.png?downsize=773:435)

Elara Capital has initiated coverage on Trent Ltd., the retail subsidiary of the Tata Group, with a 'buy' rating and a target price of Rs 8,500. The brokerage highlights Trent's leading position in India's retail sector, primarily through its well-known brands Zudio and Westside, and anticipates strong growth ahead.

Zudio, known for its fast-fashion offerings, is expected to continue dominating the segment. The brand's growth trajectory is projected at a compound annual growth rate of 31% through FY27, with the fast-fashion market share in India expected to increase from 10% in FY24 to 14% by FY27.

This growth will be supported by a combination of healthy store expansion, robust same-store sales growth, and a steady demand from India's large youth demographic, which is projected to remain stable through 2031. Zudio's strategy of offering quality apparel at affordable prices, coupled with a focus on private labels, has positioned it as a leader in its segment.

Alongside Zudio, Trent's other flagship brand, Westside, is expected to continue delivering steady performance. Westside has maintained a strong presence in the apparel market, and its consistent brand recognition will contribute to Trent's ongoing success. The company's differentiated approach to product offerings, quick design-to-shelf cycles, and emphasis on quality at competitive prices further solidifies its market position, the brokerage said.

Trent's retail model, which relies heavily on private labels, continues to outperform its peers. The company's portfolio has outshone competitors in key areas such as store size, revenue per square foot, and Ebitda margins, due to its focus on product market fit, quick product turnaround, and a strategic balance between quality and pricing, Elara said.

Trent's private label-driven approach allows for greater control over its product offerings, helping it maintain a competitive edge in the market, the brokerage said.

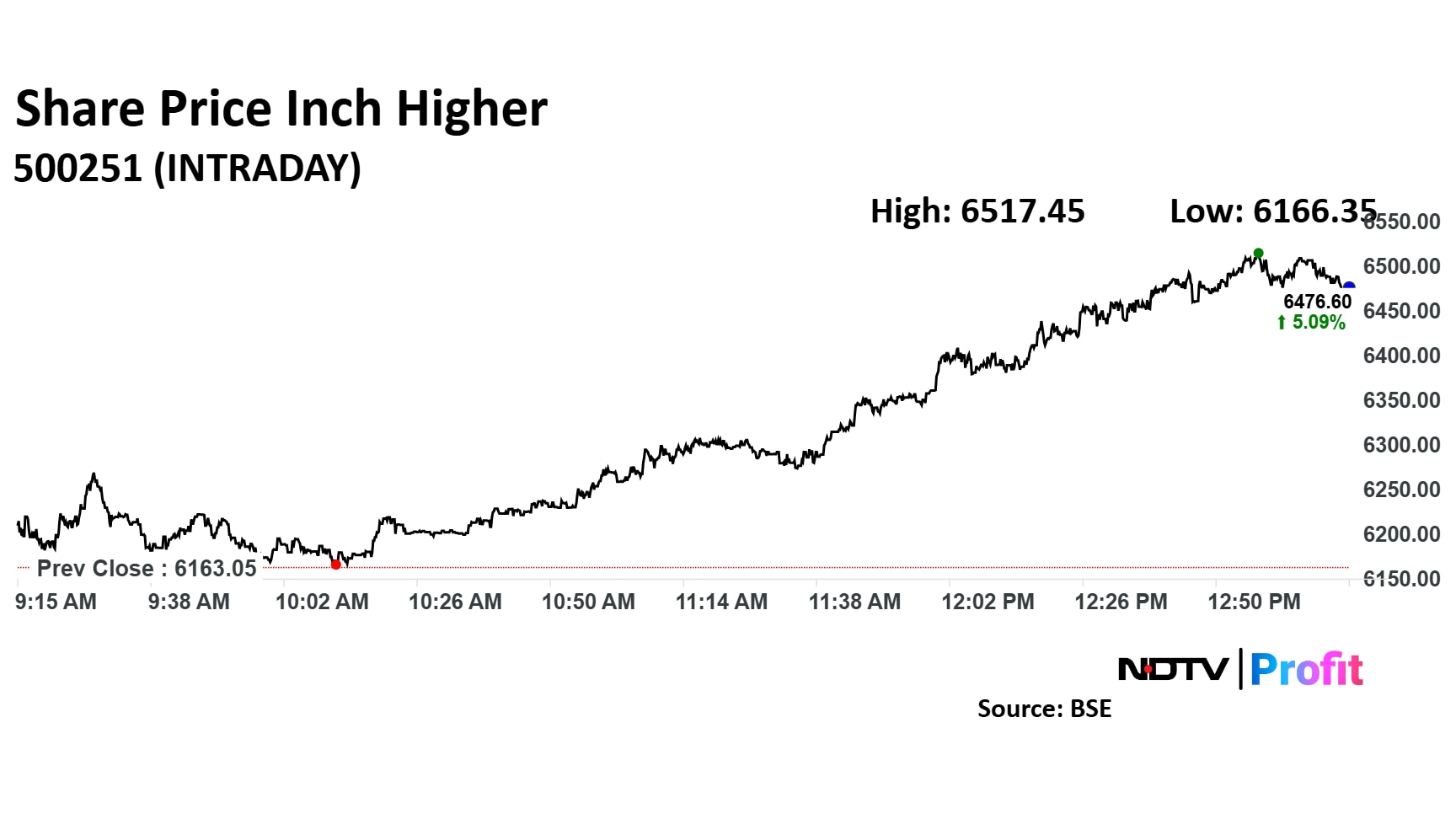

Trent Share Price

The scrip rose as much as 5.81% to Rs 6,519 apiece. It pared gains to trade 5.34% higher at Rs 6,489.85 apiece, as of 1:10 p.m. This compares to a 0.23% advance in the NSE Nifty 50.

It has risen 103.23% in the last 12 months. Total traded volume so far in the day stood at 1.21 times its 30-day average. The relative strength index was at 41.

Out of 21 analysts tracking the company, 12 maintain a 'buy' rating, five recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 6.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.