Suryoday Small Finance Bank Ltd.'s disbursements in the fourth quarter of financial year 2024 rose 43% year-on-year to Rs 2,101 crore.

Deposits rose 9% to Rs 2,101 crore over a year ago, the bank said in its provisional quarterly business updates on Thursday.

Total gross advances rose 7% year-on-year to Rs 10,251 crore in the quarter-ended June.

CASA ratio—the proportion of deposits that come from low-cost current and savings accounts—rose to 20.9% from 19.5% in the year-ago period. A higher CASA ratio indicates a lower cost of funds, since lenders don't usually give any interest on current account deposits and the interest on saving accounts is low.

Gross non-performing assets rose to 7.1% from 5.5% a year ago.

During the quarter ended March, the Bank has completed sale of its Stressed Loan Portfolio of ₹ 80.59 crores to an Asset Reconstruction Company.

Suryoday Small Finance Bank's total deposits rose 36% to Rs 10,580 crore in fiscal 2025. While disbursements for the financial year 2025 rose 1% year-on-year to Rs 6,989 crore, total gross advances rose 19% year-on-year to Rs 10,251 crore. CASA ration rose marginally to 20.9% from 20.1%.

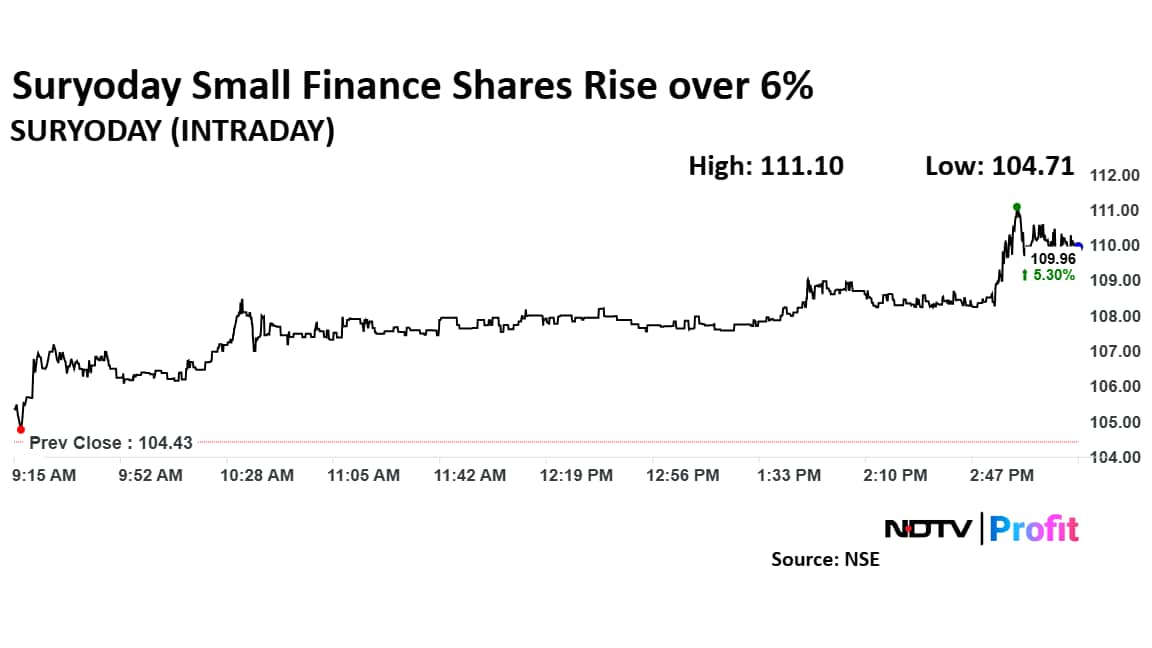

Suryoday Small Finance Share Price Rises

The shares of Suryoday Small Finance Bank rose as much as 6.39% to Rs 111.10 apiece, the highest level since March 24. It pared gains to trade 5.50% higher at Rs 110.74 apiece, as of 3:21 p.m. This compares to a 0.37% decline in the NSE Nifty 50 Index.

It has fallen 34% in the last 12 months and 20.91% year-to-date. Total traded volume so far in the day stood at 1.4 times its 30-day average. The relative strength index was at 53.

One analyst tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 66.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.