The share price of Trent Ltd. rose as high as 5.30% to touch a nearly five month high, going against the markets' downward movement on Monday. This came after the stock's inclusion in the Sensex 30.

Trent, along with Bharat Electronics Ltd., was added to the index as part of a rejig. The stocks replaced Nestle India Ltd. and IndusInd Bank Ltd.

Index rejigs are a key event for the market because they help the market participants gauge the direction in which the funds are moving. The periodic rebalancing of the Sensex ensures the benchmark index remains representative of India's evolving market dynamics.

Moreover, towards the end of last week, HSBC Securities had initiated coverage on the tata company's retail arm, with a 'buy' rating and a target price of Rs Rs 6,700.

"While competition is increasing, we don't expect rivals to dent Zudio's market leadership, given its strong brand, fashion collection refresh frequency, and store reach. For Zudio, we forecast a revenue CAGR of 31% over FY25-28," the brokerage said.

Zudio will keep expanding, it said, as it forecasted over 200 new stores a year over FY25-28. Longer term, the total number of stores can reach 1,450 stores, up from the current 765, it added.

Key downside risks include intense competition and cannibalisation from new stores in existing cities.

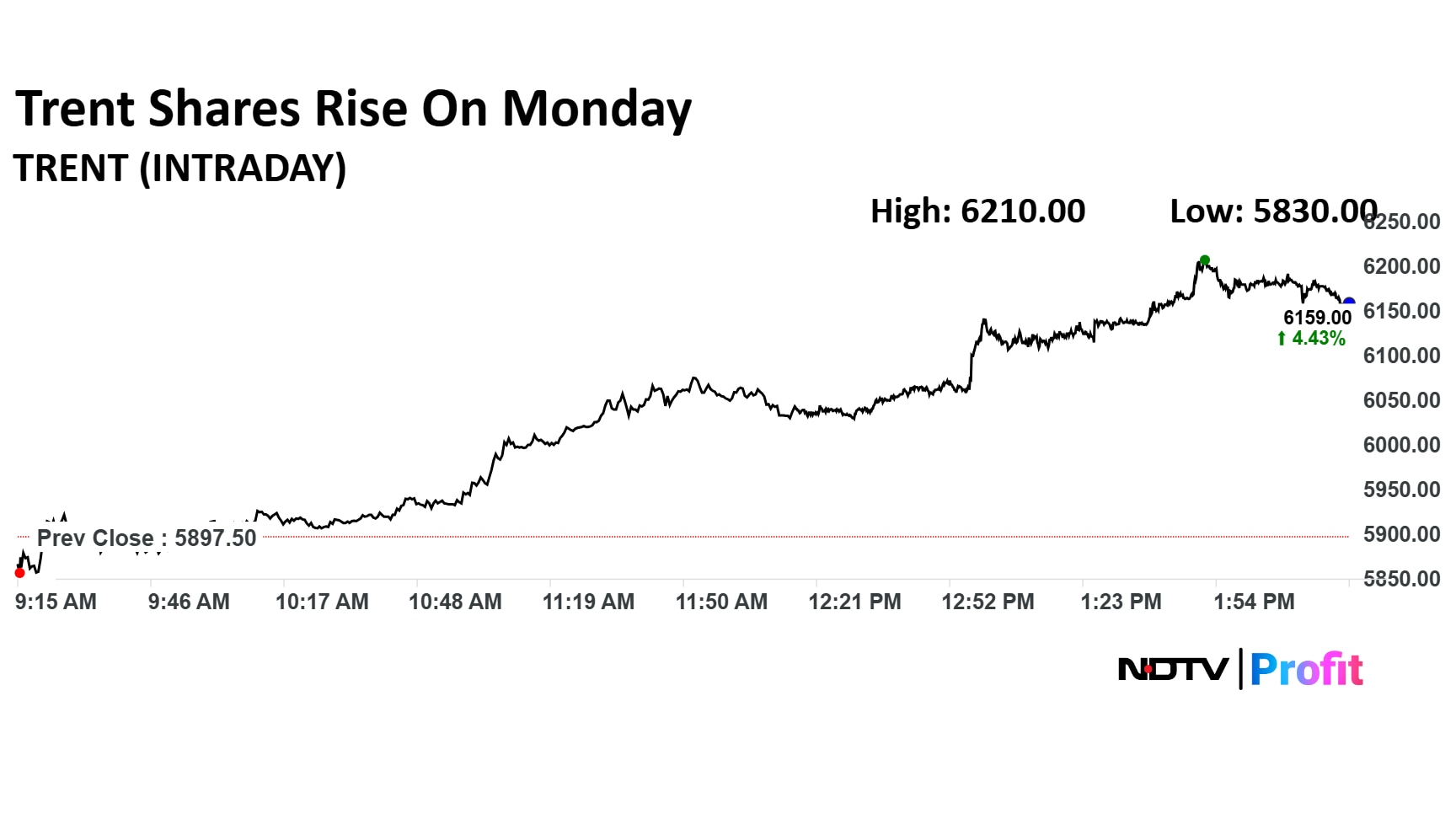

Trent Share Price Today

The scrip rose as much as 5.30% to Rs 6,210 apiece, the highest level since Feb. 3, 2025. It pared gains to trade 4.72% higher at Rs 6,176 apiece, as of 2:20 p.m. This compares to a 0.44% decline in the NSE Nifty 50.

The stock has fallen 13.31% on a year-to-date basis, and is up 17.15% in the last 12 months. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 67.37.

Out of 25 analysts tracking the company, 18 maintain a 'buy' rating, three recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.