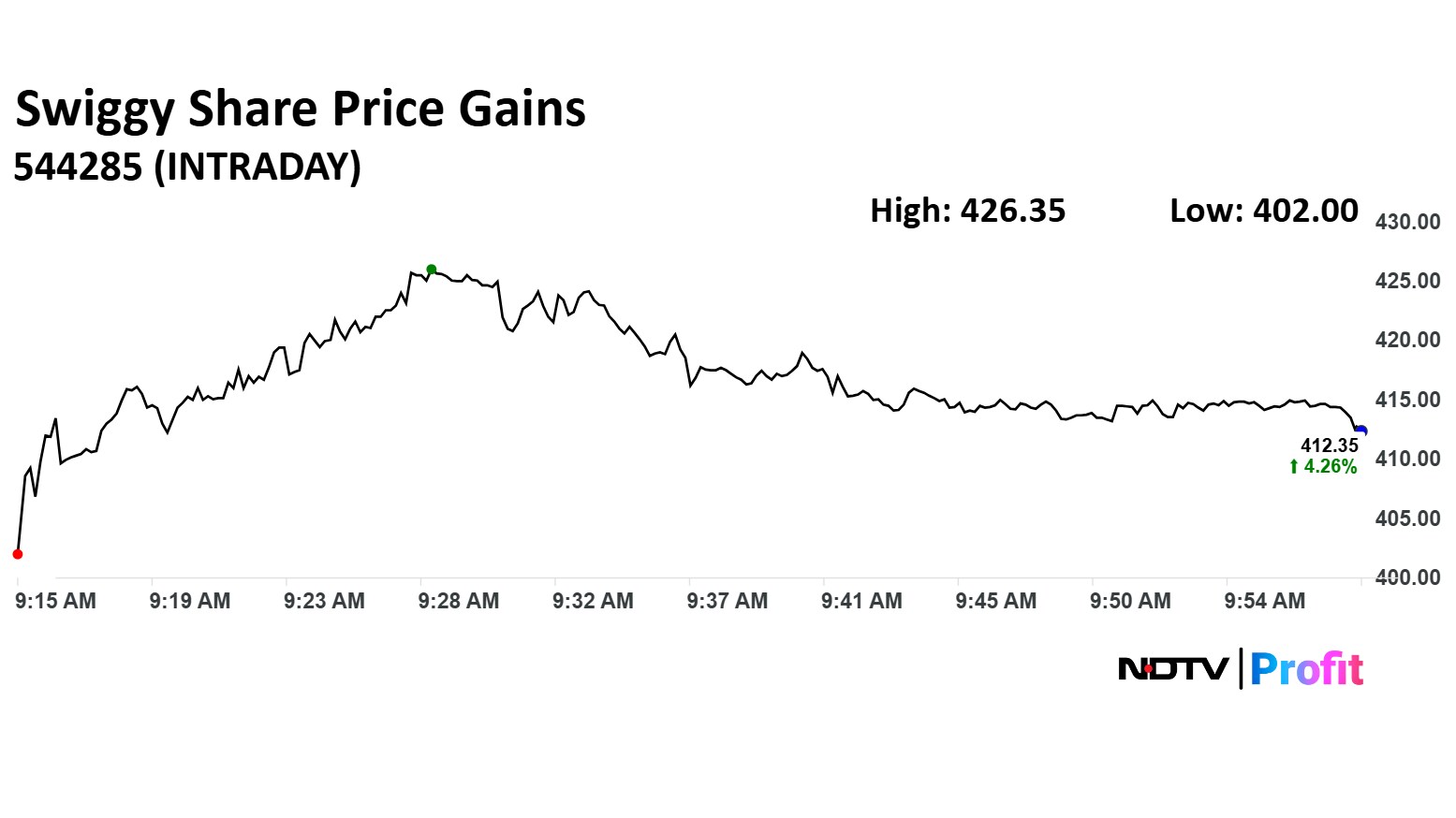

- Swiggy shares rose nearly 8% on Tuesday amid sector optimism in food delivery and quick commerce

- Swiggy stock reached an intraday high of Rs 426, gaining 10.78% over the past month

- Elara Securities gave Swiggy an ‘Accumulate’ rating with a target price of Rs 450

Swiggy Ltd. shares surged nearly 8% on Tuesday, riding the wave of investor optimism sweeping through India's food delivery and quick commerce sector. The rally follows Eternal Ltd's (Zomato's parent) strong Q1 earnings and upbeat commentary, which reassured markets about the stability and growth potential of the duopoly that dominates the space.

Swiggy's stock hit an intraday high of Rs 426, up 7.99% for the day, and has gained 10.78% over the past month and 6.59% in the last seven days.

Last week, Elara Securities initiated coverage on the stock with an ‘Accumulate' rating and a target price of Rs 450, citing Swiggy's strong execution headroom in both food delivery and quick commerce.

The rally was also fueled by Eternal's Q1 results, which showed a 23% quarter-on-quarter revenue jump and narrowing losses in Blinkit and Hyperpure.

Out of 25 analysts tracking the stock, 19 maintain a ‘Buy' rating, reflecting broad confidence in Swiggy's growth trajectory and operational improvements. The company is expected to announce its Q1 FY26 results on July 31, which could further influence investor sentiment.

Swiggy's share price rally is being driven by sector-wide optimism, strong peer performance, and improving fundamentals.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.