Waaree Energies Ltd. share price fell nearly 5% during early trade on Friday after a report said the US is investigating whether India's largest solar panel maker evaded anti-dumping and countervailing duties on solar cells from China and other Southeast Asian nations.

US Customs and Border Protection has started a formal investigation of Waaree and Waaree Solar Americas Inc. and imposed interim measures, Bloomberg News reported. The authorities suspect Waaree evaded duties when bringing merchandise into the US.

The investigation is being launched in response to an allegation by the American Alliance for Solar Manufacturing Trade Committee that Waaree was mislabeling solar cells that originated in China as coming from India to avoid tariffs on Chinese solar products, the report said.

China is the world's top producer of solar power equipment, and its scale allows it to sell products at cut-throat prices around the world.

Domestic manufacturers of photovoltaic equipment in the US have complained about unfair Chinese subsidies and dumping.

In August, the US Commerce Department launched a new trade probe on modules from Indonesia, Laos and India after US makers filed a complaint. Steep duties were imposed earlier this year on solar equipment from Vietnam, Cambodia, Malaysia and Thailand, as per Bloomberg.

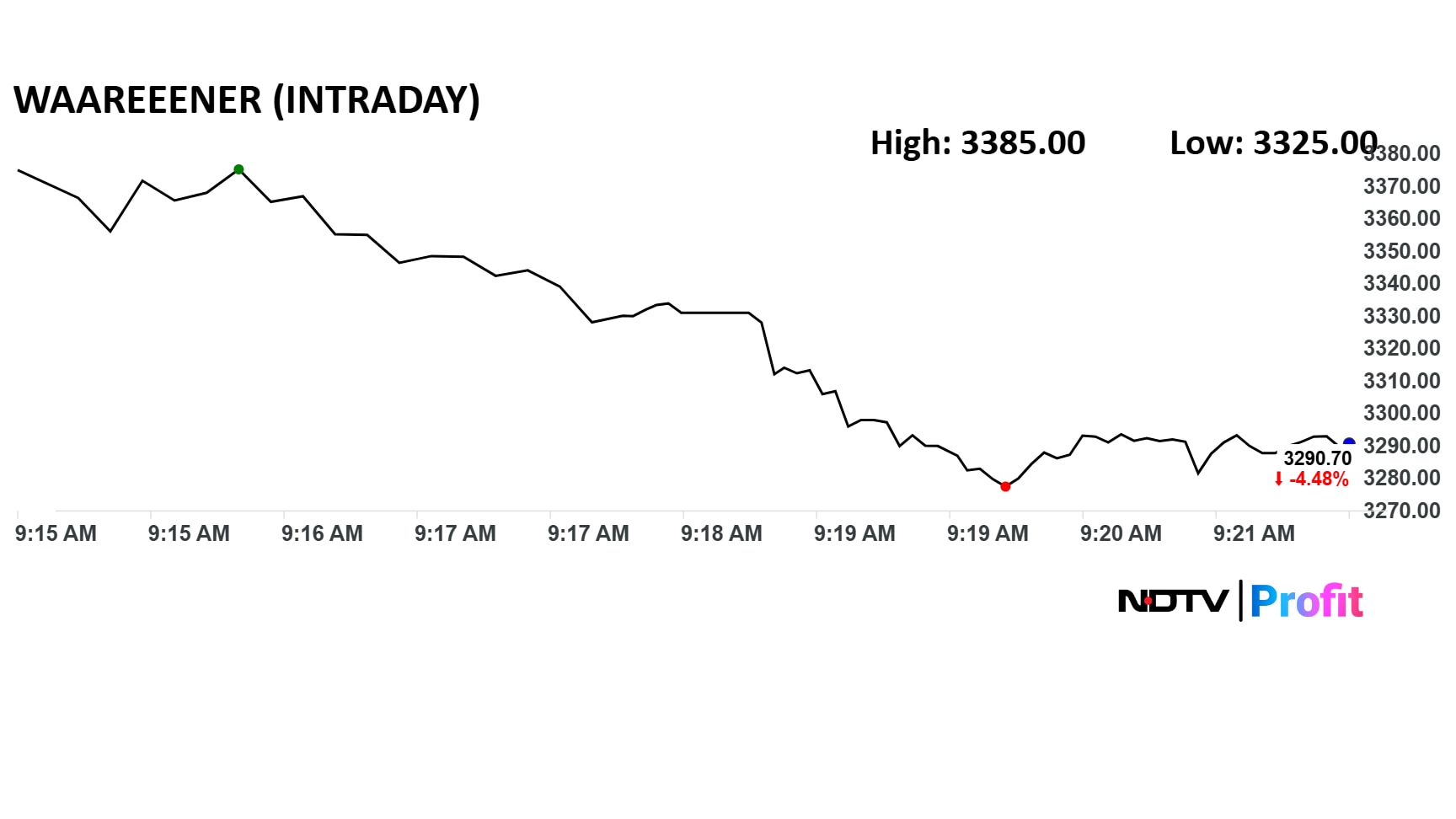

Waaree Energies Share Price Movement

Waaree Energies' share price declined 5% intraday to Rs 3,276 apiece. The benchmark Nifty 50 was down 0.2%.

The total traded volume so far in the day was Rs 153 crore. The relative strength index was at 63.

The stock has risen 47% since listing in October 2024.

Six out of the nine analysts tracking Waaree Energies have a 'buy' rating on the stock, and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price target implies a potential upside of 2% over the previous close.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.