.jpg 2.jpg?downsize=773:435)

Shares of Strides Pharma Science Ltd. rose nearly 8% on Thursday as its Contract Development & Manufacturing Organization and soft gelatin business OneSource will list on the National Stock Exchange Ltd. and BSE Ltd. on Friday.

OneSource received the final listing and trading approval for its equity shares from the NSE and the BSE on Jan. 22, the company said in an exchange filing on Thursday.

As of Dec. 6, — which is the the record date — Strides Pharma shareholders had received one fully paid equity of Rs 1 each in OneSource for two equities held in Strides. The allotment was finalised on Dec. 10 in 2024.

In September, Strides Pharma had said that it will spin off its CDMO and soft gelatin business under Stelis and call it OneSource. OneSource is India's first specialty pharma pure play CDMO, according to the company. The company includes three arms, ibologics and high-end drug devices combination, which was under Stelis, oral technologies and sterile injectables.

In November 2024 the National Company Law Tribunal gave approval to Strides Pharma for the spinning of OneSource.

The move will result in the integration of synergies and enable better supervision of the business, the company had said in an exchange filing. In addition, it would help achieve growth and sustain value creation for the shareholders the company said.

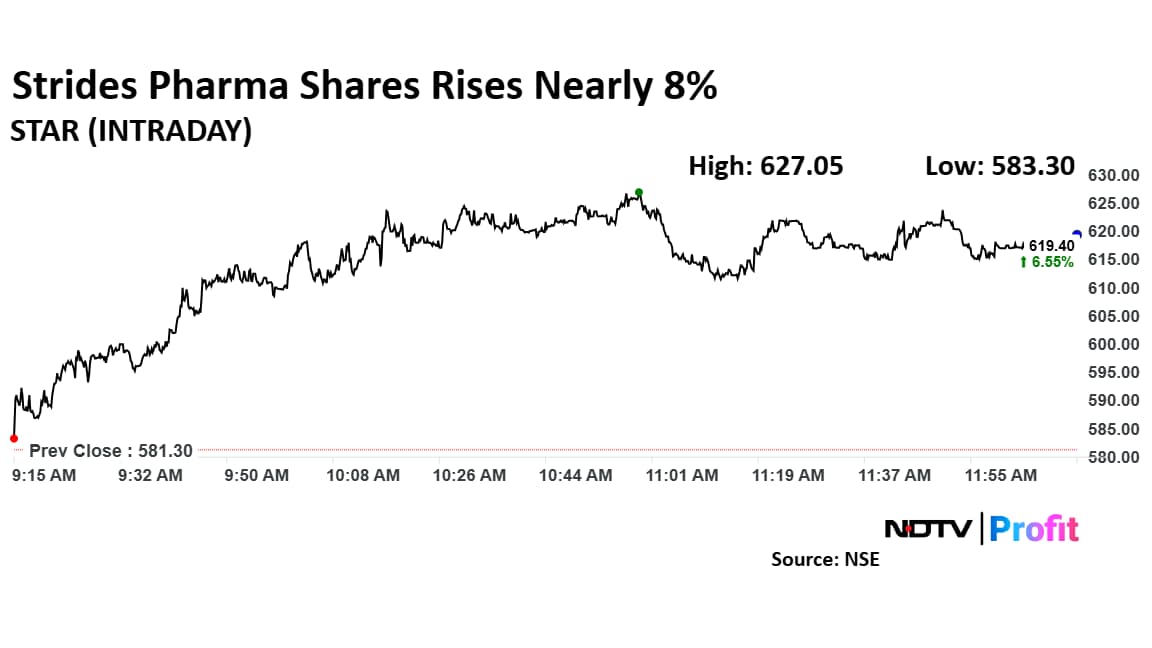

Strides Pharma Share Price

Share price of Strides Pharma rose as much as 7,87% to Rs 627.05 apiece, the highest level since Jan. 17. It pared gains to trade 6.27% higher at Rs 617.75 apiece as of 12:07 p.m., compared to a 0.29% advance in the NSE Nifty 50.

The stock has risen 106.94% in the last 12 months. Total traded volume so far in the day stood at 2.1 times its 30-day average. The relative strength index was at 43.

The two analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 108.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.