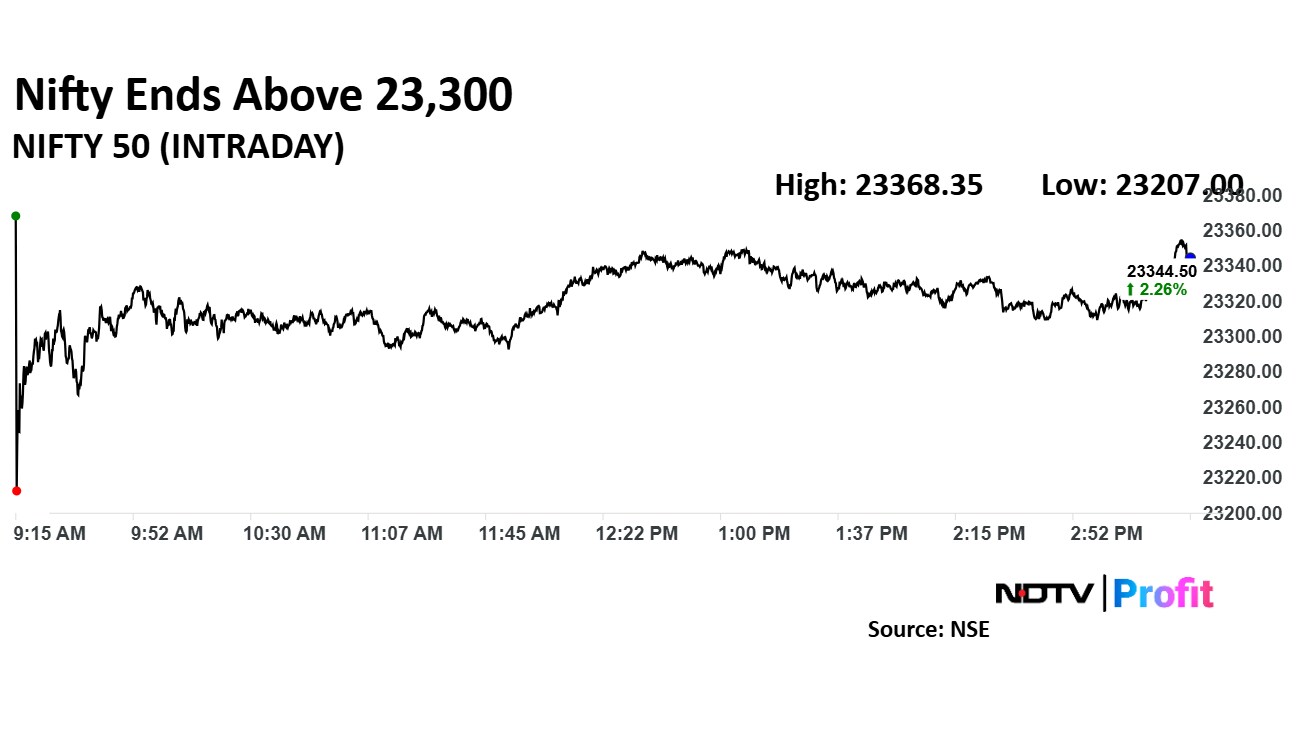

The NSE Nifty 50, which rose over 2% on Tuesday, could face resistance at around the 23,500 levels, according to analysts.

"If the index continues its upward momentum, it may encounter resistance in the 23,440 to 23,500 range, while strong support is expected at 23,050," according to Aditya Gaggar Director of Progressive Shares.

In addition, on daily charts, the market is holding uptrend continuation formation, which supports a further uptrend from the current levels, said Shrikant Chouhan, head of equity research at Kotak Securities. The analyst is of the view that the current market texture is bullish. "Due to temporary overbought conditions, we could see some profit booking at higher levels," he said.

"For traders, 23,400 and 23,500 would act as key resistance areas, while 23,200 to 23,135 could serve as crucial support zones. However, below 23,135, the uptrend would be vulnerable," Chouhan added.

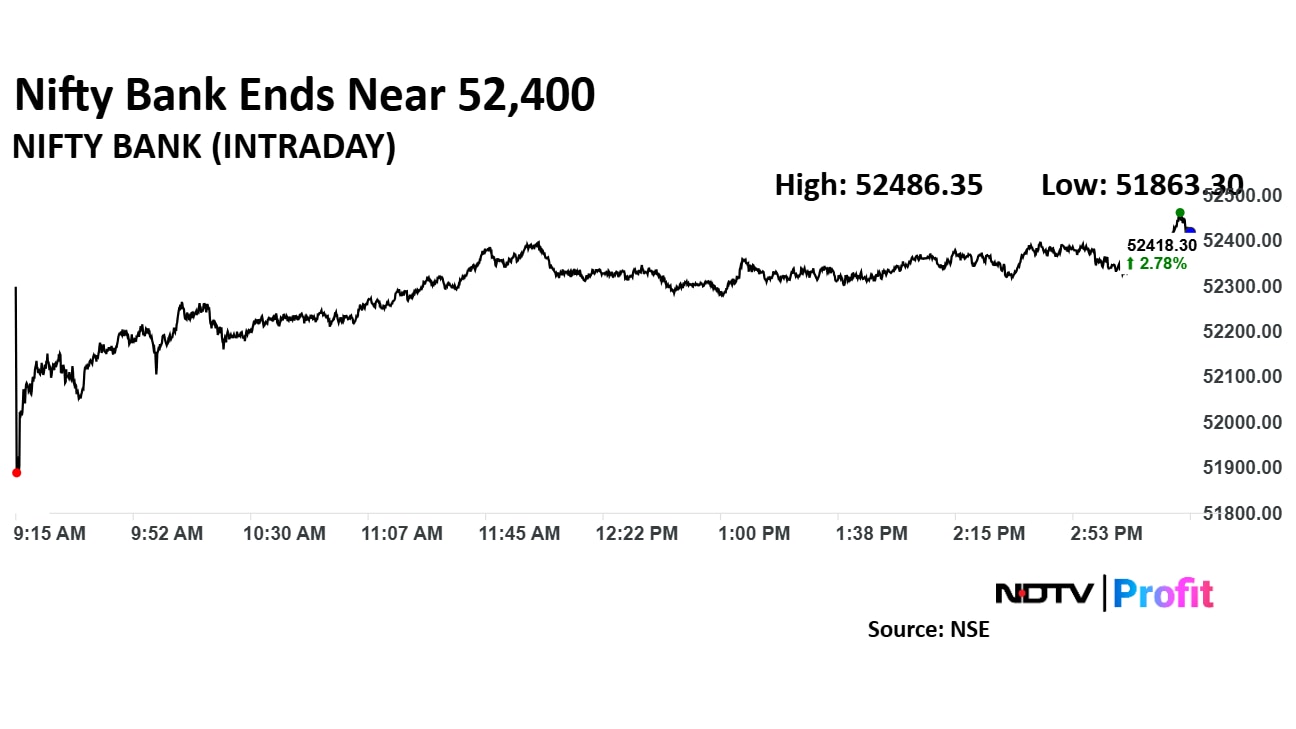

For Bank Nifty, after strong gains, 52,000 remains an immediate support zone on the downside, while 52,500 acts as a near-term resistance zone, as per Satish Chandra Aluri from Lemonn Markets Desk.

Market Recap

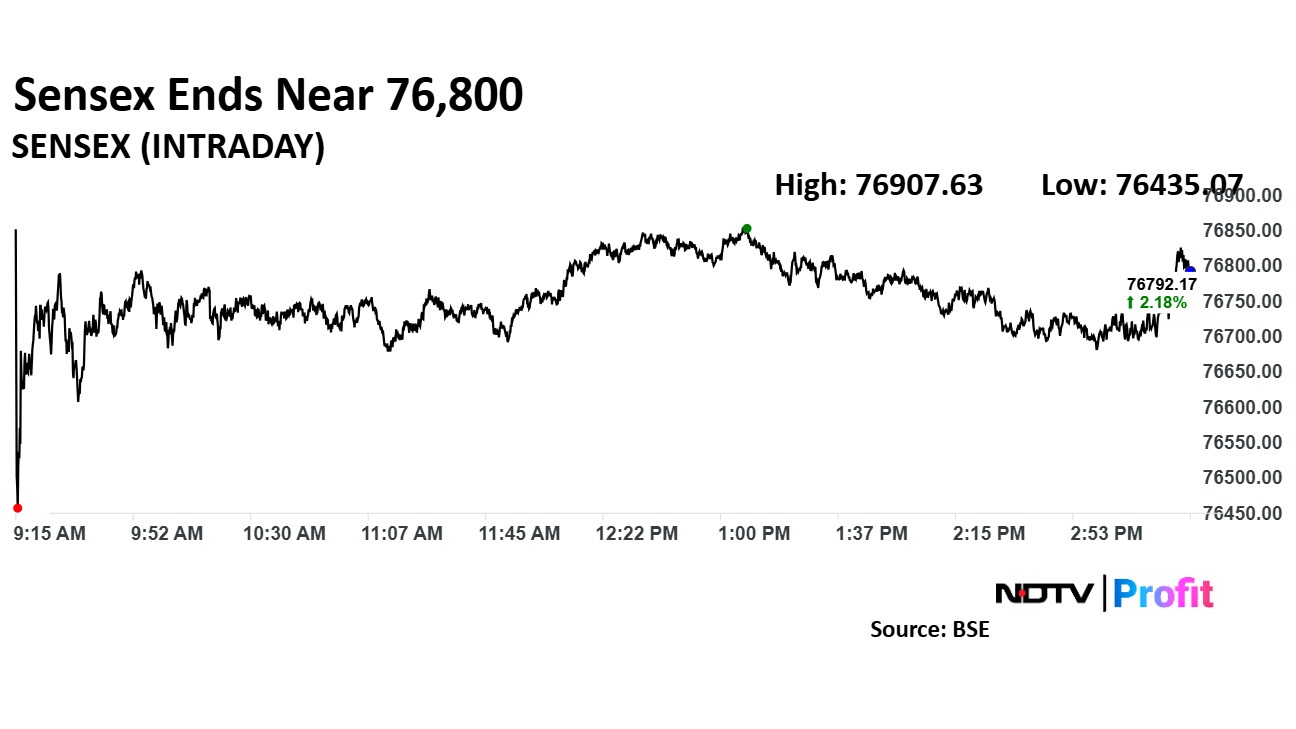

The benchmark equity mark indices continued their upward trajectory to close higher for the second consecutive trading session on Tuesday.

US President Donald Trump's decision to halt reciprocal tariffs on non-retaliating countries for 90 days last week sparked the positive rally on Friday.

The NSE Nifty 50 closed 2.19% higher at 23,328 as it gained 500 points. Meanwhile, the Sensex closed 2.10% higher at 76,734.

During the day, the benchmark indices surged even higher as Nifty 50 hit an intraday high of 2.36% and Sensex surged to hit an intraday high of 2.33%.

FII/DII

Foreign portfolio investors turned net buyers of Indian equities on Tuesday after nine sessions as they mopped up stocks worth Rs 6,065.78 crore. FPIs last turned net buyers on March 27, where they bought equities worth Rs 11,111.25 crore—highest single-day buying so far in 2025.

Domestic institutional investors turned net sellers after four sessions of buying, as they net offloaded equities worth Rs 3,136.02 crore, according to provisional data from the National Stock Exchange.

Global Cues

Most markets in Asia-Pacific were trading lower as market participants await China GDP data, while US tariff concerns weigh. The Nikkei 225 and KOSPI were trading 0.42% and 0.39% down, respectively as of 6:37 a.m.

On Tuesday, the Dow Jones Industrial Average and S&P 500 ended 0.38% down at 40,368.96, while the S&P 500 ended 0.17% down at 5,396.63 as of 6:38 a.m.

The dollar index was trading 0.32% down at 99.90, and the brent crude was trading 0.15% higher at $64.77 a barrel as of 6:40 a.m. The Bloomberg spot gold was trading 1.27% higher at record high of $3,271.32.

The GIFT Nifty was trading 0.11% or 26 points down at 23,285.50 as of 6:41 a.m.

Money Market

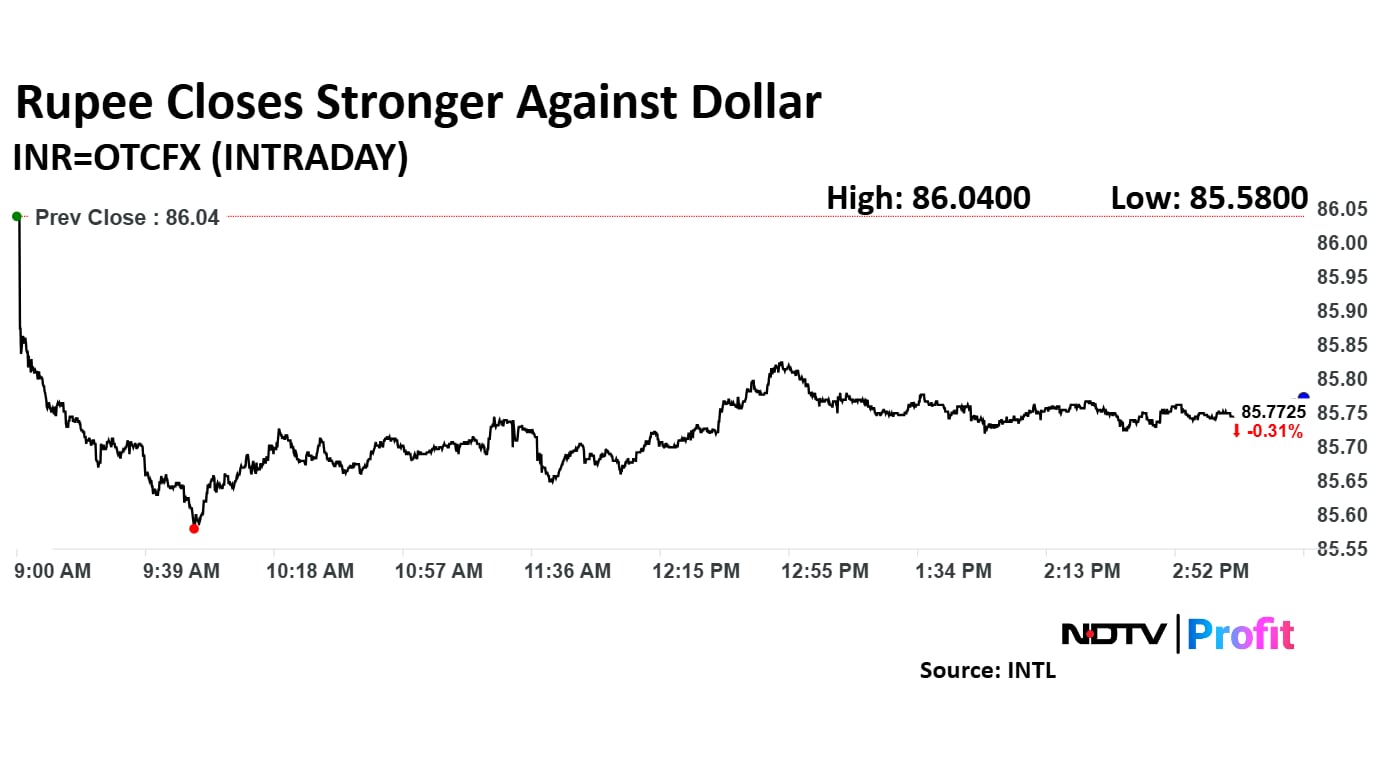

Rupee closed stronger against the US dollar on Tuesday. The local currency strengthened by 28 paise to close at 85.77 against the greenback, according Bloomberg. It had closed at 86.05 on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.