Trent Ltd. saw its share price fluctuate on Thursday, initially rising by 1.13% before declining to trade 0.34% lower. Despite this volatility, brokerages remain optimistic about the company following a recent analysts meet.

Morgan Stanley has maintained an 'outperform' rating with a target price of Rs 6,359. Macquarie has also maintained its 'outperform' call on the stock with a target price of Rs 7,000.

Trent Ltd. operates a range of retail formats including Westside, Zudio, and Star Bazaar, catering to diverse consumer needs across India.

In Trent's Q4 financial results, revenue increased by 29% to Rs 4,106 crore, compared to Rs 3,187 crore the previous year, slightly below Bloomberg's estimate of Rs 4,131 crore.

Ebitda rose by 38% to Rs 656 crore, surpassing the estimated Rs 609 crore, with margins expanding to 16% from 15%, beating the forecasted 14.7%.

However, net profit saw a decline of 47%, falling to Rs 350 crore from Rs 654 crore, though it exceeded the estimated Rs 302 crore.

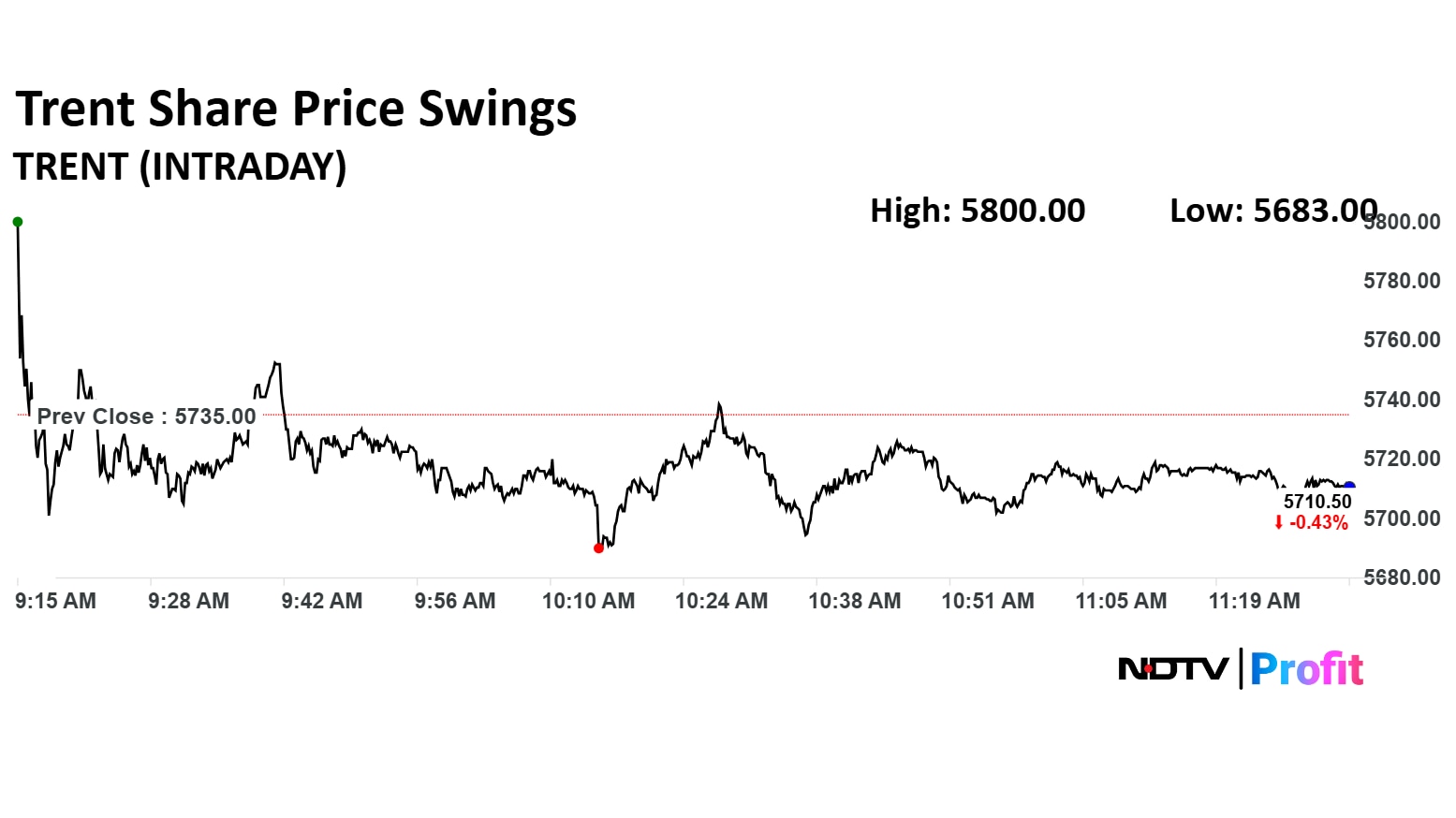

Trent Share Price Today

The scrip rose as much as 1.13% to Rs 5,800 apiece but later gave up gains to trade 0.43% higher at Rs 5,710 apiece, as of 11:35 a.m. This compares to a flat NSE Nifty 50.

It has risen 6.60% in the last 12 months. Total traded volume so far in the day stood at 0.55 times its 30-day average. The relative strength index was at 55.

Out of 24 analysts tracking the company, 17 maintain a 'buy' rating, three recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 7.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.