Shares of United Spirits Ltd. rose on Friday to hit an over one-month high after Citi upgraded it to 'buy' from 'neutral', with a target price of Rs 1,650. It cited strong growth prospects, driven by a favourable policy environment and effective strategies to manage commodity cost pressures.

Despite challenges from rising commodity costs, such as higher Extra Neutral Alcohol and glass prices, Citi expects moderate margin expansion for United Spirits. The company's efforts in productivity improvements and revenue growth management should help offset these pressures.

United Spirits is well-positioned to benefit from an easing regulatory environment in India, according to the brokerage. Over recent years, states like Andhra Pradesh, Telangana, and Uttar Pradesh have seen favourable changes, such as lower working capital requirements and increased outlet reach, which have boosted volumes. Potential regulatory changes in Delhi could further support growth in the long term, said the brokerage in its note on Friday.

Additionally, the company is tapping into the premiumisation trend in India's liquor market. Growth in the higher-end Prestige and BII segments remains strong, while the below-premium portfolio continues to show long-term potential. This shift towards premium products aligns with India's rising affluence, creating opportunities for higher margins.

According to Citi, United Spirits is well-positioned to grow in India's expanding organised liquor market, with strong structural drivers like increasing disposable incomes, favourable demographics, and shifting consumption patterns. The brokerage forecasts 11% revenue, 15% Ebitda, and 16% EPS CAGR over financial years 2024-2027.

The company's new Managing Director and Chief Executive Officer, Praveen Someshwar, is expected to bring in fresh strategic initiatives that could further accelerate growth. United Spirits' focus on driving double-digit sales growth over the medium term reflects its ambition to capitalise on India's expanding organised liquor market.

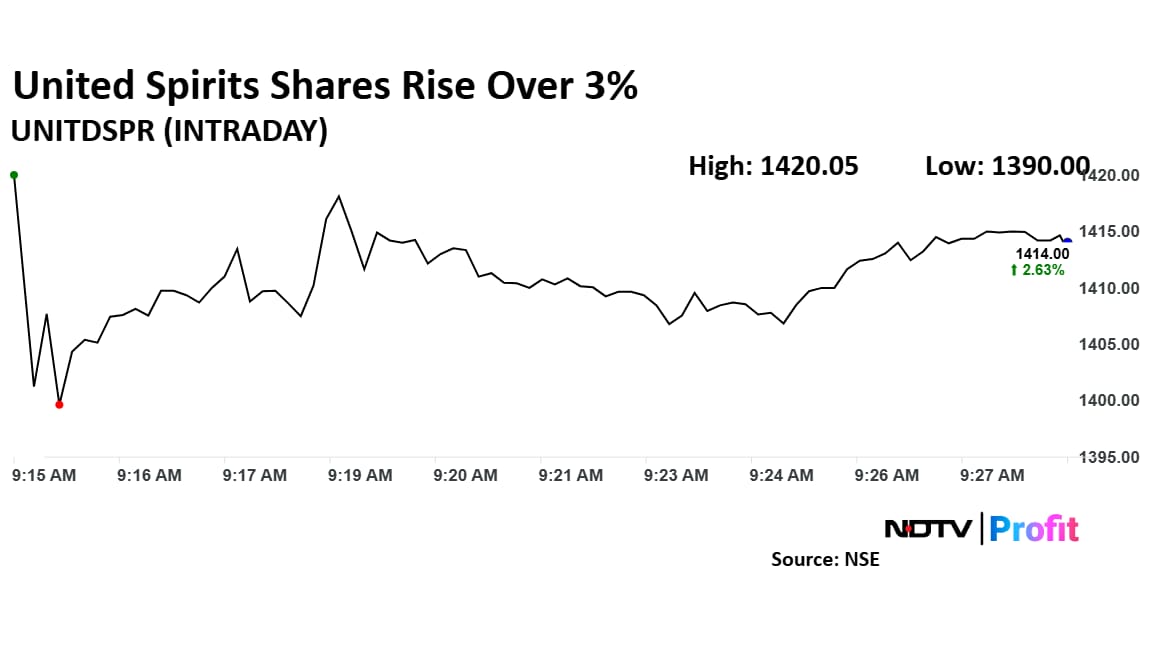

United Spirits Share Price

Shares of United Spirits rose as much as 3.07% to Rs 1,420.05 apiece, the highest level since Feb. 11. It pared gains to trade 2.14% higher at Rs 1,407.30 apiece, as of 9:26 a.m. This compares to a 0.05% decline in the NSE Nifty 50.

The stock has risen 26.08% in the last 12 months and fallen 15.06% year-to-date. Relative strength index was at 60.

Out of 25 analysts tracking the company, 16 maintain a 'buy' rating, four recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 9.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.