Texmaco Rail Engineering Ltd.'s share price advanced to the highest level in nearly five months in Thursday's session as the company fetched an order worth Rs 535 crore from a South African entity.

Under this order, Texmaco Rail will manufacture and supply 560 open top wagons for Rs 282 crore to Camalco South Africa. The company has also won a maintenance contract worth Rs 253 crore for 20 years, the company said in the exchange filing on Wednesday.

Texmaco Rail will complete the order in two phases within 24 months from purchase order date with provision for an additional order of 1,040 wagons in subsequent phases, the company said in the exchange filing.

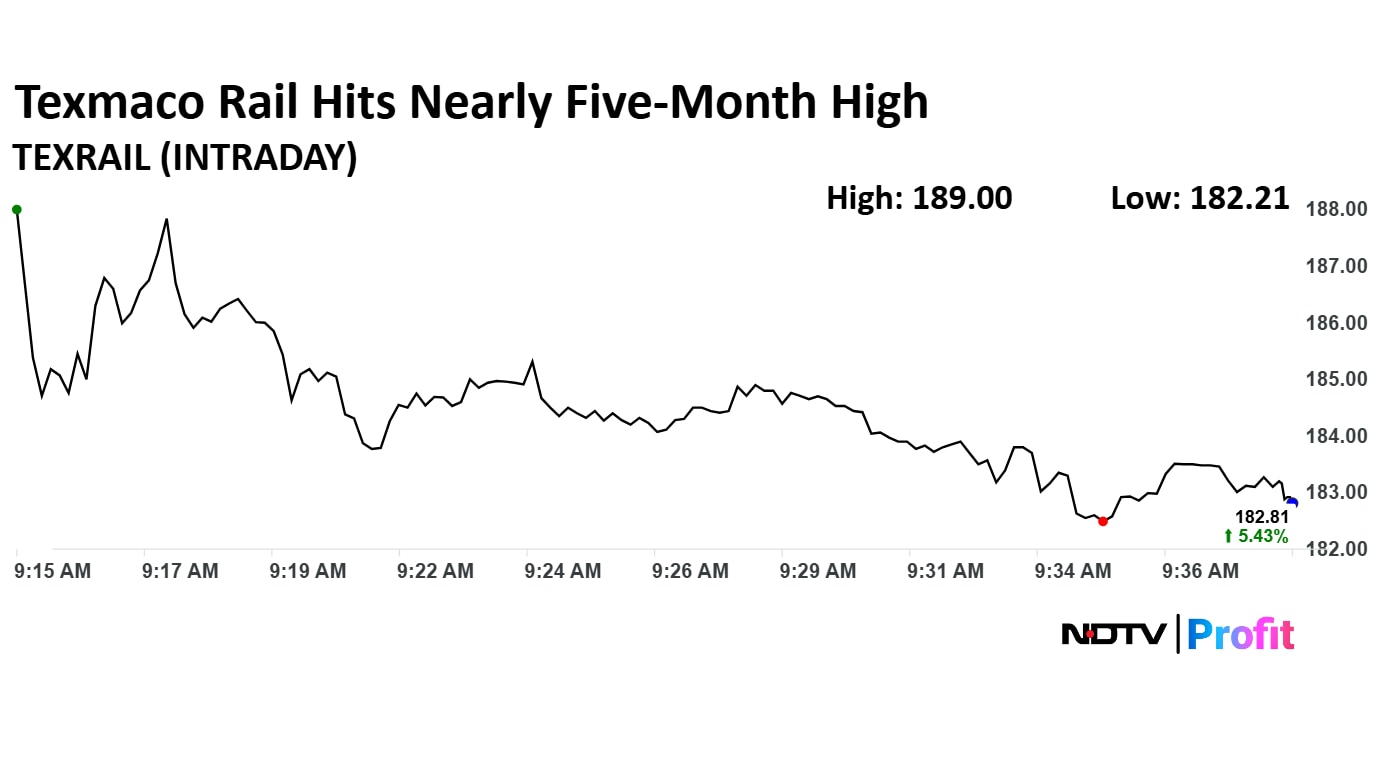

Texmaco Rail Engineering Share Price

Texmaco Rail and Engineering share price jumped 9% to Rs 189 apiece, the highest level since Feb. 1. The share price pared gains to trade 5.72% higher at Rs 183.35 apiece as of 9:41 a.m., as compared to a 0.40% advance in the NSE Nifty 50.

The stock declined 17.01% in 12 months, and 5.41% on year-to-date basis. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 66.76.

Four analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 33%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.