-The local currency closed 17 paise lower against the U.S. Dollar at 83.35.

-It closed at 83.18 on Tuesday

Source: Cogencis

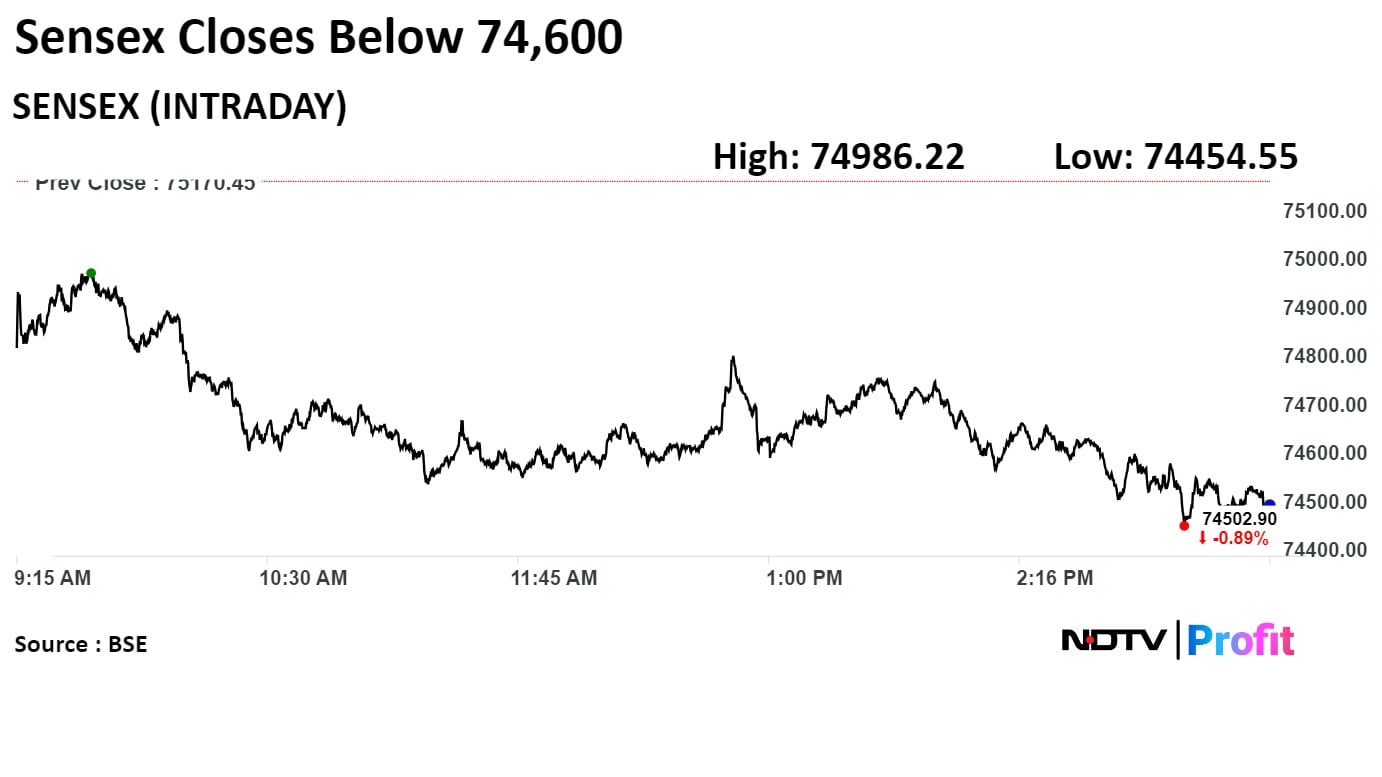

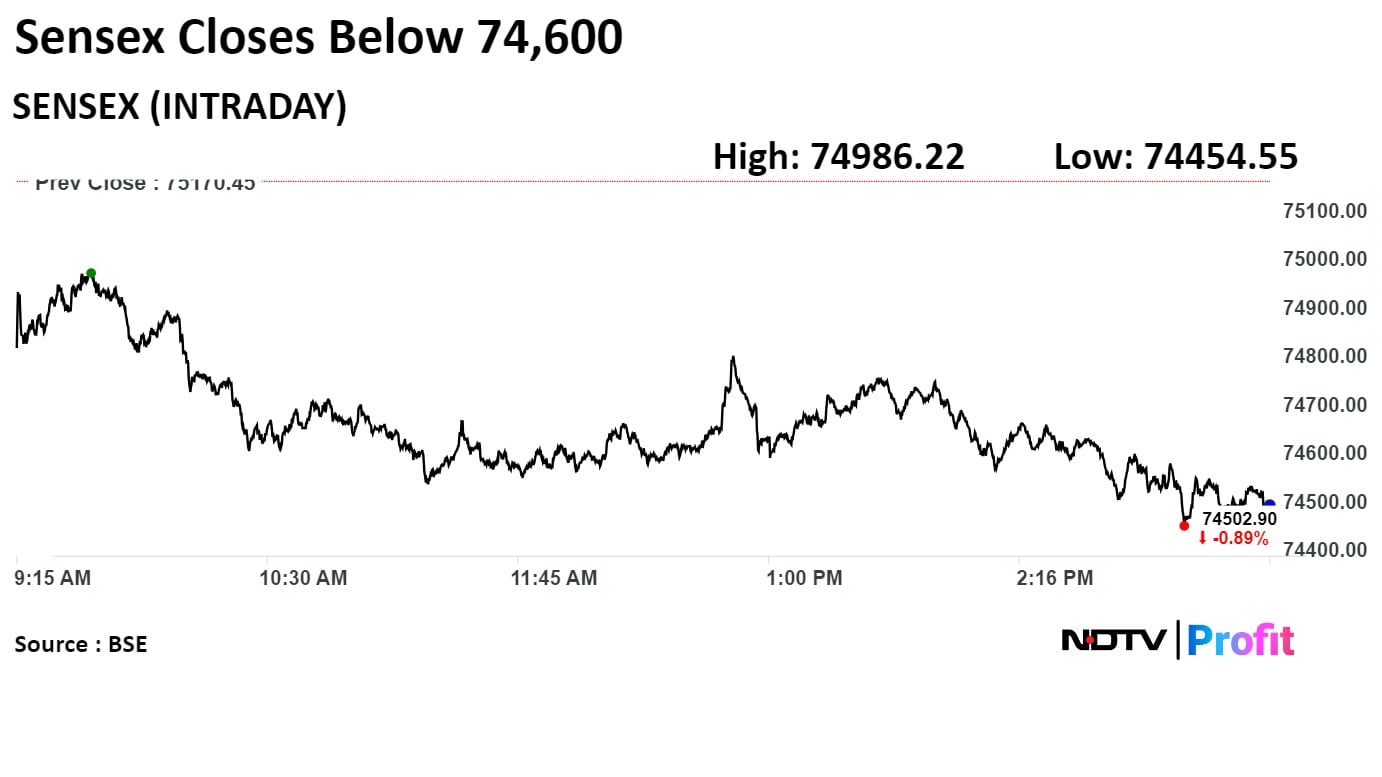

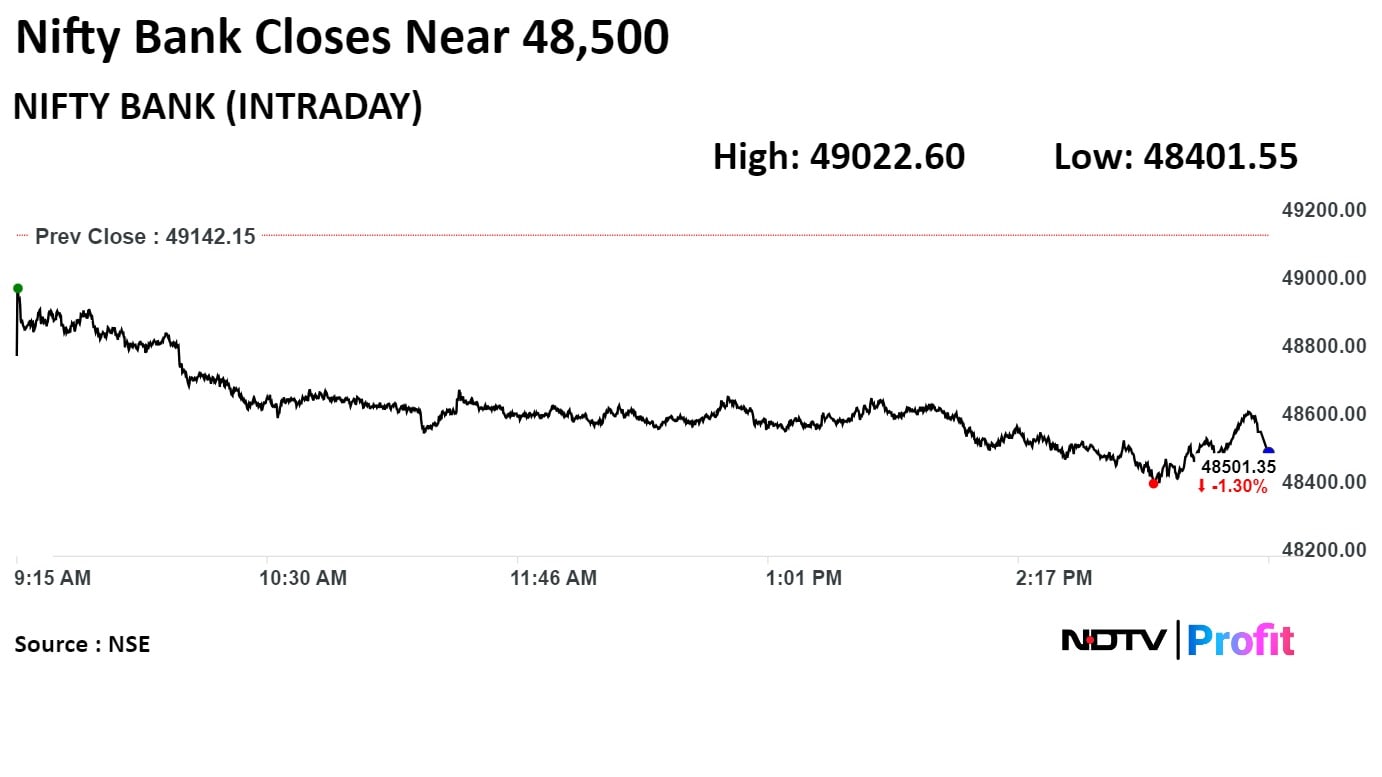

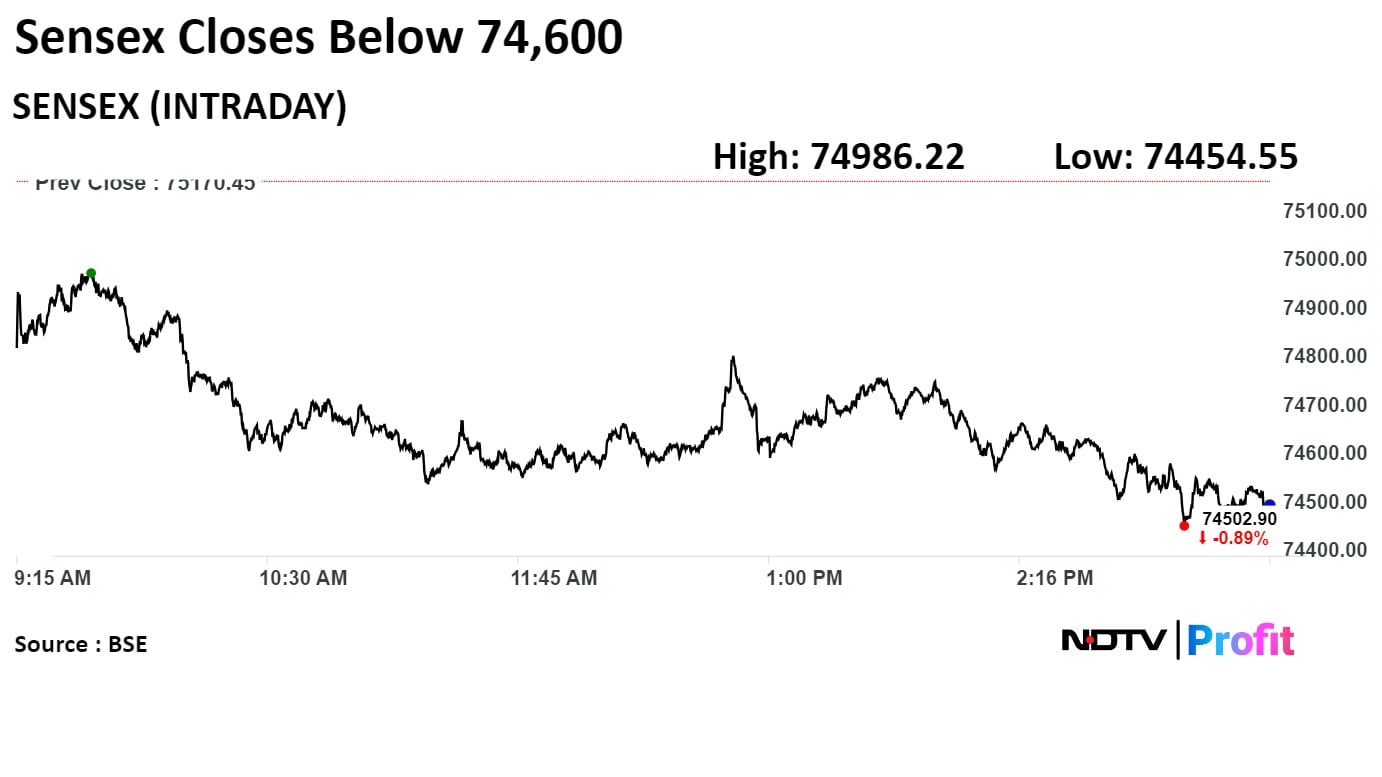

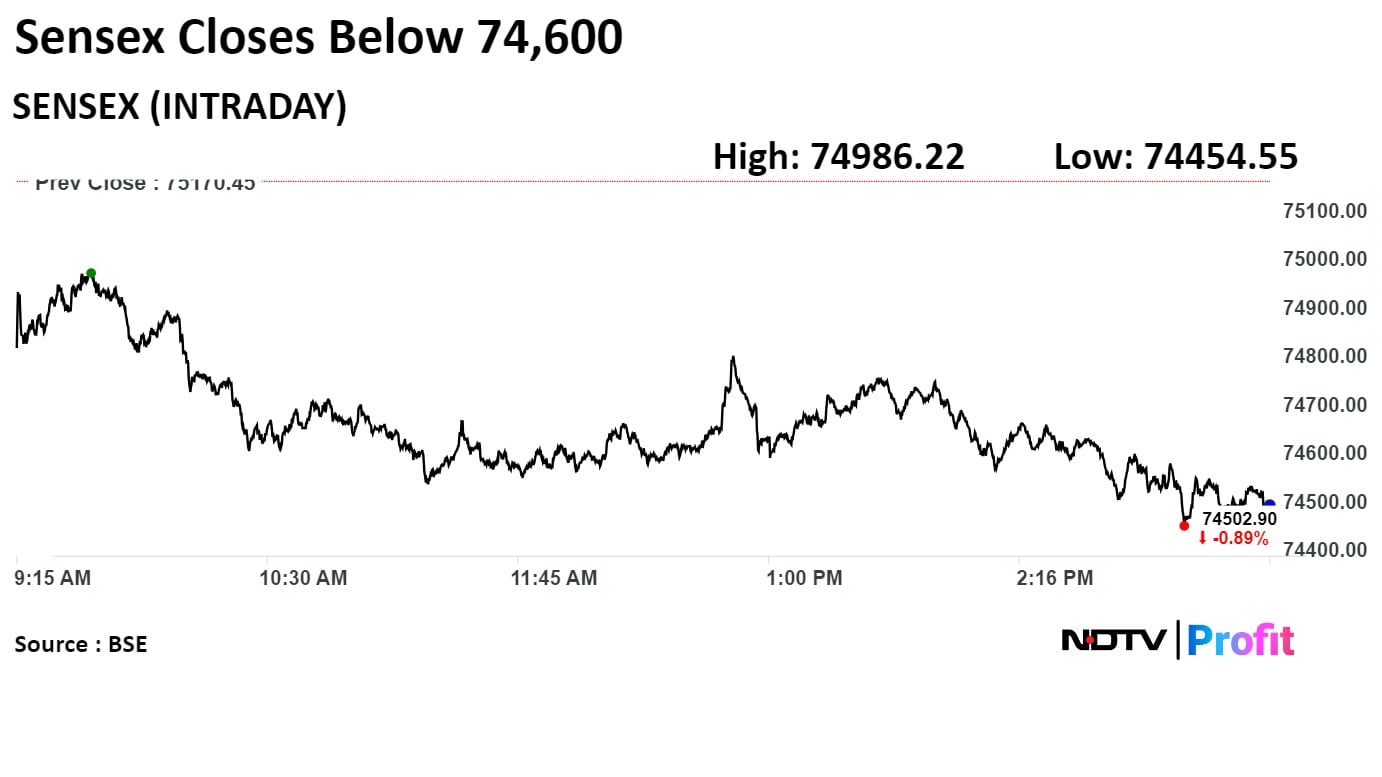

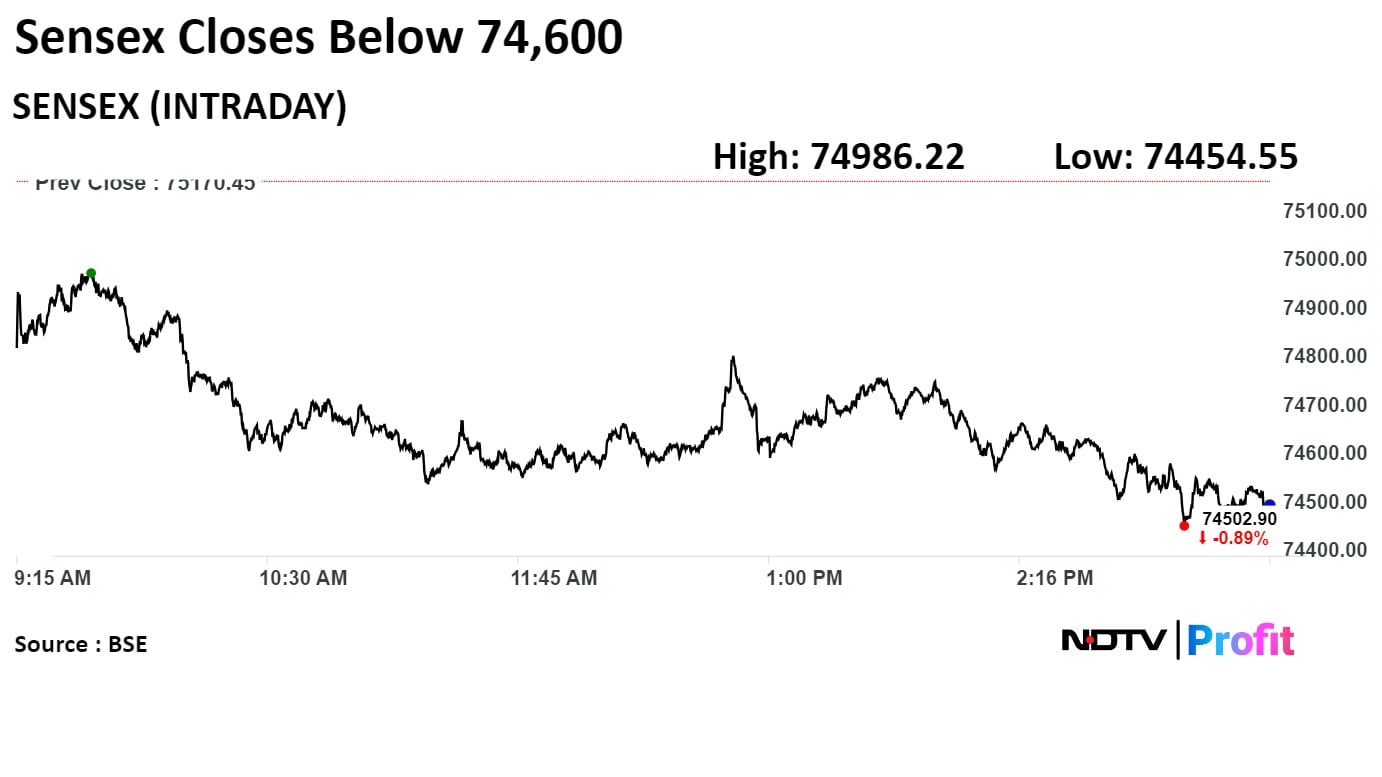

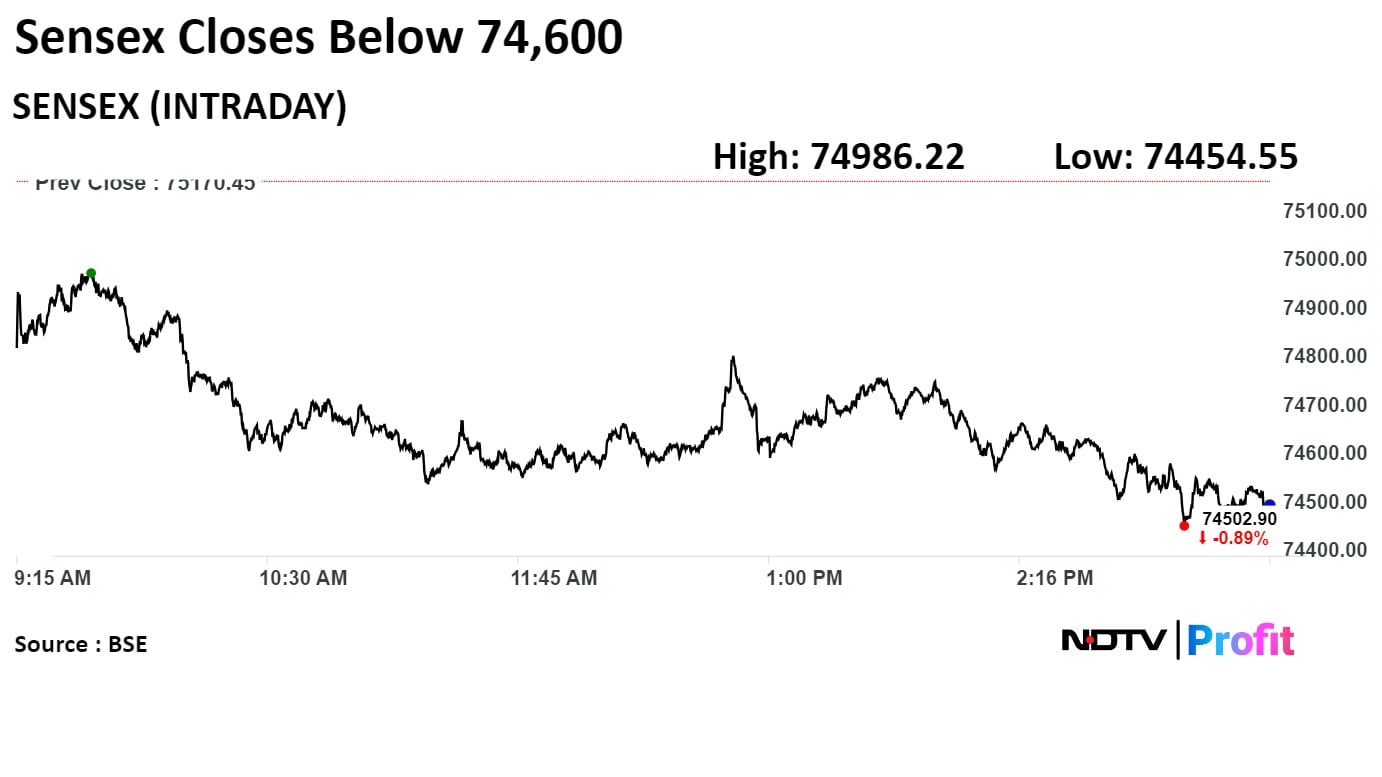

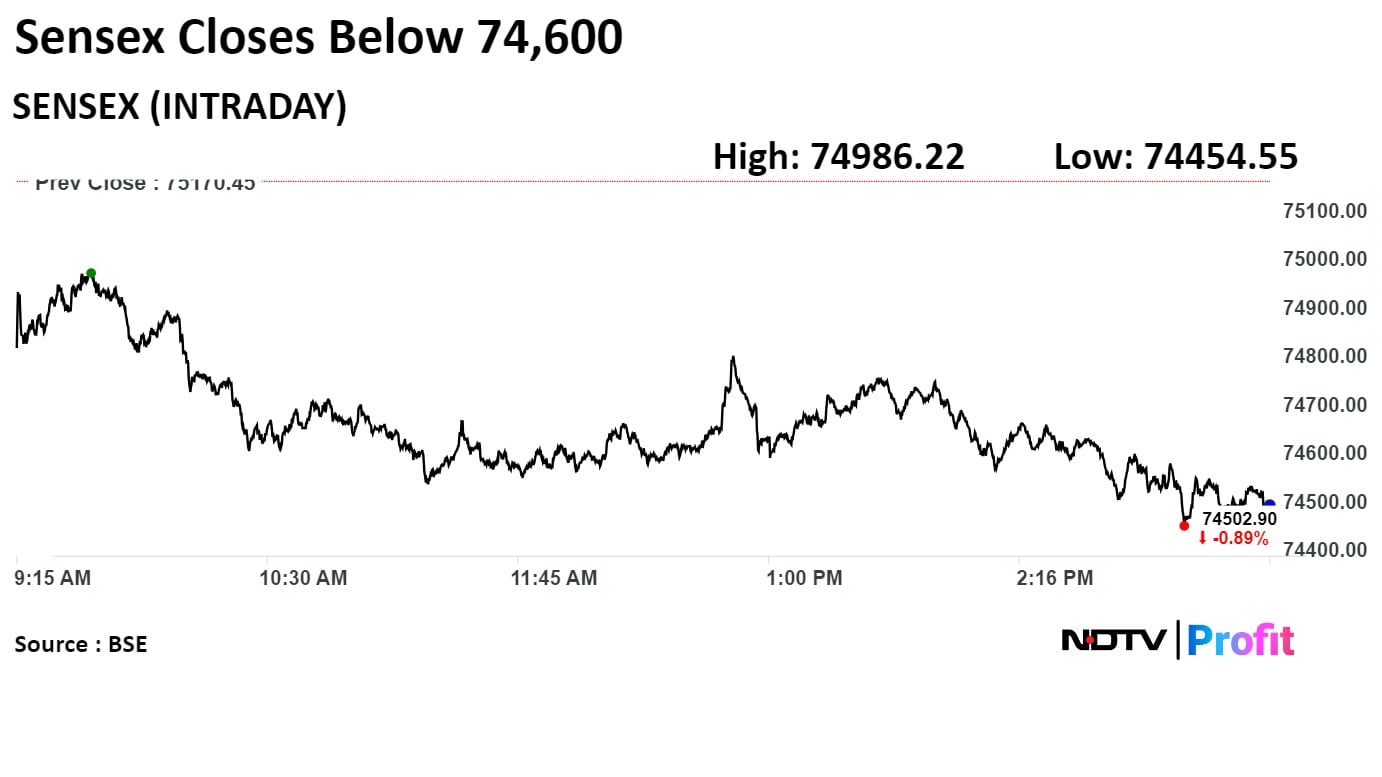

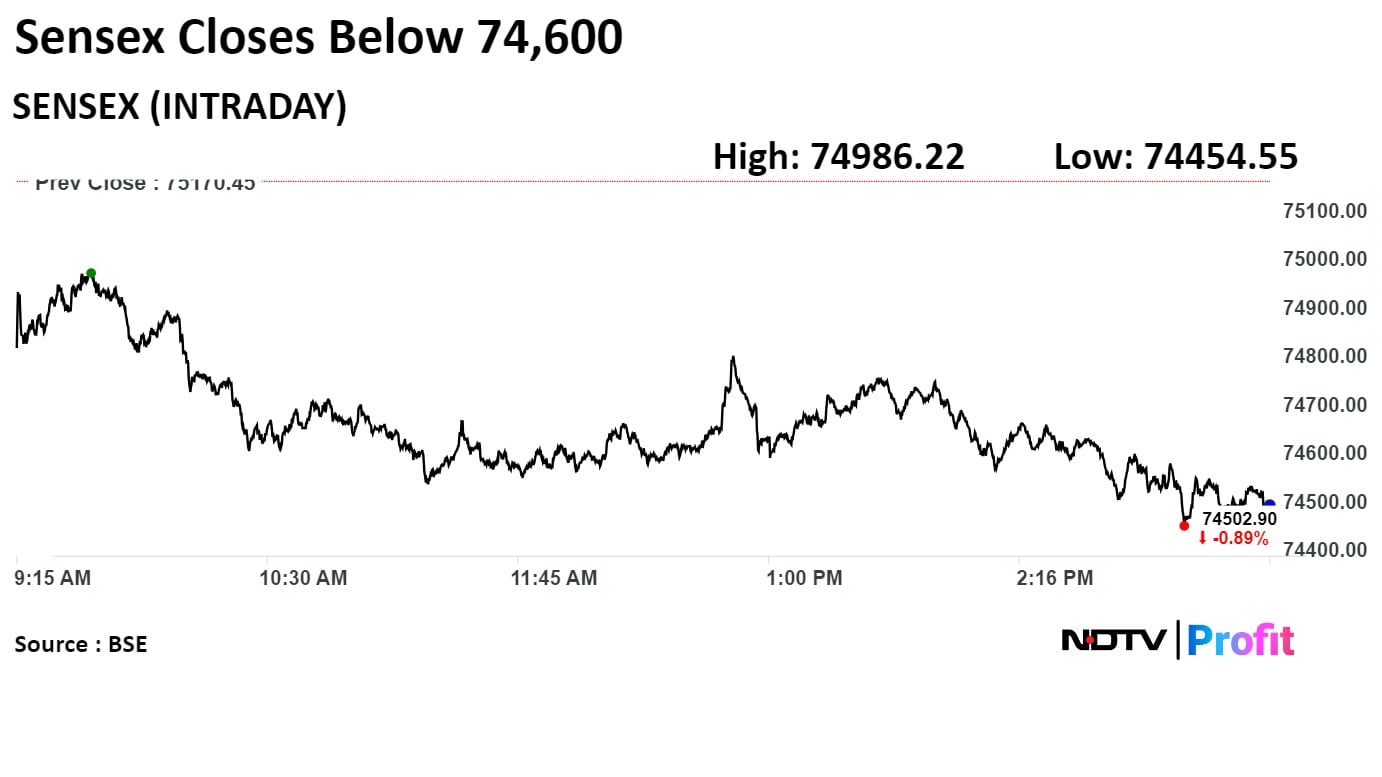

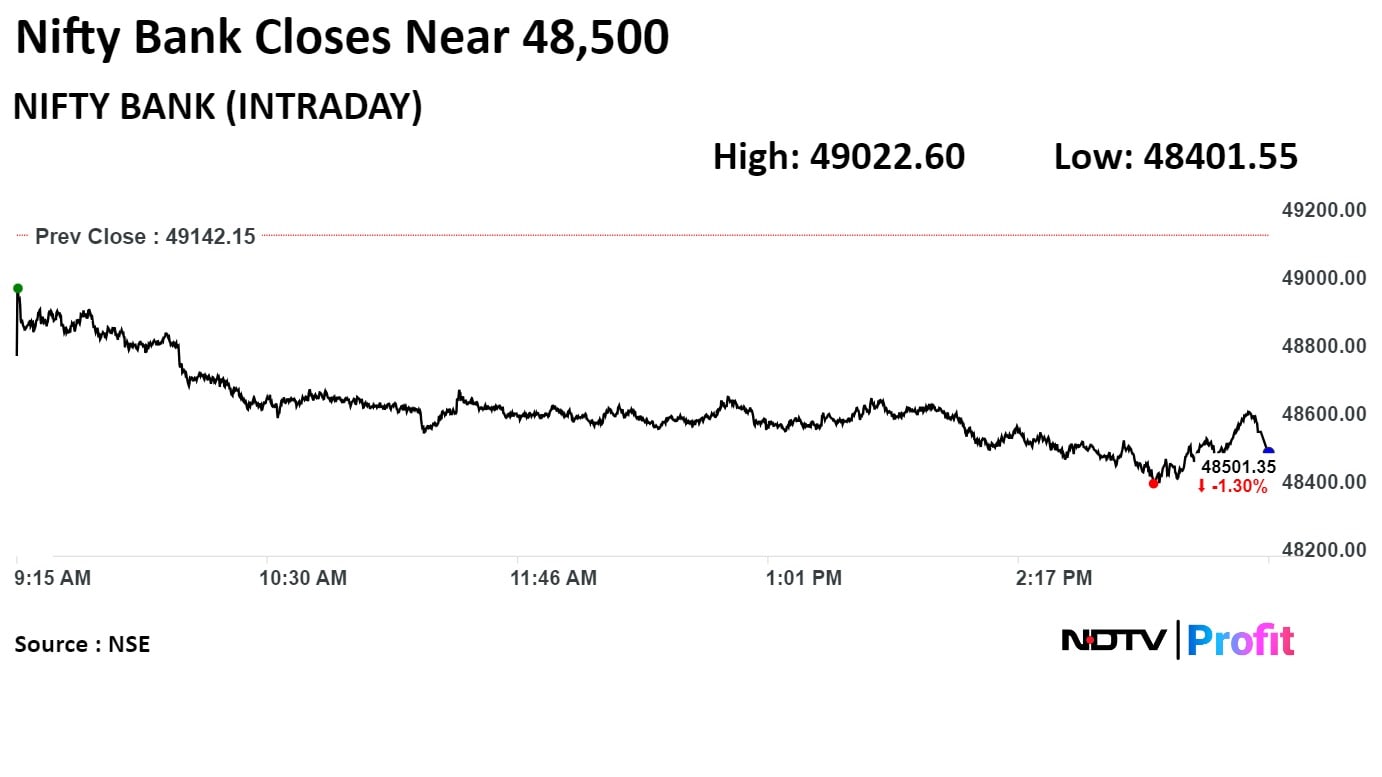

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

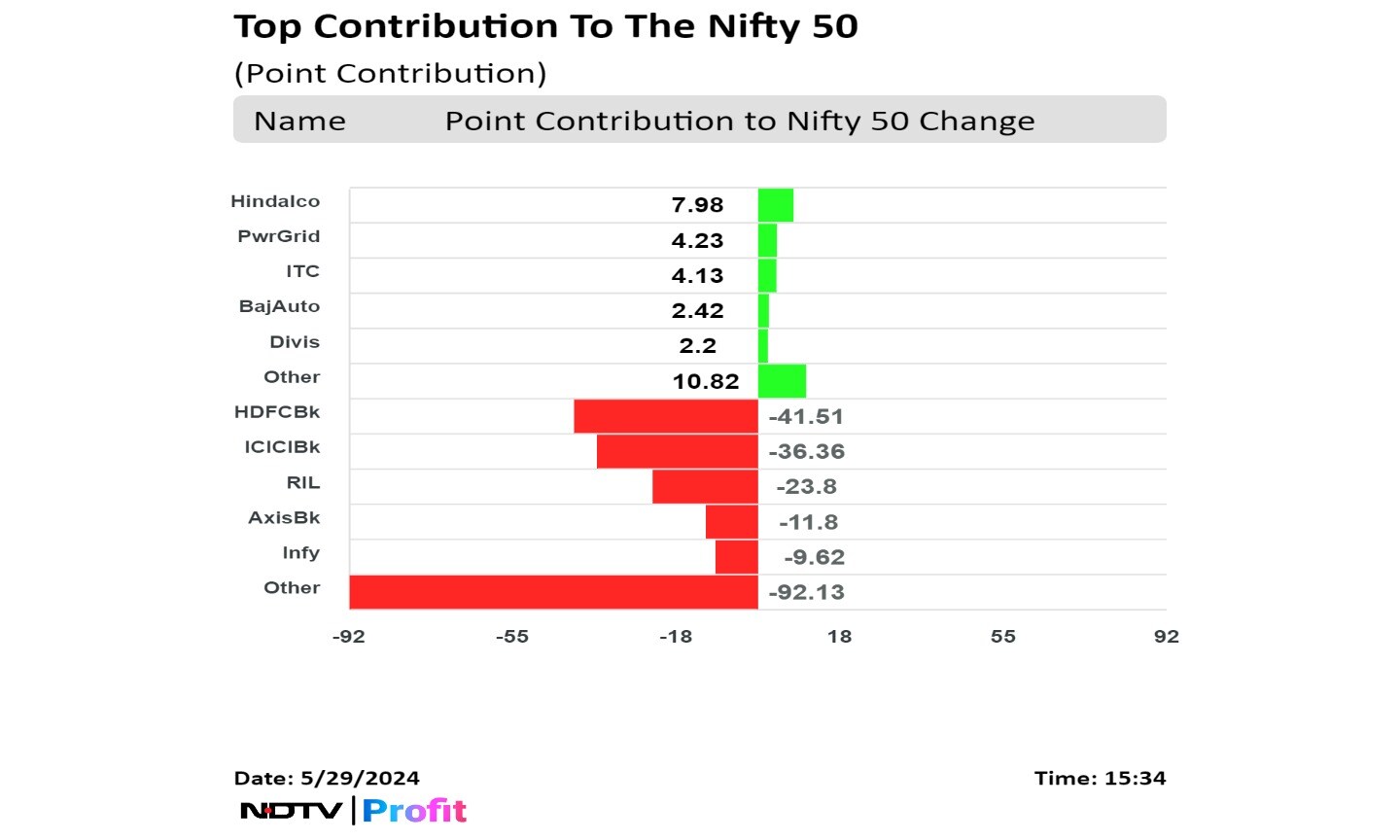

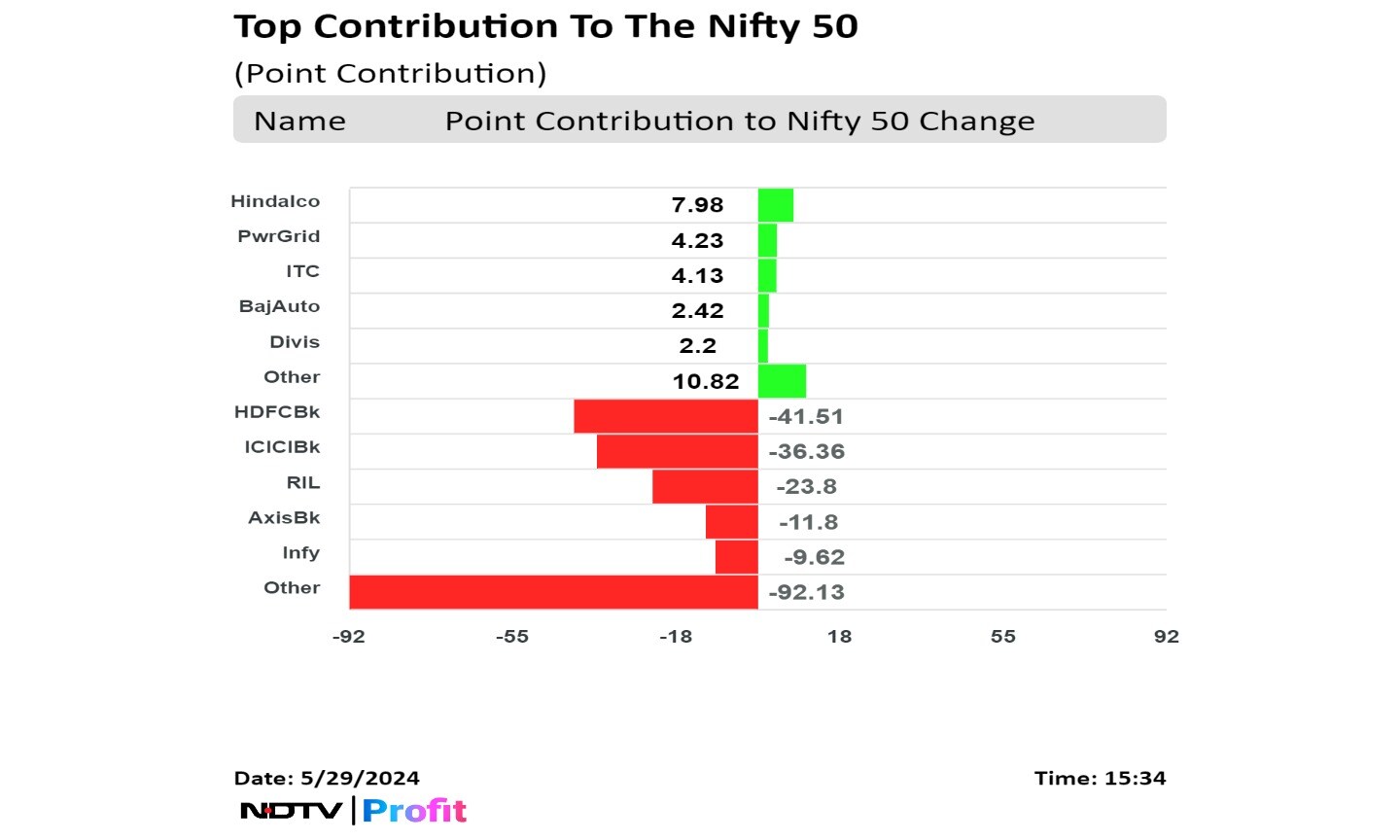

Shares of HDFC Bank Ltd., ICICI Bank Ltd., Reliance Industries Ltd., Axis Bank Ltd., and Infosys Ltd. dragged the Nifty.

Whereas those of Hindalco Industries Ltd., Power Grid Corp. Of India, ITC Ltd., Bajaj Auto Ltd., and Divi's Laboratories Ltd minimised the losses.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

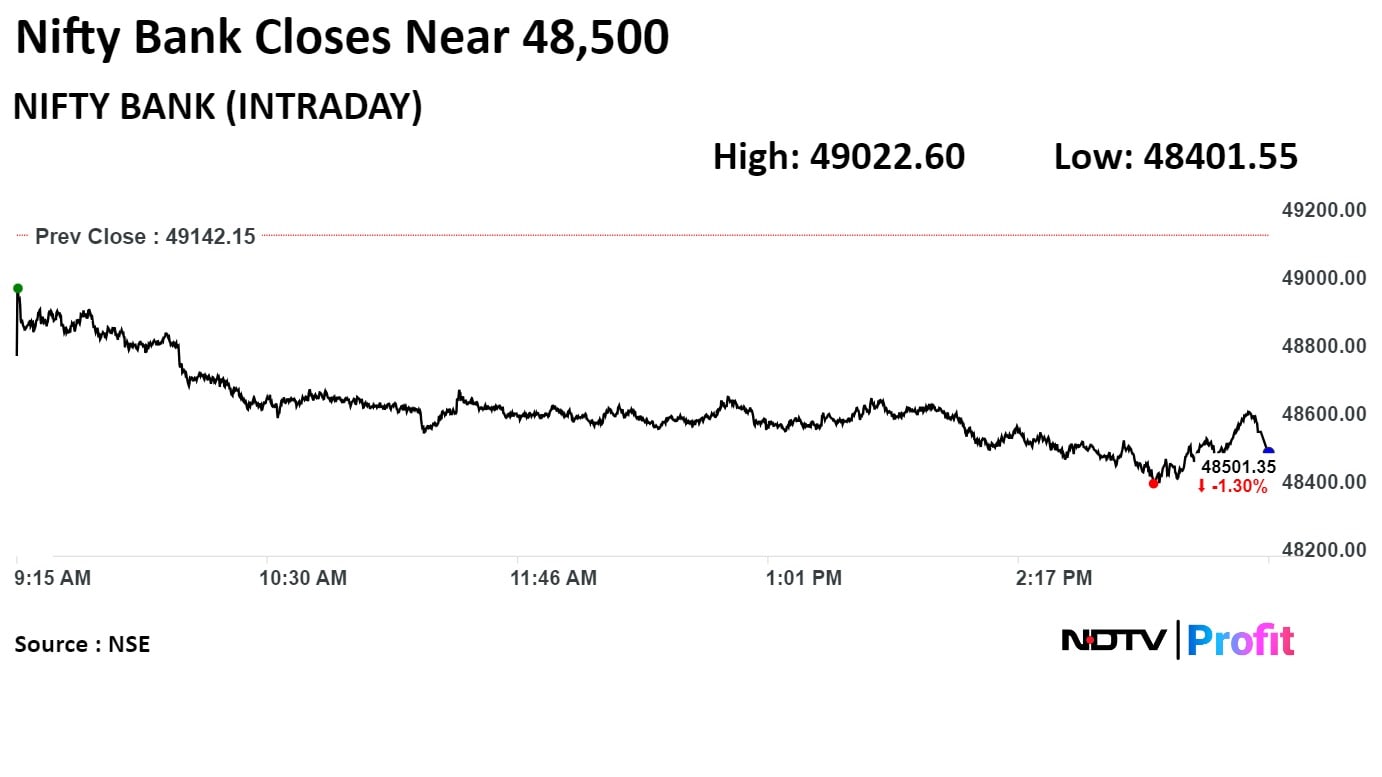

Shares of HDFC Bank Ltd., ICICI Bank Ltd., Reliance Industries Ltd., Axis Bank Ltd., and Infosys Ltd. dragged the Nifty.

Whereas those of Hindalco Industries Ltd., Power Grid Corp. Of India, ITC Ltd., Bajaj Auto Ltd., and Divi's Laboratories Ltd minimised the losses.

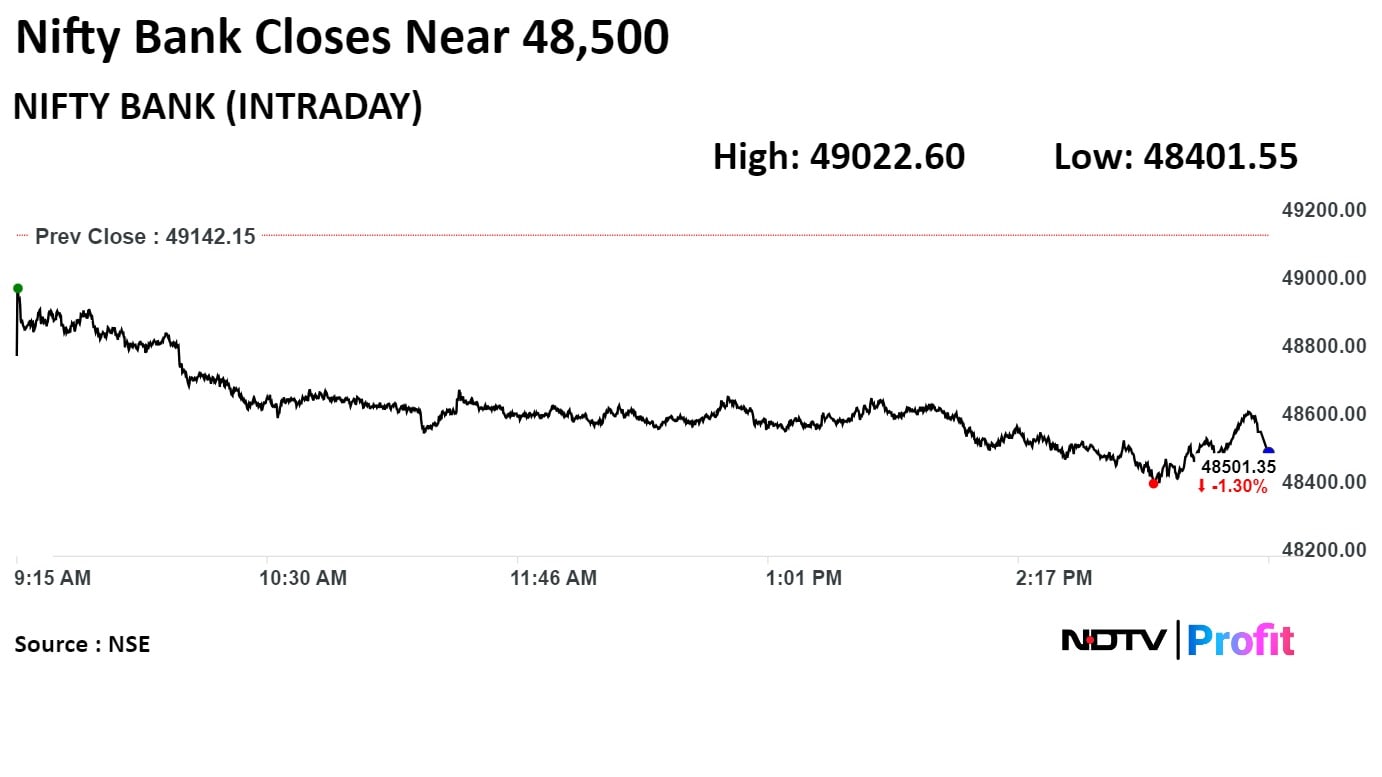

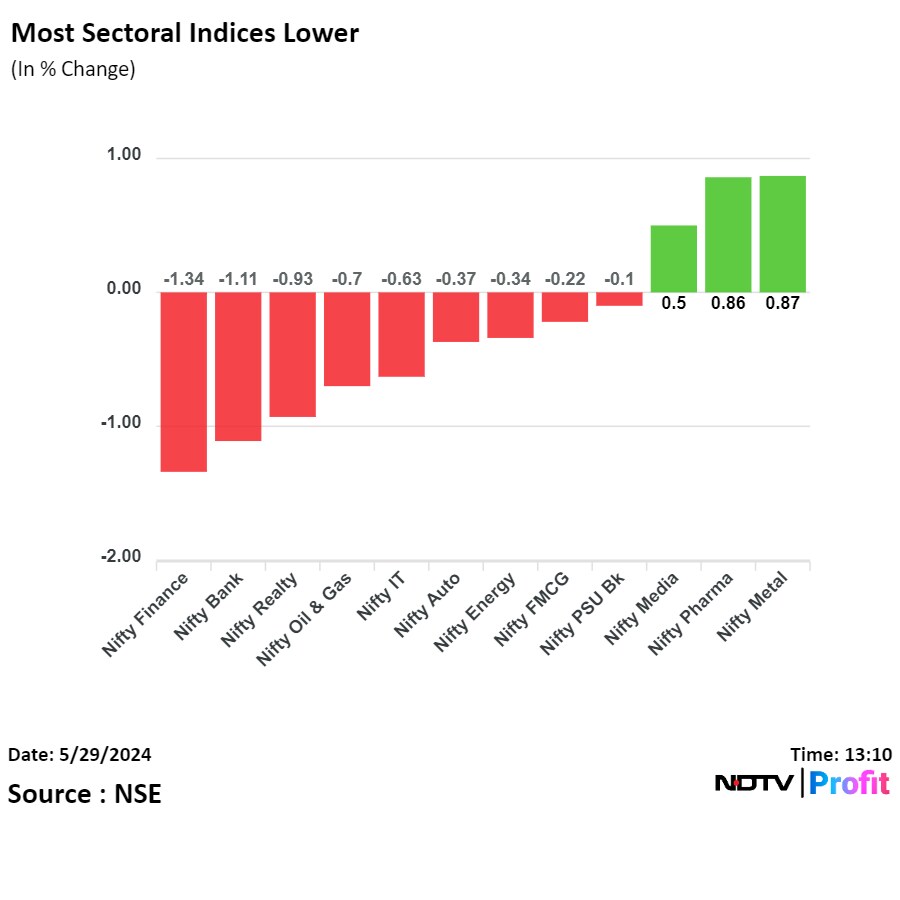

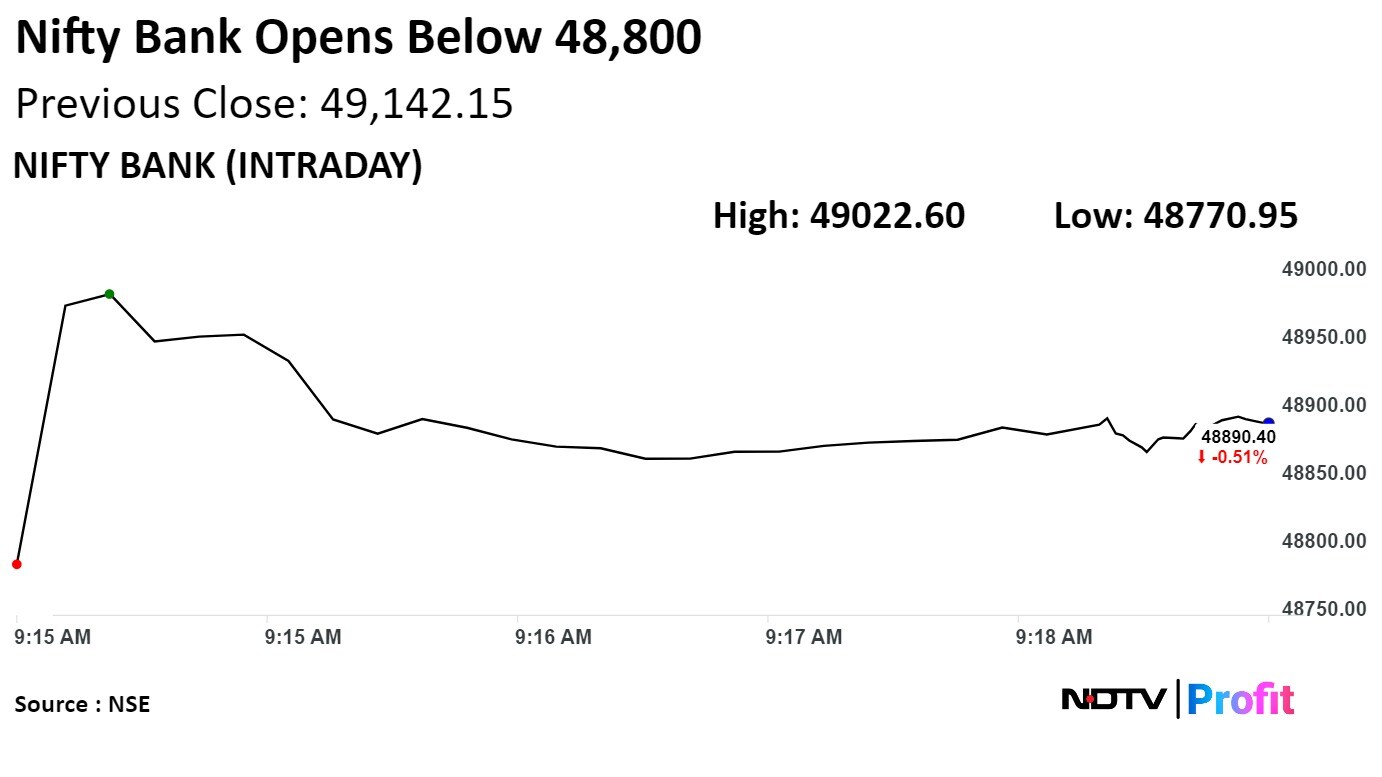

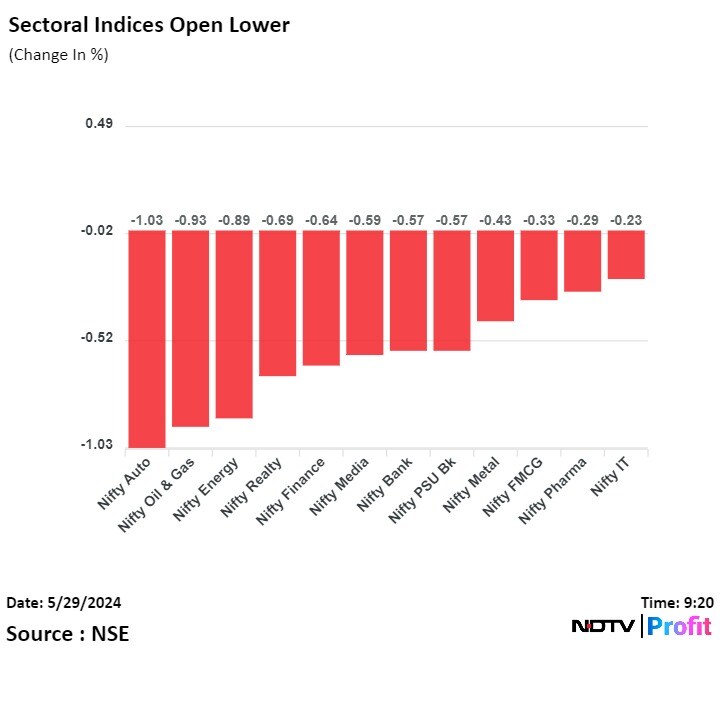

Most sectoral indices ended lower with Nifty Financial Services and Nifty Bank falling the most.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Shares of HDFC Bank Ltd., ICICI Bank Ltd., Reliance Industries Ltd., Axis Bank Ltd., and Infosys Ltd. dragged the Nifty.

Whereas those of Hindalco Industries Ltd., Power Grid Corp. Of India, ITC Ltd., Bajaj Auto Ltd., and Divi's Laboratories Ltd minimised the losses.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Benchmark equity indices continued falling in the fourth consecutive day and recorded their biggest fall in 14 sessions on Wednesday.

The Nifty closed at 22,703.95, down 184.20 points or 0.80% and the Sensex closed at 74,502.90, lower by 667.55 points or 0.89%. This is the worst fall for both the indices since May 9.

"The Bears showed their presence with a steep fall in the opening trade itself. In the mid-session, minor recovery was seen but that was quickly fizzled out as another round of selling took place which dragged the Index below 22,700," said Aditya Gaggar, Director of Progressive Shares.

"On the daily chart, Nifty has breached its immediate support of 22,780 but considering the monthly expiry day tomorrow, we feel that a short covering move will bring the Index above the triangle pattern breakout point i.e. 22,780," he added.

Shares of HDFC Bank Ltd., ICICI Bank Ltd., Reliance Industries Ltd., Axis Bank Ltd., and Infosys Ltd. dragged the Nifty.

Whereas those of Hindalco Industries Ltd., Power Grid Corp. Of India, ITC Ltd., Bajaj Auto Ltd., and Divi's Laboratories Ltd minimised the losses.

Most sectoral indices ended lower with Nifty Financial Services and Nifty Bank falling the most.

Broader markets ended on a mixed note on Wednesday. The S&P BSE Midcap fell 0.38% and the S&P BSE Smallcap rose 0.23%.

On BSE, 13 sectors declined, and seven advanced out of 20. The S&P BSE Bankex declined the most, and the S&P BSE Healthcare and Telecommunication were the leading sectors.

Market breadth was skewed in favour of sellers. Around 2,127 stocks declined, 1,693 stocks rose, and 109 remained unchanged.

Net profit at Rs 663 crore vs Rs 326 crore

Margin at 16.9% vs 10.1%

EBITDA at Rs 524 crore vs Rs 211 crore

Revenue at Rs 3,104 crore vs Rs 2,079 crore, up 49.3%

Margin at 21% vs 16.8%

Net profit at Rs 220 crore vs Rs 257 crore, down 14.7%

EBITDA at Rs 438 crore vs Rs 469 crore , down 6.6%

Revenue at Rs 2086 crore vs Rs 2,796 crore, down 25.4%

Margin at 10.8% vs 9.2%

EBITDA at Rs 2,935 crore vs Rs 2,061 crore, up 42.4%

Revenue at Rs 27,058 crore vs Rs 22,517 crore, up 20.2%

Net profit at Rs 1,444 crore vs Rs 699 crore

Incorporates wholly-owned subsidiary Thermax Chemical Solutions Pvt

Source: Exchange Filing

Revenue at Rs 2,936 crore vs Rs 2,903 crore, up 1.1%

EBITDA at Rs 402 crore vs Rs 353 crore, up 13.8%

Margin at 13.7% vs 12.2%

Net profit at Rs 304 crore vs Rs 68 crore

Home Minister Amit Shah said that market volatility should not be attributed solely to the ongoing elections, as it is a normal phenomenon.

"A drop of 300-400 points after a rise of 1,200-1,300 points is a normal occurrence and happens 15-20 times a year, even without elections," Shah said in an interview with NDTV Editor-in-Chief Sanjay Pugalia.

Credit rating agency S&P Global on Wednesday revised India's outlook to 'positive' from 'stable'.

Adds GenAI capabilities to its maintenance, repair & overhaul solution for enterprise clients

Source: Exchange filing

Approves issuing up to 86.5 lakh shares via QIP

Source: Exchange filing

The scrip rose as much as 3.4% to Rs 698.7, its lifetime high. It pared gains to trade 3.2% higher at Rs 703.35 as of 12:29 p.m. This compares to a 0.69% decline in the Nifty.

The scrip rose as much as 3.4% to Rs 698.7, its lifetime high. It pared gains to trade 3.2% higher at Rs 703.35 as of 12:29 p.m. This compares to a 0.69% decline in the Nifty.

.png)

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

.png)

"For the Bank Nifty, we believe the 49,000 level will act as immediate support, given the substantial open interest in the 49,000 put, which holds approximately 26 lakh shares. On the upside, 49,500 is expected to serve as a resistance area, with the 49,500 call strike holding a nominal open interest of around 36 lakh shares," Jain said.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

.png)

"For the Bank Nifty, we believe the 49,000 level will act as immediate support, given the substantial open interest in the 49,000 put, which holds approximately 26 lakh shares. On the upside, 49,500 is expected to serve as a resistance area, with the 49,500 call strike holding a nominal open interest of around 36 lakh shares," Jain said.

.png)

ICICI Bank Ltd., HDFC Bank Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., and Axis Bank Ltd. weighed on the benchmark.

Power Grid Corp, Hindalco Industries Ltd., Sun Pharmaceuticals Industries Ltd., Nestle India Ltd., and Adani Enterprises Ltd. limited losses in the benchmark.

On NSE, eight sectors were trading in negative, two were flat and two were positive. The NSE Nifty Finance declined the most, while the NSE Nifty Media rose the most.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

.png)

"For the Bank Nifty, we believe the 49,000 level will act as immediate support, given the substantial open interest in the 49,000 put, which holds approximately 26 lakh shares. On the upside, 49,500 is expected to serve as a resistance area, with the 49,500 call strike holding a nominal open interest of around 36 lakh shares," Jain said.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

.png)

"For the Bank Nifty, we believe the 49,000 level will act as immediate support, given the substantial open interest in the 49,000 put, which holds approximately 26 lakh shares. On the upside, 49,500 is expected to serve as a resistance area, with the 49,500 call strike holding a nominal open interest of around 36 lakh shares," Jain said.

.png)

ICICI Bank Ltd., HDFC Bank Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., and Axis Bank Ltd. weighed on the benchmark.

Power Grid Corp, Hindalco Industries Ltd., Sun Pharmaceuticals Industries Ltd., Nestle India Ltd., and Adani Enterprises Ltd. limited losses in the benchmark.

On NSE, eight sectors were trading in negative, two were flat and two were positive. The NSE Nifty Finance declined the most, while the NSE Nifty Media rose the most.

.png)

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

.png)

"For the Bank Nifty, we believe the 49,000 level will act as immediate support, given the substantial open interest in the 49,000 put, which holds approximately 26 lakh shares. On the upside, 49,500 is expected to serve as a resistance area, with the 49,500 call strike holding a nominal open interest of around 36 lakh shares," Jain said.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

.png)

"For the Bank Nifty, we believe the 49,000 level will act as immediate support, given the substantial open interest in the 49,000 put, which holds approximately 26 lakh shares. On the upside, 49,500 is expected to serve as a resistance area, with the 49,500 call strike holding a nominal open interest of around 36 lakh shares," Jain said.

.png)

ICICI Bank Ltd., HDFC Bank Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., and Axis Bank Ltd. weighed on the benchmark.

Power Grid Corp, Hindalco Industries Ltd., Sun Pharmaceuticals Industries Ltd., Nestle India Ltd., and Adani Enterprises Ltd. limited losses in the benchmark.

On NSE, eight sectors were trading in negative, two were flat and two were positive. The NSE Nifty Finance declined the most, while the NSE Nifty Media rose the most.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

.png)

"For the Bank Nifty, we believe the 49,000 level will act as immediate support, given the substantial open interest in the 49,000 put, which holds approximately 26 lakh shares. On the upside, 49,500 is expected to serve as a resistance area, with the 49,500 call strike holding a nominal open interest of around 36 lakh shares," Jain said.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

India's benchmark equity indices declined through midday on Tuesday, tracking losses in shares of ICICI Bank Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. The market continues to be anxious as the country awaits the declaration of the 2024 general elections on Tuesday, June 4.

At 11:44 p.m., the NSE Nifty 50 was 166.30 points or 0.73% lower at 22,721.85, and the S&P BSE Sensex was 585.99 points or 0.78% down at 74,584.46. Intraday, the NSE Nifty 50 fell 0.80% to 22,705.60, and the S&P BSE Sensex declined 0.84% to 74,539.56.

"In the last three sessions, the market has shown a bullish trend in the first half, followed by profit booking in the second half. Additionally, the India VIX continued to rise, gaining 4% yesterday to surpass 24. This stock market turbulence may persist until the election results are announced," said Shrey Jain, founder and chief executive officer of SAS Online.

.png)

.png)

"For the Bank Nifty, we believe the 49,000 level will act as immediate support, given the substantial open interest in the 49,000 put, which holds approximately 26 lakh shares. On the upside, 49,500 is expected to serve as a resistance area, with the 49,500 call strike holding a nominal open interest of around 36 lakh shares," Jain said.

.png)

ICICI Bank Ltd., HDFC Bank Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., and Axis Bank Ltd. weighed on the benchmark.

Power Grid Corp, Hindalco Industries Ltd., Sun Pharmaceuticals Industries Ltd., Nestle India Ltd., and Adani Enterprises Ltd. limited losses in the benchmark.

On NSE, eight sectors were trading in negative, two were flat and two were positive. The NSE Nifty Finance declined the most, while the NSE Nifty Media rose the most.

.png)

.png)

Broader markets were trading on a mixed note. The S&P BSE Midcap fell 0.35%, and the S&P BSE Smallcap rose 0.09%.

On BSE, 17 sectors declined, and three advanced out of 20. The S&P BSE Bankex declined over 1% to become the loser sector. The S&P BSE Consumer Durables was the best performing sector.

Market breadth was skewed in favour of sellers. Around 2,1012 stocks declined, 1,551 stocks advanced, and 150 stocks remained unchanged.

Launches AI-powered platforms iCPX and iAPX for corporate procurement and accounts payable processes

Source: Exchange filing

Submits term sheet to independent directors of Ebix to acquire 100% stake in the company as a member of the consortium led by Eraaya Lifespaces

Source: Exchange filing

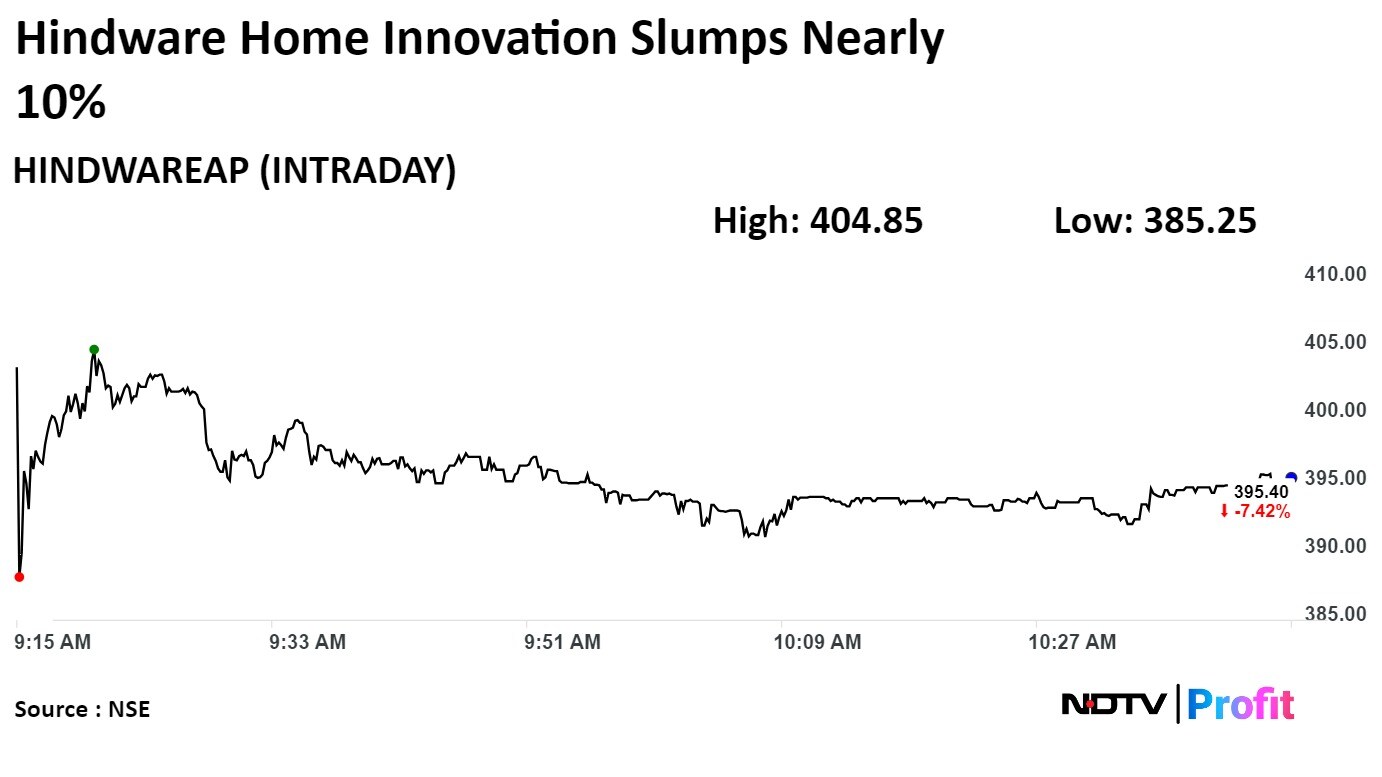

Hindware Home Innovation Ltd.'s shares tumbled nearly 10% Wednesday after the company's net profit almost halved year-on-year in January-March period.

Its consolidated net profit declined 88% on the year to Rs 2.73 crore in the quarter ended in March from Rs 22.75 crore.

Hindware Home Innovation Ltd.'s shares tumbled nearly 10% Wednesday after the company's net profit almost halved year-on-year in January-March period.

Its consolidated net profit declined 88% on the year to Rs 2.73 crore in the quarter ended in March from Rs 22.75 crore.

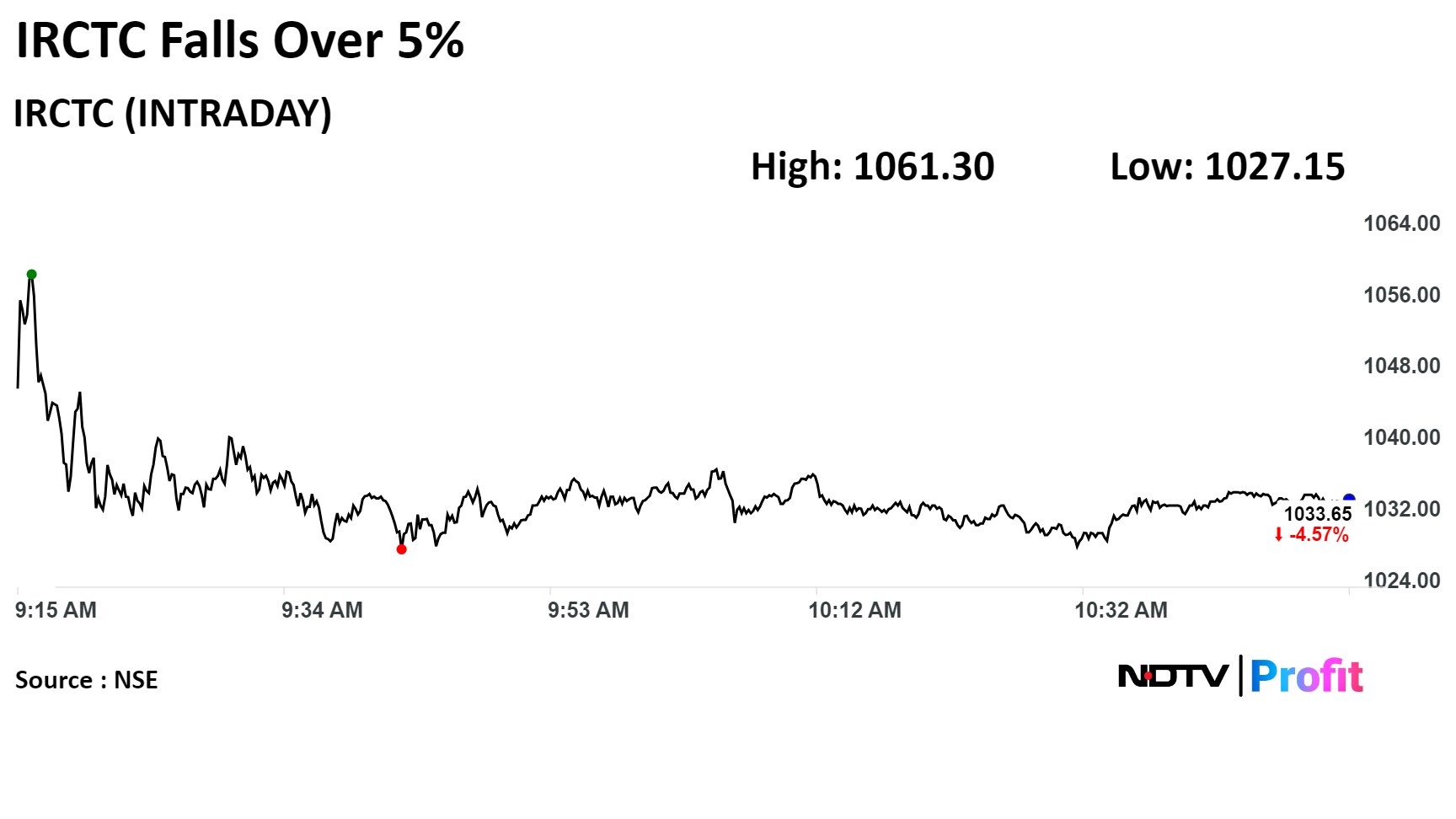

Shares of Indian Railway Catering And Tourism Corp. extended losses in the fifth consecutive session on Wednesday as its net profit for the quarter ended March missed expectations.

Shares of Indian Railway Catering And Tourism Corp. extended losses in the fifth consecutive session on Wednesday as its net profit for the quarter ended March missed expectations.

Out of the nine analysts tracking the company, four maintain a 'buy' rating, two recommend a 'hold,' and three suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 12.4%.

Total unexecuted order book stands at Rs 2,600 crore

Source: Exchange Filing

Gets 551.25 MW order for 3 MW series wind power project from Aditya Birla Group.

Source: Exchange Filing

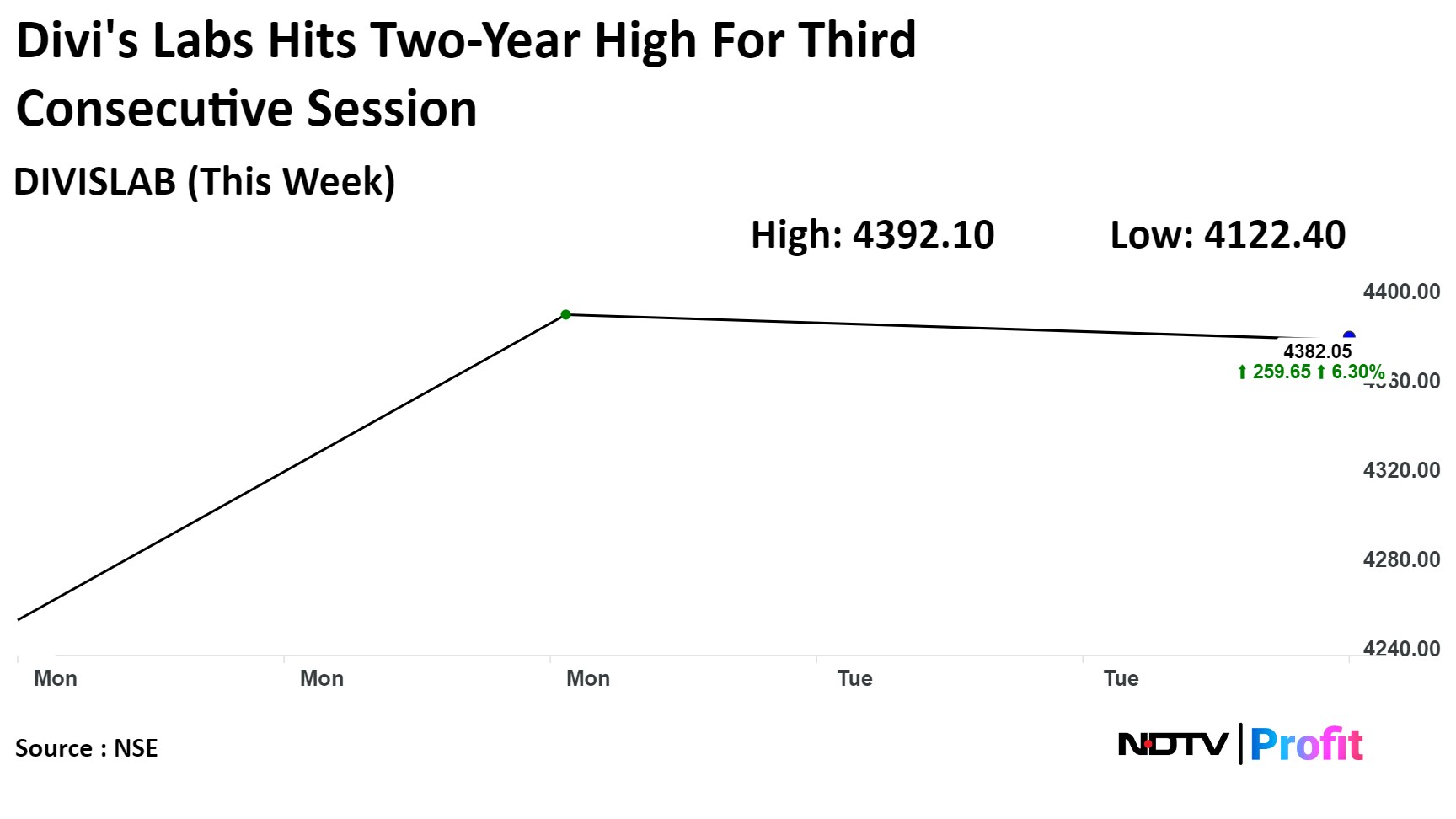

Today, it hit an intraday high of Rs 4,430, before erasing gains to trade 0.23% lower at Rs 4,381.85. This compares to a 0.56% decline in the Nifty.

Today, it hit an intraday high of Rs 4,430, before erasing gains to trade 0.23% lower at Rs 4,381.85. This compares to a 0.56% decline in the Nifty.

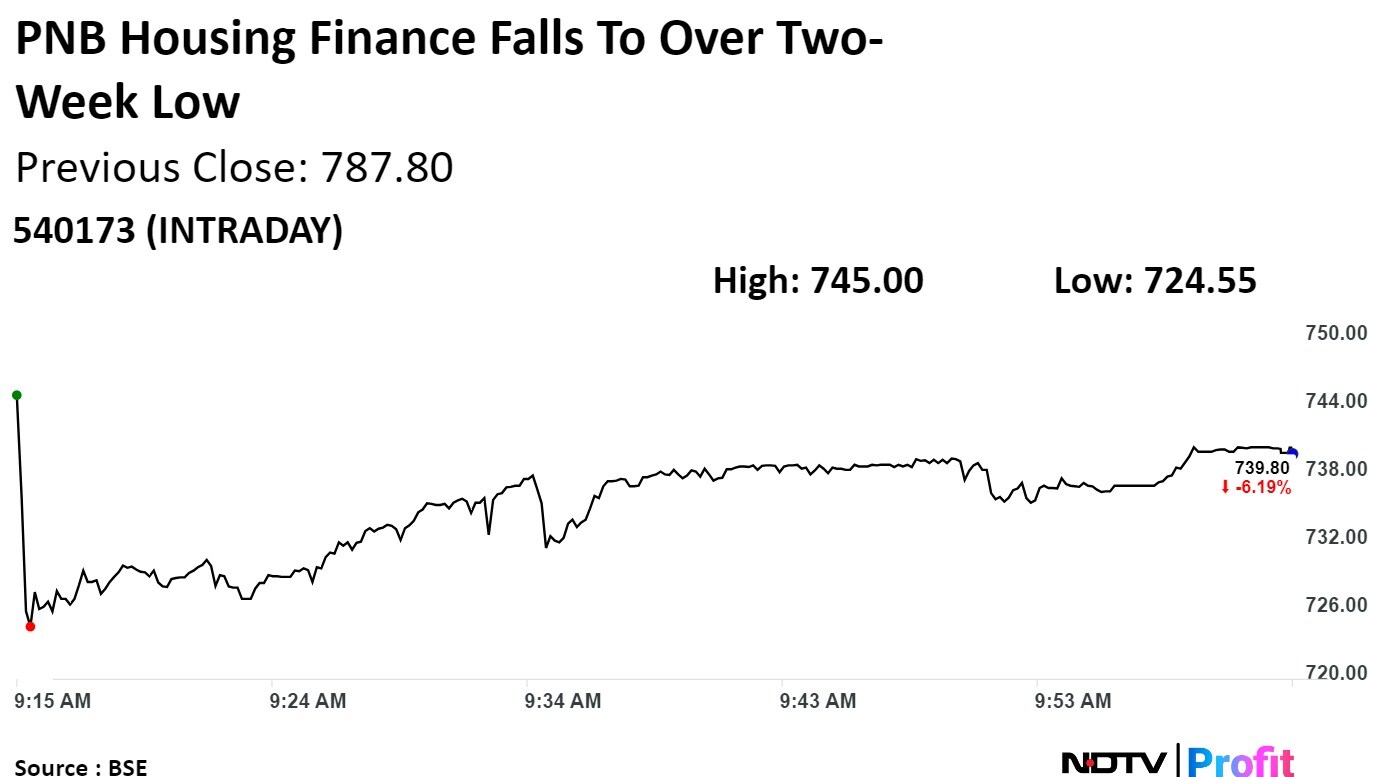

PNB Housing Finance Ltd. tumbled to two-week low after its 1.026% equity changed hands in two large trades.

The housing finance company's 26.65 crore shares changed hands in two bunch trades. The average price of the block deals are Rs 728 per share. The total value of the two block deals is Rs 193.8 crore, according to date available on Bloomberg.

PNB Housing Finance Ltd. tumbled to two-week low after its 1.026% equity changed hands in two large trades.

The housing finance company's 26.65 crore shares changed hands in two bunch trades. The average price of the block deals are Rs 728 per share. The total value of the two block deals is Rs 193.8 crore, according to date available on Bloomberg.

PNB Housing Finance Ltd. declined 8.10% to Rs 724.00, the lowest level since May 14, 2024. It pared losses to trade 6% lower at Rs 740.60 as of 10:04 a.m., as compared to 0.43% decline in the NSE Nifty 50 index.

The scrip gained 53.13% in 12 months, and declined 5.57% on year to date basis. Total traded volume so far in the day stood at 617 times its 30-day average. The relative strength index was at 44.05.

Out of 12 analysts tracking the company, 10 maintain a 'buy' rating, and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 26.3%.

MTAR Technologies Limited reported its results on Tuesday. Q4FY24 revenue was up by 20.8% QoQ, while net profits decrease by 54%. The company reported FY24 revenue of Rs.581 crore which was below the guided number of Rs.610 crore. Ebitda margin also missed the guidance of 24% versus reported figure of19.4%.

The management attributed the miss in margins to deferment of orders in Clean Energy segment and delay in execution of projects in the Space vertical.

MTAR Technologies Limited reported its results on Tuesday. Q4FY24 revenue was up by 20.8% QoQ, while net profits decrease by 54%. The company reported FY24 revenue of Rs.581 crore which was below the guided number of Rs.610 crore. Ebitda margin also missed the guidance of 24% versus reported figure of19.4%.

The management attributed the miss in margins to deferment of orders in Clean Energy segment and delay in execution of projects in the Space vertical.

.png)

The scrip rose as much as 4.99% intraday, its upper circuit limit to Rs 359.45 apiece, the highest level since Tuesday as of 9:39 a.m. This compares to a 0.32% decline in the NSE Nifty 50.

It has fallen 43.43% on a year-to-date basis and 48.45% in the last twelve months. Total traded volume so far in the day stood at 0.17 times its 30-day average. The relative strength index was at 50.16.

The scrip rose as much as 4.99% intraday, its upper circuit limit to Rs 359.45 apiece, the highest level since Tuesday as of 9:39 a.m. This compares to a 0.32% decline in the NSE Nifty 50.

It has fallen 43.43% on a year-to-date basis and 48.45% in the last twelve months. Total traded volume so far in the day stood at 0.17 times its 30-day average. The relative strength index was at 50.16.

.png)

Earlier, today the company called reports of Gautam Adani buying stake in the company 'speculative'.

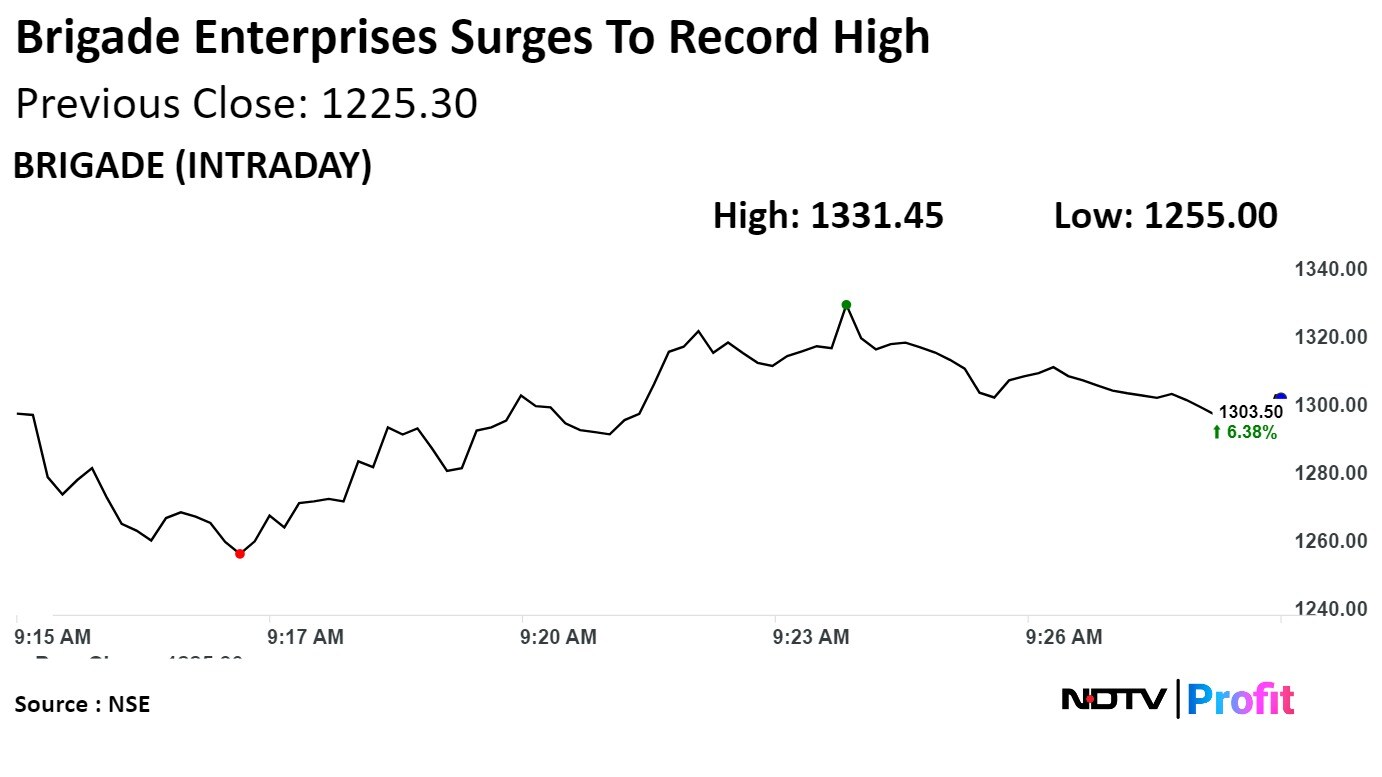

Shares of Brigade Enterprises Ltd. rose to the highest level since its listing on bourses after the company's net profit more than trebled in January-March.

Shares of Brigade Enterprises Ltd. rose to the highest level since its listing on bourses after the company's net profit more than trebled in January-March.

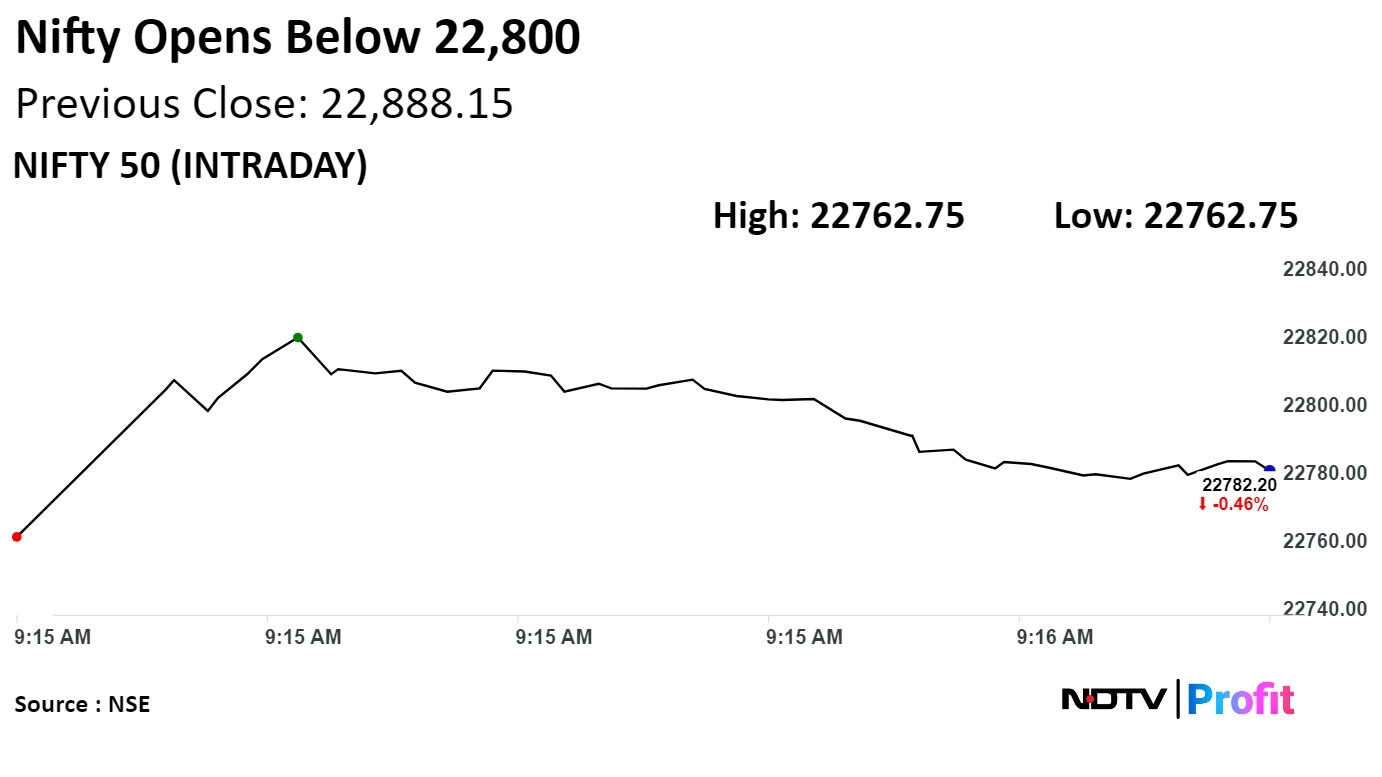

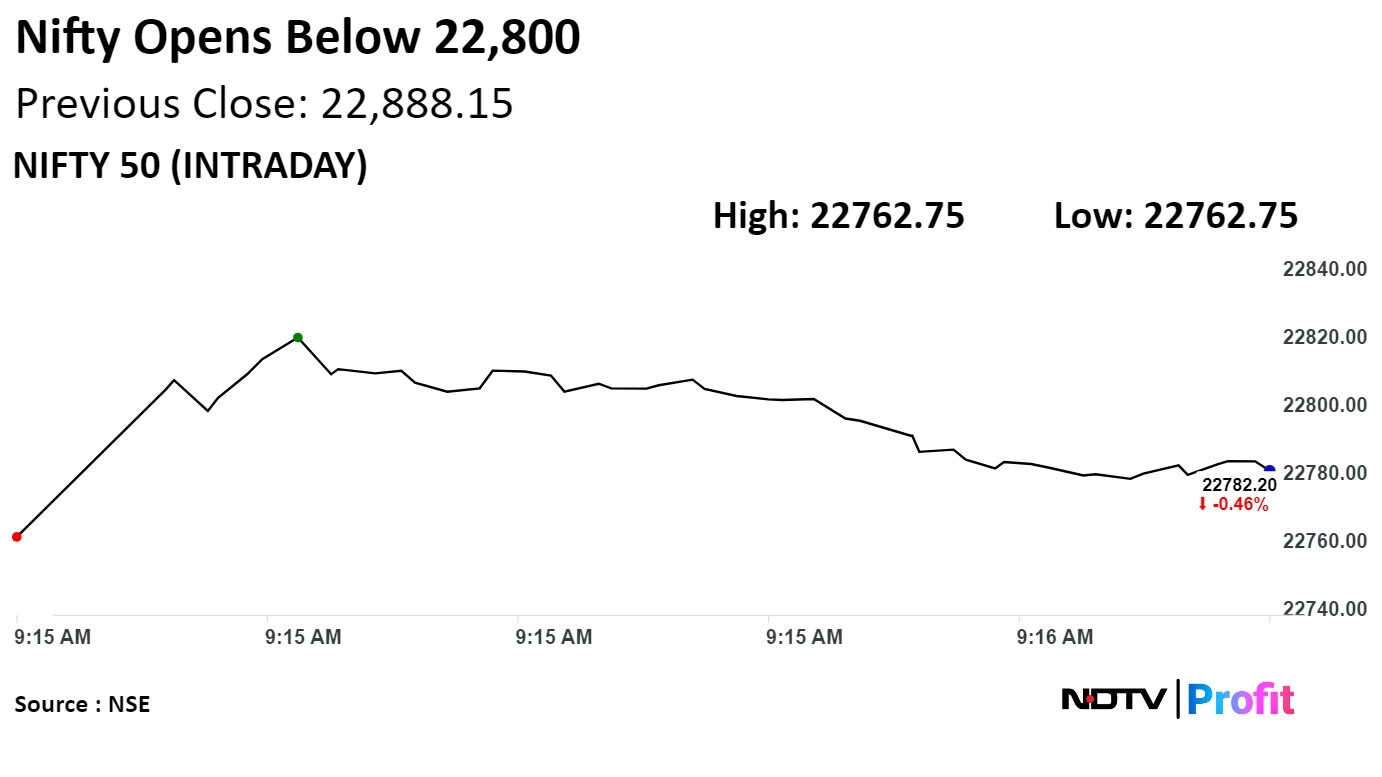

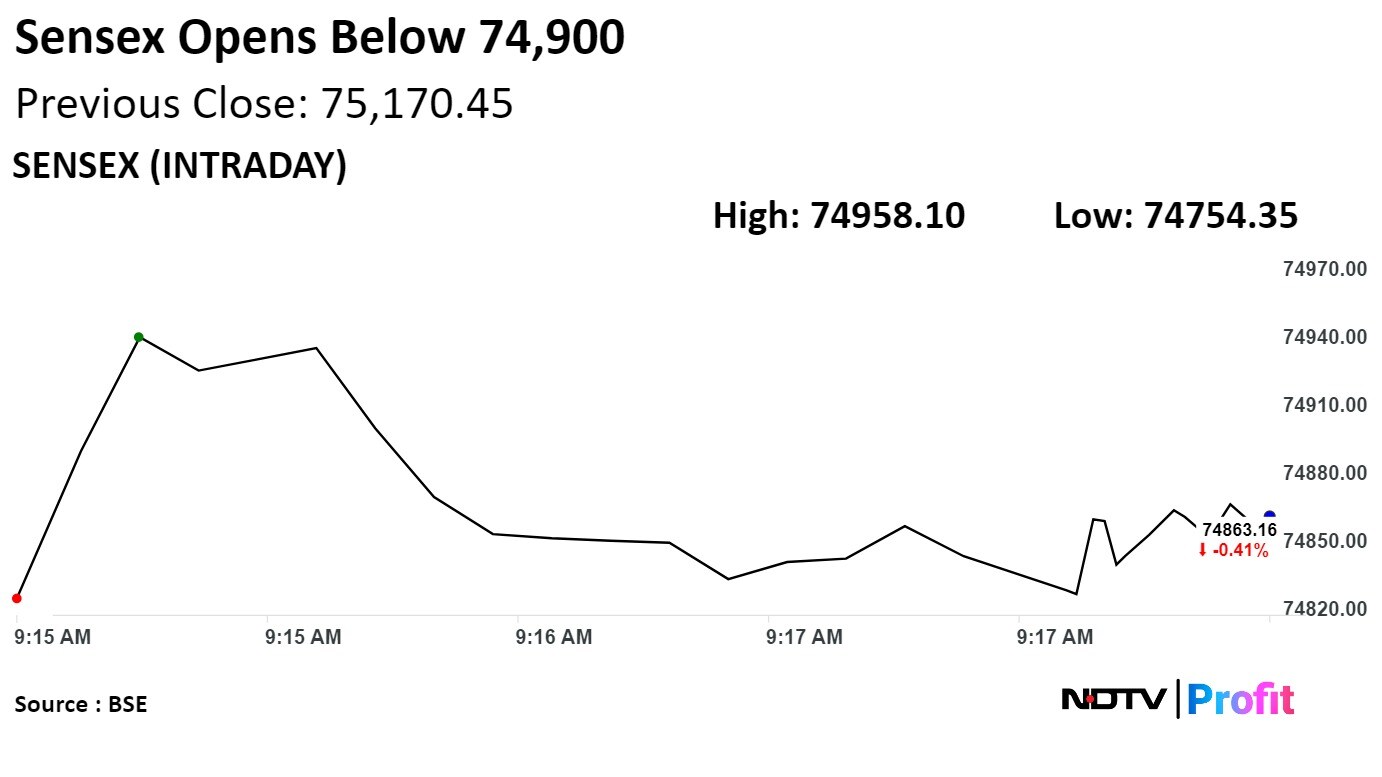

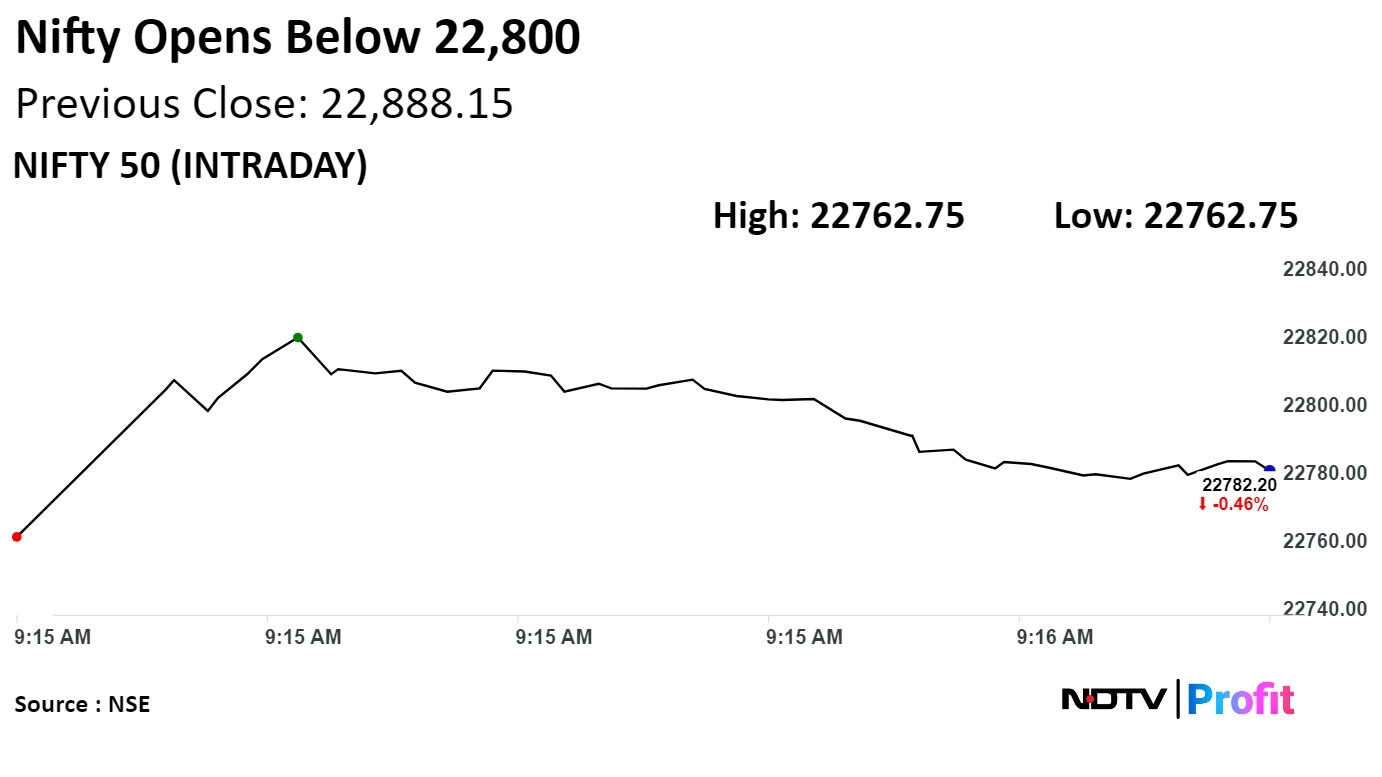

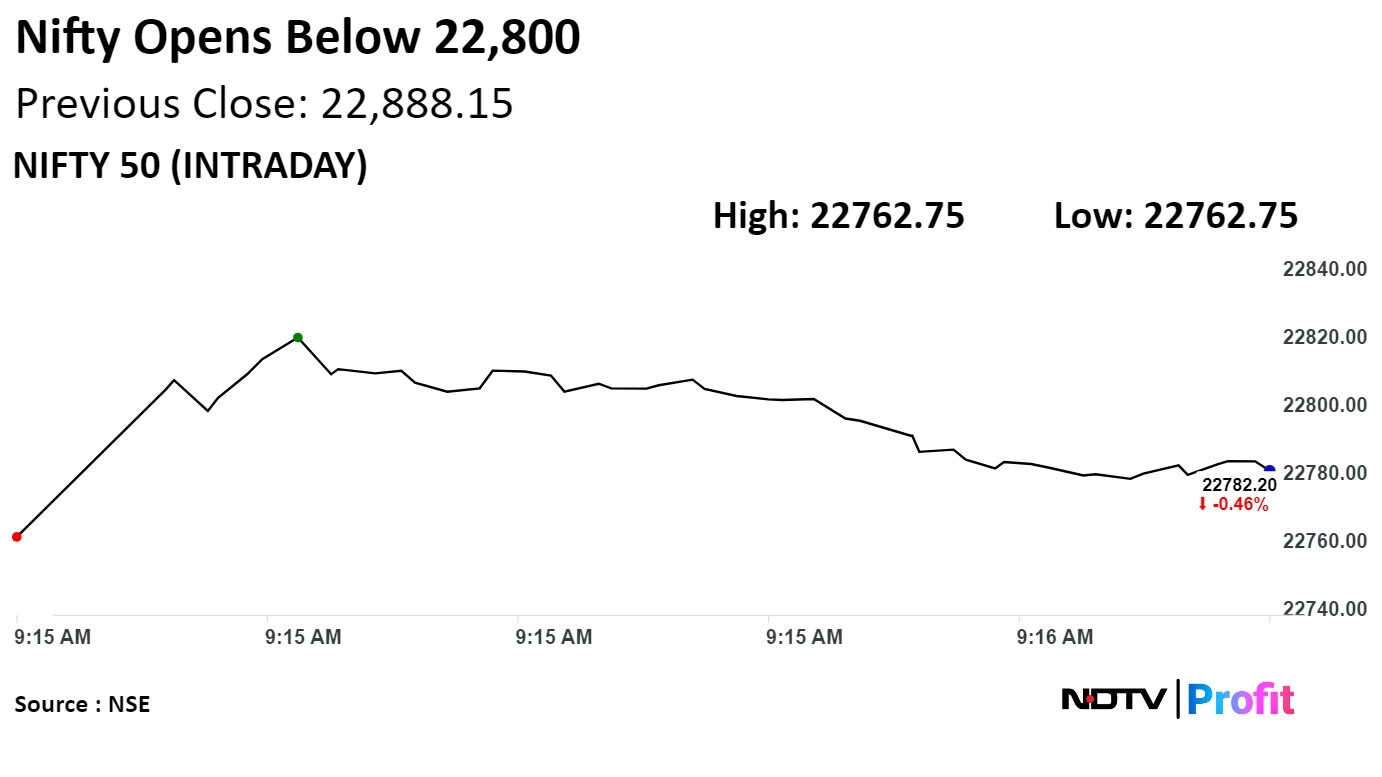

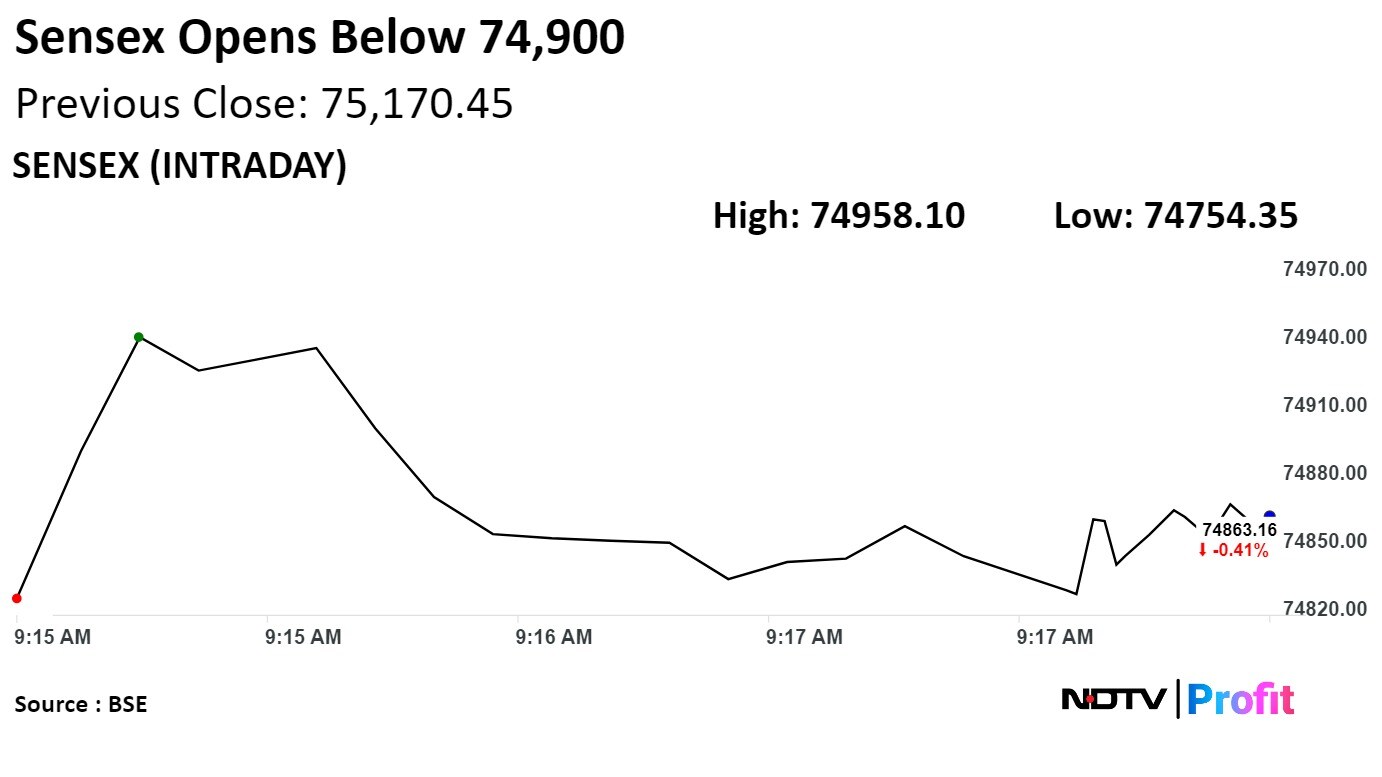

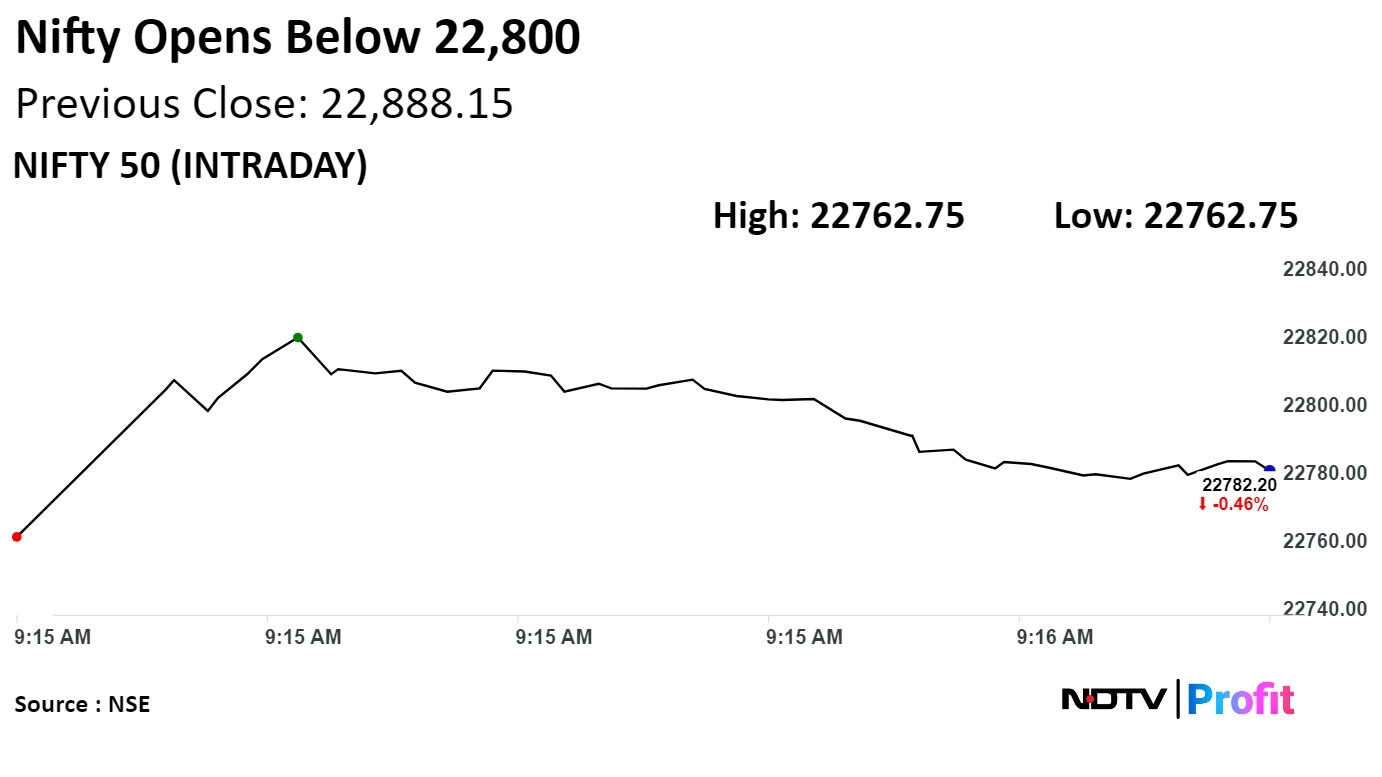

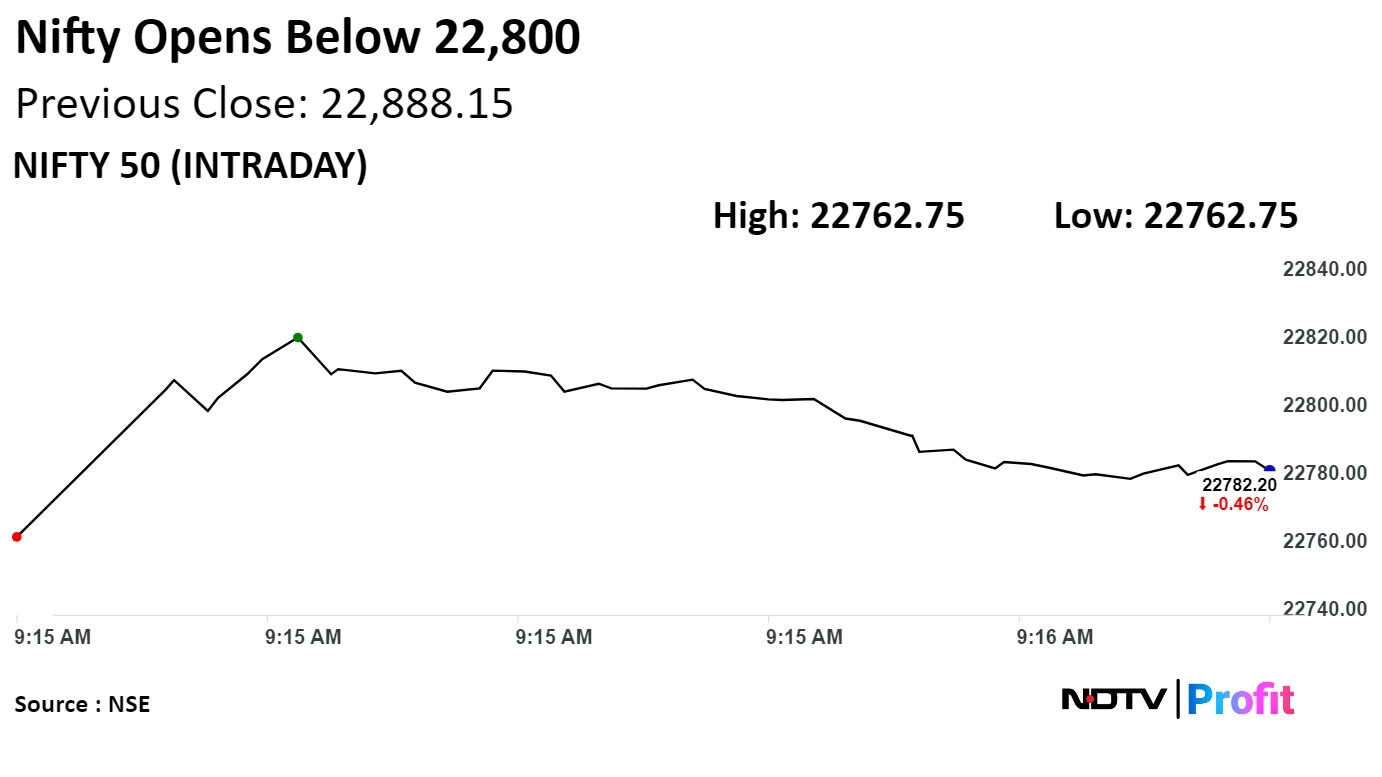

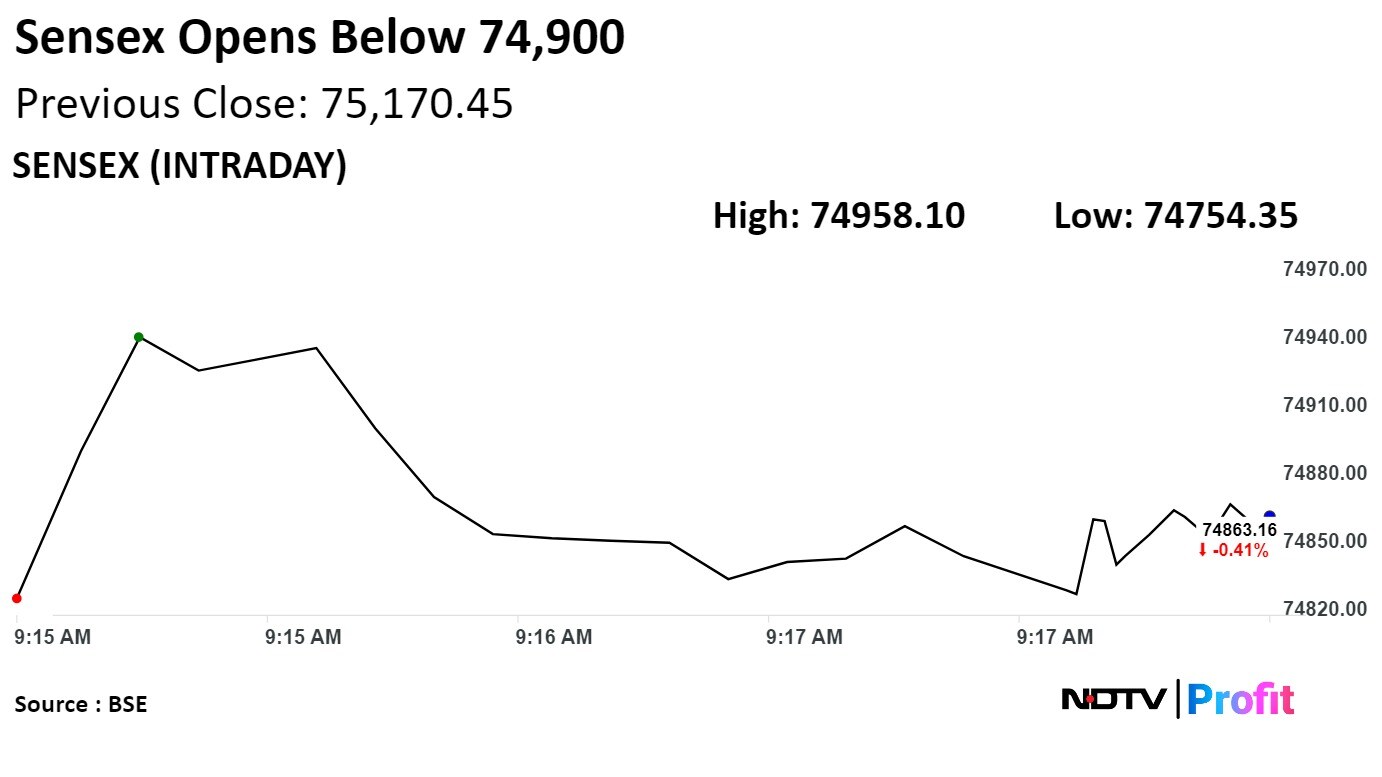

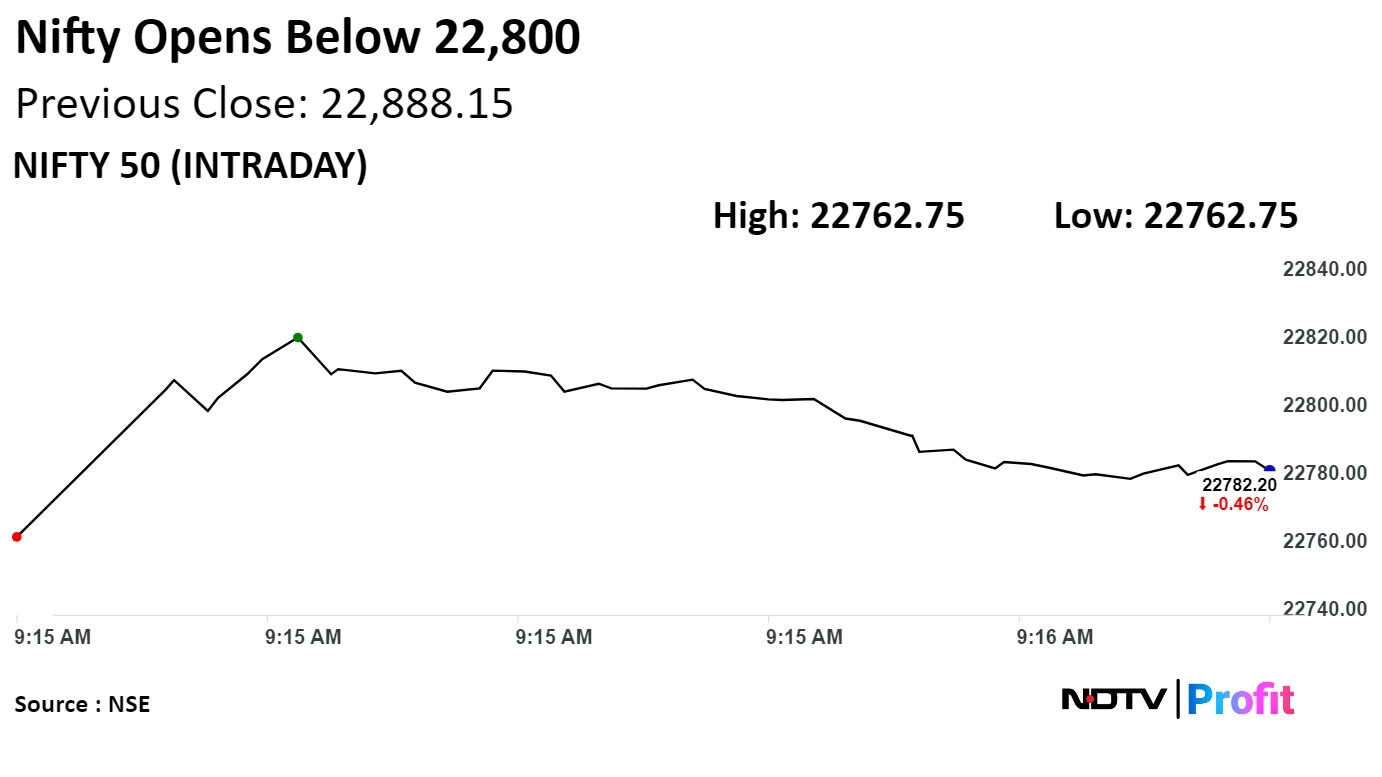

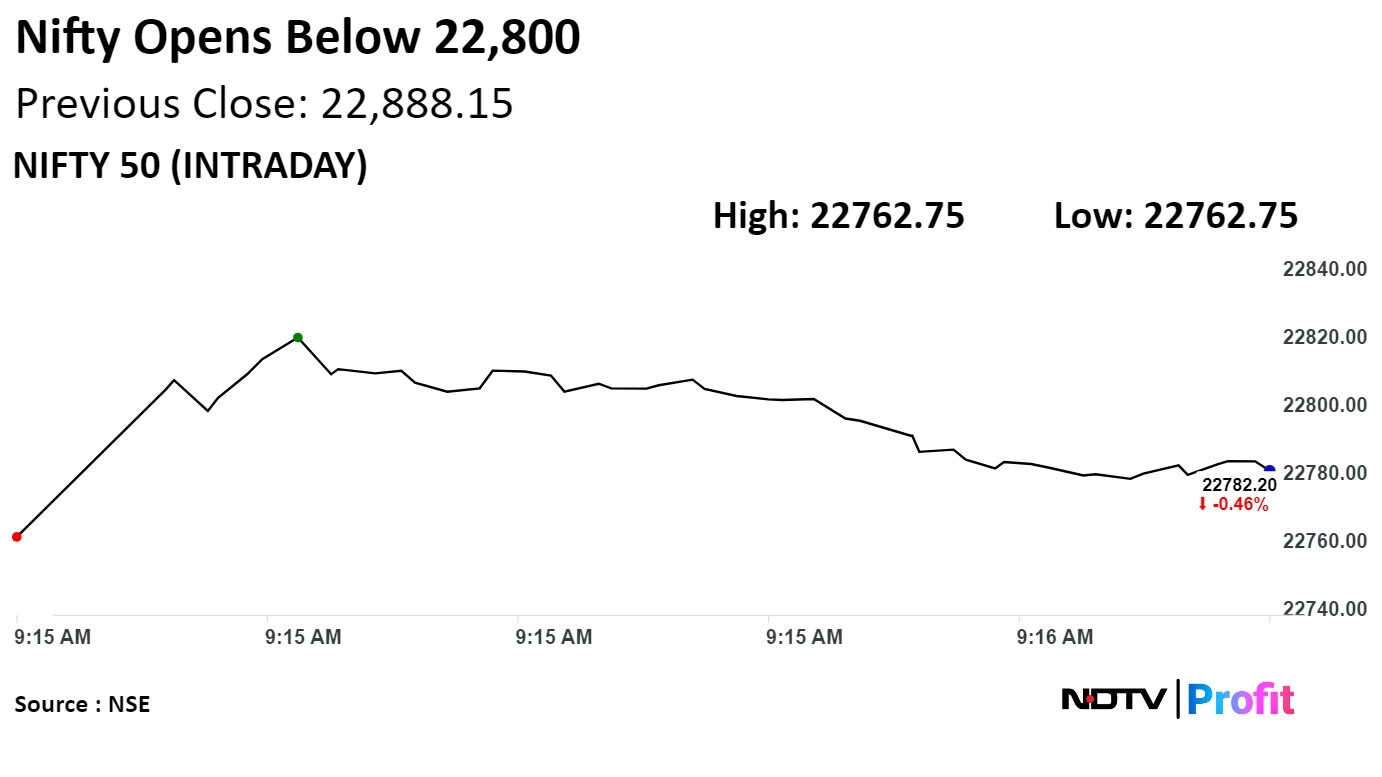

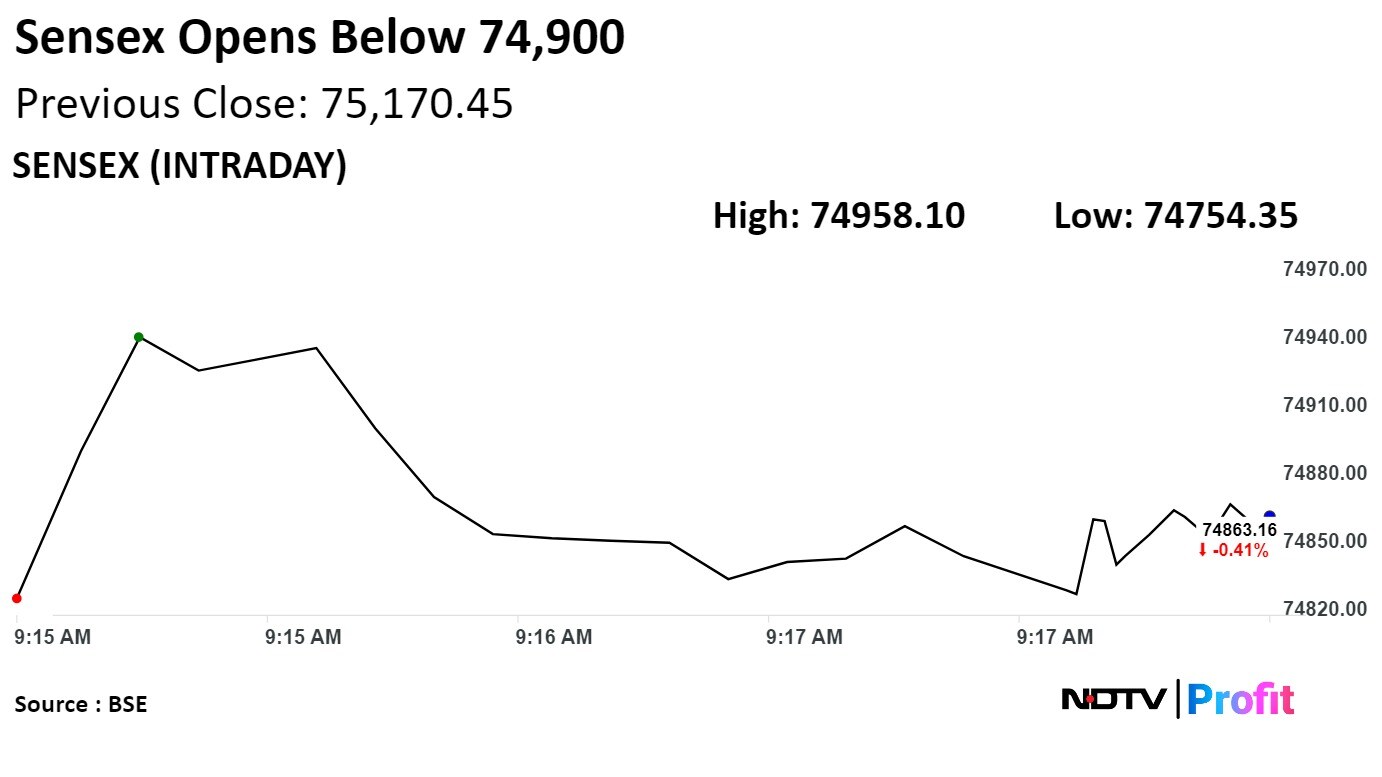

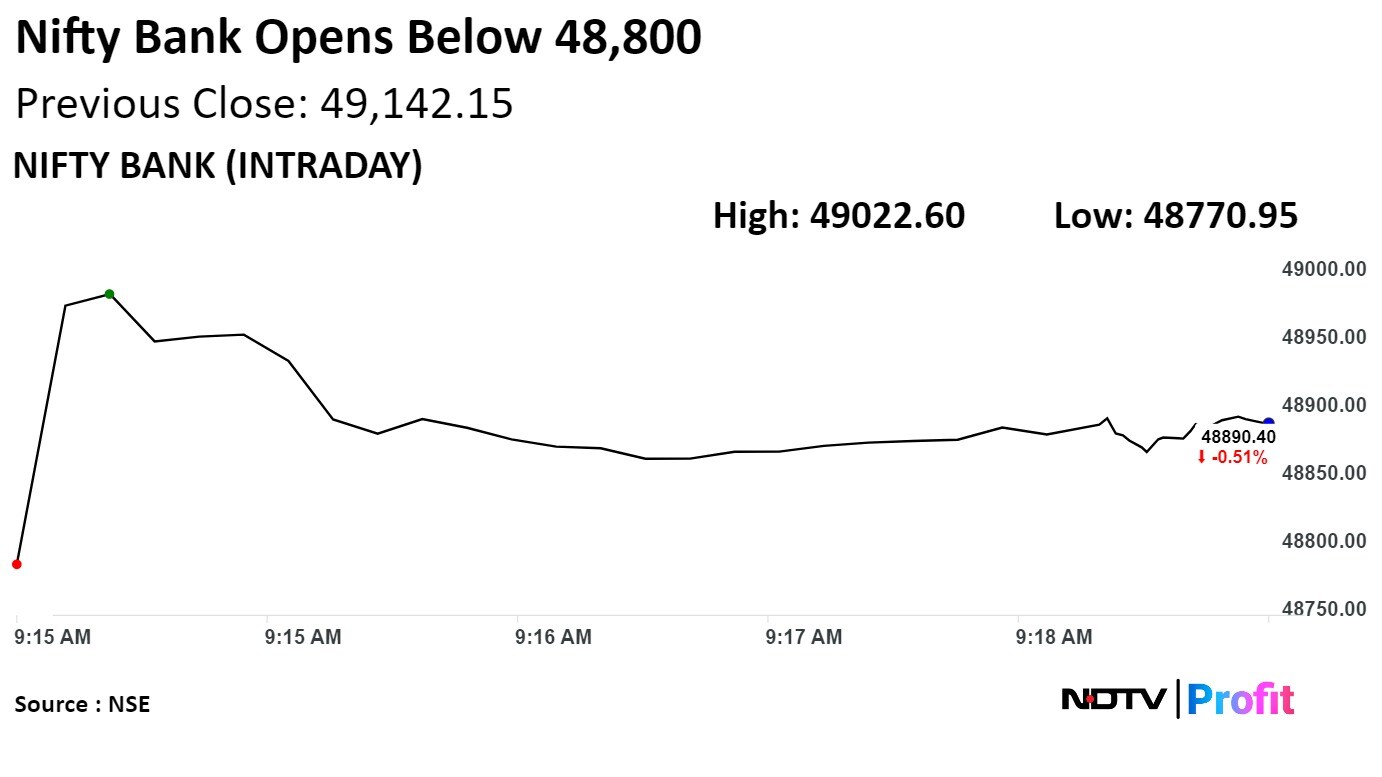

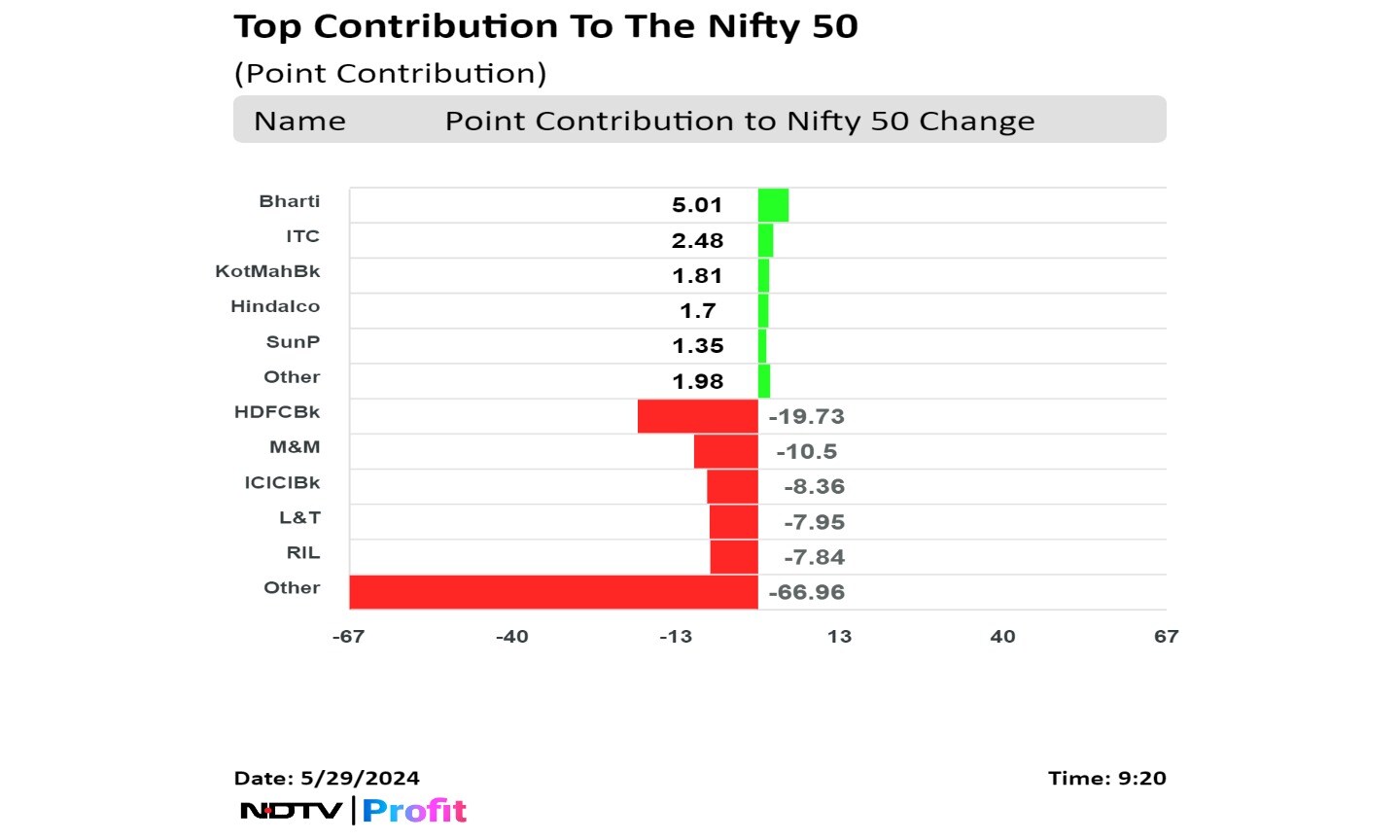

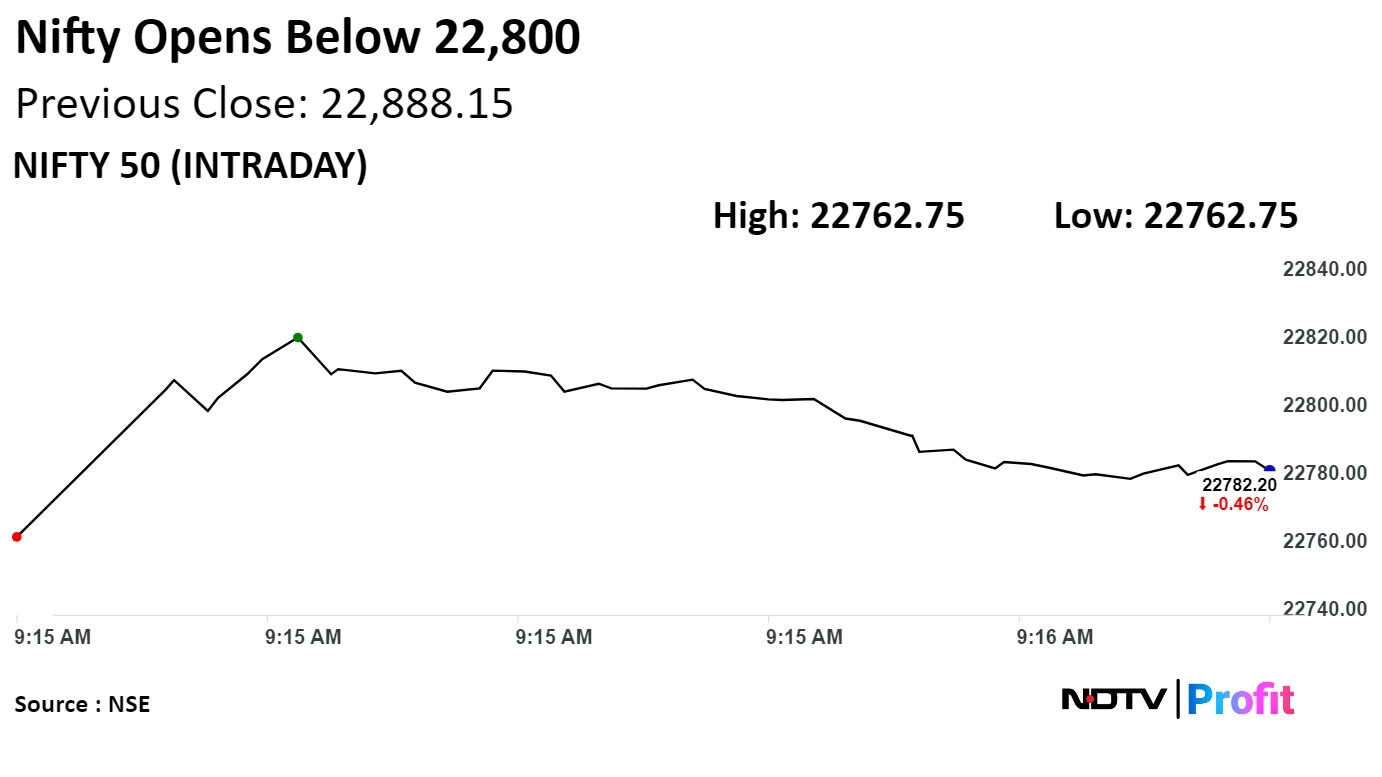

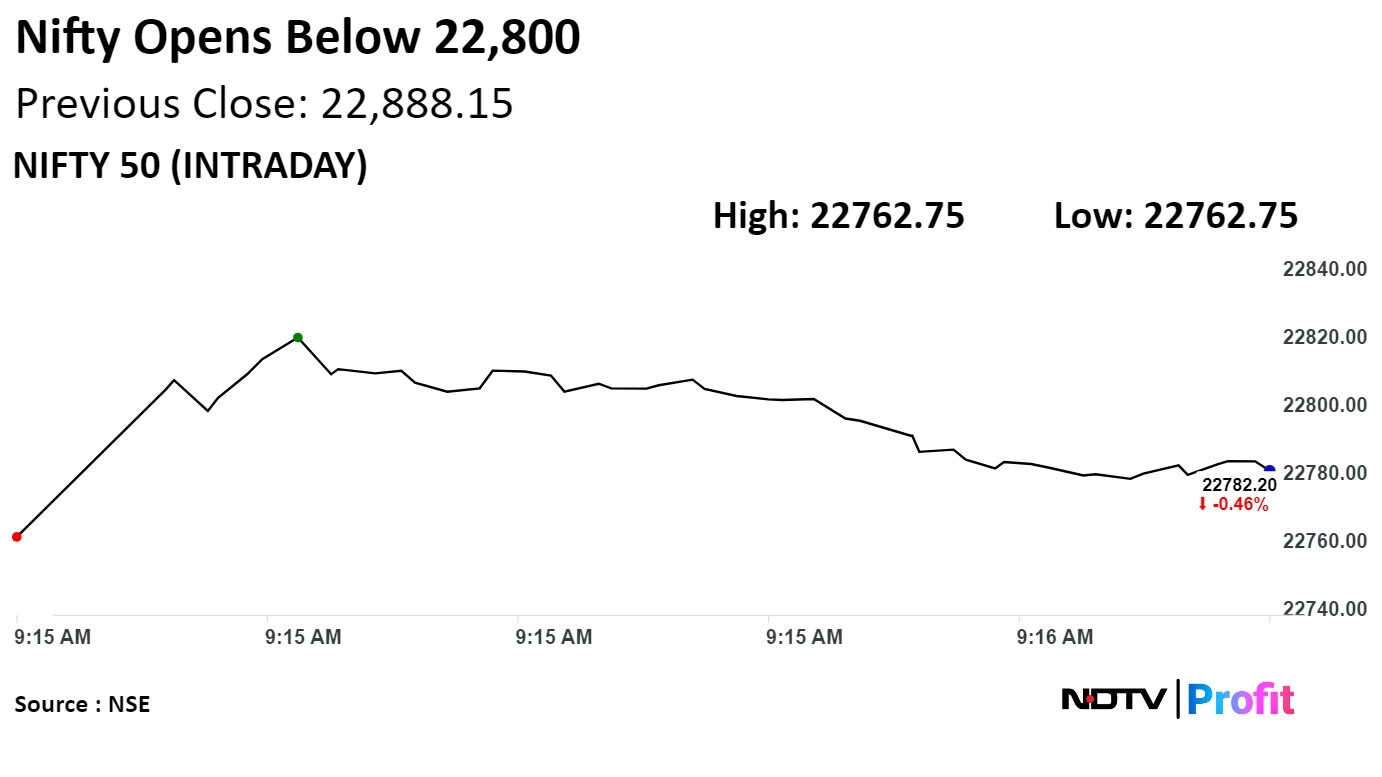

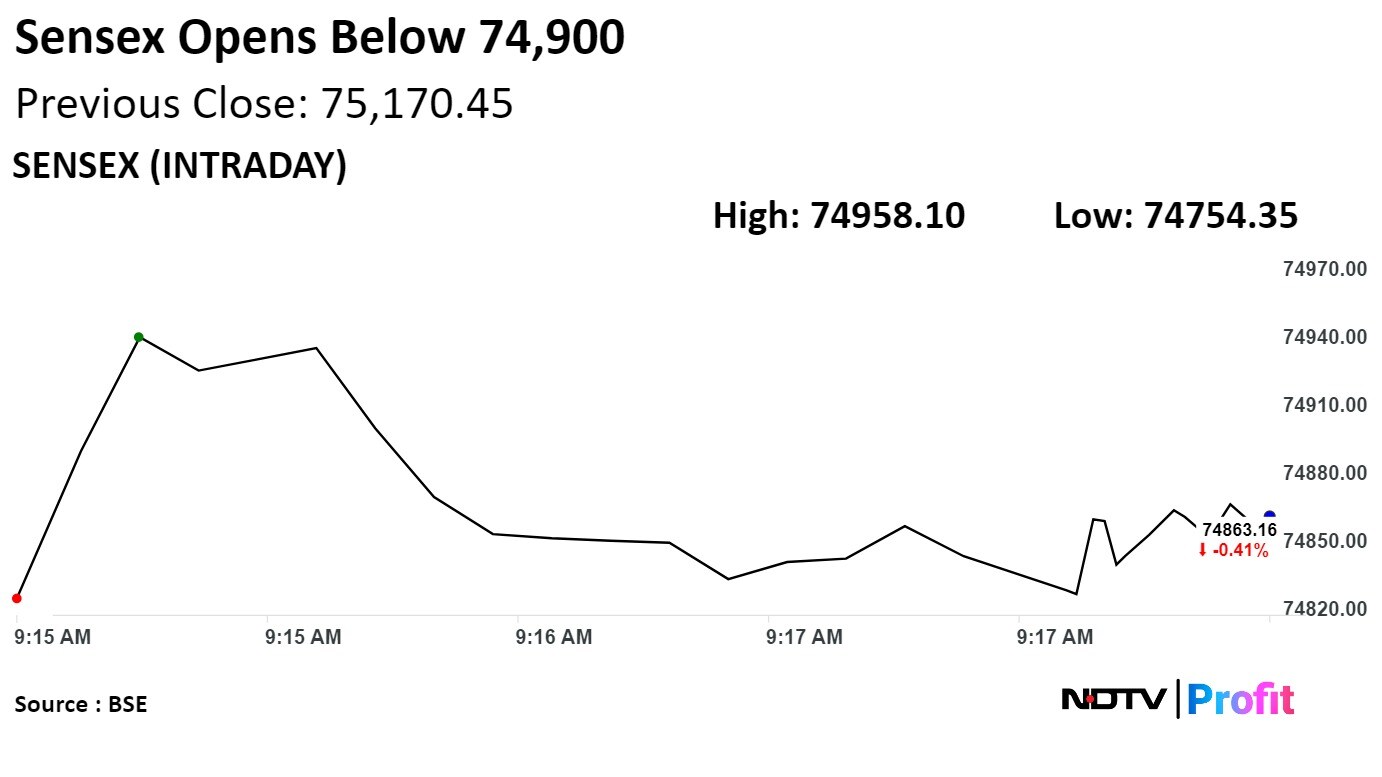

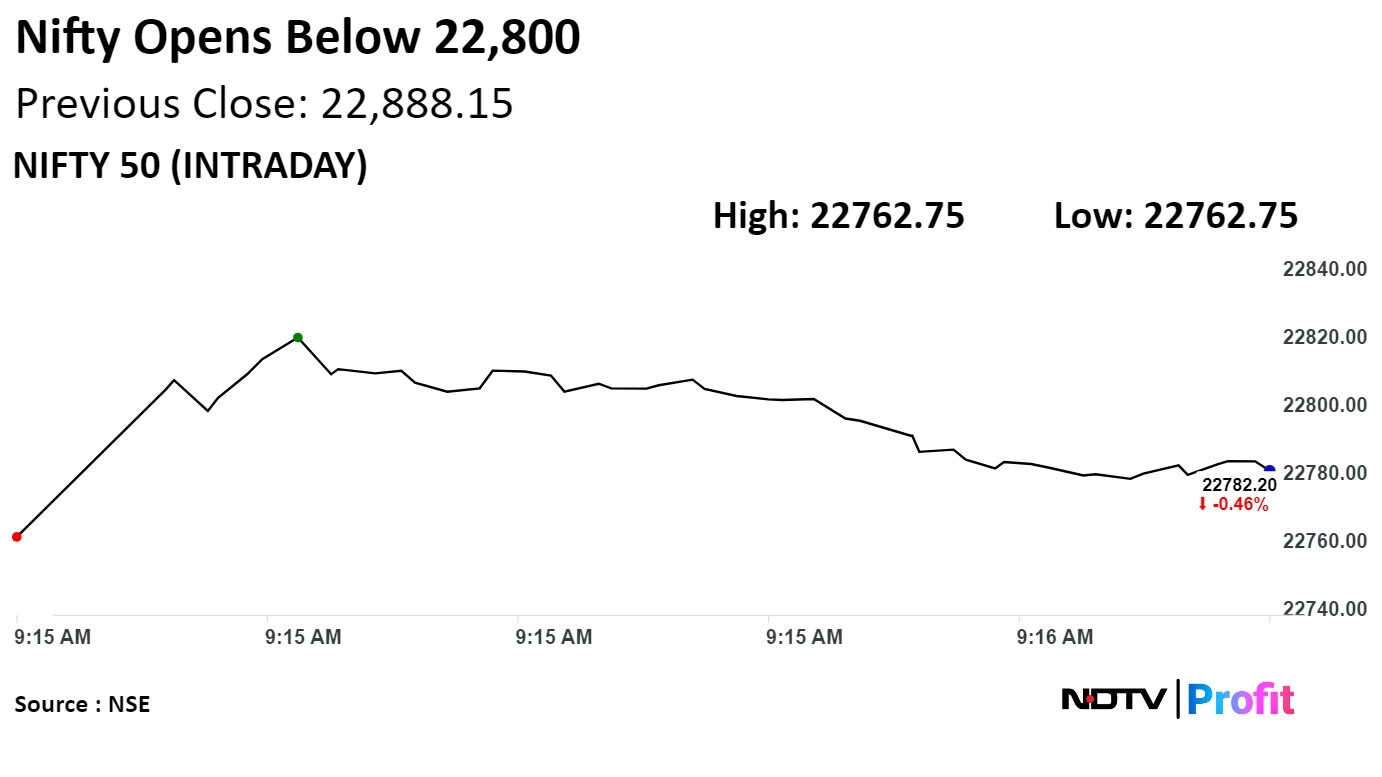

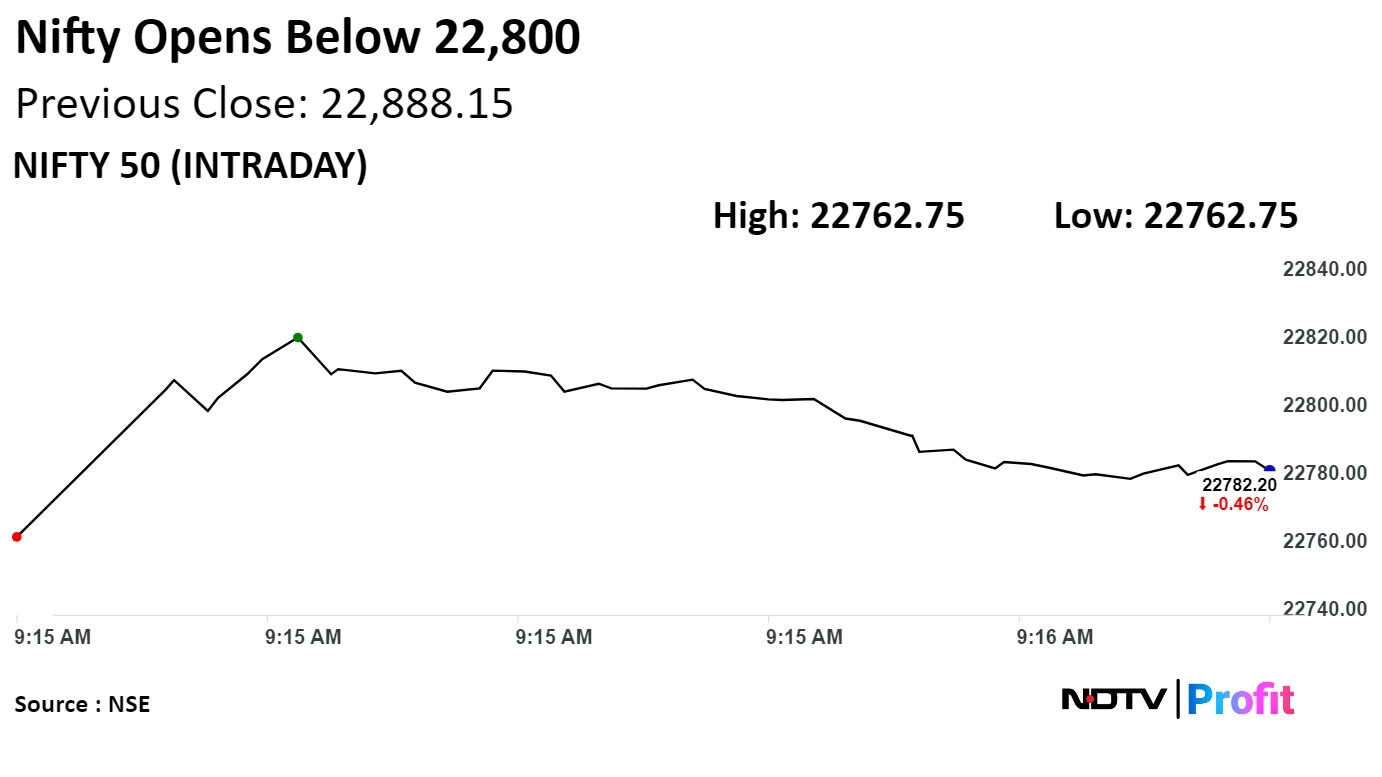

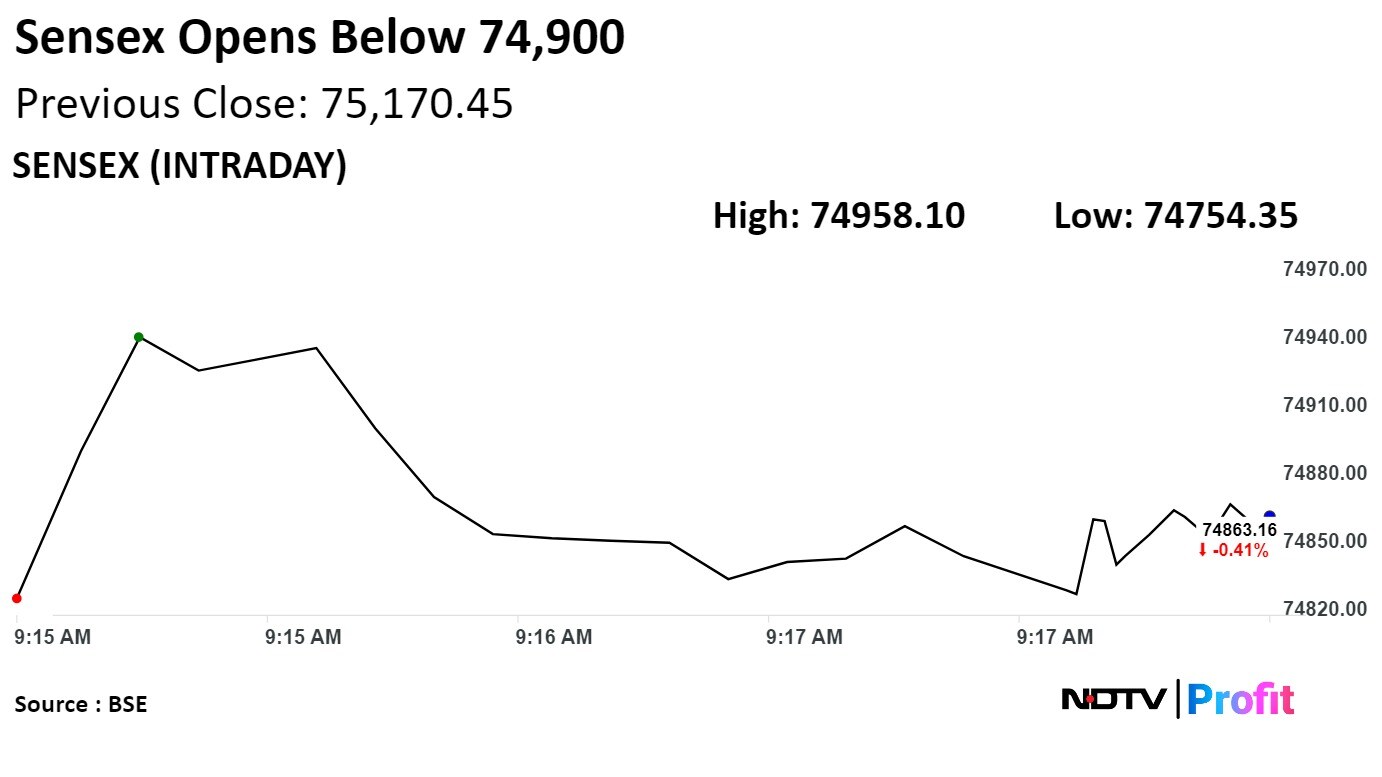

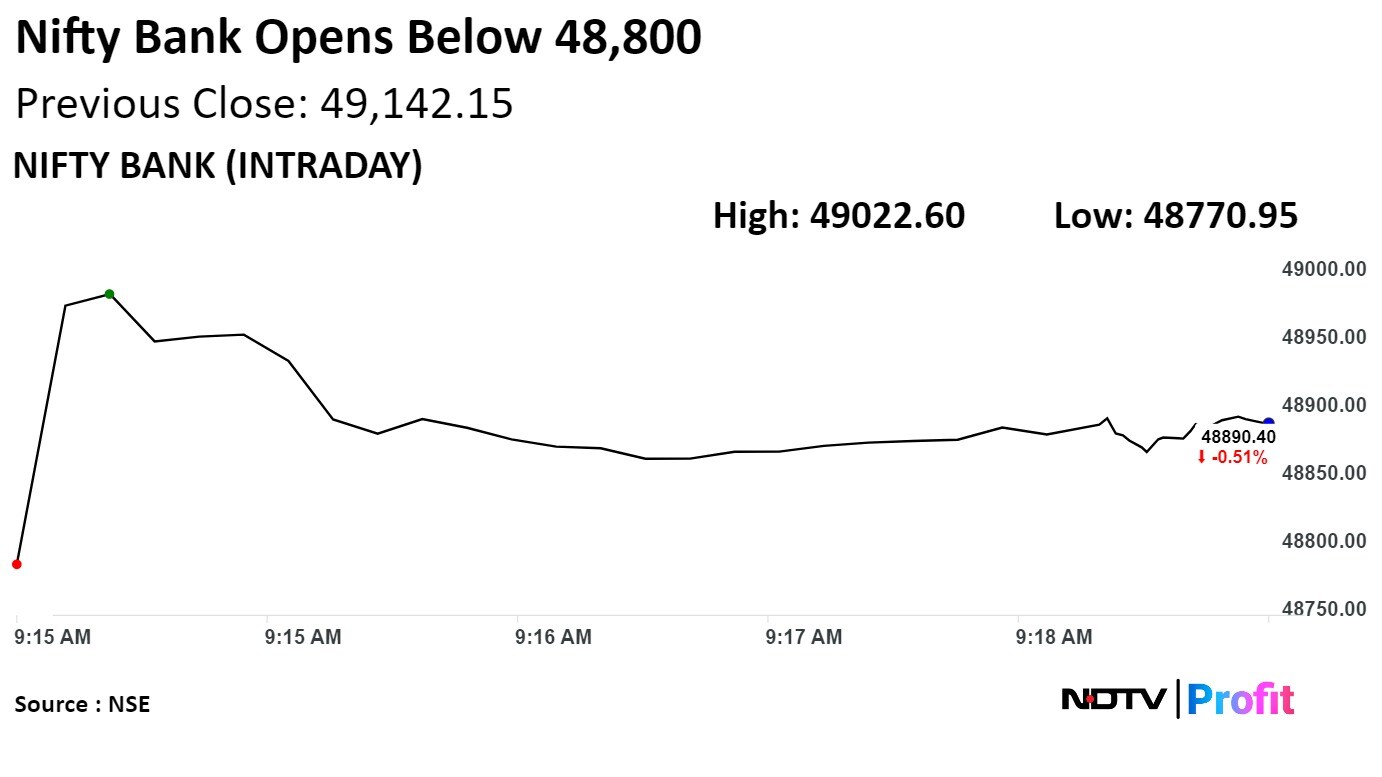

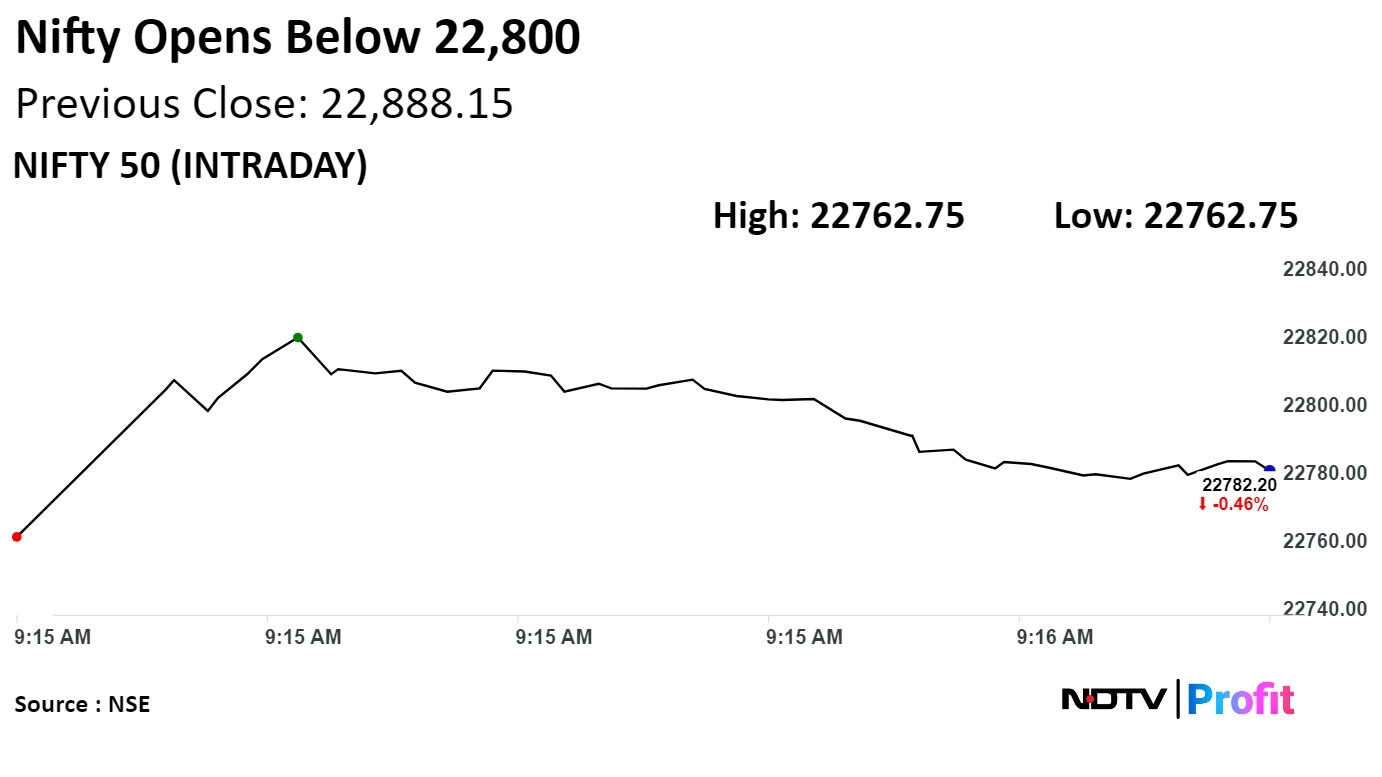

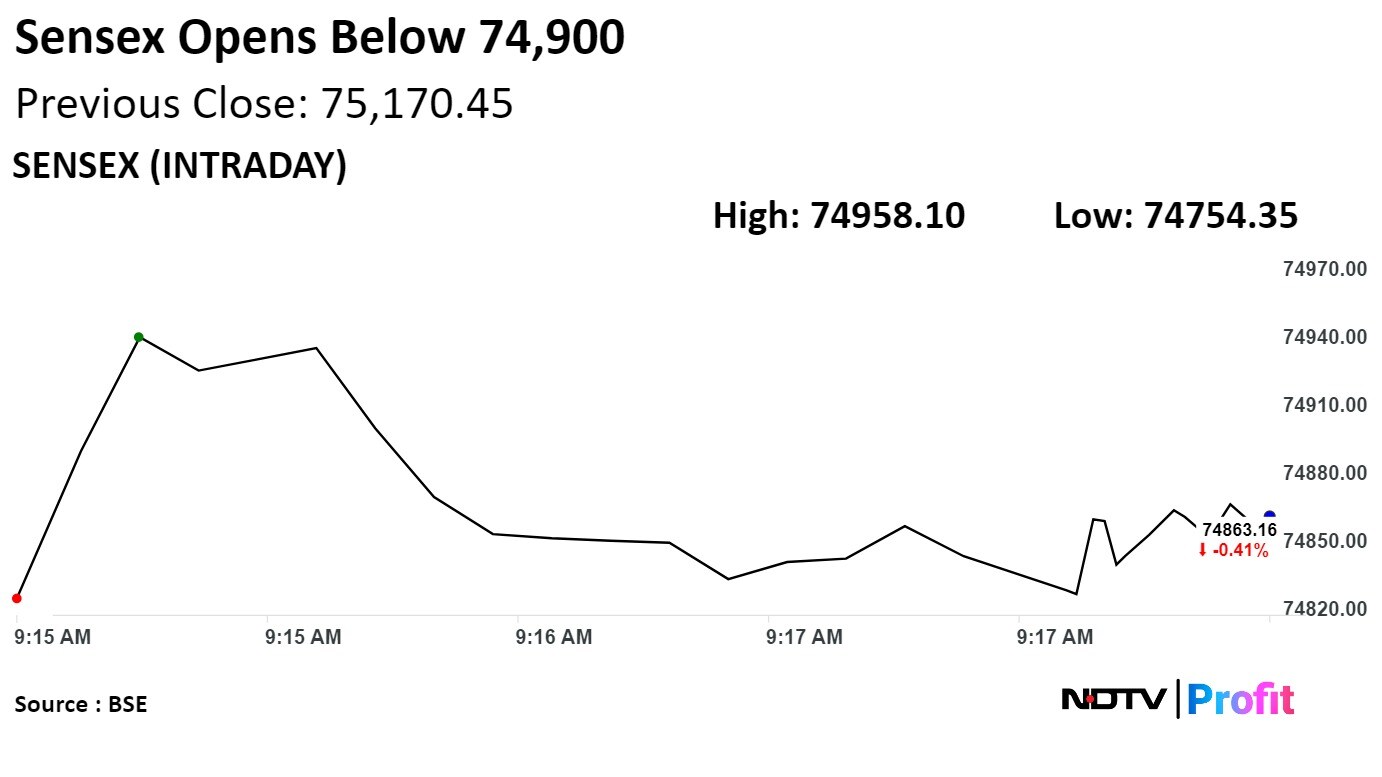

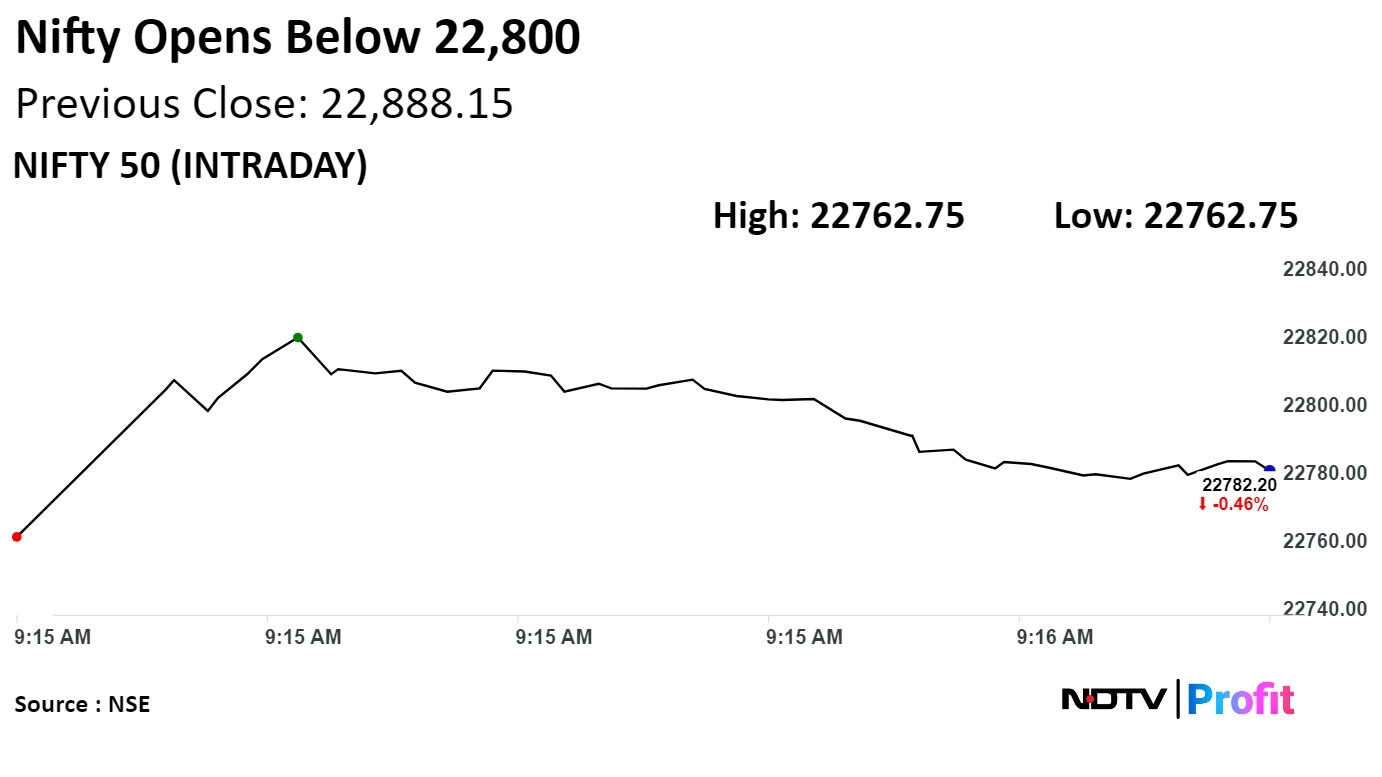

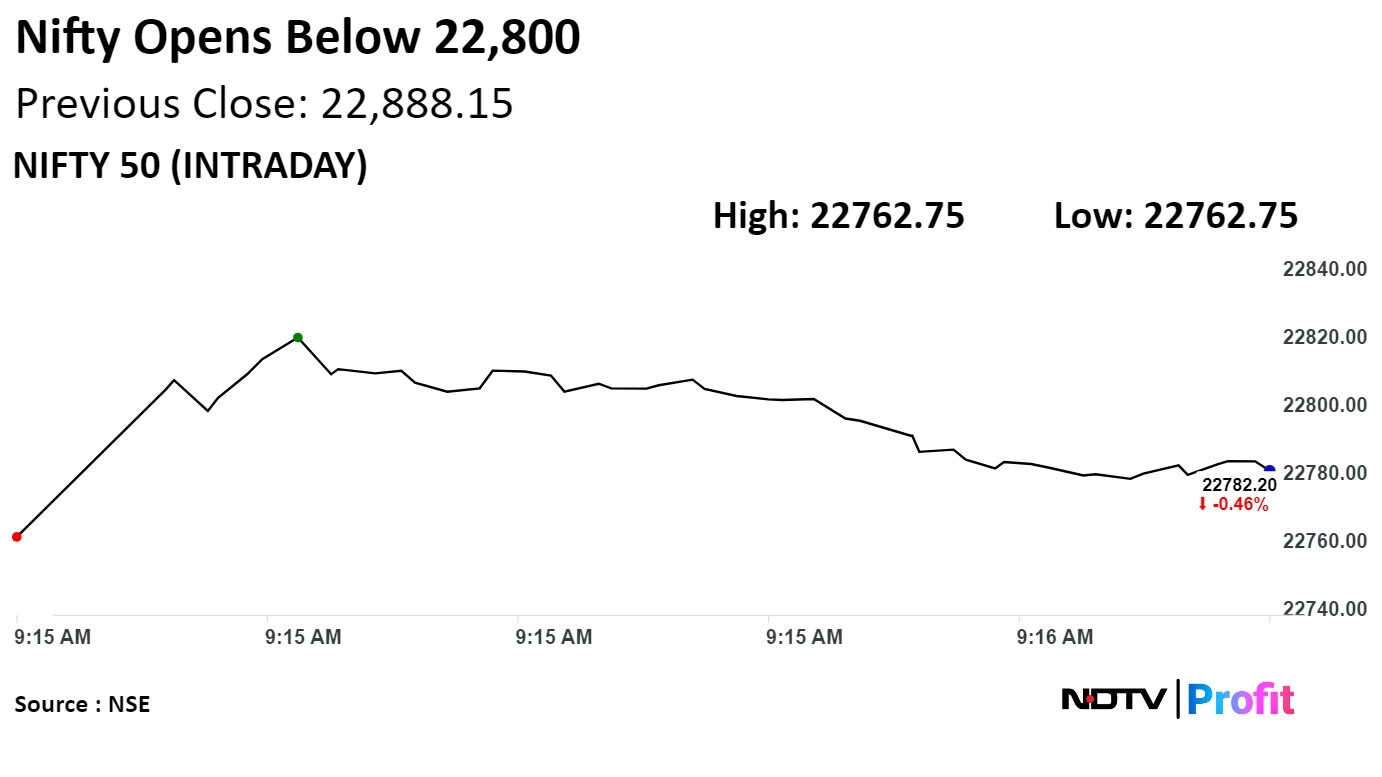

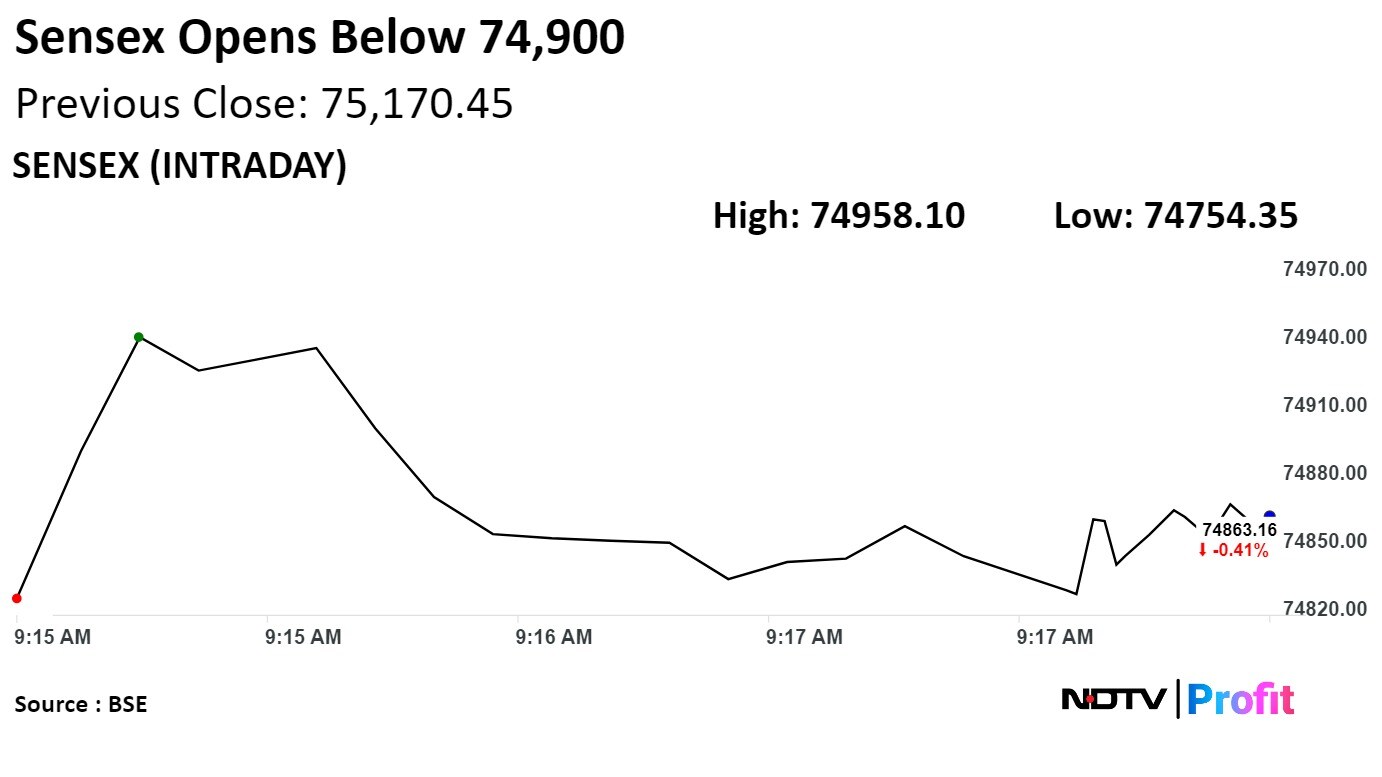

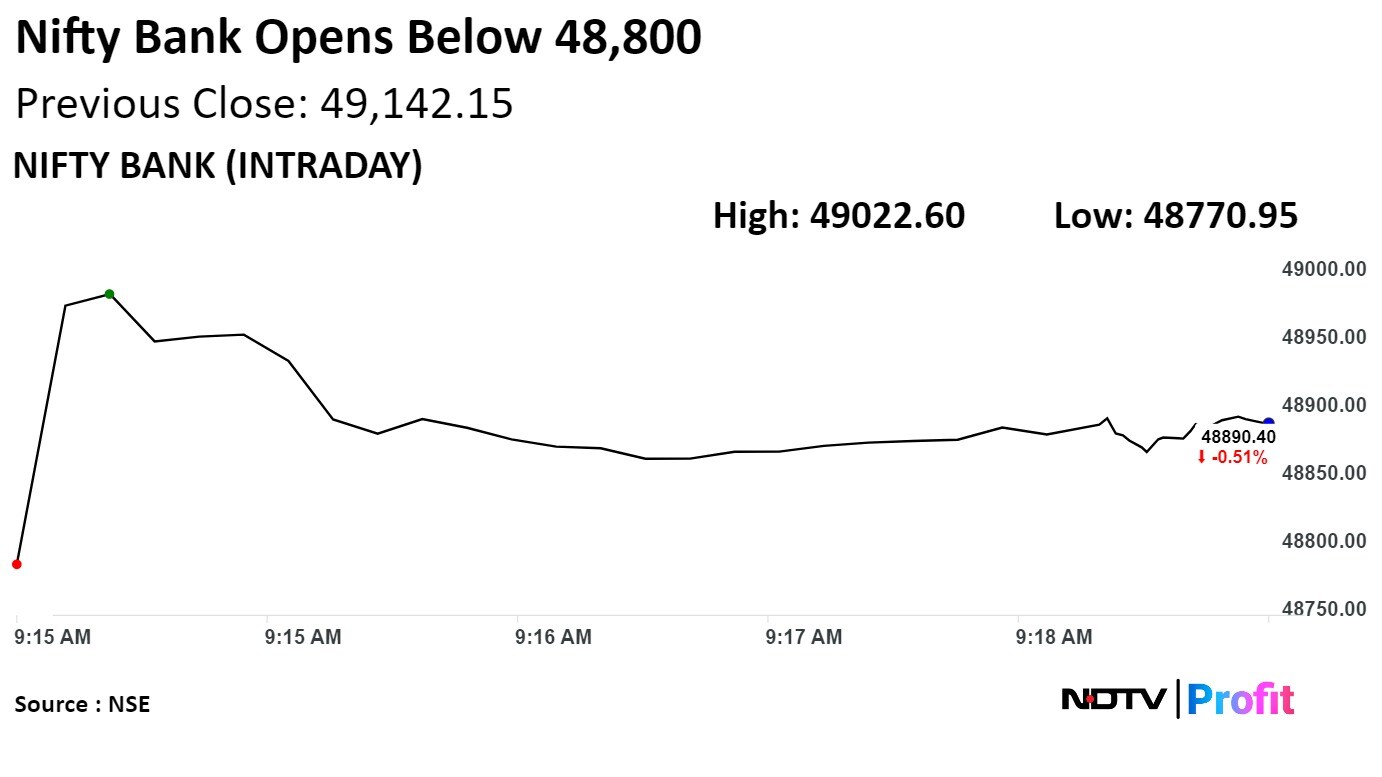

Benchmark equity indices opened lower, extended losses in the fourth consecutive session, as HDFC Bank, M&M dragged.

At pre-open, the Nifty was at 22,762.75, down 125.40 points or 0.55% and the Sensex fell 220.05 points or 0.29% to 75,170.45.

"Stronger-than-expected May US consumer confidence and hawkish commentary remarks from Fed’s officials pulled down European, Asian and US Index futures," said Vikas Jain, senior research analyst at Reliance Securities.

"We believe the market is consolidating due to an extended upmove from 21800 levels, said Shrikant Chouhan, head of equity research at Kotak Securities. "On the downside, 22800 -22750/74900-74700 would be the key support zones while 23050-23100/75500-75700 could be the key resistance zone."

Benchmark equity indices opened lower, extended losses in the fourth consecutive session, as HDFC Bank, M&M dragged.

At pre-open, the Nifty was at 22,762.75, down 125.40 points or 0.55% and the Sensex fell 220.05 points or 0.29% to 75,170.45.

"Stronger-than-expected May US consumer confidence and hawkish commentary remarks from Fed’s officials pulled down European, Asian and US Index futures," said Vikas Jain, senior research analyst at Reliance Securities.

"We believe the market is consolidating due to an extended upmove from 21800 levels, said Shrikant Chouhan, head of equity research at Kotak Securities. "On the downside, 22800 -22750/74900-74700 would be the key support zones while 23050-23100/75500-75700 could be the key resistance zone."

Benchmark equity indices opened lower, extended losses in the fourth consecutive session, as HDFC Bank, M&M dragged.

At pre-open, the Nifty was at 22,762.75, down 125.40 points or 0.55% and the Sensex fell 220.05 points or 0.29% to 75,170.45.

"Stronger-than-expected May US consumer confidence and hawkish commentary remarks from Fed’s officials pulled down European, Asian and US Index futures," said Vikas Jain, senior research analyst at Reliance Securities.

"We believe the market is consolidating due to an extended upmove from 21800 levels, said Shrikant Chouhan, head of equity research at Kotak Securities. "On the downside, 22800 -22750/74900-74700 would be the key support zones while 23050-23100/75500-75700 could be the key resistance zone."

Benchmark equity indices opened lower, extended losses in the fourth consecutive session, as HDFC Bank, M&M dragged.

At pre-open, the Nifty was at 22,762.75, down 125.40 points or 0.55% and the Sensex fell 220.05 points or 0.29% to 75,170.45.

"Stronger-than-expected May US consumer confidence and hawkish commentary remarks from Fed’s officials pulled down European, Asian and US Index futures," said Vikas Jain, senior research analyst at Reliance Securities.

"We believe the market is consolidating due to an extended upmove from 21800 levels, said Shrikant Chouhan, head of equity research at Kotak Securities. "On the downside, 22800 -22750/74900-74700 would be the key support zones while 23050-23100/75500-75700 could be the key resistance zone."

Benchmark equity indices opened lower, extended losses in the fourth consecutive session, as HDFC Bank, M&M dragged.

At pre-open, the Nifty was at 22,762.75, down 125.40 points or 0.55% and the Sensex fell 220.05 points or 0.29% to 75,170.45.

"Stronger-than-expected May US consumer confidence and hawkish commentary remarks from Fed’s officials pulled down European, Asian and US Index futures," said Vikas Jain, senior research analyst at Reliance Securities.

"We believe the market is consolidating due to an extended upmove from 21800 levels, said Shrikant Chouhan, head of equity research at Kotak Securities. "On the downside, 22800 -22750/74900-74700 would be the key support zones while 23050-23100/75500-75700 could be the key resistance zone."

Benchmark equity indices opened lower, extended losses in the fourth consecutive session, as HDFC Bank, M&M dragged.

At pre-open, the Nifty was at 22,762.75, down 125.40 points or 0.55% and the Sensex fell 220.05 points or 0.29% to 75,170.45.

"Stronger-than-expected May US consumer confidence and hawkish commentary remarks from Fed’s officials pulled down European, Asian and US Index futures," said Vikas Jain, senior research analyst at Reliance Securities.

"We believe the market is consolidating due to an extended upmove from 21800 levels, said Shrikant Chouhan, head of equity research at Kotak Securities. "On the downside, 22800 -22750/74900-74700 would be the key support zones while 23050-23100/75500-75700 could be the key resistance zone."

Benchmark equity indices opened lower, extended losses in the fourth consecutive session, as HDFC Bank, M&M dragged.

At pre-open, the Nifty was at 22,762.75, down 125.40 points or 0.55% and the Sensex fell 220.05 points or 0.29% to 75,170.45.

"Stronger-than-expected May US consumer confidence and hawkish commentary remarks from Fed’s officials pulled down European, Asian and US Index futures," said Vikas Jain, senior research analyst at Reliance Securities.

"We believe the market is consolidating due to an extended upmove from 21800 levels, said Shrikant Chouhan, head of equity research at Kotak Securities. "On the downside, 22800 -22750/74900-74700 would be the key support zones while 23050-23100/75500-75700 could be the key resistance zone."

Benchmark equity indices opened lower, extended losses in the fourth consecutive session, as HDFC Bank, M&M dragged.

At pre-open, the Nifty was at 22,762.75, down 125.40 points or 0.55% and the Sensex fell 220.05 points or 0.29% to 75,170.45.

"Stronger-than-expected May US consumer confidence and hawkish commentary remarks from Fed’s officials pulled down European, Asian and US Index futures," said Vikas Jain, senior research analyst at Reliance Securities.

"We believe the market is consolidating due to an extended upmove from 21800 levels, said Shrikant Chouhan, head of equity research at Kotak Securities. "On the downside, 22800 -22750/74900-74700 would be the key support zones while 23050-23100/75500-75700 could be the key resistance zone."

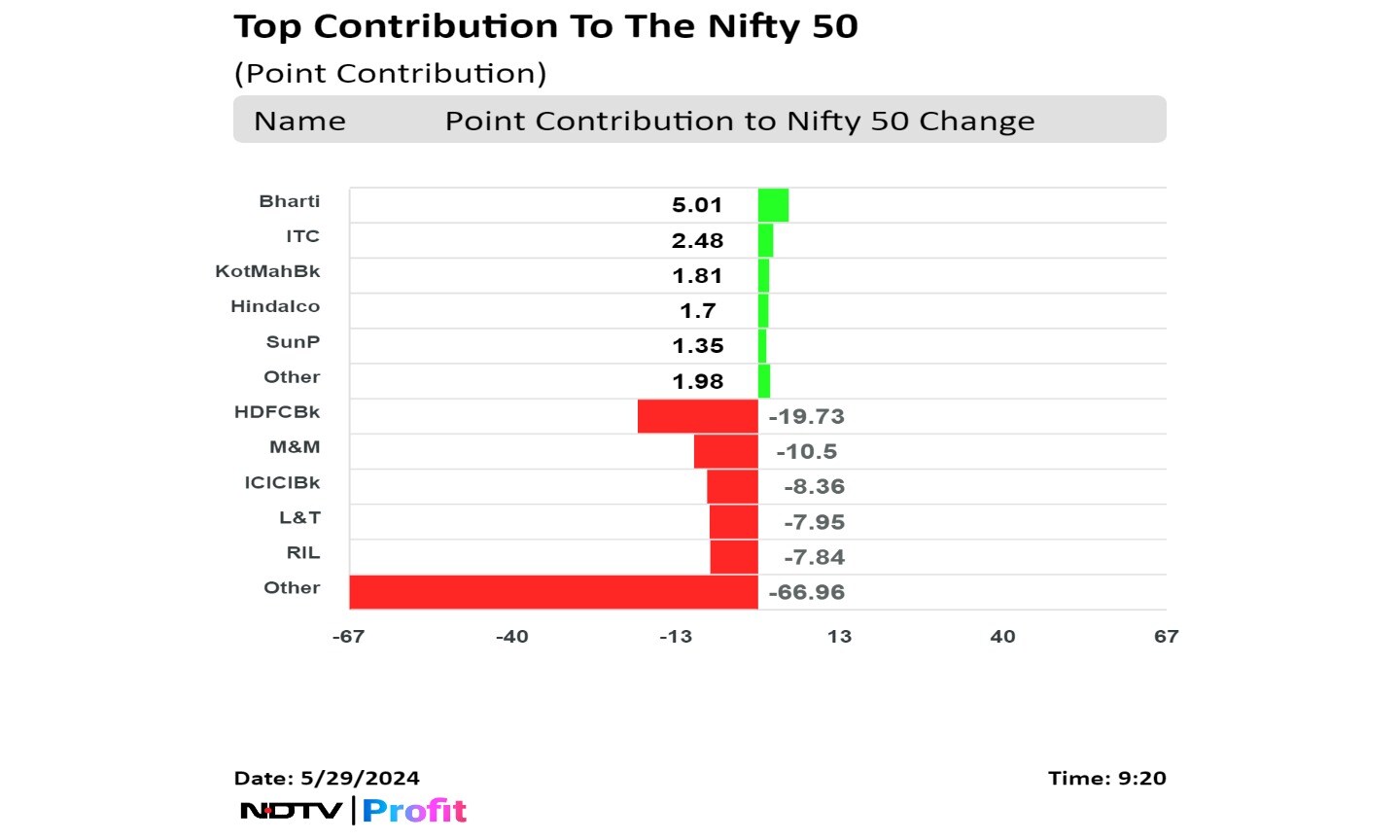

Shares of HDFC Bank Ltd., Mahindra & Mahindra Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., and Reliance Industries Ltd. dragged the Nifty.

While those of Bharti Airtel Ltd., ITC Ltd., Kotak Mahindra Bank Ltd., Hindalco Industries Ltd., and Sun Pharmaceutical Industries minimised the losses.

Benchmark equity indices opened lower, extended losses in the fourth consecutive session, as HDFC Bank, M&M dragged.

At pre-open, the Nifty was at 22,762.75, down 125.40 points or 0.55% and the Sensex fell 220.05 points or 0.29% to 75,170.45.

"Stronger-than-expected May US consumer confidence and hawkish commentary remarks from Fed’s officials pulled down European, Asian and US Index futures," said Vikas Jain, senior research analyst at Reliance Securities.

"We believe the market is consolidating due to an extended upmove from 21800 levels, said Shrikant Chouhan, head of equity research at Kotak Securities. "On the downside, 22800 -22750/74900-74700 would be the key support zones while 23050-23100/75500-75700 could be the key resistance zone."

Benchmark equity indices opened lower, extended losses in the fourth consecutive session, as HDFC Bank, M&M dragged.

At pre-open, the Nifty was at 22,762.75, down 125.40 points or 0.55% and the Sensex fell 220.05 points or 0.29% to 75,170.45.

"Stronger-than-expected May US consumer confidence and hawkish commentary remarks from Fed’s officials pulled down European, Asian and US Index futures," said Vikas Jain, senior research analyst at Reliance Securities.