Tata Steel Ltd.'s share price rose over 1% in trade on Monday so far, extending its gains from the previous session. The share price saw an uptick after JPMorgan raised the target price, reiterating its 'overweight' rating on the stock on Thursday. The brokerage raised the target price to Rs 180, which implied 20% upside potential.

JPMorgan's positive view on the Nifty 50 counter is backed by visible positive catalysts to earnings growth of European business. Expected supportive contribution from Germany's infrastructure fund news and substantial increase in steel price spread is not fully appreciated yet by some investors, it says.

JPMorgan expects that Tata Steel's Europe business will reach Ebitda breakeven in the first quarter of financial year 2026. They raised Ebitda estimates for FY26 and FY27 by 8–11%. There are expectations of a potential steel output cut from China, the brokerage's investors team noted during the Hong Kong Shanghai meeting. If it happens, it will be a key catalyst. However, it's not priced in JPMorgan's estimates yet.

JPMorgan cautioned about potential adverse impact on demand due to US tariff policy, while tension escalation between Russia and Ukraine will be positive for Europe steel prices, the brokerage said.

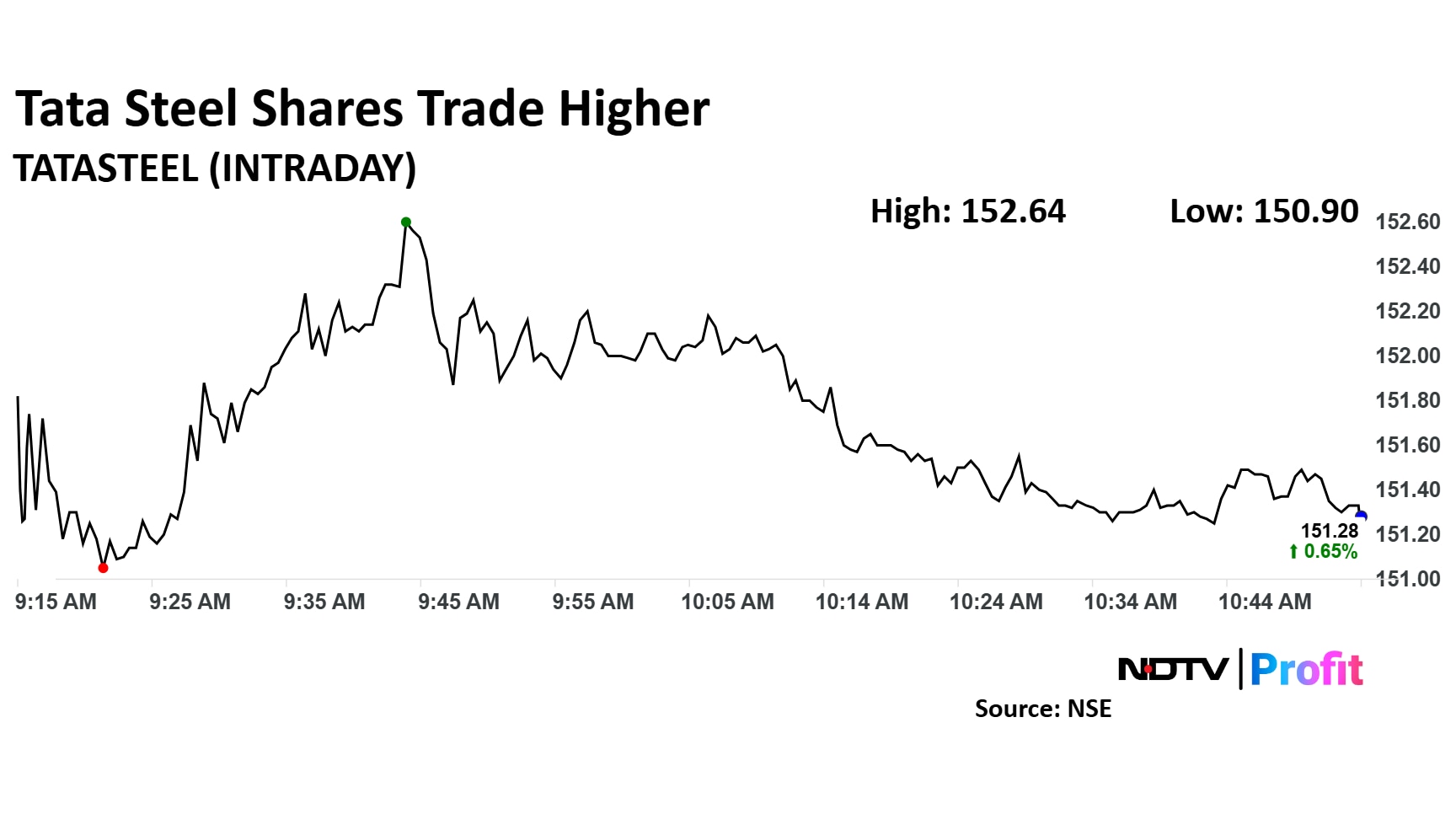

Tata Steel Share Price

Tata Steel rose as much as 1.17% during the day to Rs 152.6 apiece on the NSE. It was trading 0.47% higher at Rs 151.5 apiece, compared to an 0.35% advance in the benchmark Nifty 50 as of 10:48 a.m.

It has risen 6.83% in the last 12 months. The relative strength index was at 62.21.

Twenty one out of the 35 analysts tracking the company have a 'buy' rating on the stock, eight recommend a 'hold' and six suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 149.8, implying a downside of 0.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.