Trent Ltd.'s share price dropped by 8.71% on Friday following its Annual General Meeting for 2025, which received mixed reviews from brokerages such as Nuvama and Macquarie. The stock is top dragger in Nifty 50 companies.

Nuvama has downgraded Trent to a 'hold' rating, adjusting its target price to Rs 5,884. The brokerage cited near-term challenges and a valuation that seems overstretched. Meanwhile, Macquarie continues to rate Trent as 'underperform' with a target price of Rs 8,191, expressing concerns about the company's growth trajectory and the difficulties in meeting its goals.

According to Nuvama's report, Trent's management reiterated its goal of achieving 25% growth in the coming years, but the current performance falls short of this target. Consequently, Nuvama has revised its FY26-27E revenue and Ebitda estimates downward by 5-6% and 9-12%, respectively. Although there is anticipated growth in Zudio Beauty and Star Business, these segments need to stabilise before scaling up, leading to the downgrade, Nuvama said.

Macquarie's key observations include Trent's commitment to opening at least 250 new stores in FY25 and aiming for 25-30% growth in FY26. However, Macquarie is cautious, emphasising that annual performance provides a more accurate picture than quarterly results, particularly in terms of sales, profitability, and store expansions.

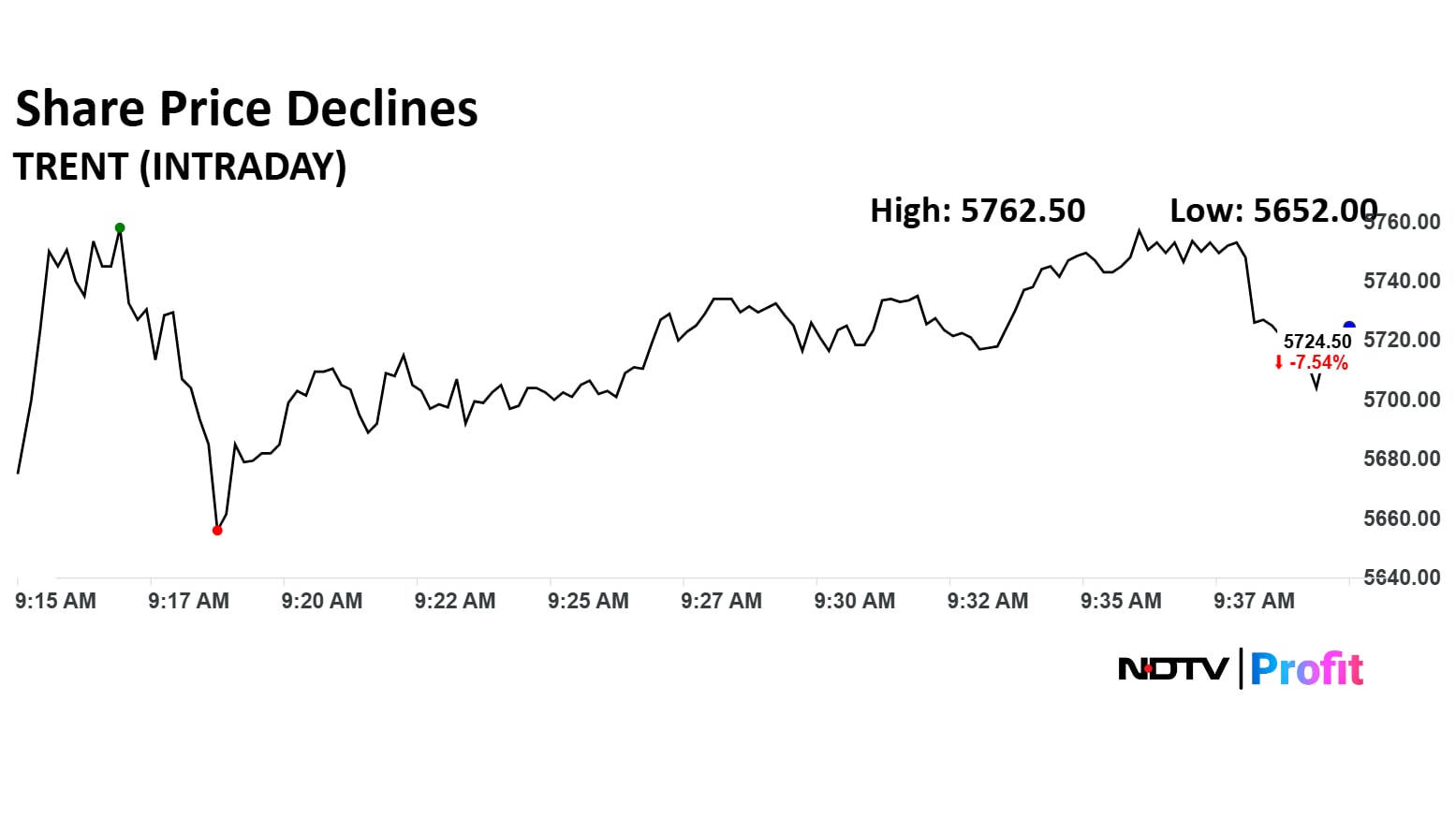

Trent Share Price Today

The scrip fell as much as 8.71% to Rs 5,652 apiece. It pared losses to trade 7.24% lower at Rs 5,742 apiece, as of 09:46 a.m. This compared to a flat Nifty 50.

It has risen 2.59% in the last 12 months. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 46.

Out of 25 analysts tracking the company, 18 maintain a 'buy' rating, four recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.