Stove Kraft Ltd.'s share price has surged over 41% in three months to June. However, the stock price has declined 32.27% on year-to-date basis.

Six analysts who track Stove Kraft maintain a 'buy' rating. Nirmal Bang Institution, Emkay Global Research, JM Financial, Dolat Capital and Yes Research are some of the prominent brokerages who maintained the view on the stock.

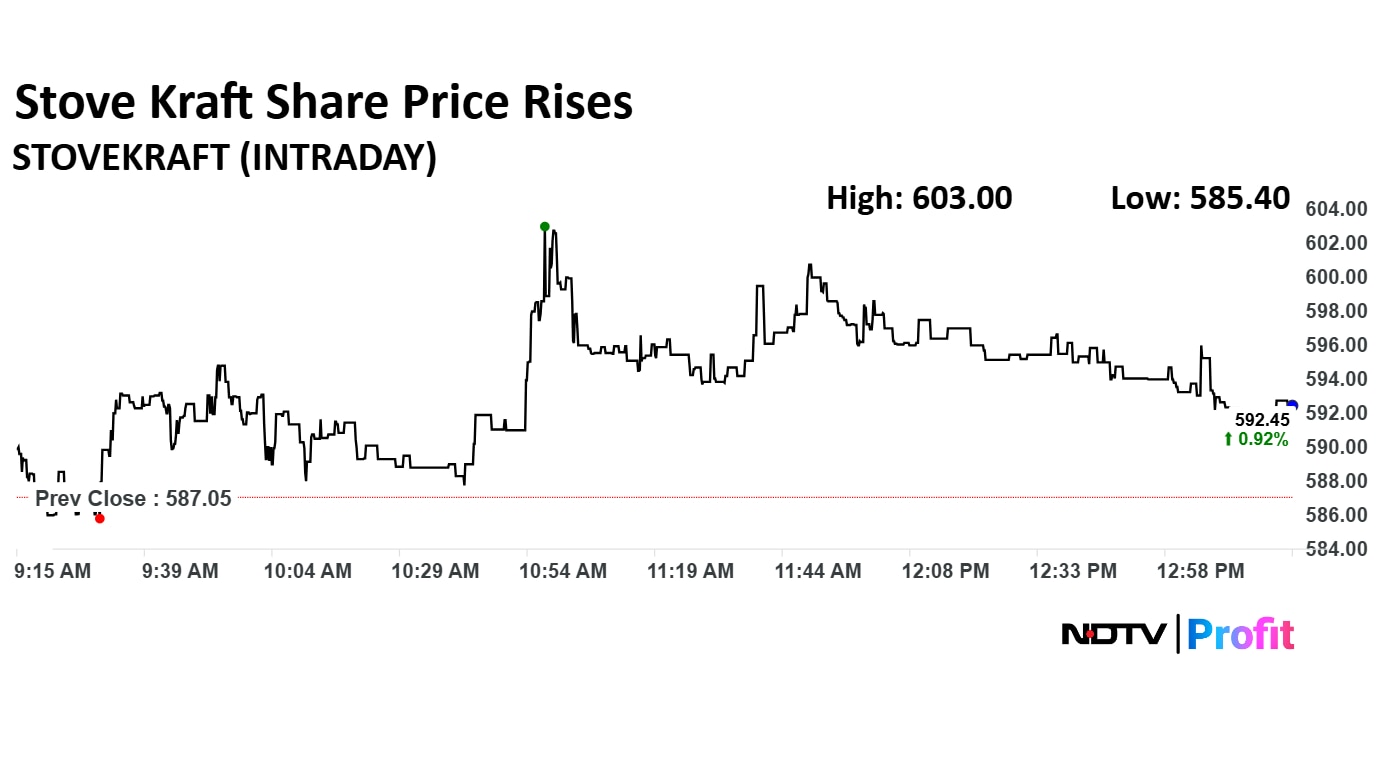

On Monday, Stove Kraft share price rose 2.72% to Rs 603.00. The share price pared gains to trade 0.92% higher at Rs 592.45 apiece as of 1:25 p.m., as compared to a 0.51% decline in the NSE Nifty 50.

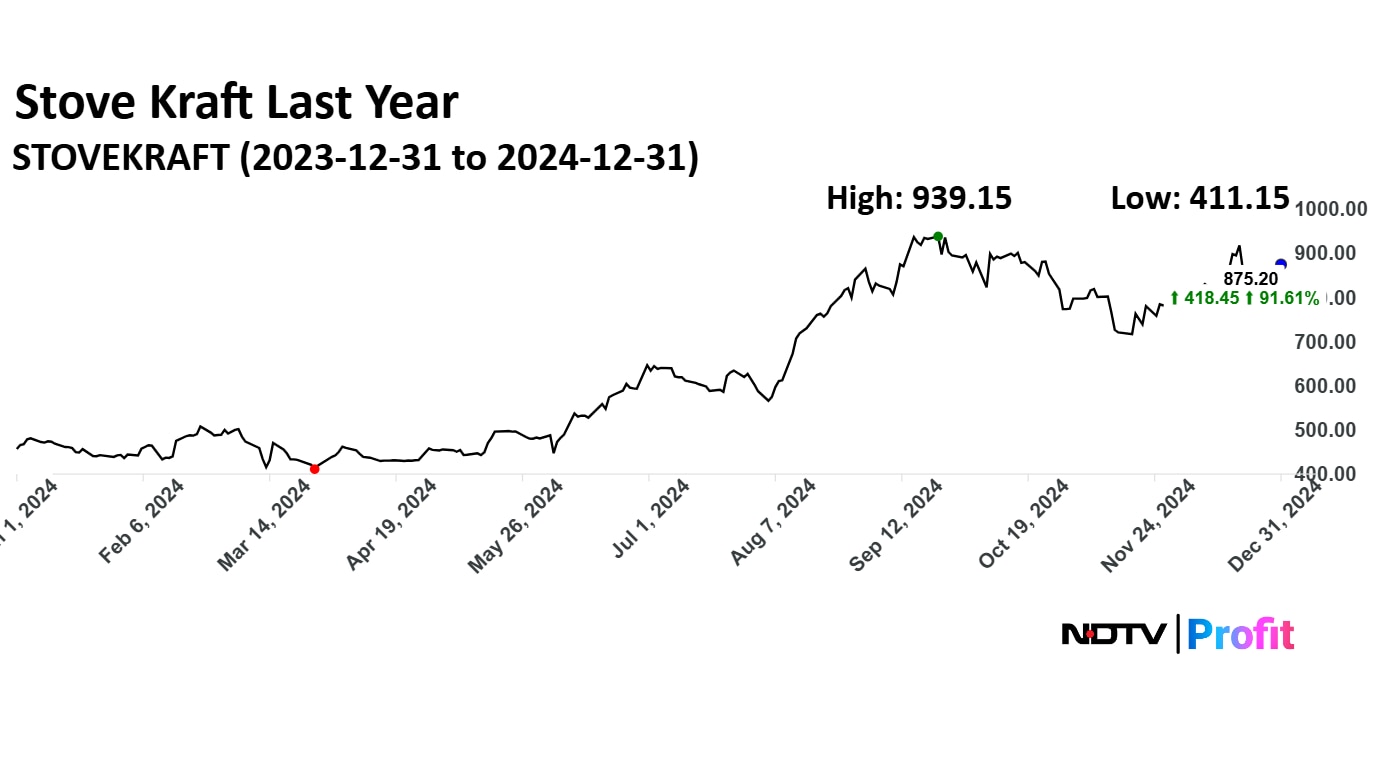

In 12 months, Stove Kraft stock declined 8.55%. The relative strength index was at 53.16.

In 2024, Stove Kraft shares surged nearly 100%. Its high during previous calendar year was at Rs 939.15, and low at Rs 411.15 apiece.

Stove Kraft is an emerging kitchen appliances manufacturer and solution provider. It's one of the dominant player in pressure cooker market. Its manufacturing units are located in Bengaluru and Baddi, Himachal Pradesh.

Financial Performance

In January–September, Stove Kraft's revenue declined 3.8% on the year to Rs 313 crore. Its net profit slumped 45% to Rs 1.5 crore in the fourth quarter from the corresponding period of the previous financial year. Operating profit declined 18.8% on the year to Rs 29.5 crore.

In financial year 2025, its revenue advanced 6.3% on the year to Rs 1,449.8 crore. Its net profit advanced 12.8% on the year to Rs 38.5 crore.

Small appliances contributed the most to its topline growth during financial year 2025. Pressure cookers and gas cooktop followed small appliances.

Growth volumes in all categories declined last financial year.

Nevertheless, the company remained positive about future growth outlook possibilities as inflation easing, and rural demand has improved.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.