.jpg?downsize=773:435)

Suzlon Energy Ltd.'s share price rose to the highest level in nearly two months in Tuesday's session as Motilal Oswal Financial Services Ltd. initiated coverage on the company. The brokerage has a target price of Rs 70, which implies a 21% upside.

Suzlon Energy is expected to benefit from the growth wave in India's wind energy space because of its capacity and global lead position, according to Motilal Oswal Financial Services. Suzlon Energy holds the lead position in the global backdrop. It has an installed capacity of 20.9 gigawatts across 17 countries. In India, it's the top energy service provider in the wind energy space with the highest installed capacity of 15 gigawatts.

Suzlon Energy is operating with a vertically integrated structure, including in-house research, development and manufacturing facilities in India. Its operations span over wind turbine generator sales, project execution, foundry and forging components, and operation and maintenance services, Motilal Oswal Financial Services said.

Relatively low penetration of wind energy in India offers significant room for growth, according to Motilal Oswal Financial Services. Wind energy is expected to account for 20% of India's renewable energy compared to 39% in the US and Germany and 42% in the UK by 2030.

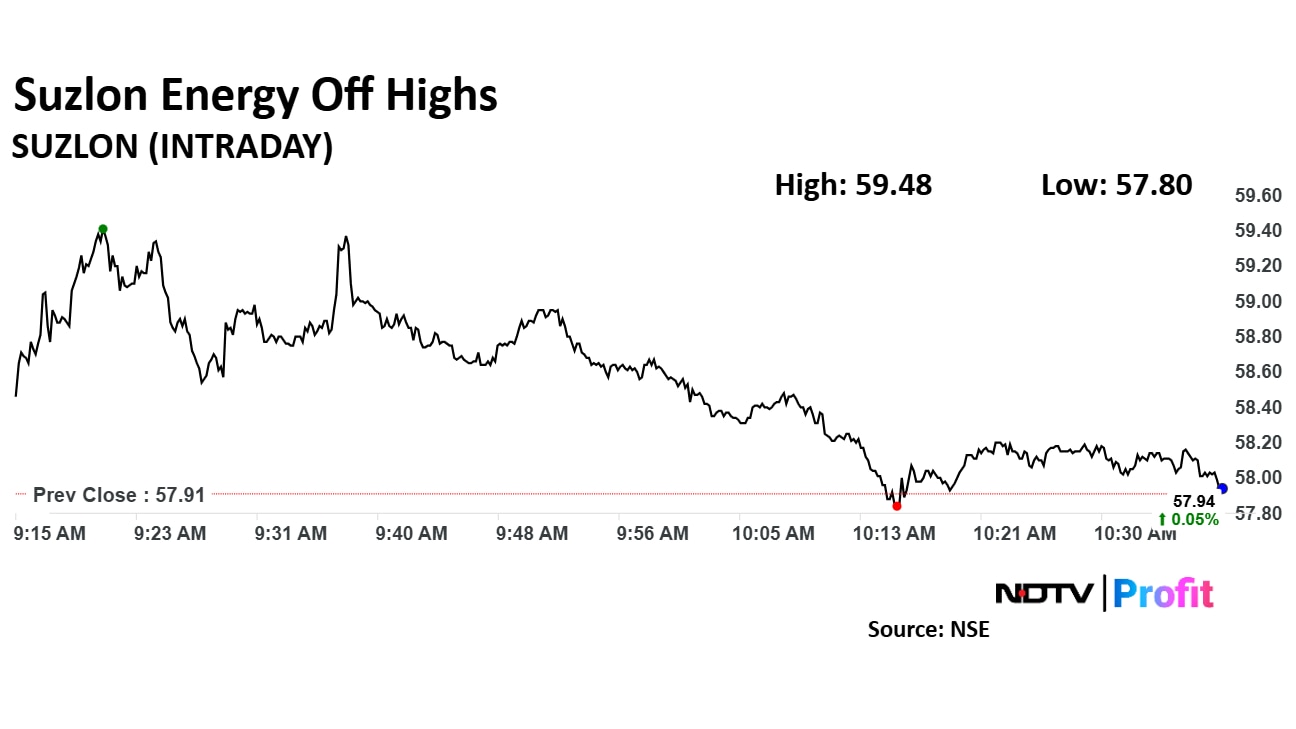

Suzlon Energy share price rose 2.71% to Rs 59.48, the highest level since Feb 1. It pared most gains to trade 0.05% higher at Rs 57.94 apiece as of 10:39 a.m., as compared to 0.29% advance in the NSE Nifty 50 index.

It has risen 56.47% in 12 months, and declined 6.73% on year-to-date basis. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 60.54.

Out of eight analysts tracking the company, seven maintain a 'buy' rating, one recommends a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 19.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.