Shares of Venus Pipes and Tubes Ltd. rose on Wednesday after Investec initiated coverage on the company, with a 'buy' rating. The brokerage has set a target price of Rs 1,665 on the stock on the back of noteworthy financials and fast growth.

Significant revenue growth posted by the company had sent signals for strong execution on capacity expansion, the brokerage highlighted. This cue is also well supported by visible volume growth.

The brokerage cited improved profitability through good backward integration. Expansion into hollow pipes had helped the company de-risk from heavy dependency on imports. This expansion had been further instrumental in boosting profitability of the overall business.

The company's expansion into titanium and seamless tubes had also boosted profitability. The brokerage highlighted these expansions came with increased upside risks. Based on the brokerage's estimates, the expansion into titanium and seamless tubes, coupled with a foray into fitting, took the upside risks higher.

The company also saw a three-time multiplication of capacity. This uptick was supported as the company focused funds on capex.

Venus Pipes and Tubes Ltd. manufactures stainless-steel pipes and tubes and is based out of Kutch, Gujarat. The company offers high precision and heat exchanger tubes, hydraulic and instrumentation tubes, and seamless, welded, and box pipes.

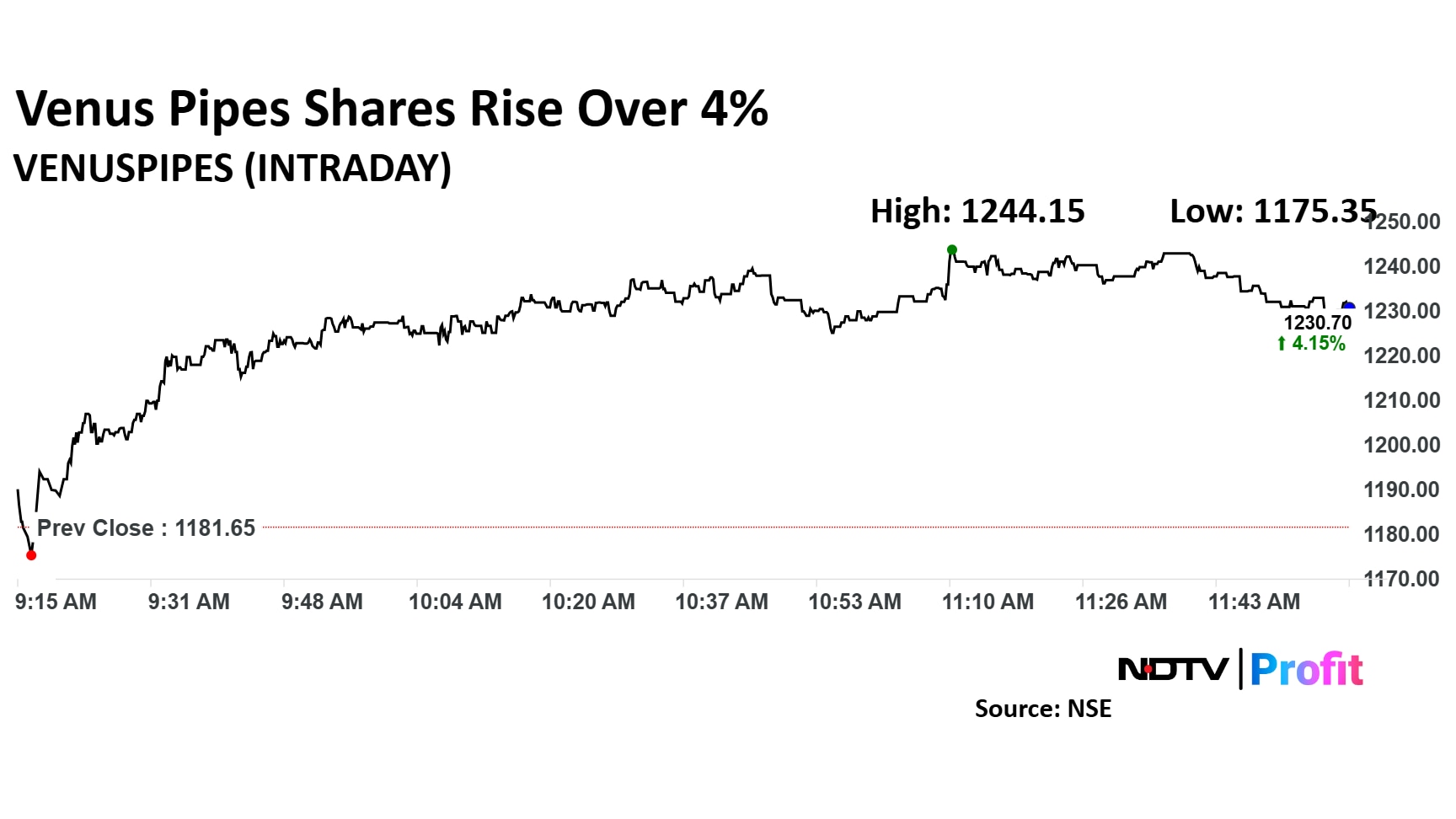

Venus Pipes Share Price

Venus Pipes stock rose as much as 5.29% during the day to Rs 1,244.1 apiece on the NSE. It was trading 4.12% higher at Rs 1,230.3 apiece, compared to a 0.20% advance in the benchmark Nifty 50 as of 11:59 a.m.

It was down 25.44% in the last 12 months. Total traded volume so far in the day stood at 0.7 times its 30-day average. The relative strength index was at 39.52.

All seven analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 1,927.8, implying a upside of 55.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.