Thangamayil Jewellery Ltd.'s share price hit the 20% upper circuit as Equirus Securities reiterated its long position on the counter because of its potential to post robust growth moving forward. The brokerage has a target price of Rs 2,614, which implies an upside of 27%.

Equirus Securities also kept Thangamayil Jewellery as its top pick in the retail sector. It estimates that the jeweller will deliver revenue, Ebitda, net profit CAGR of 24%, 39%, and 58% respectively, over financial year 2025 and 2027. In the present market environment, the stock delivers an attractive entry point, it said.

Thangamayil Jewellery's flagship store in T-Nagar, Chennai, is believed to drive significantly higher revenue density compared to its other 61-store network. The T-Nagar store marks the first of 5–7 planned outlets in Chennai. Two more stores are about to open soon, the brokerage said.

Thangamayil Jewellery's T-Nagar store operates as a central hub and optimise inventory management, workforce training, and customer acquisition, while satellite stores ensure deeper market penetration. "By leveraging Chennai's strong purchasing power, Thangamayil Jewellery aims to enhance its market share in a competitive landscape," Equirus Securities said. The expansion aligned with its long-term growth strategy and reinforces Thangamayil Jewellery's position in Tamil Nadu's high-value jewellery segment through operational efficiency and strategic network development.

Thangamayil Jewellery's DigiGold scheme has the potential to enhance deposit volumes and deepen engagement with its loyal customer base. The jeweller attracted 50,000 DigiGold customers without a physical store in presence, which showed the scheme's effectiveness in driving customer acquisition, Equirus Securities said.

As of last calendar year, Thangamayil Jewellery holds Rs 290 crore gold metal loans, which is factored in at 2.9%, funding 24% of its inventory. Temporary rise in GML interests rate may pose a near-term challenge, Thangamayil Jewellery's recent rights issue proceeds are expected to alleviate inventory funding pressures, ensuring operational stability, the brokerage said.

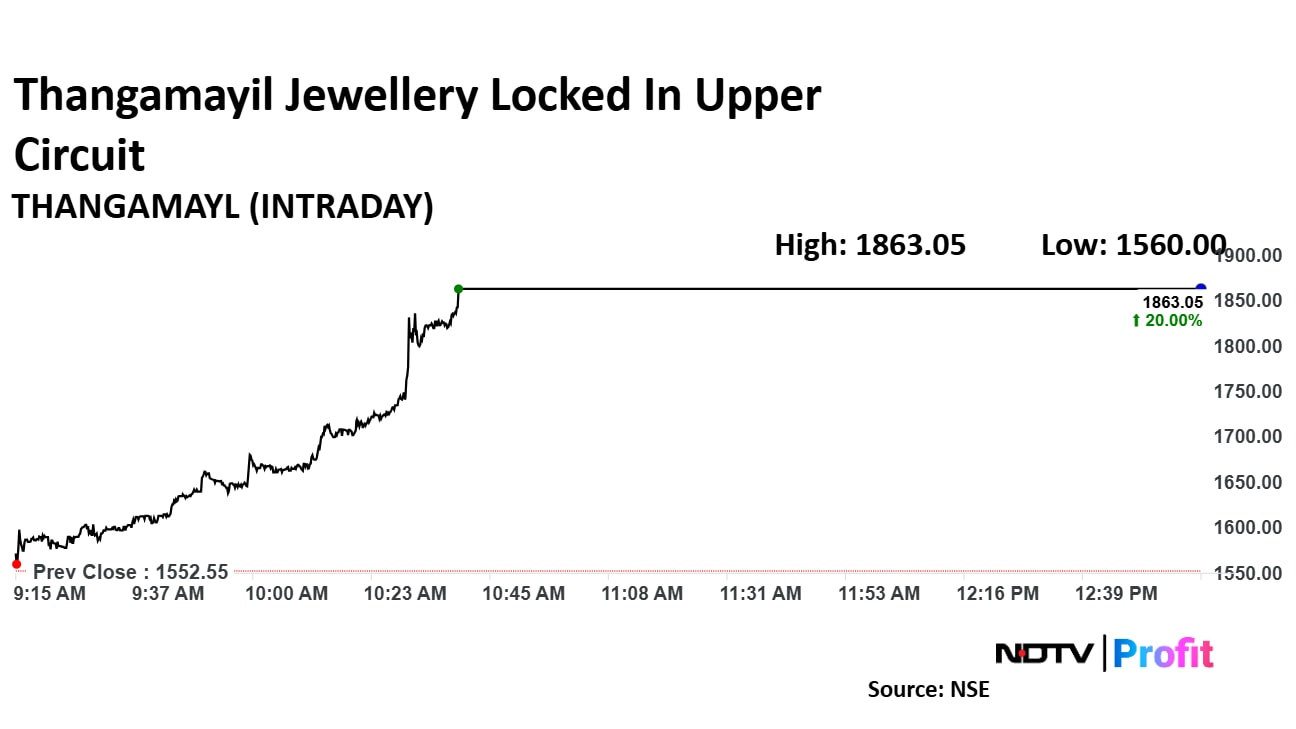

Thangamayil Jewellery share price rose 20% to Rs 1,863.05 apiece, the highest level since Feb 10. The scrip snapped a seven-day losing streak on Tuesday. It remained locked in the upper circuit as of 12:59 p.m., as compared to 0.09% advance in the NSE Nifty 50 index.

Thangamayil Jewellery rose 44.54% in 12 months. The relative strength index was at 55.73.

Four analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 34.1%.

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.