Shares of Waaree Energies Ltd. hit nearly one-month high on Tuesday after the board of directors approved the acquisition of Kamath Transformers Pvt.

The board on Monday approved Rs 293 crore acquisition of the transformer producer as part of its expansion activity, according to an exchange filing. Kamath Transformers was incorporated in 1996 and is into manufacturing transformers. In financial year 2024, the company posted a turnover of Rs 122.68 crore, while in fiscal 2023 it had reported a turnover of Rs 54.41 crore.

The board also approved acquisition of Green New Delhi Forever Energy Pvt. by Waaree Forever Energies Pvt., a wholly-owned subsidiary of Waaree Energies. It will be acquired for Rs 1 lakh per share at a face value of Rs 10 each, the filing said.

Waaree Energies expects to complete both the acquisitions in financial year 2026 in an all-cash consideration.

Waaree Energies Q4 Performance

Waaree Energies reported a 34% rise in its consolidated net profit for the fourth quarter of financial year 2025, according to an exchange filing on Tuesday.

India's largest solar panel manufacturer's bottomline came in at Rs 619 crore in the March quarter, as compared to Rs 461 crore in the year-ago period.

The company's consolidated revenue rose 36.4% to Rs 4,004 crore from Rs 2,936 crore in the year-ago period.

The company's order book at the end of the quarter stood at 25 GW, which has a total value of Rs 47,000 crore.

Waaree Energies Share Price Advance

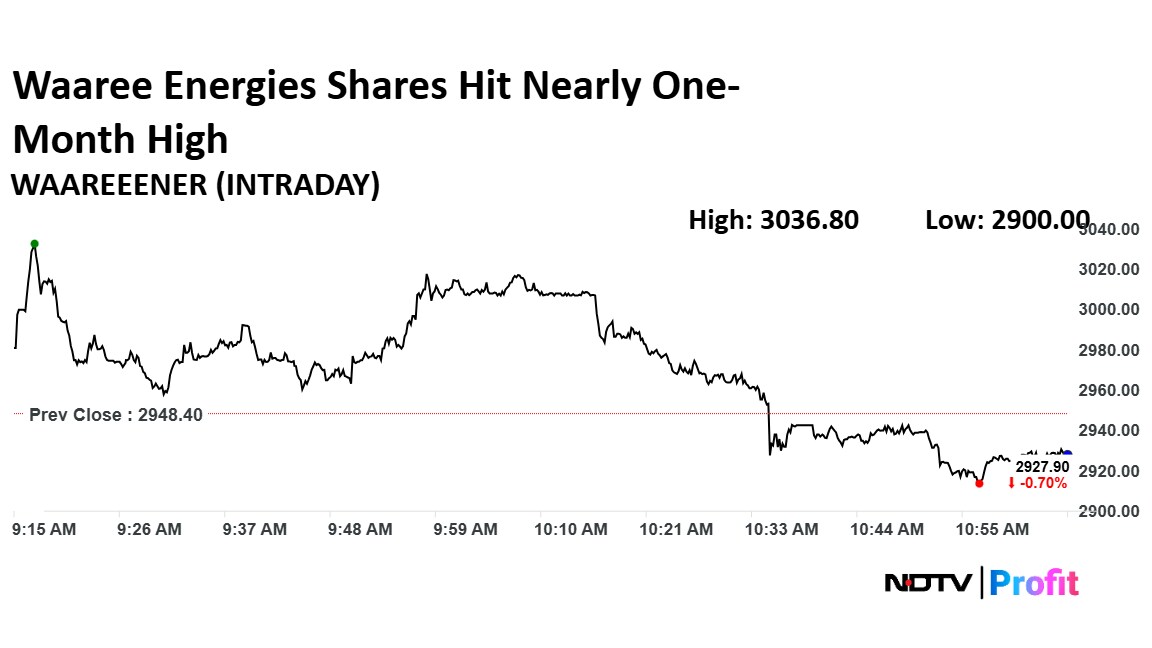

Shares of Waaree Energies rose as much as 3% to Rs 2,956.10 apiece, the highest level since April 23. It pared gains to trade 0.43% higher at Rs 2,961 apiece, as of 10:42 a.m. This compares to a 0.07% decline in the NSE Nifty 50.

The stock has risen 25.74% in the last 12 months and 2.81% year-to-date. The relative strength index was at 67.

Out of four analysts tracking the company, one maintains a 'buy' rating and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 11.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.