchor investors ended, leading to a surge in trading volume.

The company had allotted 84.96 lakh shares at Rs 1,503 apiece to 92 anchor investors, ahead of its IPO in October 2024.

The anchor lock-in period mandates that 50% of the shares allotted to anchor investors are locked for 90 days, while the remaining 50% are locked for 30 days. This period begins from the date of allotment. Once the lock-in period concludes, investors are free to sell their shares.

Goldman Sachs, BlackRock, Nomura India, Motilal Oswal, Quant Mutual Fund and Abu Dhabi Investment Authority were among the notable investors in the anchor round in October last year.

Waaree Energies is currently trading at 42 times its estimated earnings per share for the coming year, as per Bloomberg data.

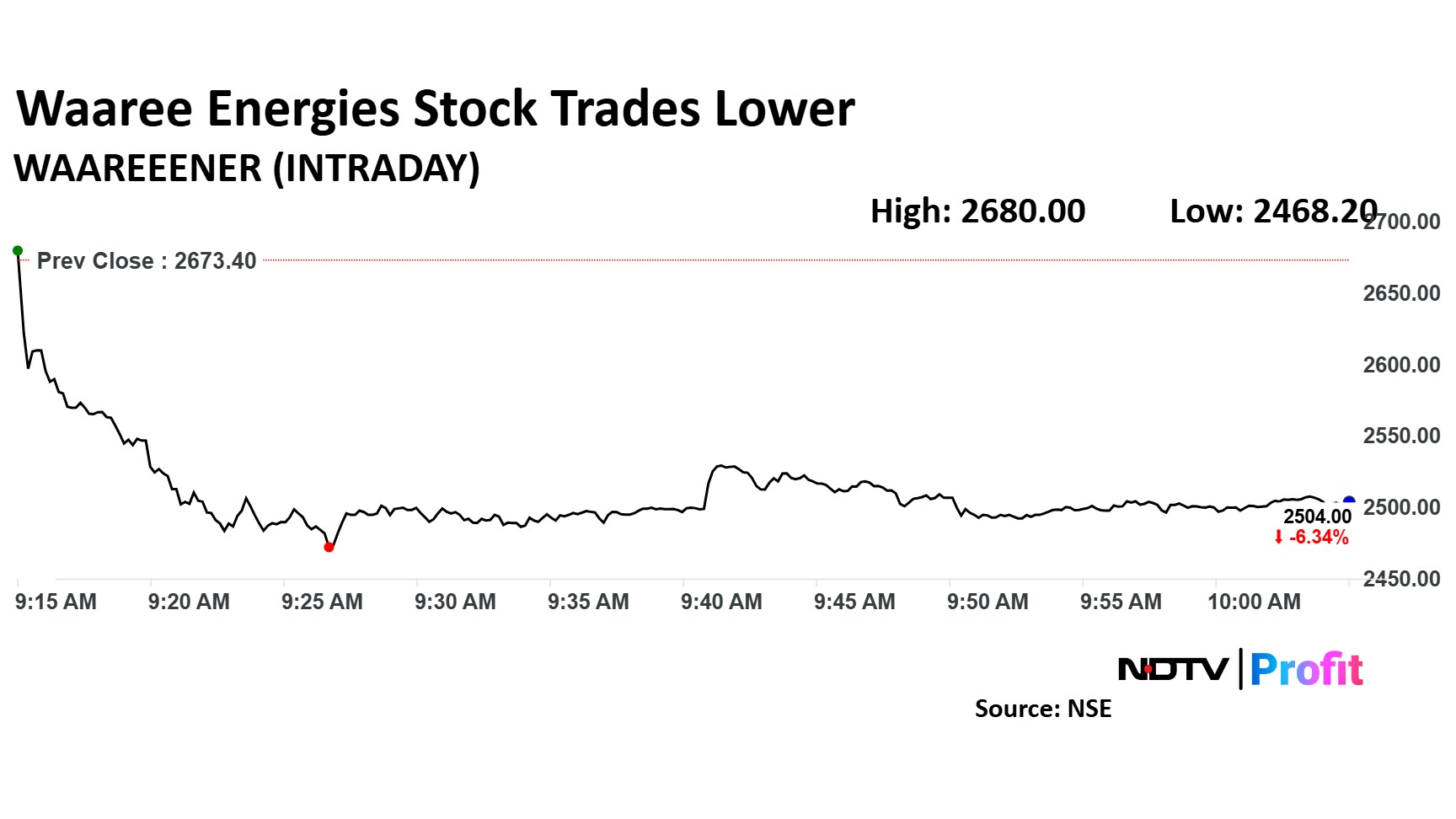

Waaree Energies Share Price

Waaree Energies share price shed over 7.7% intraday to Rs 2,468 apiece. The scrip was trading 6.3% lower at Rs 2,504 by 10:05 a.m. The benchmark NSE Nifty 50 was up 0.28%.

The stock has risen 66% since its listing in October 2024. The relative strength index was at 40.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.