The local currency weakened by 4 paise to close at 83.18 against the U.S dollar.

It closed at 83.14 on Monday.

Source: Bloomberg

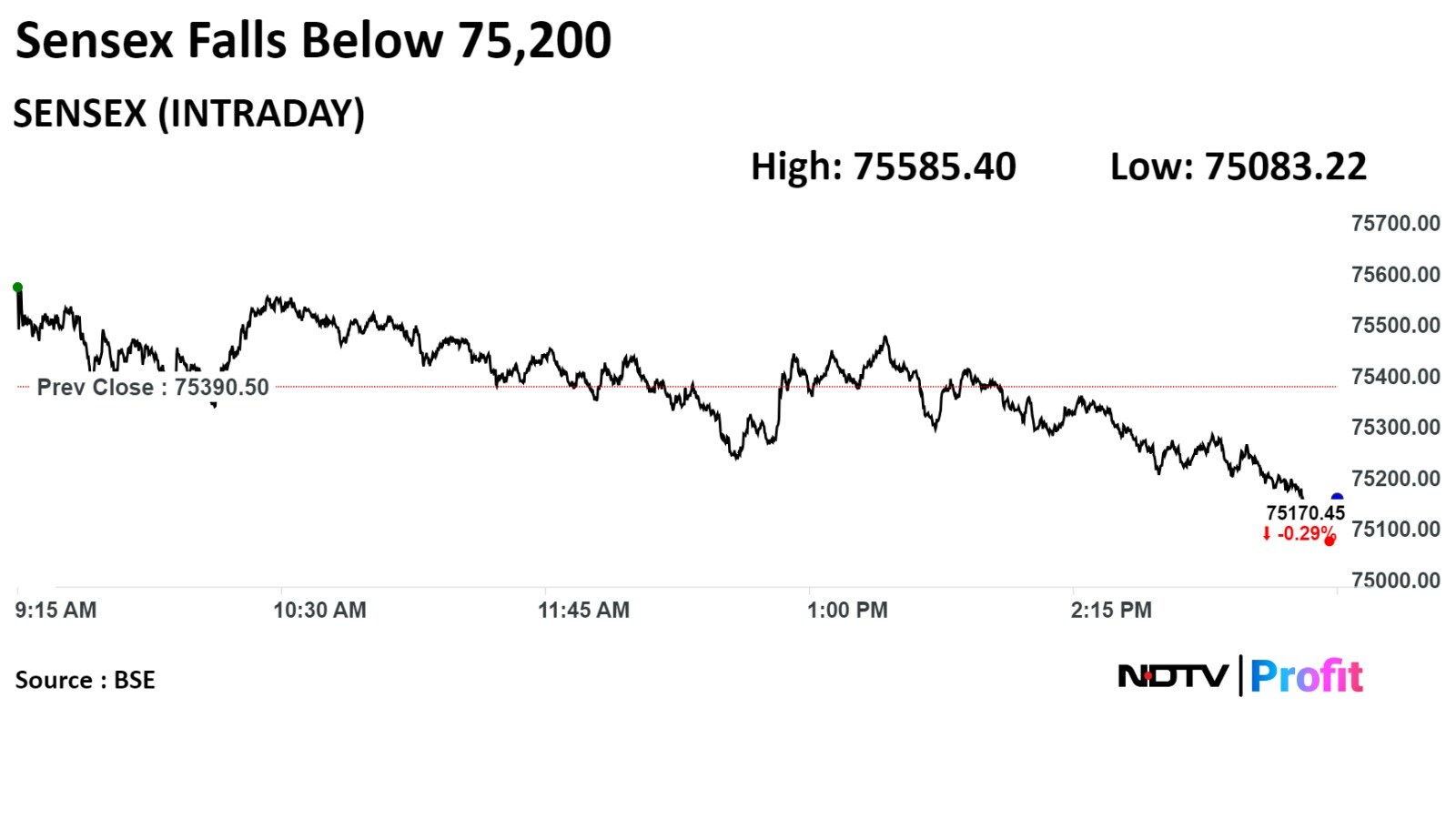

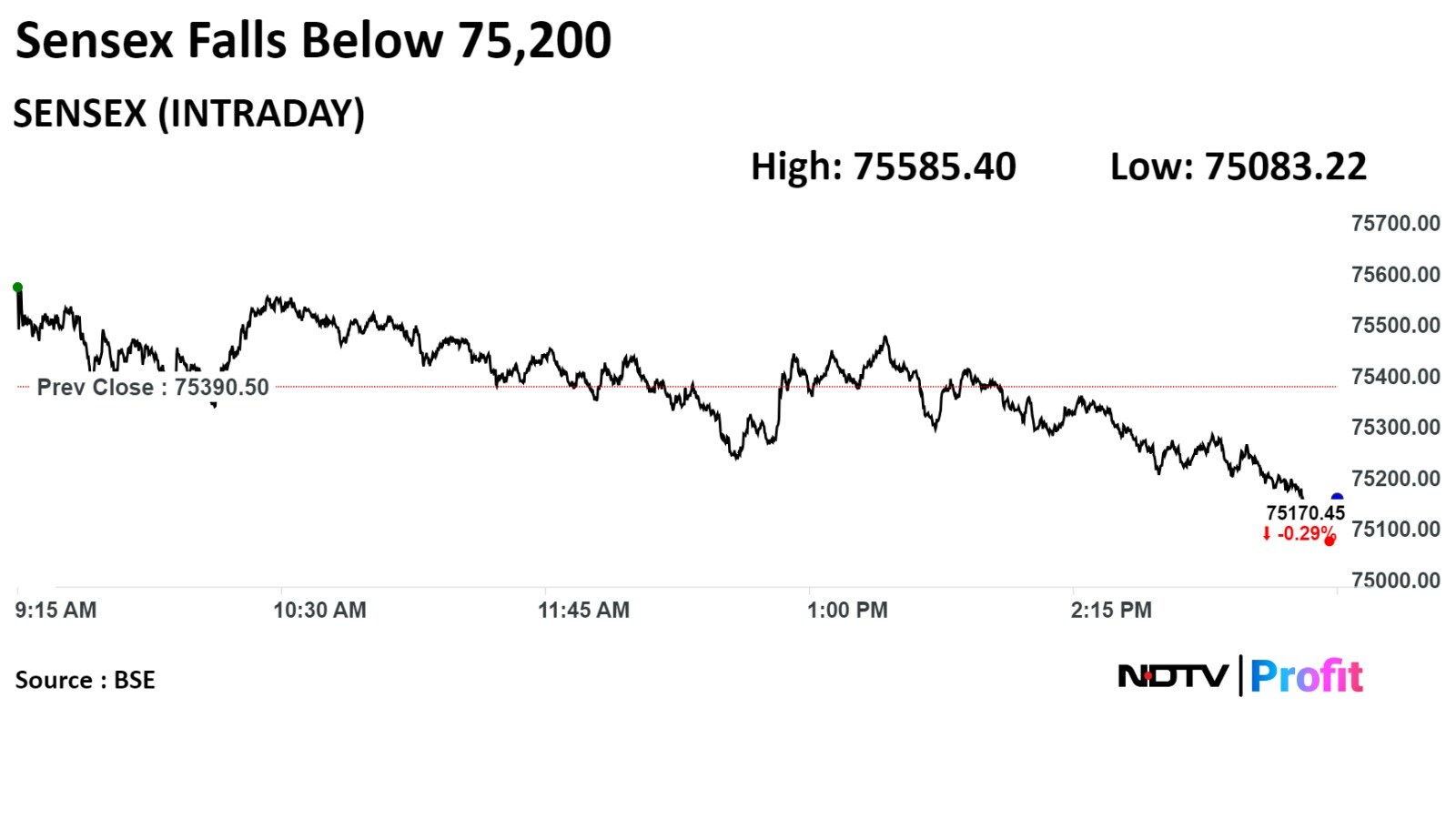

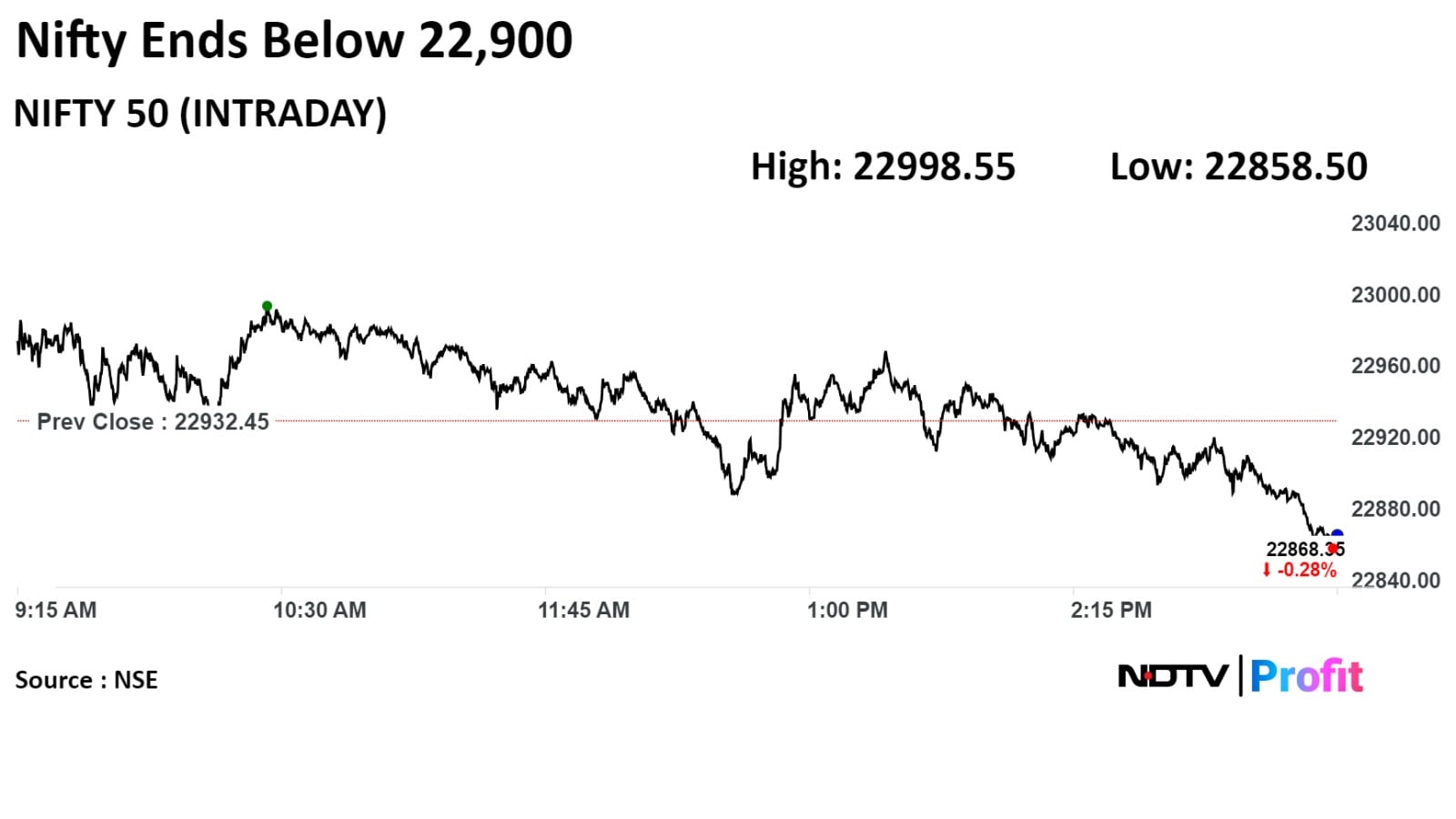

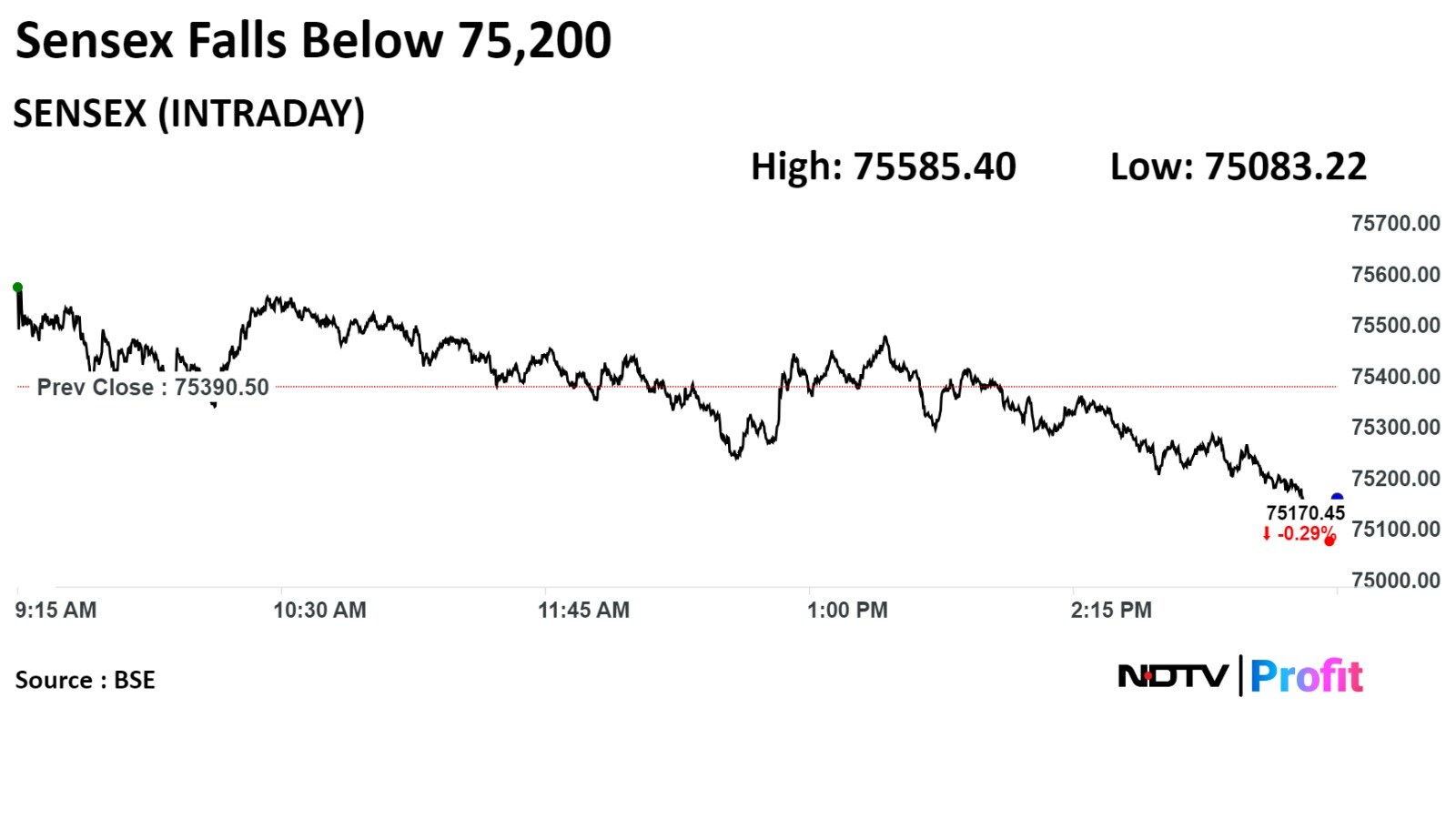

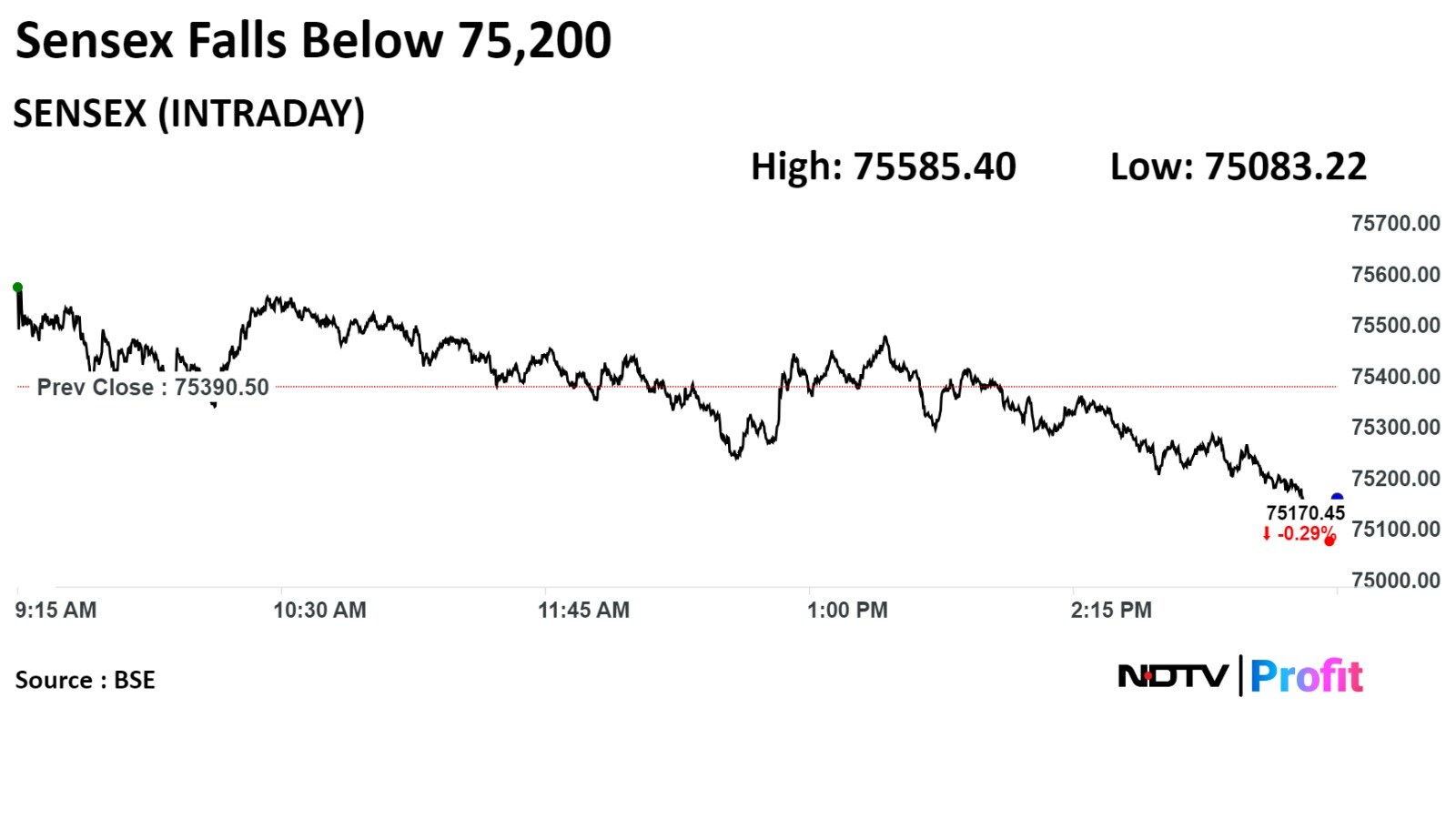

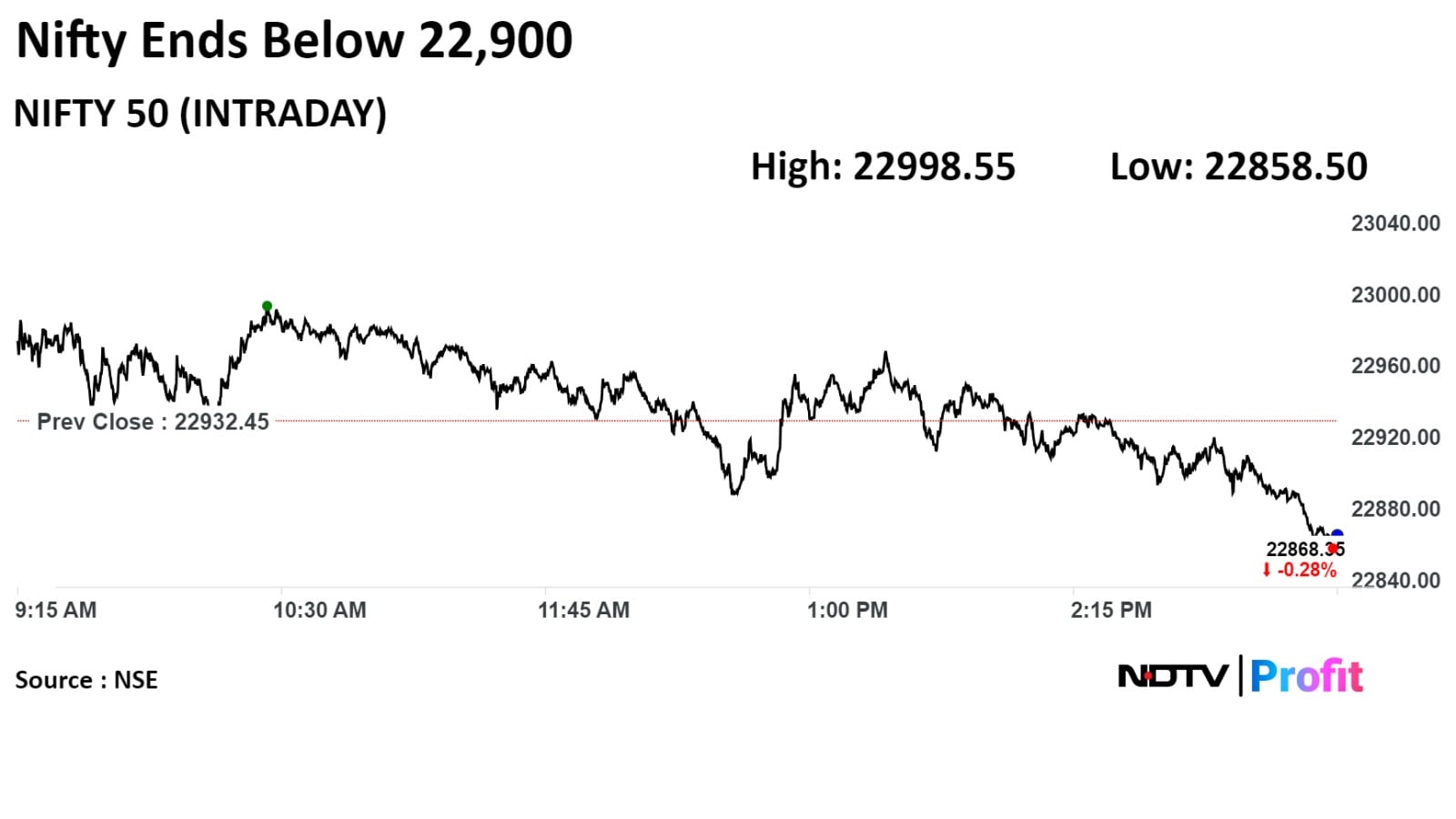

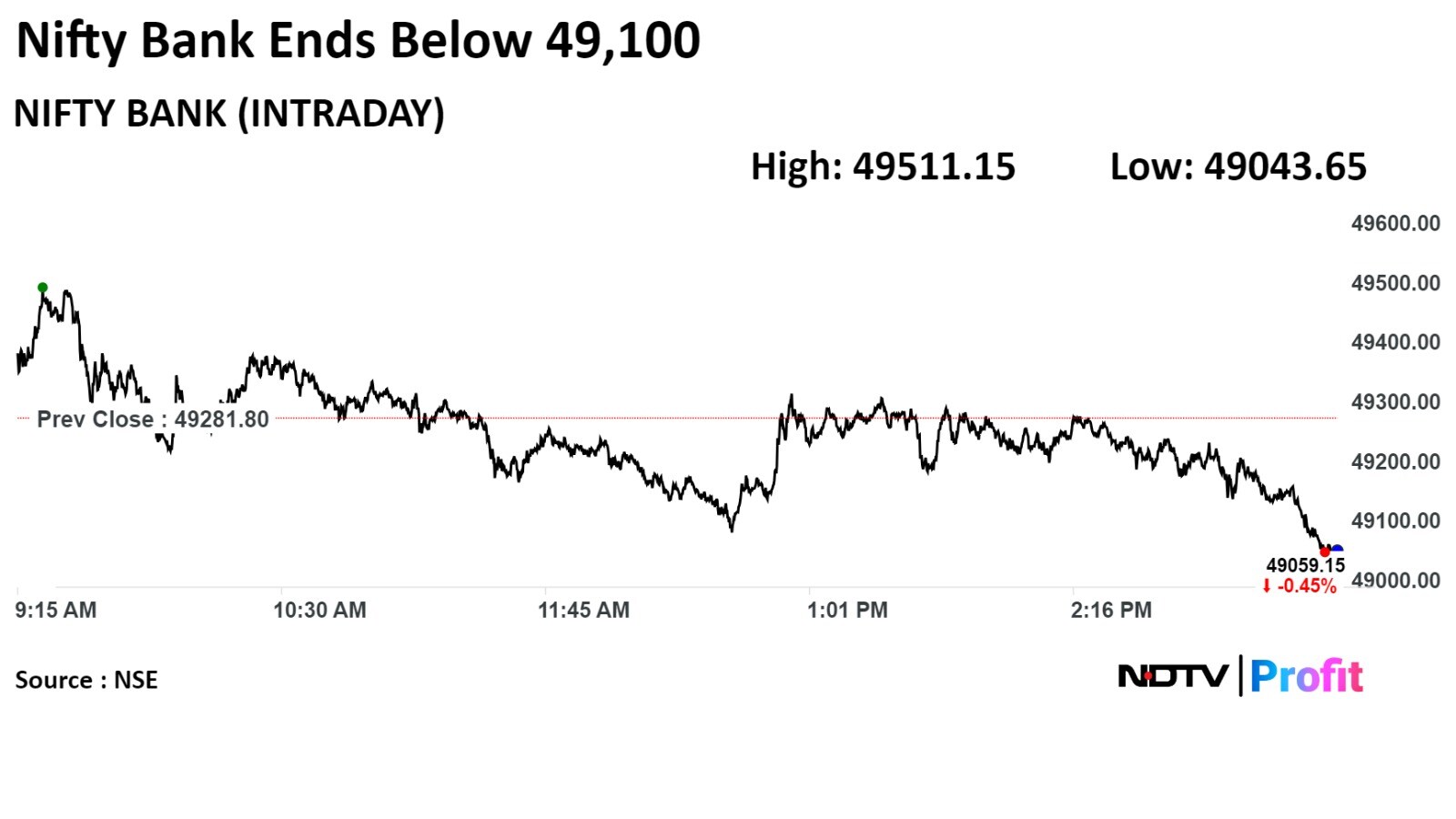

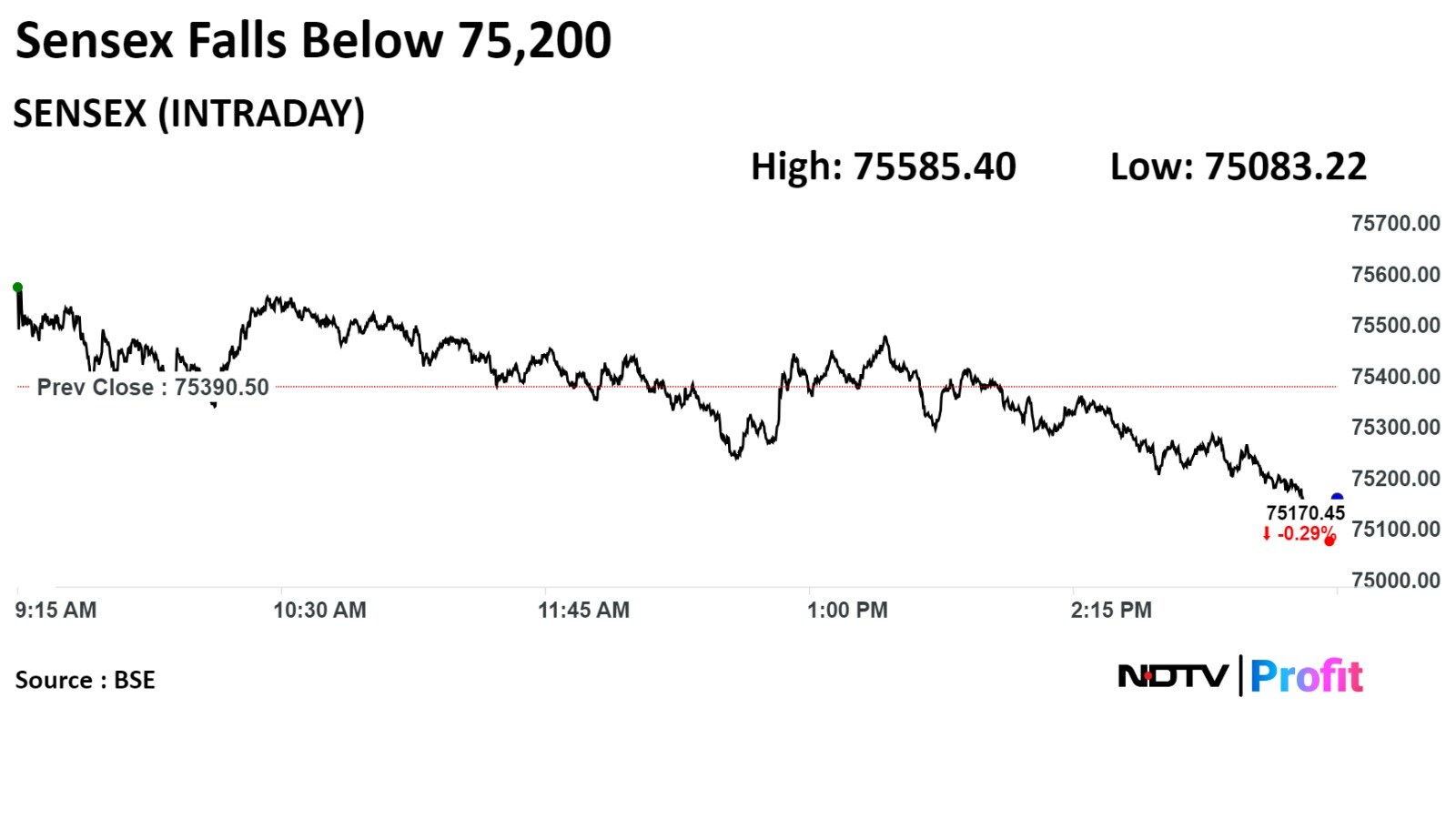

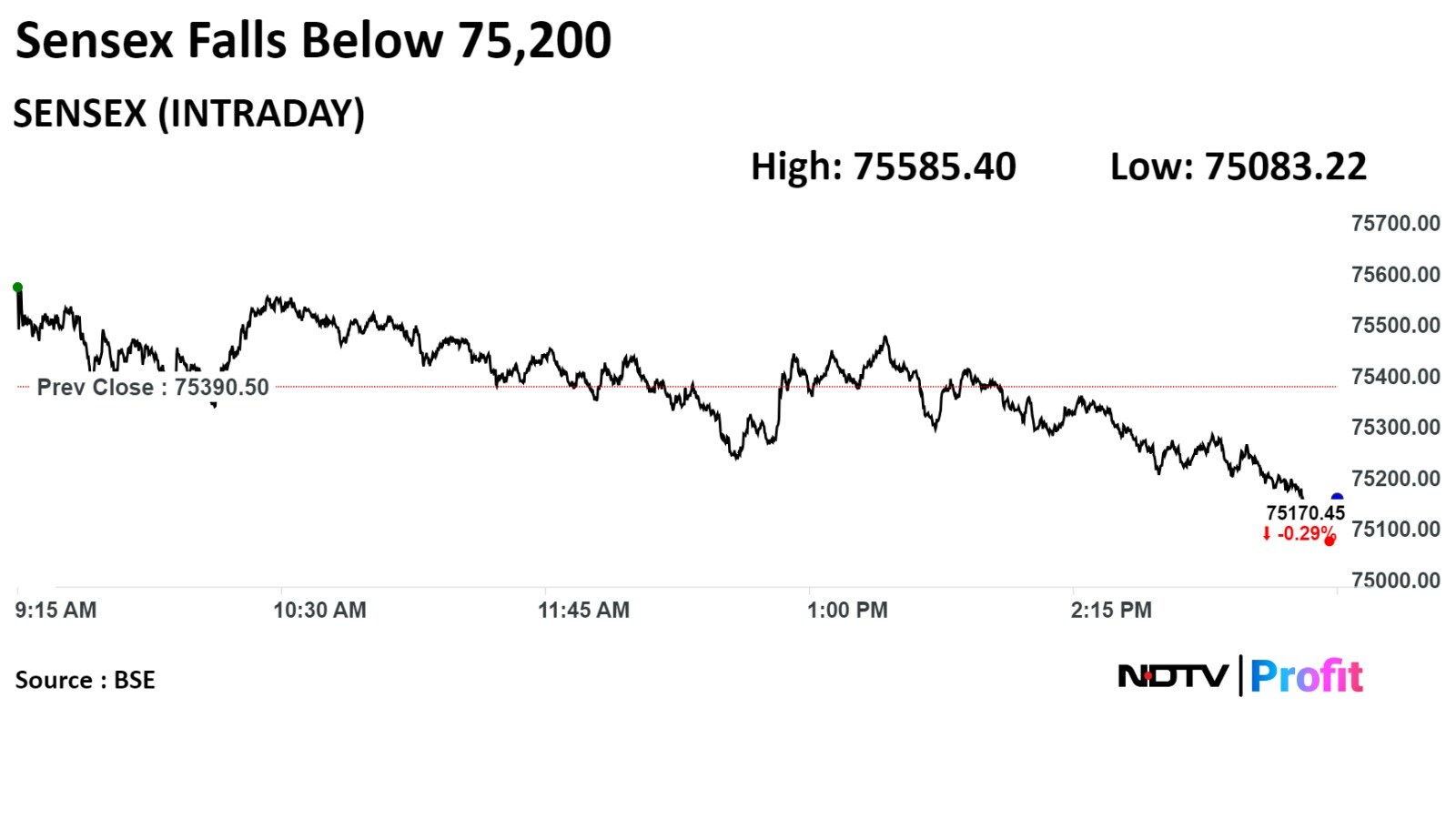

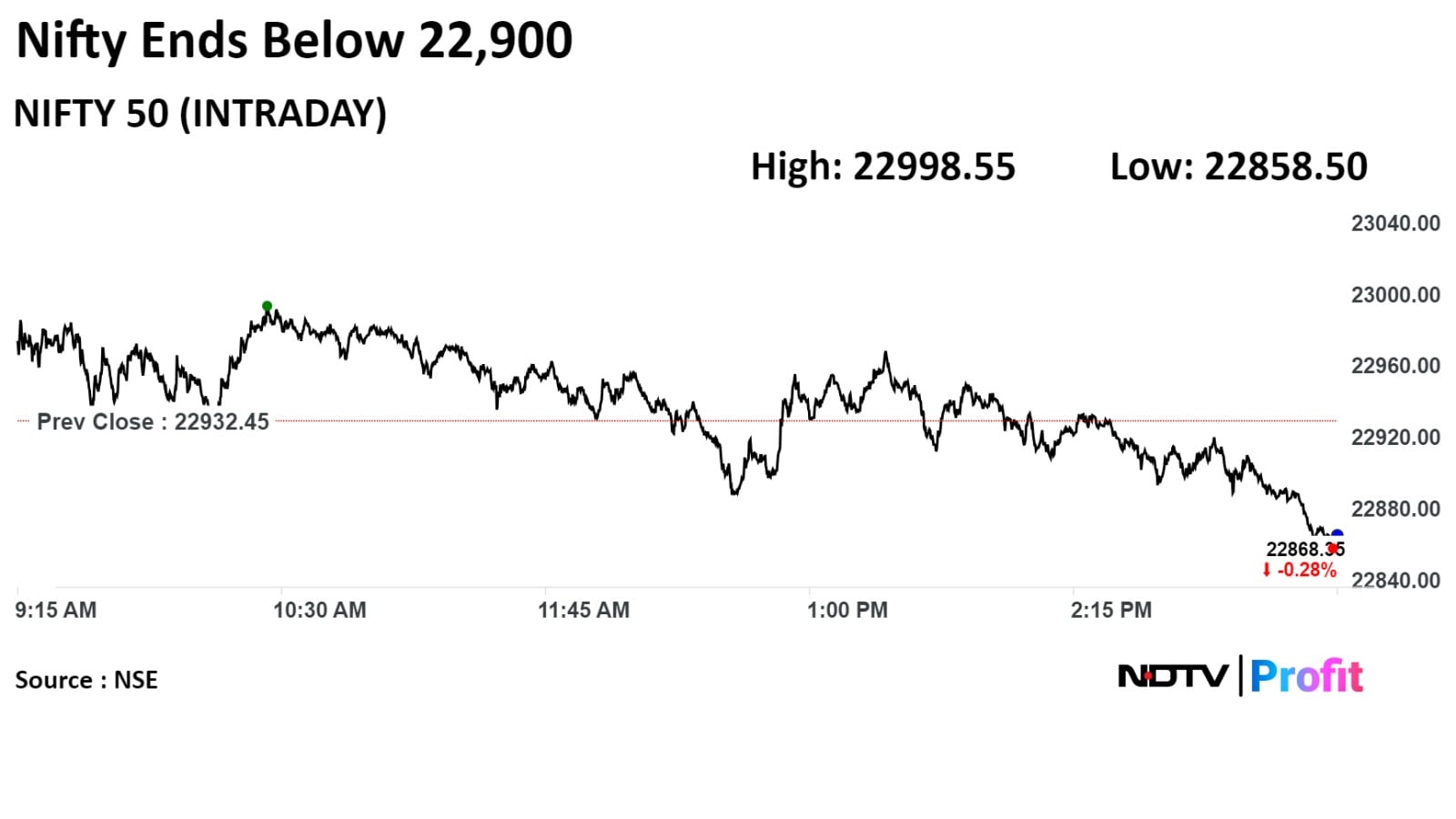

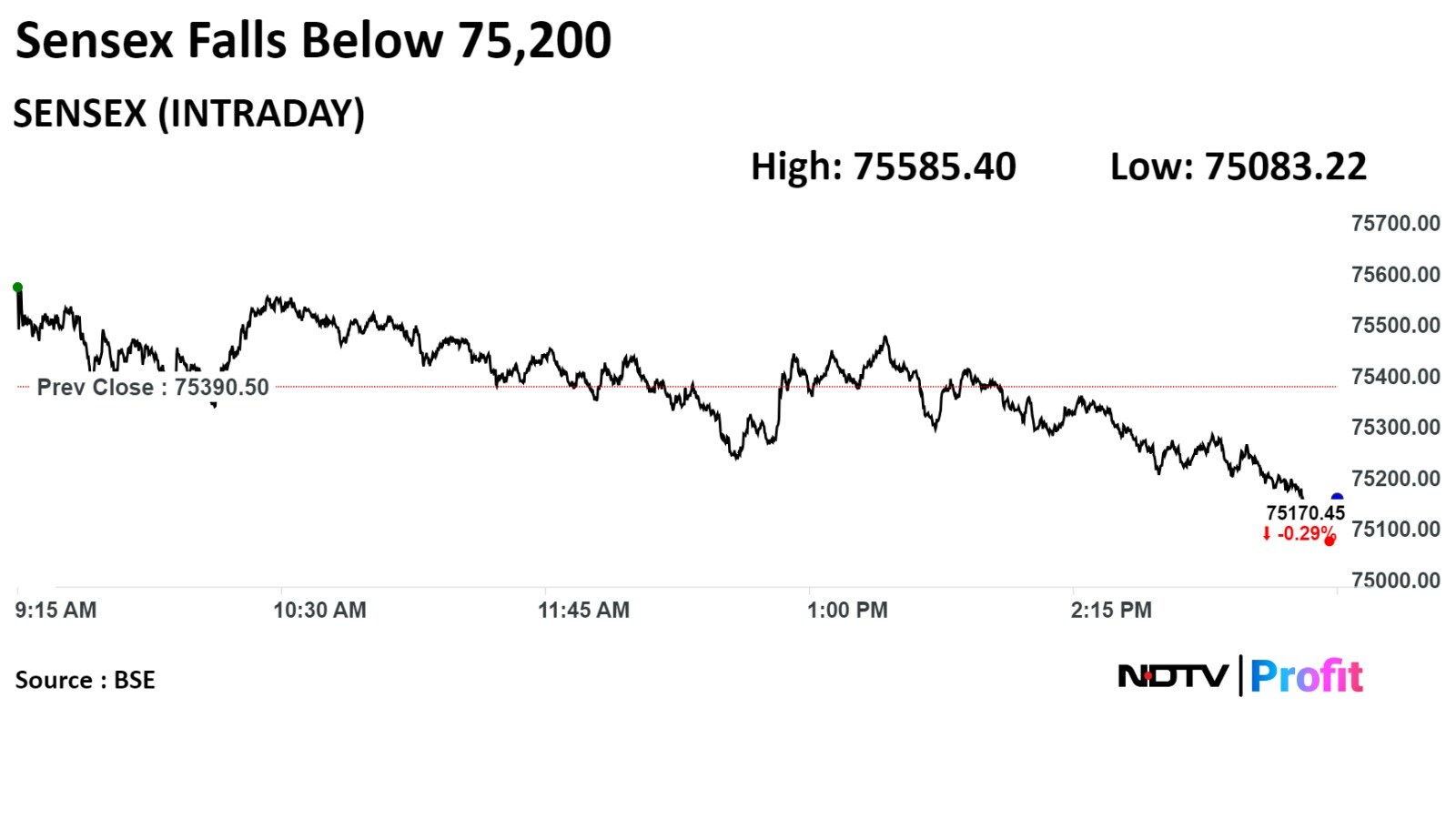

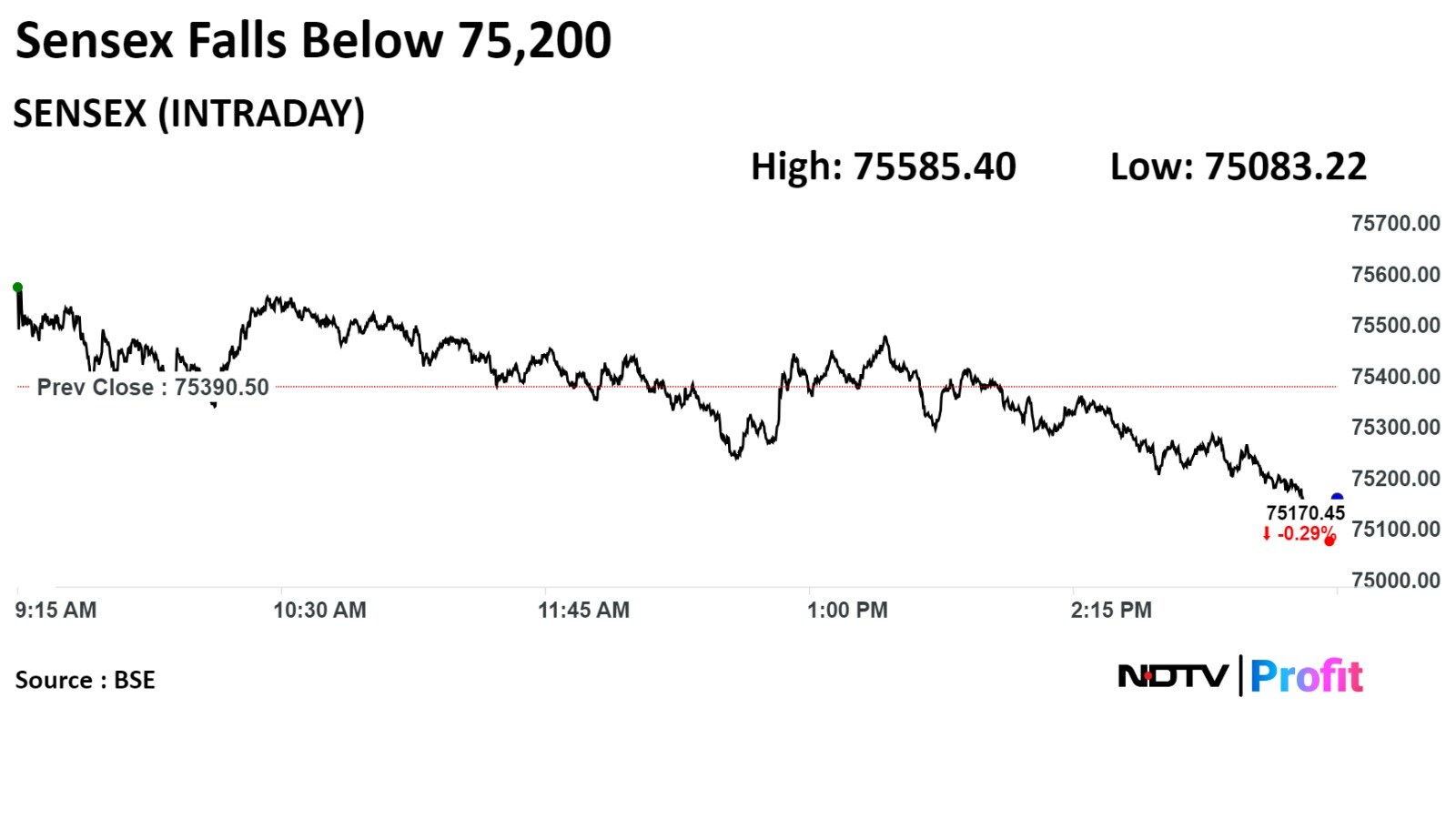

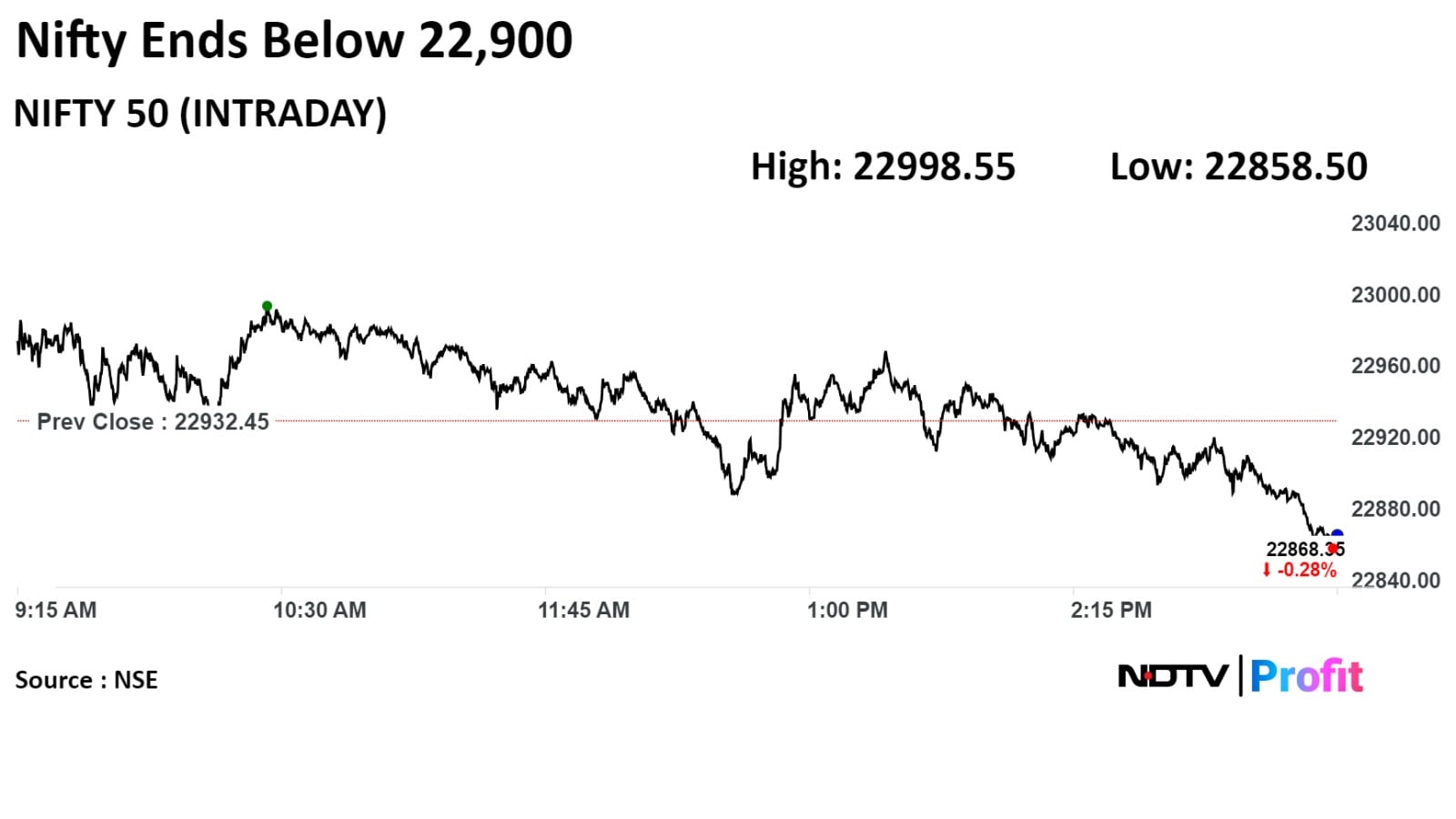

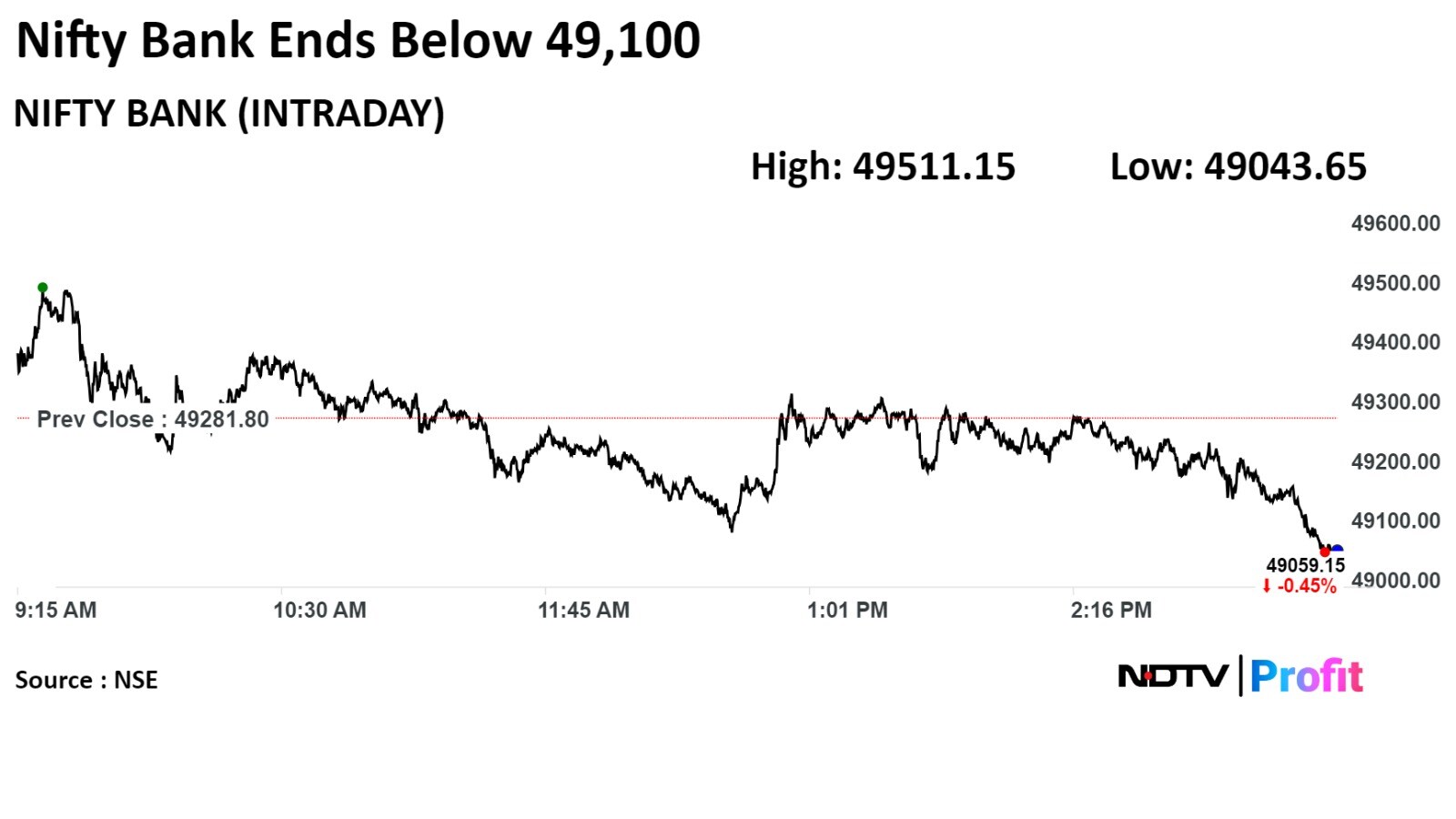

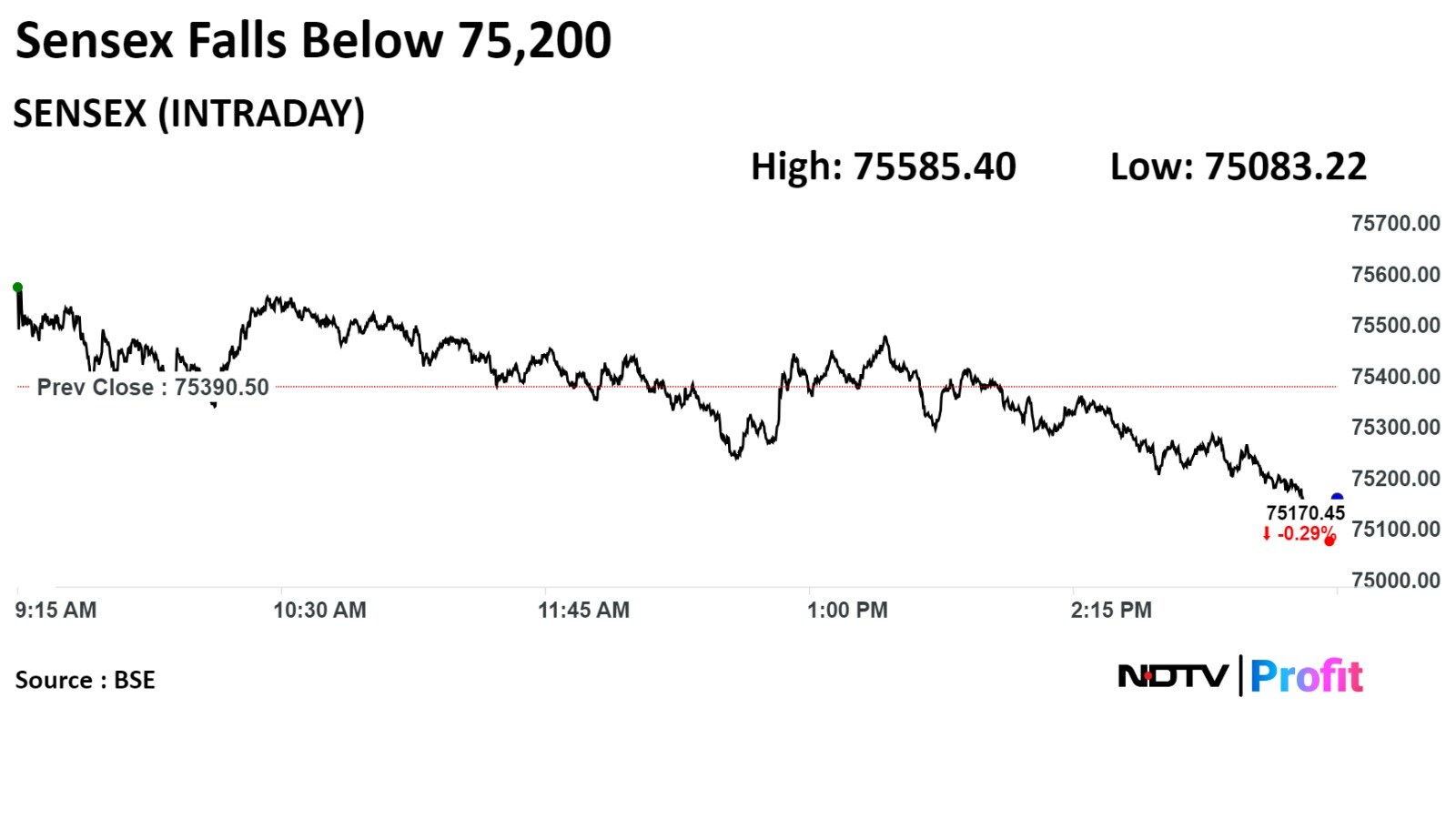

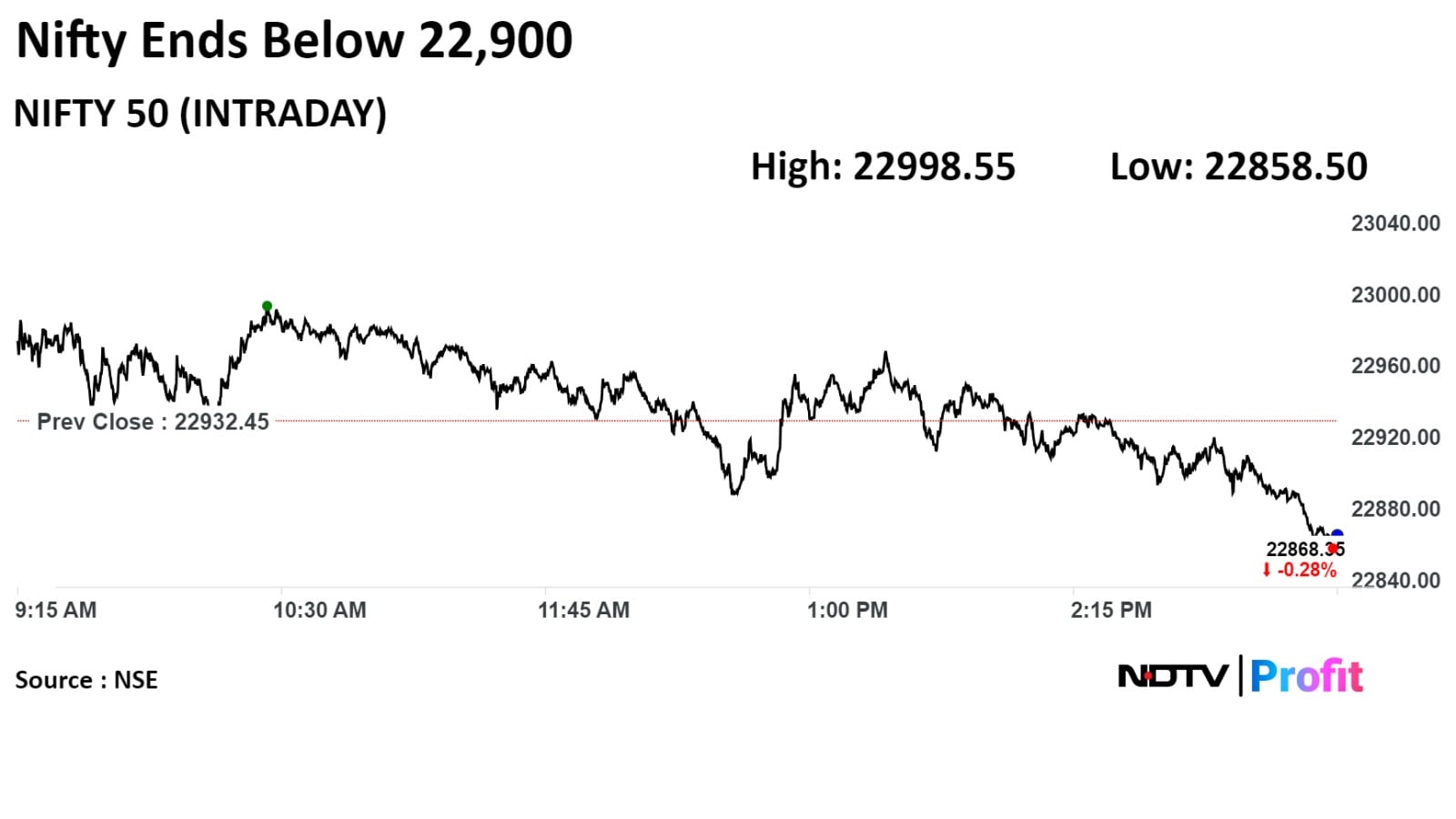

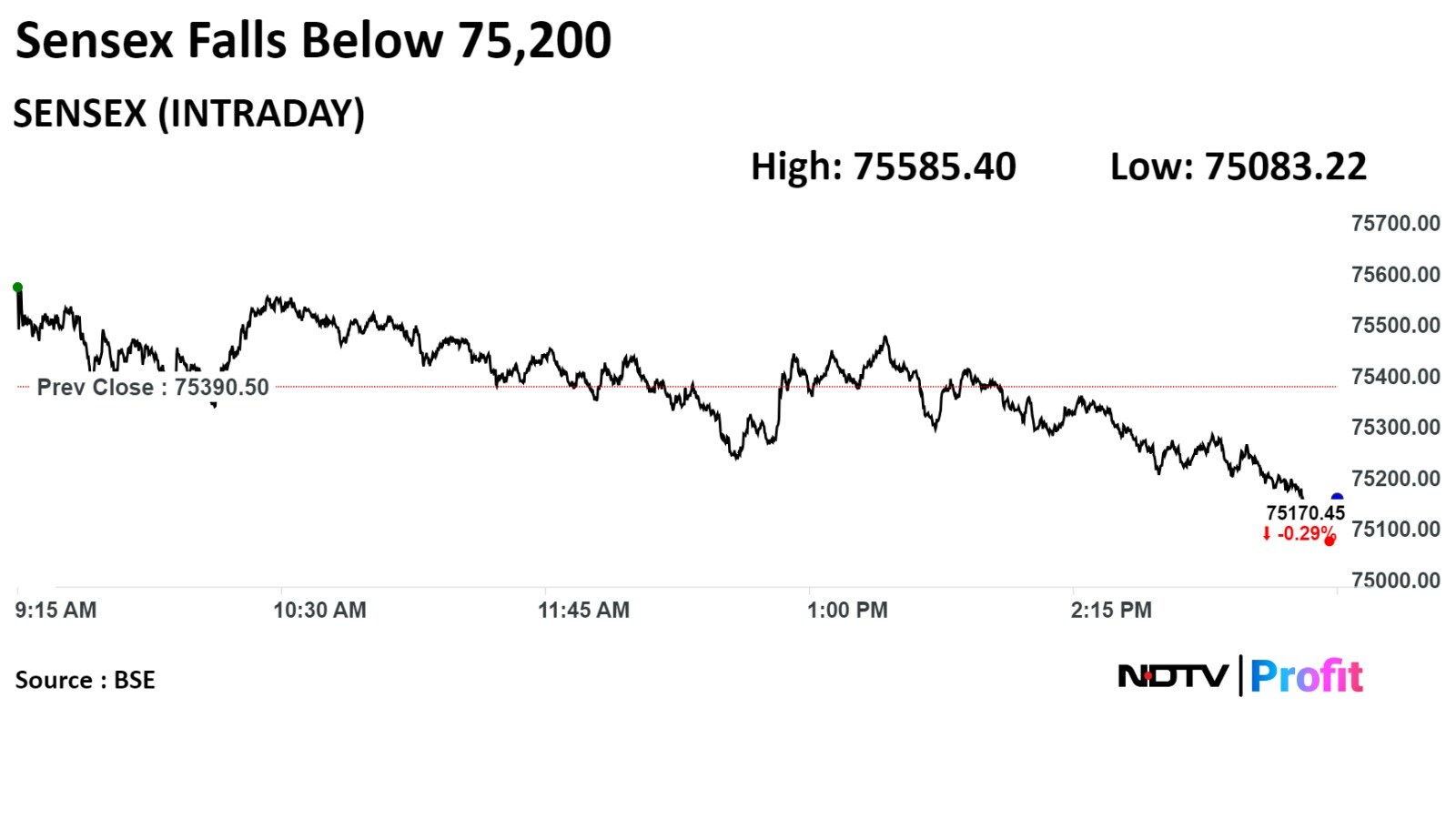

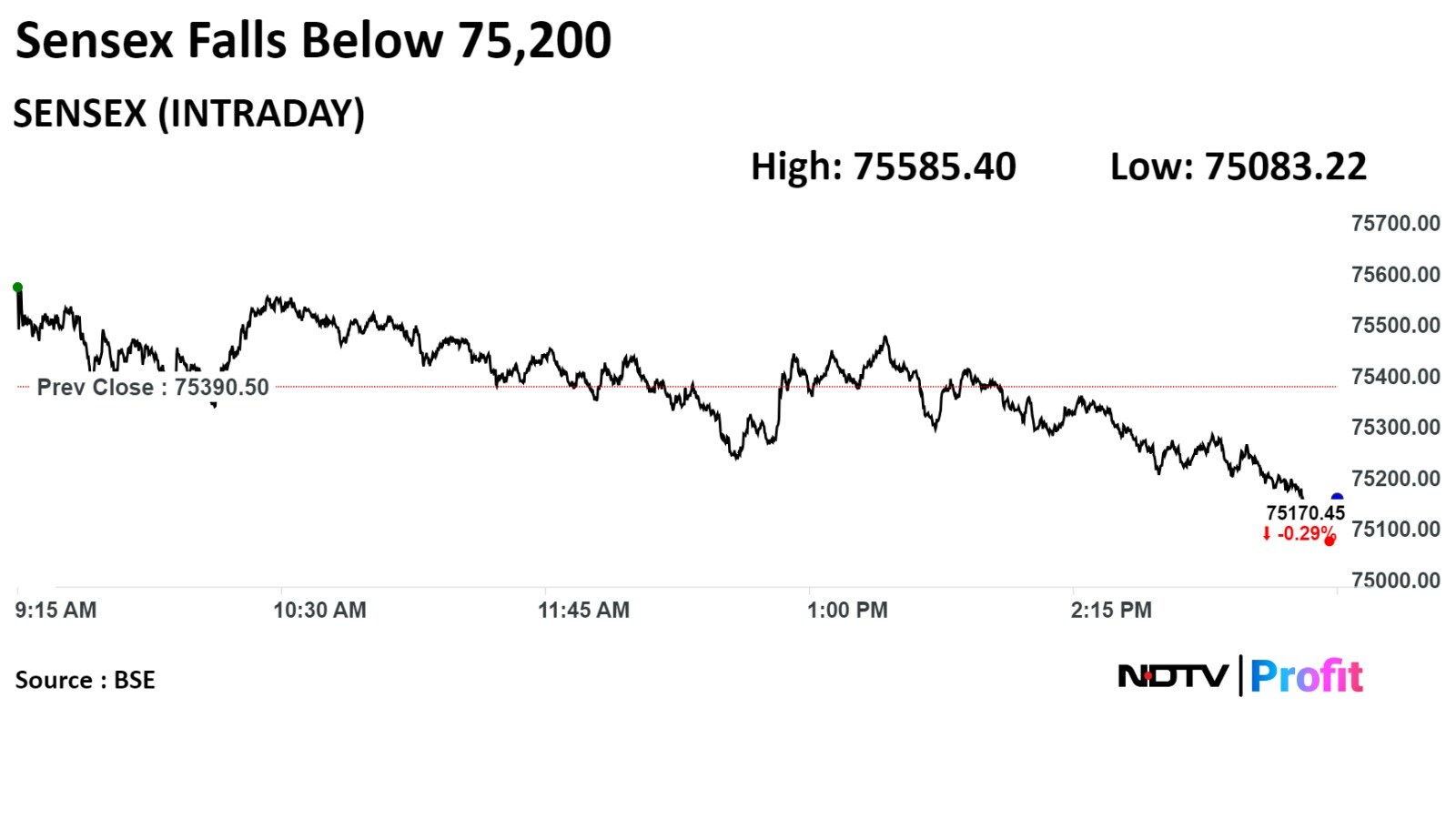

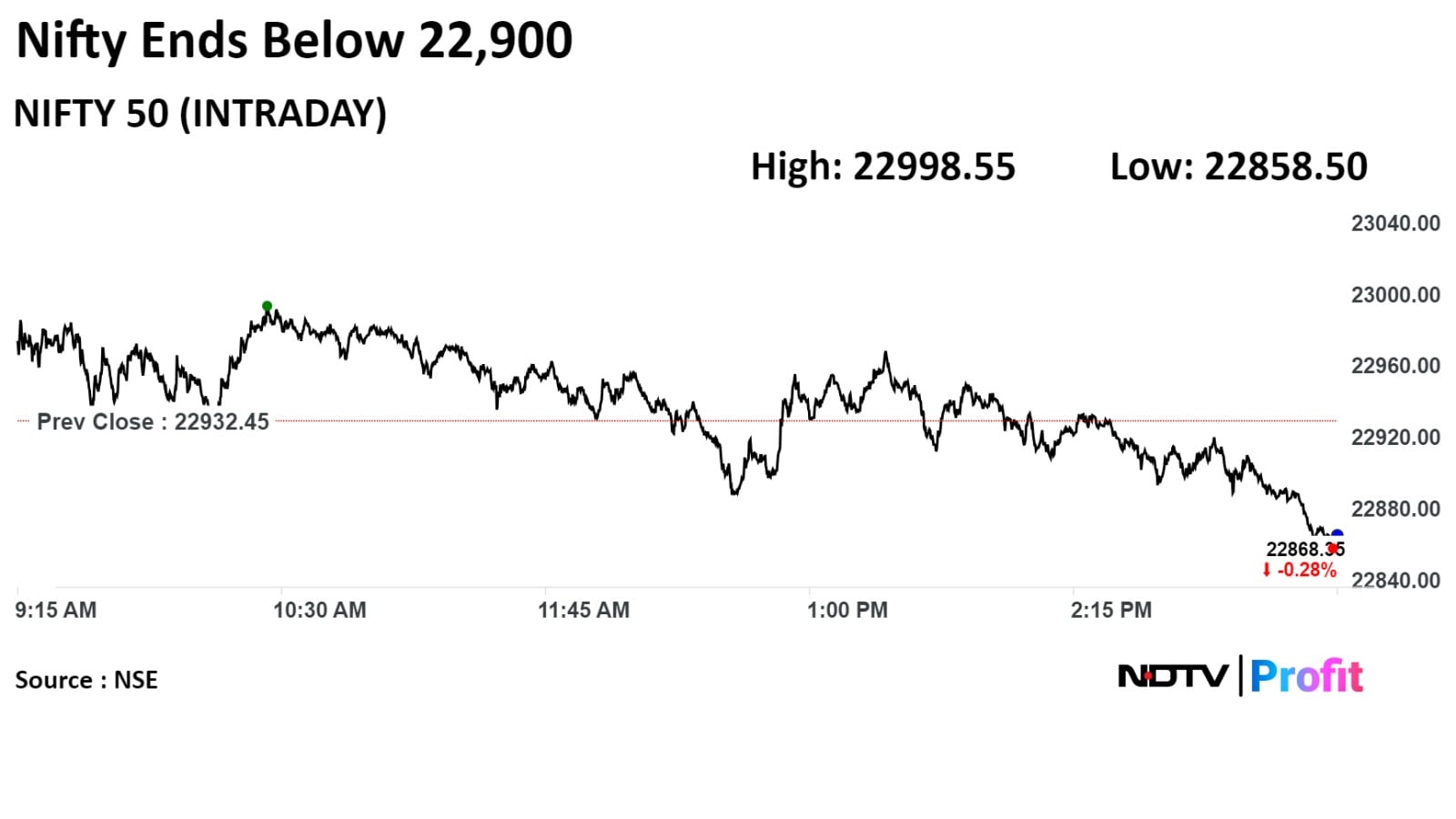

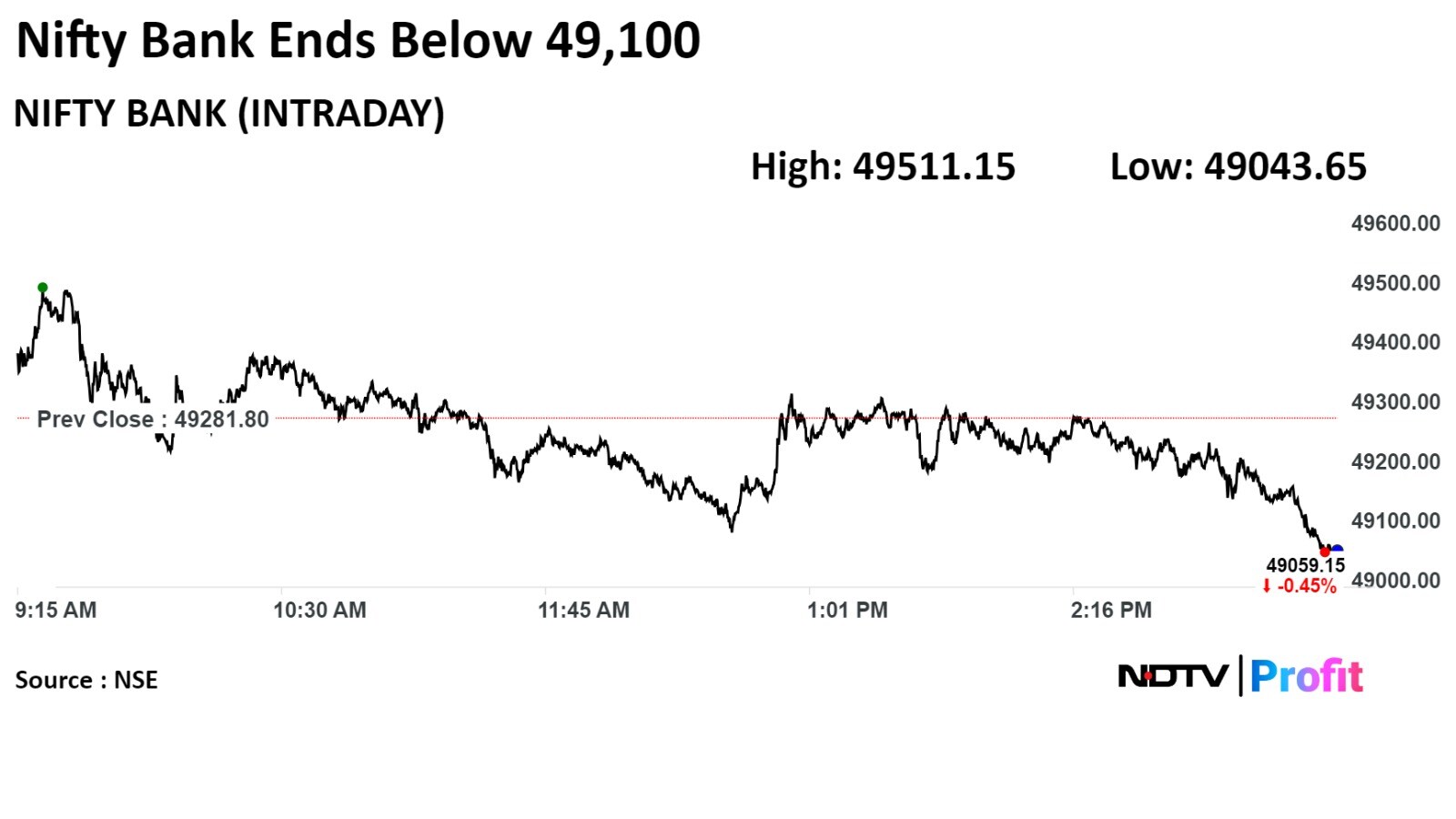

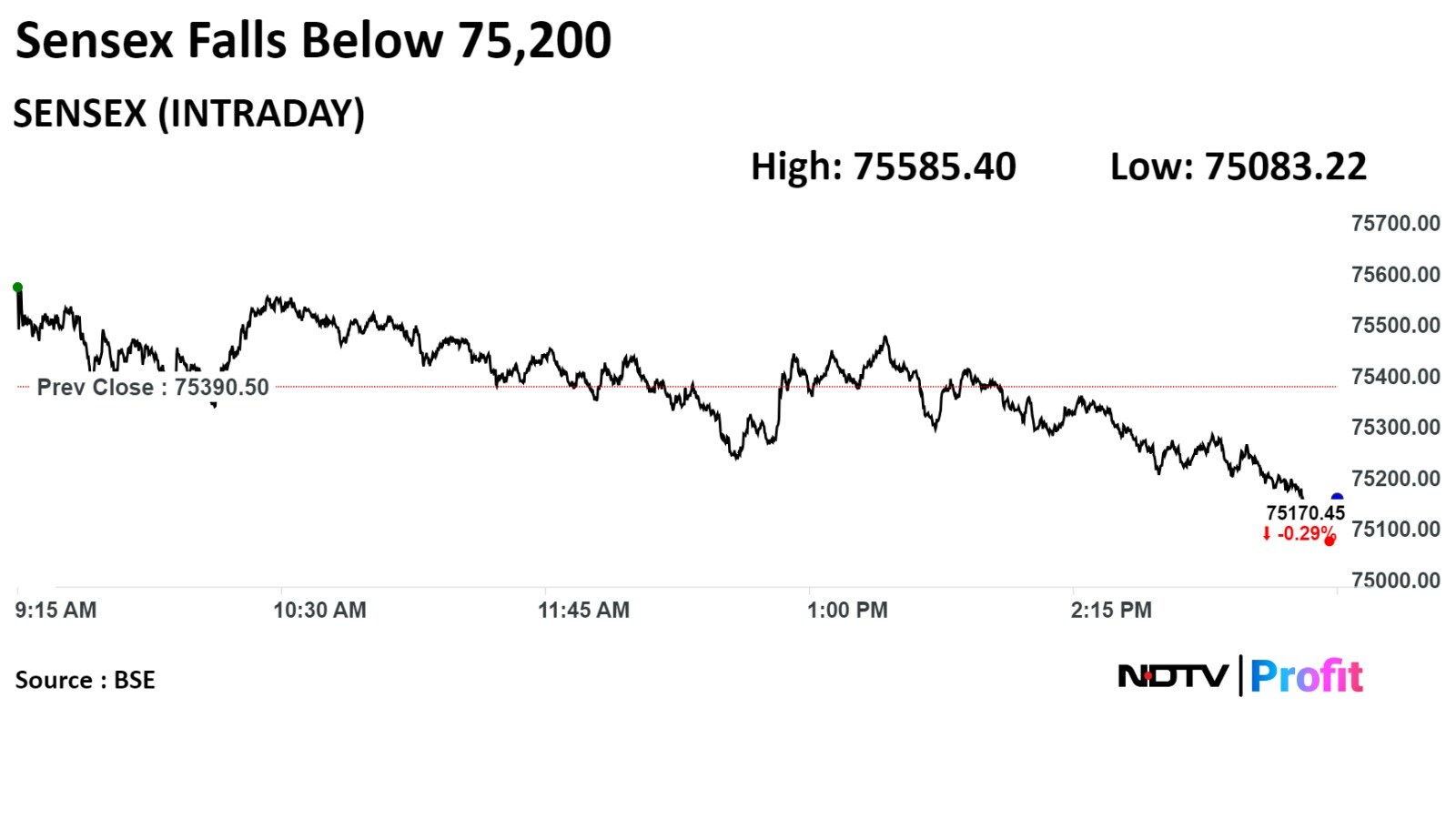

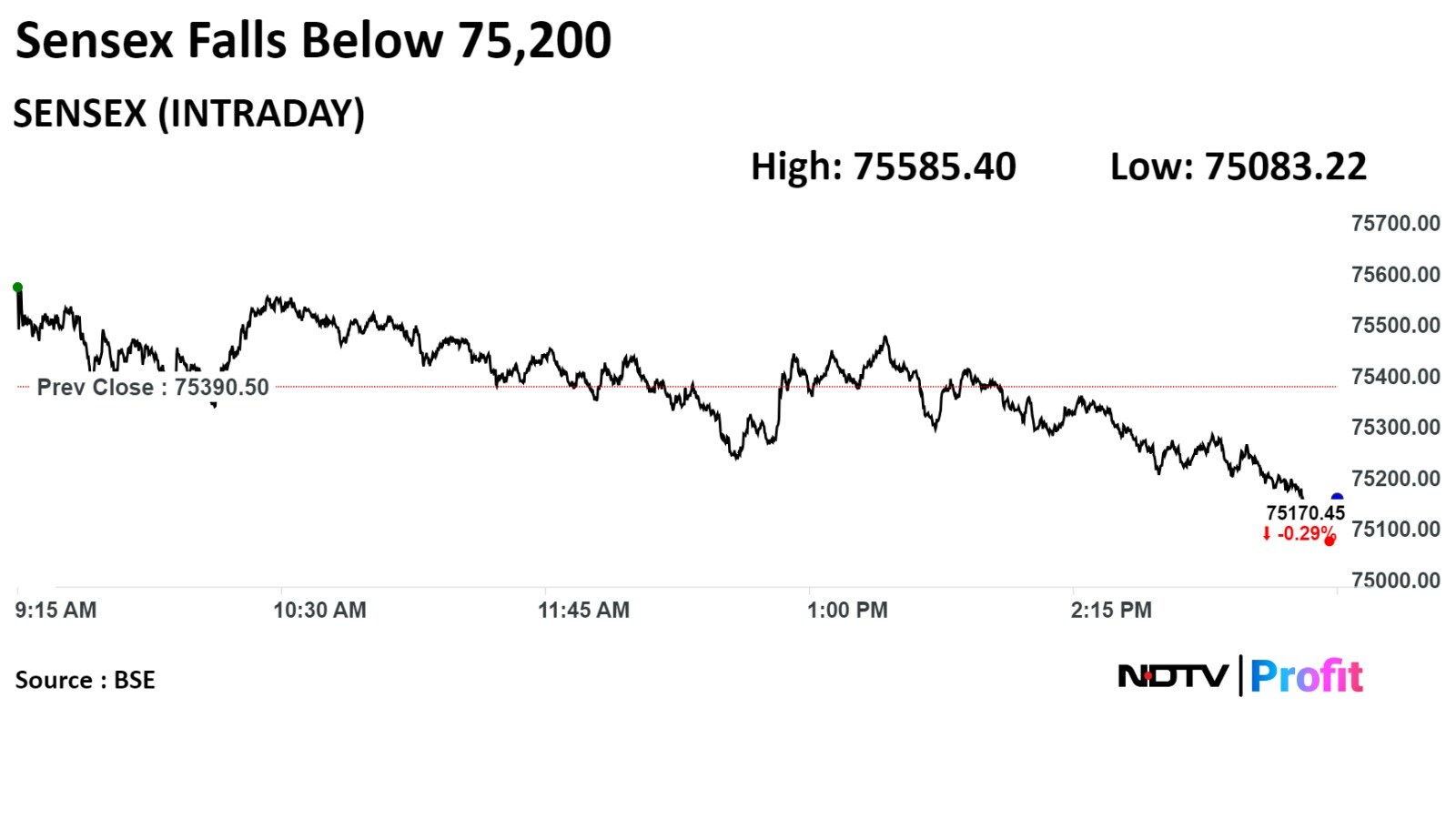

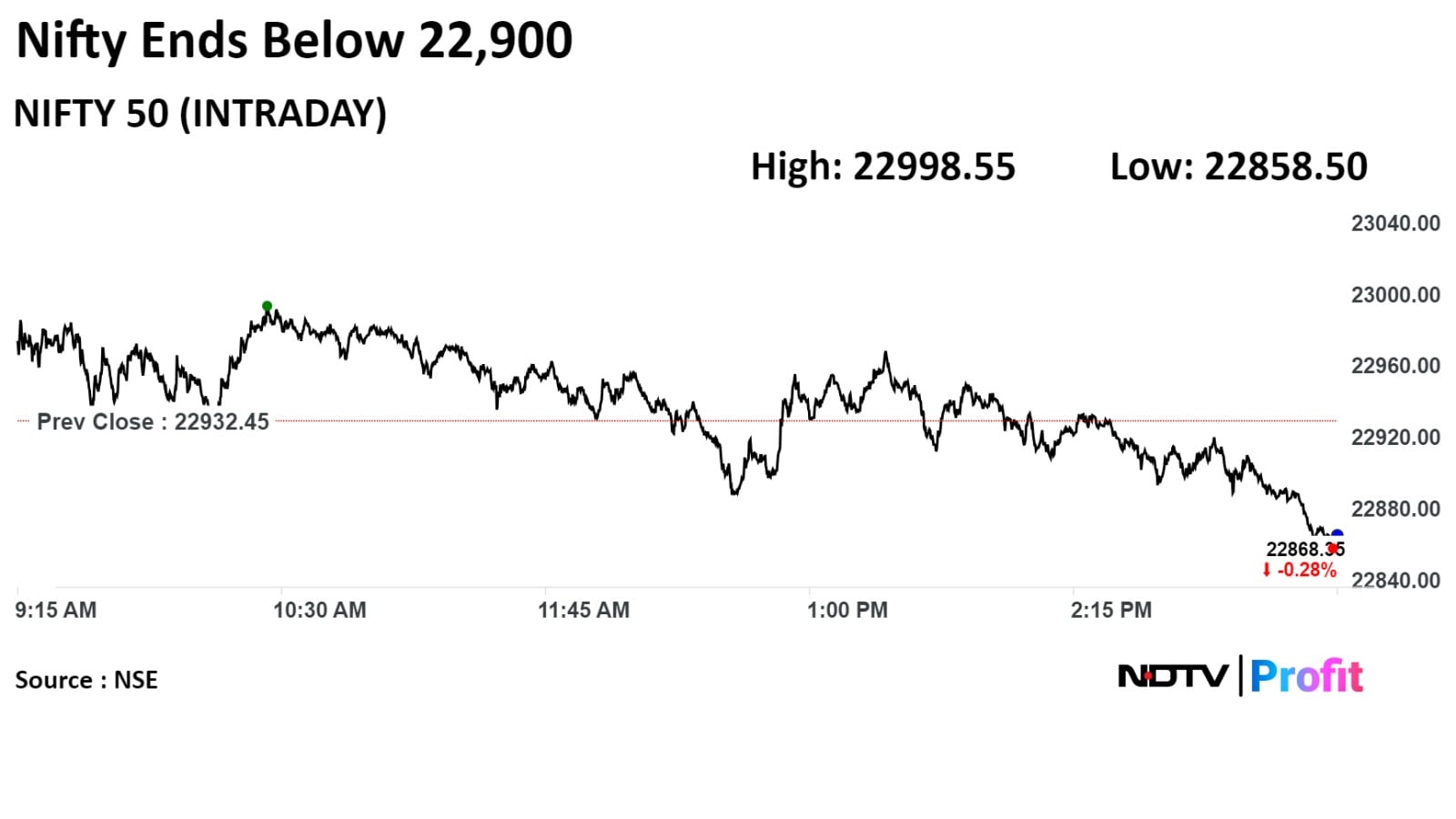

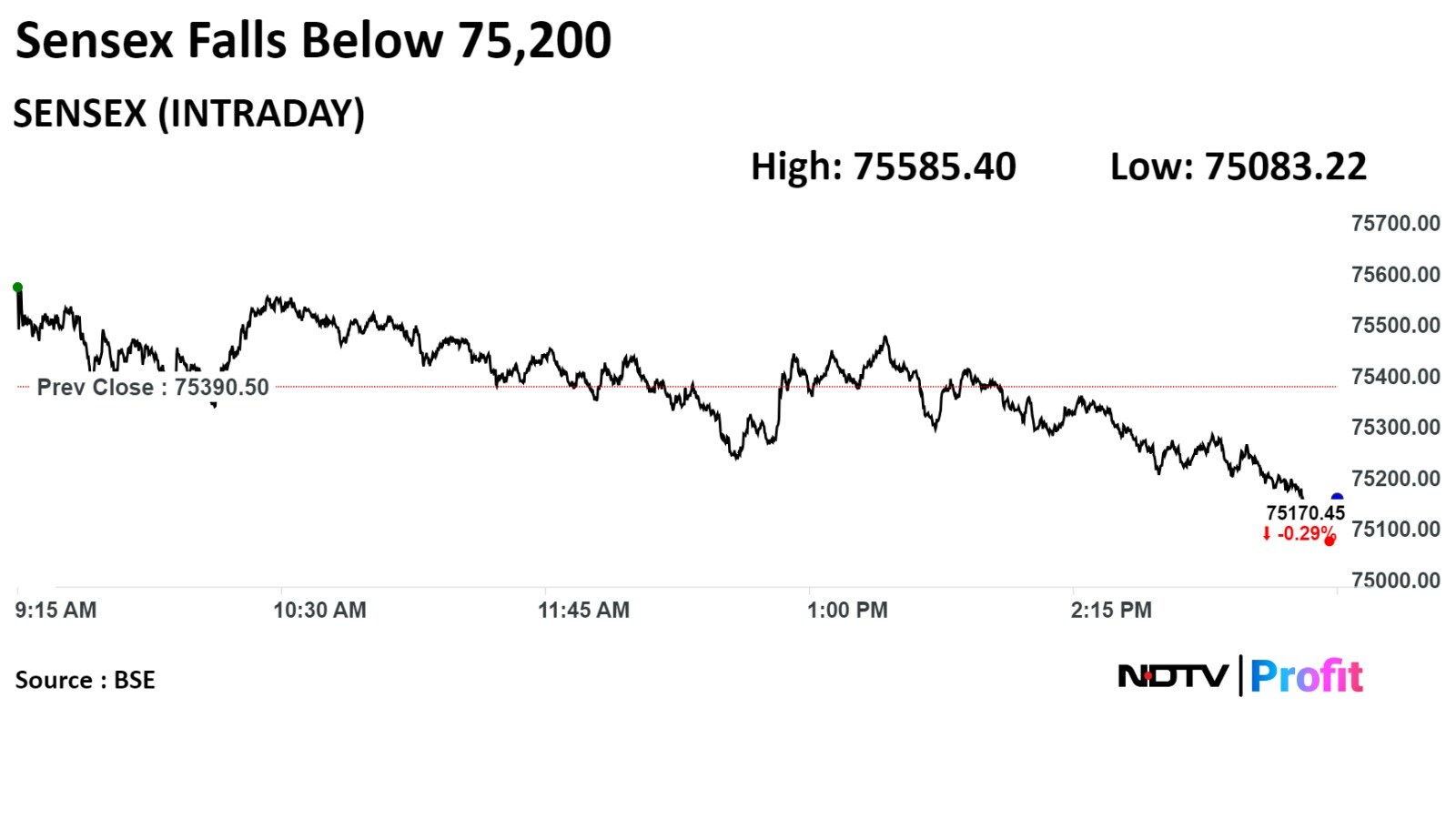

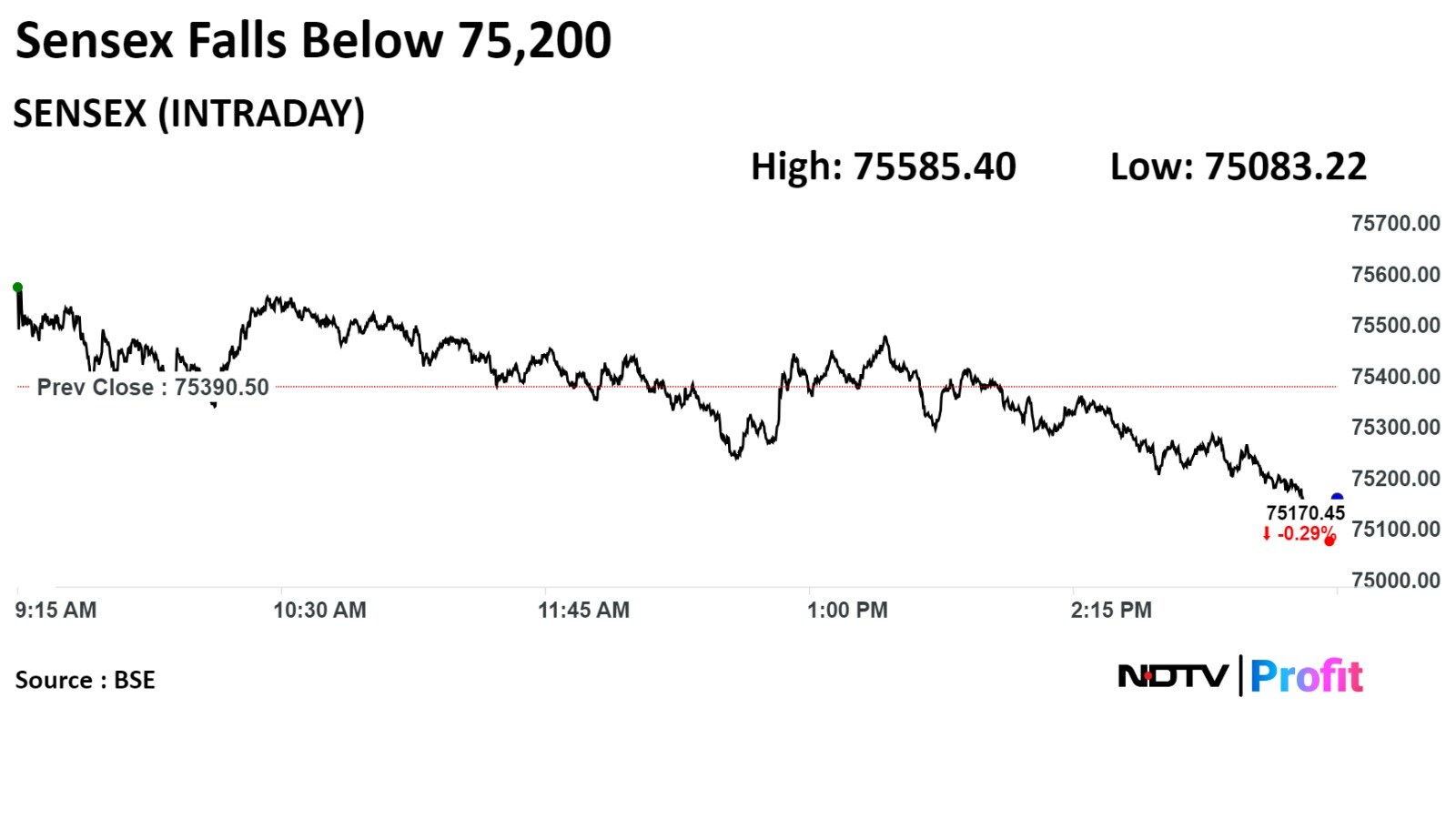

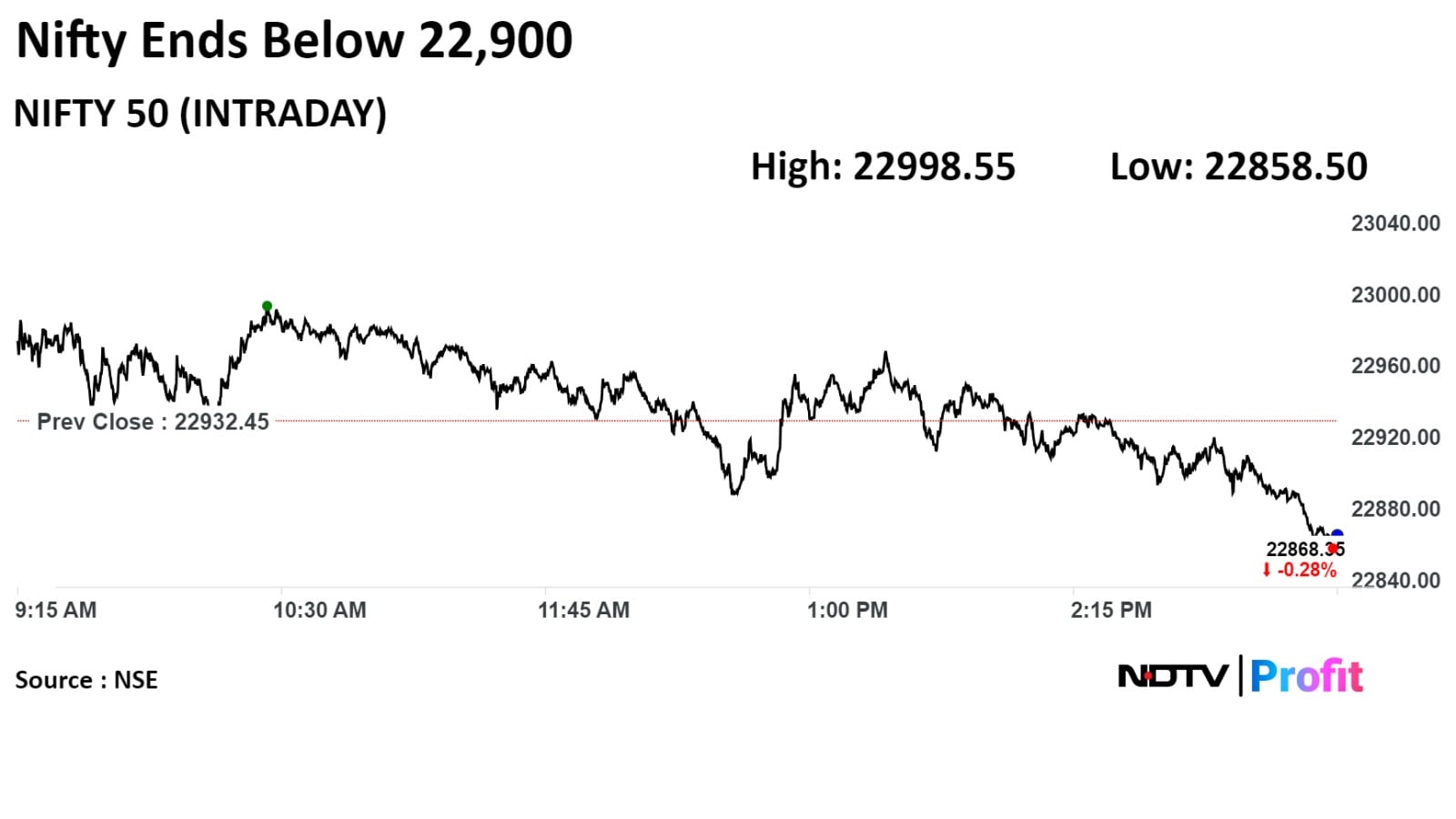

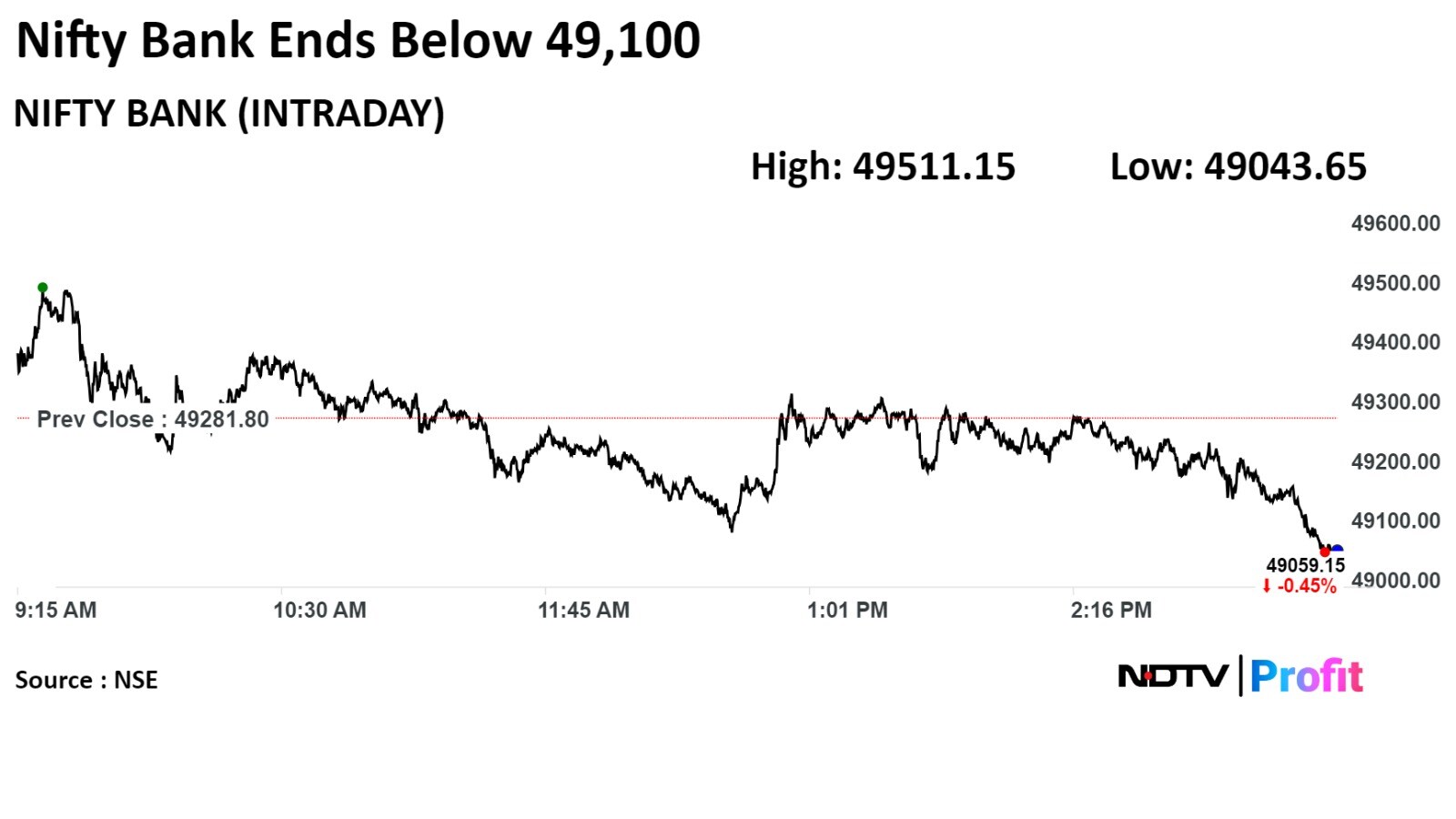

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

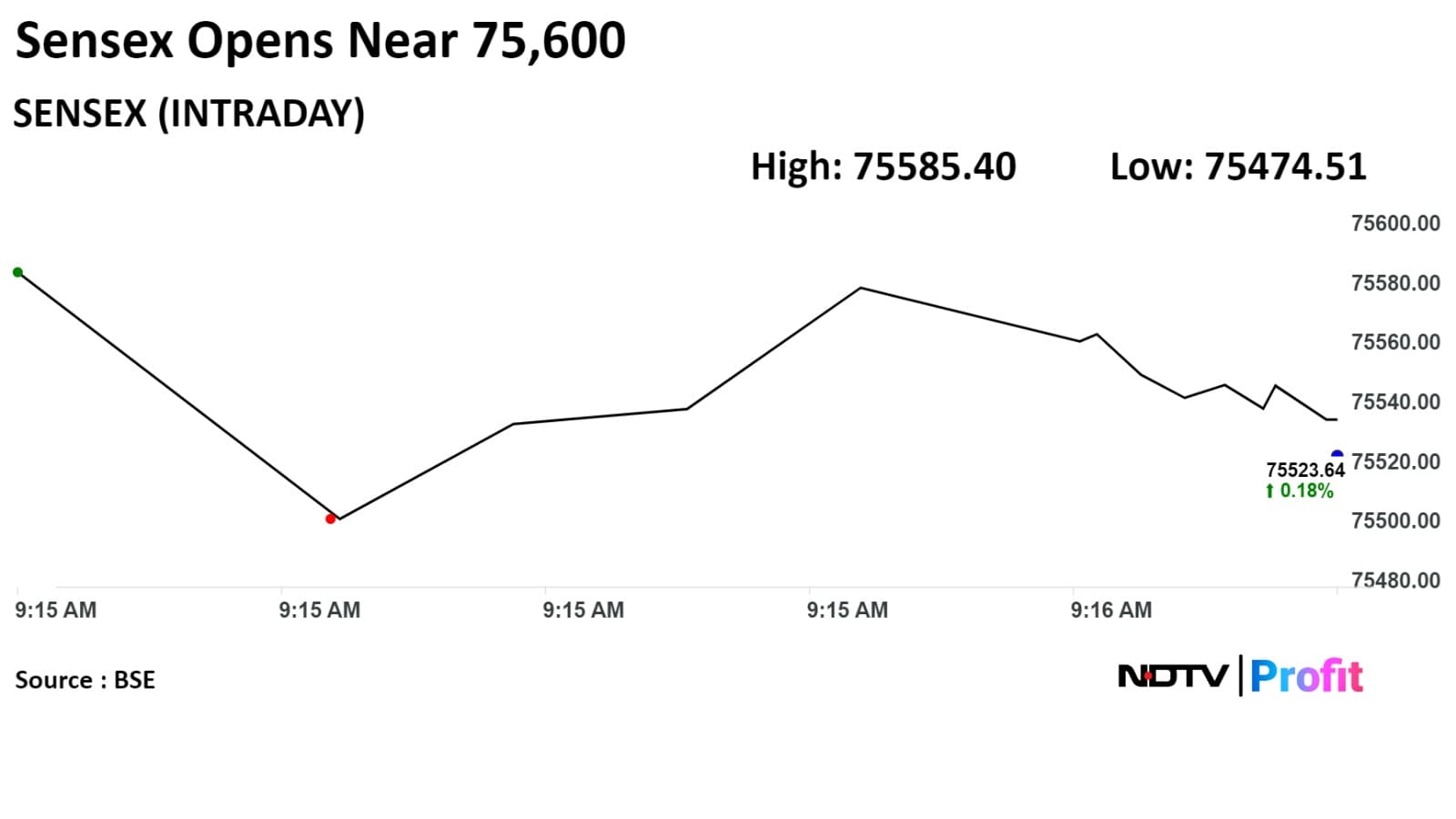

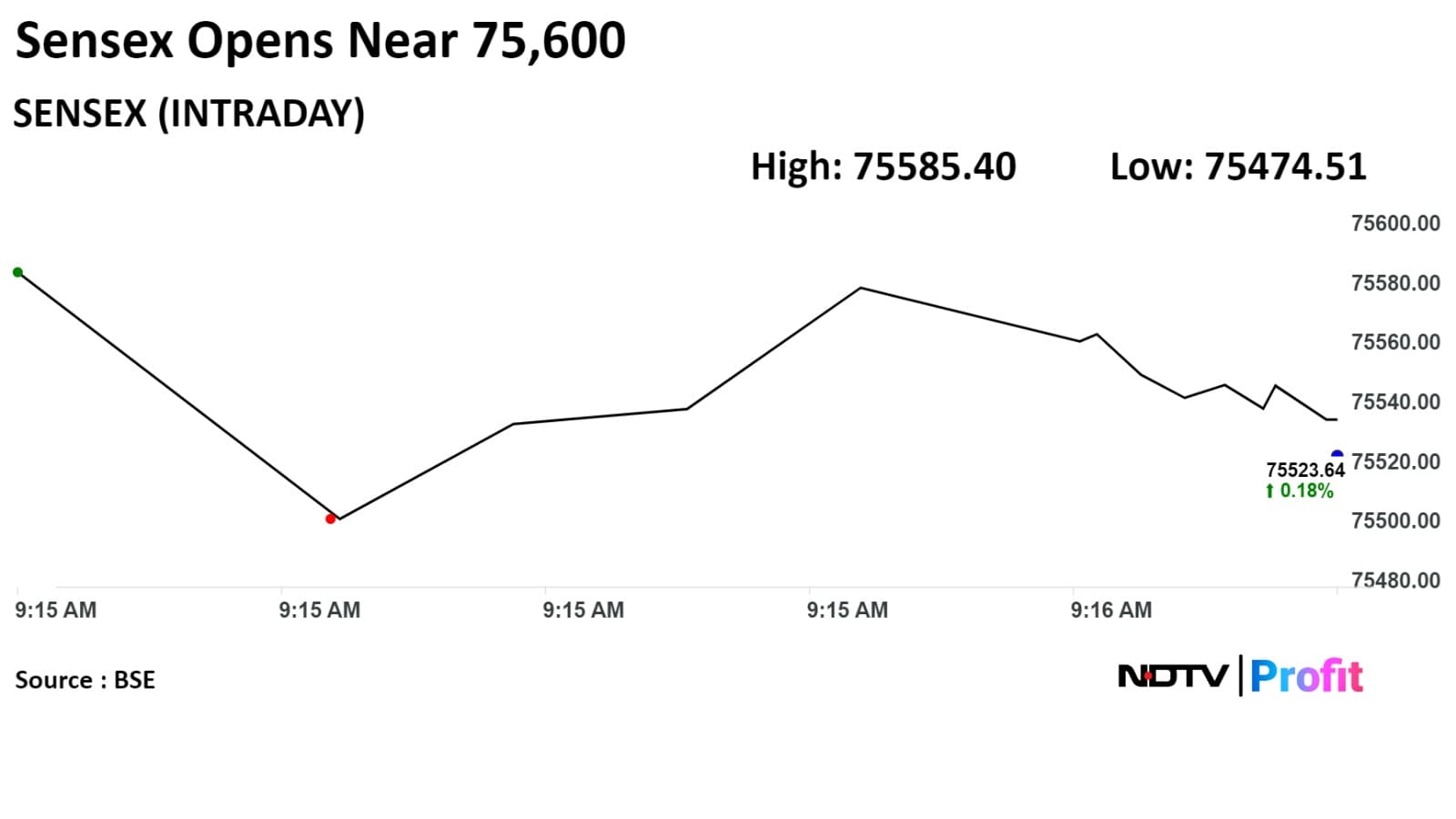

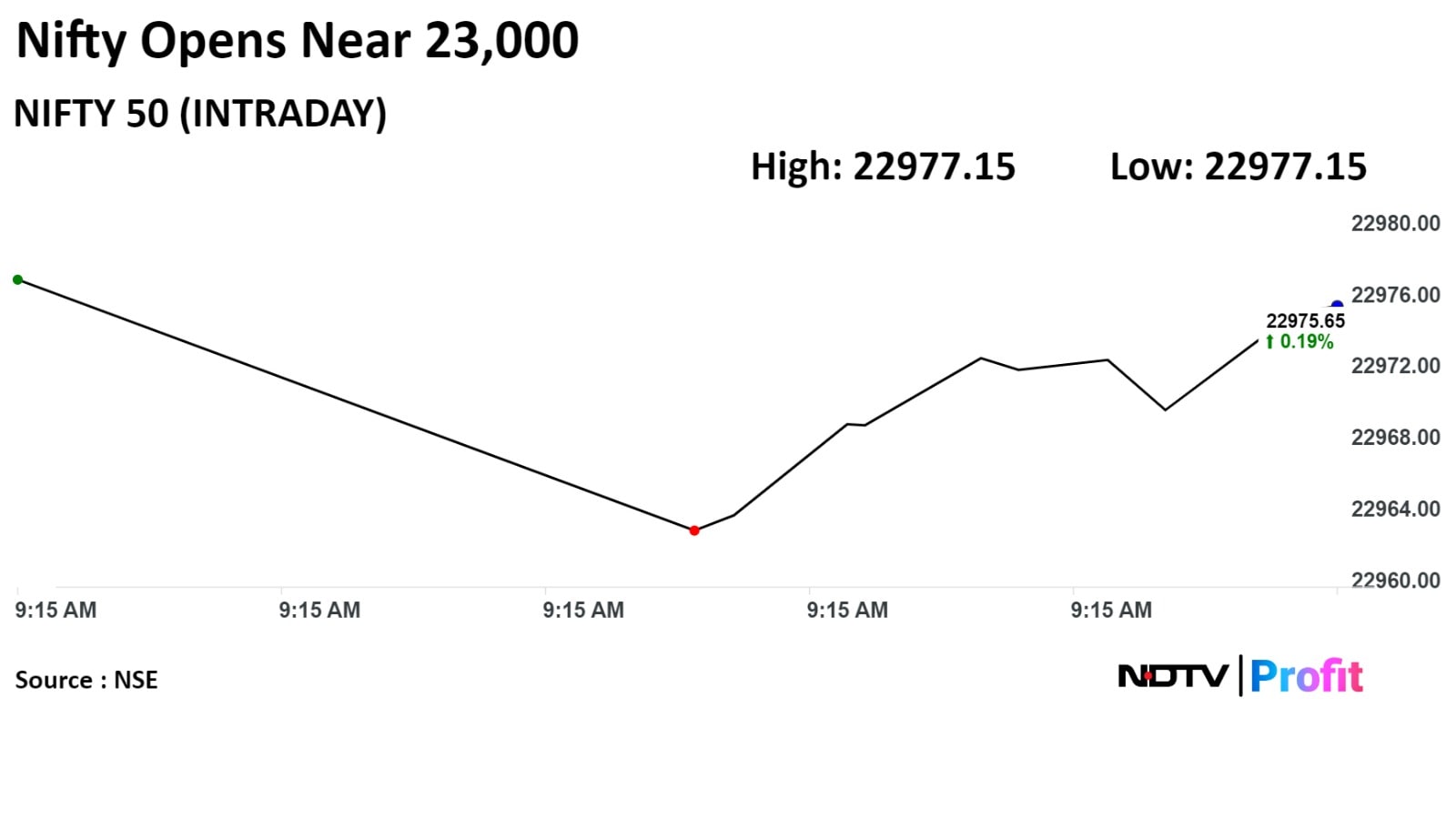

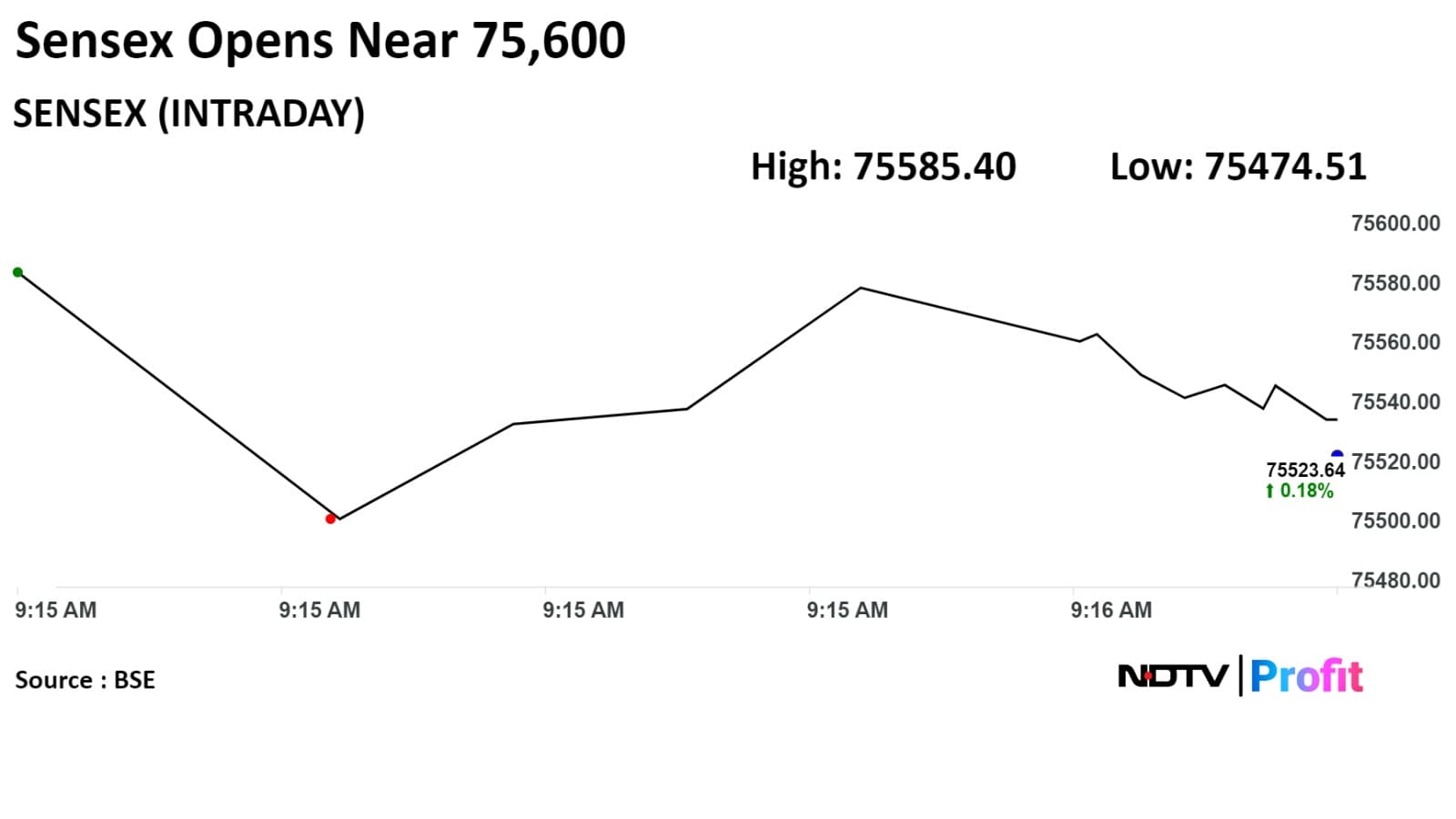

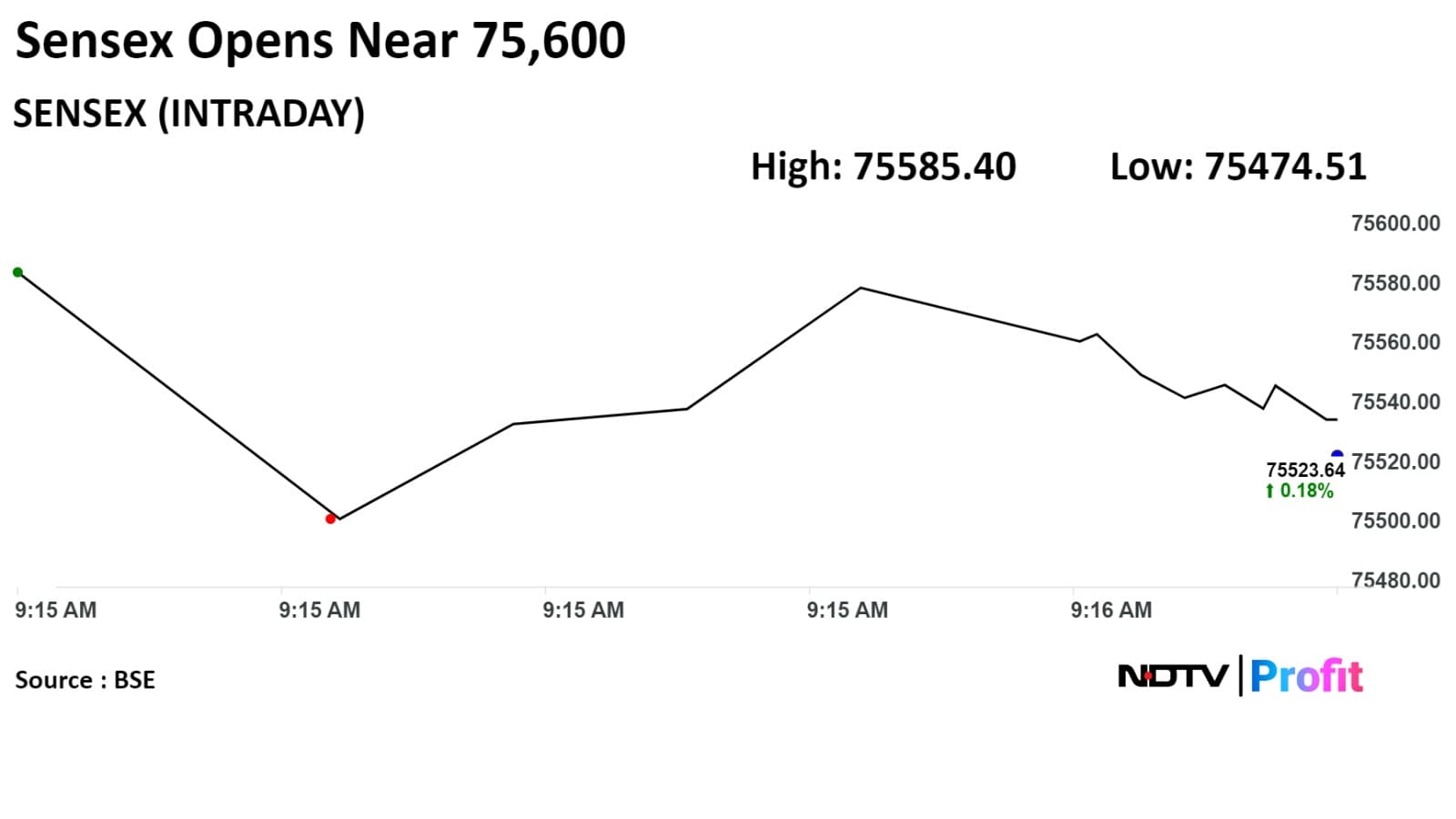

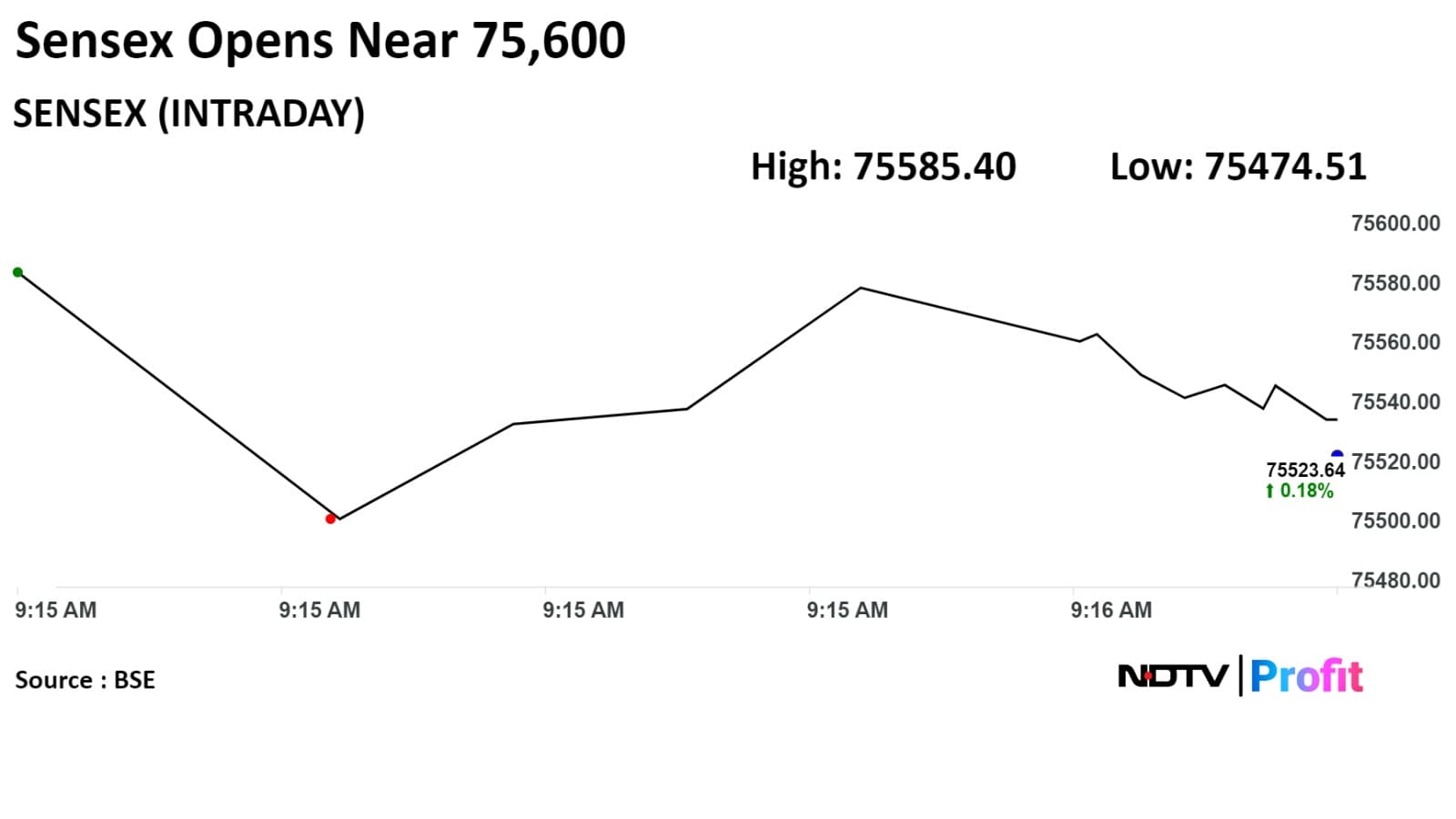

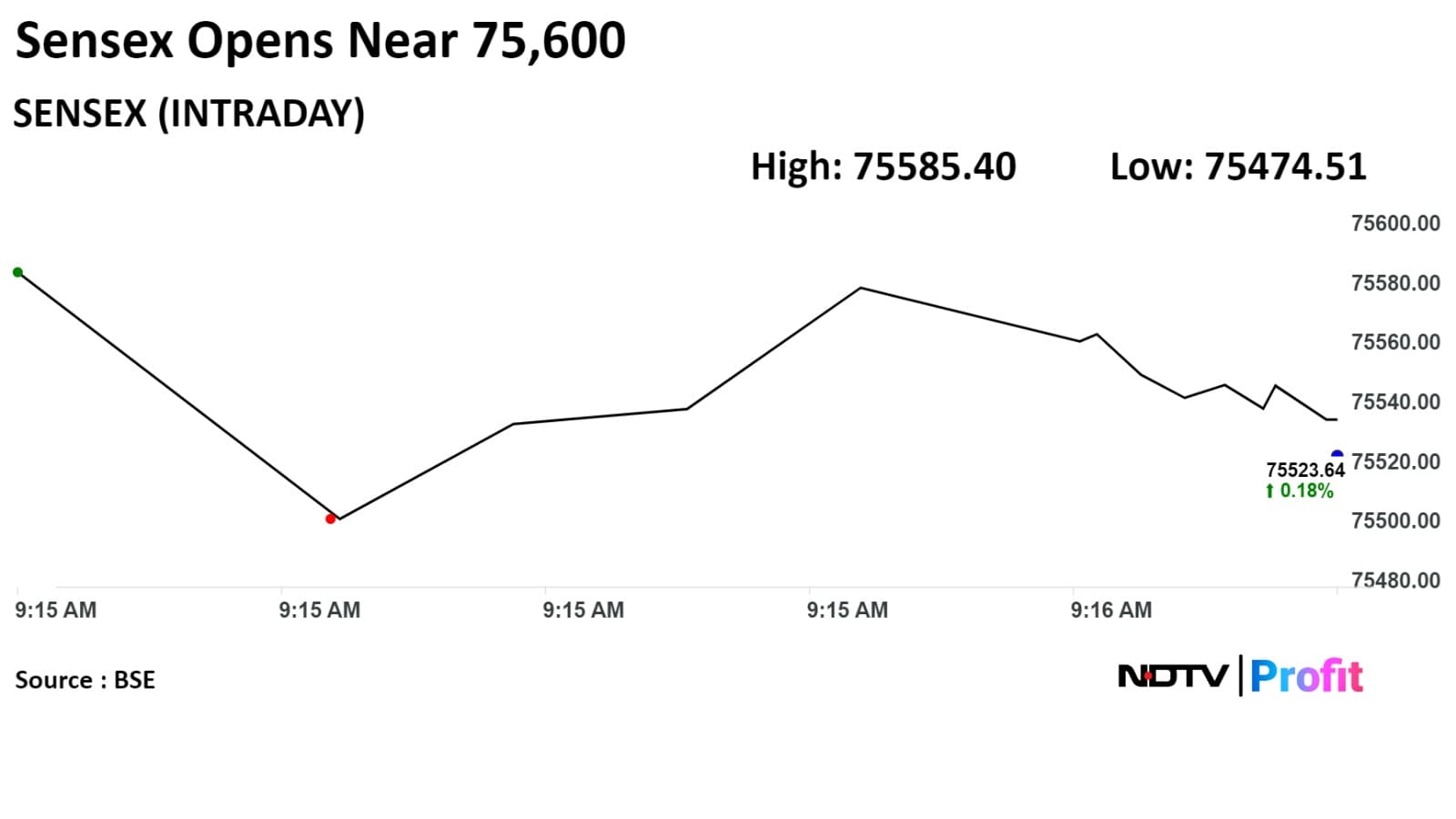

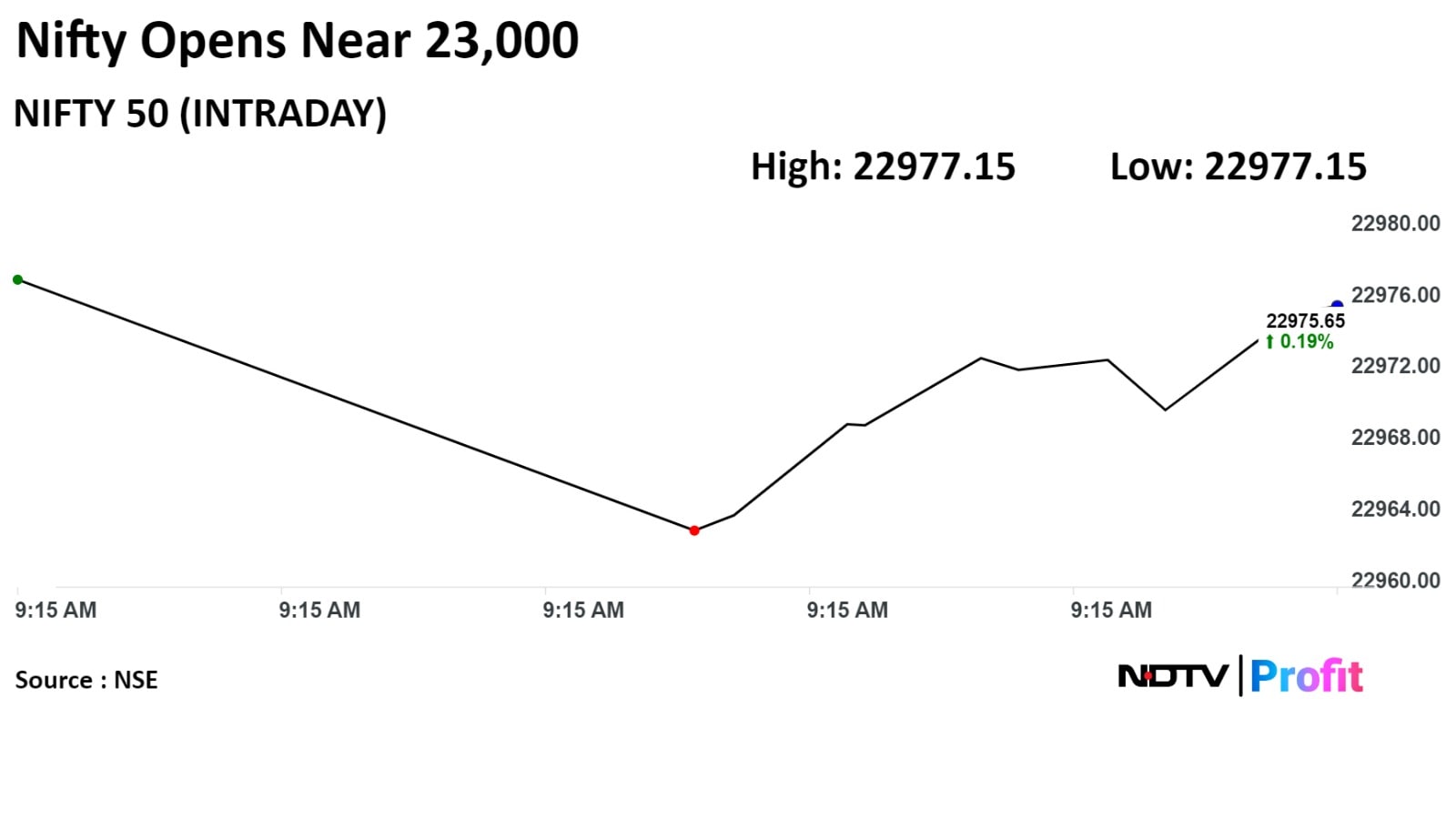

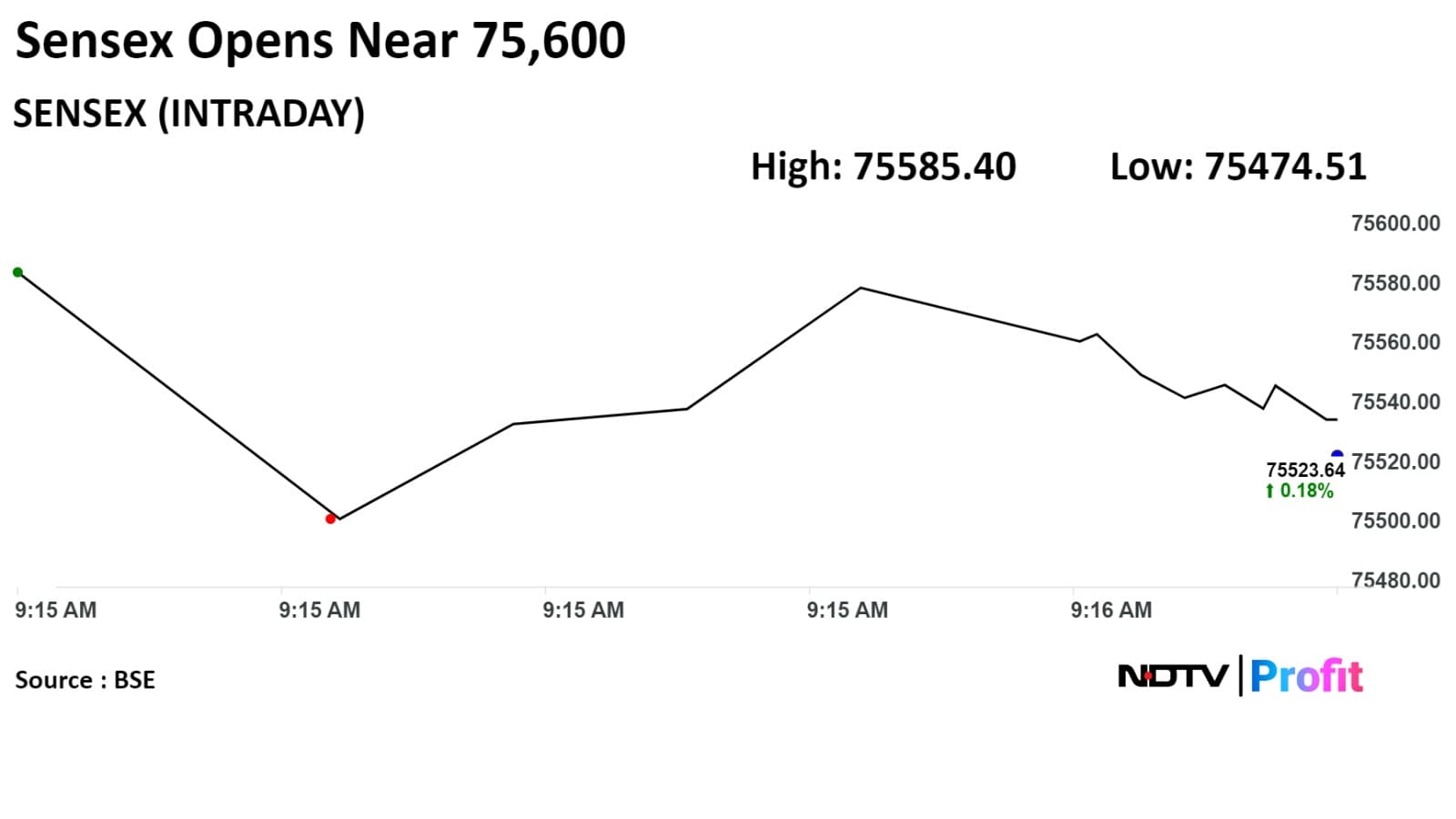

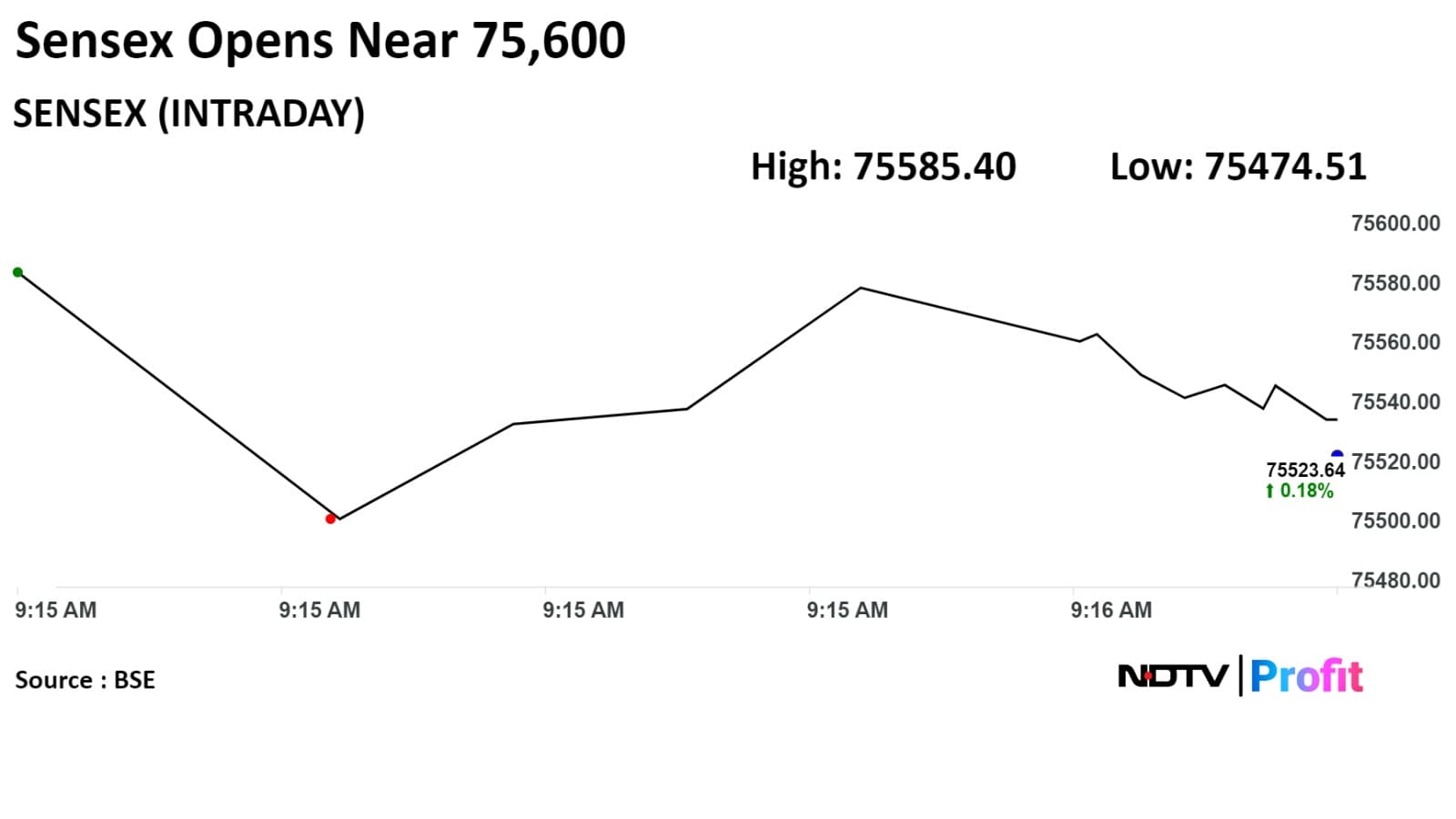

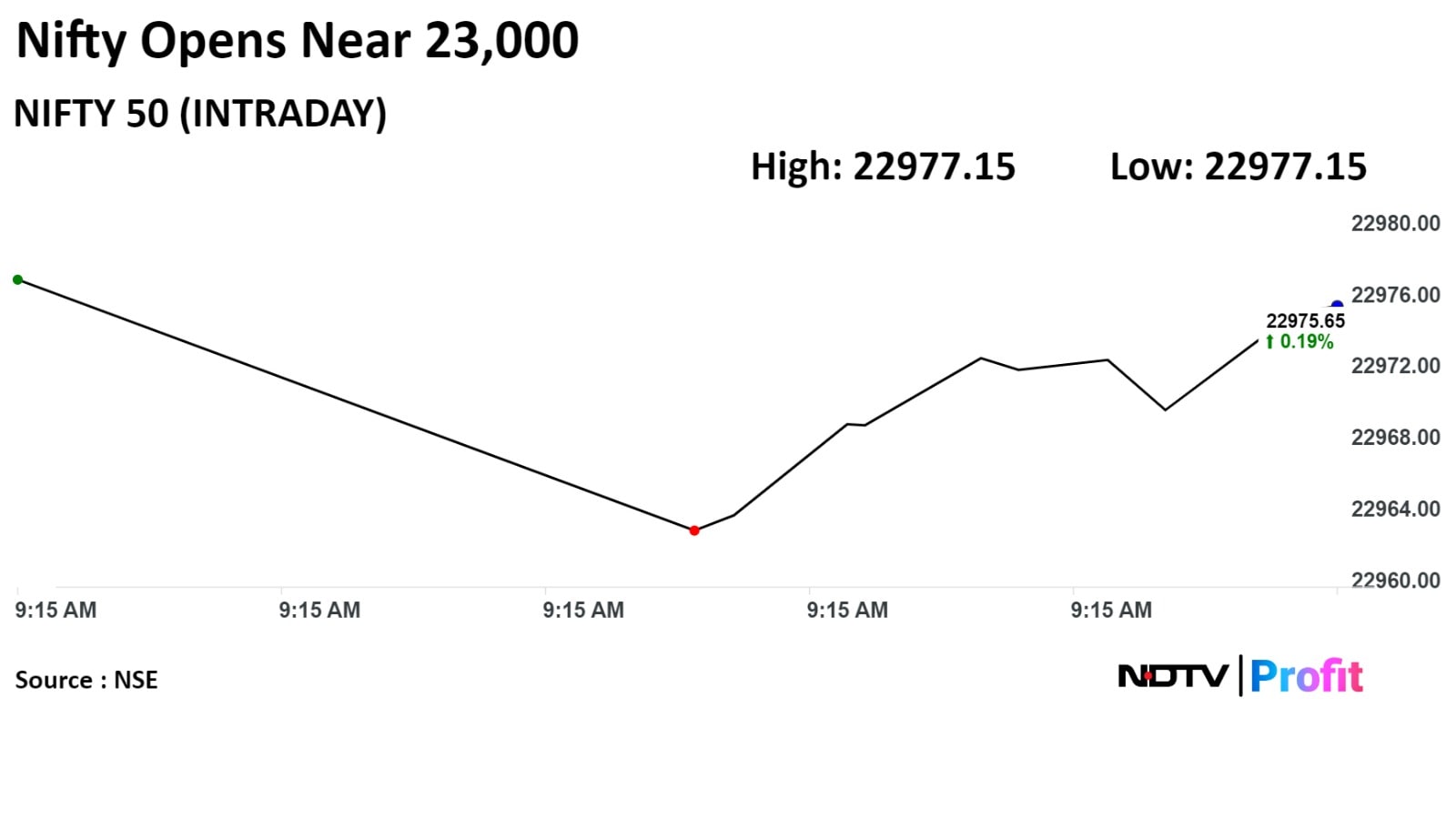

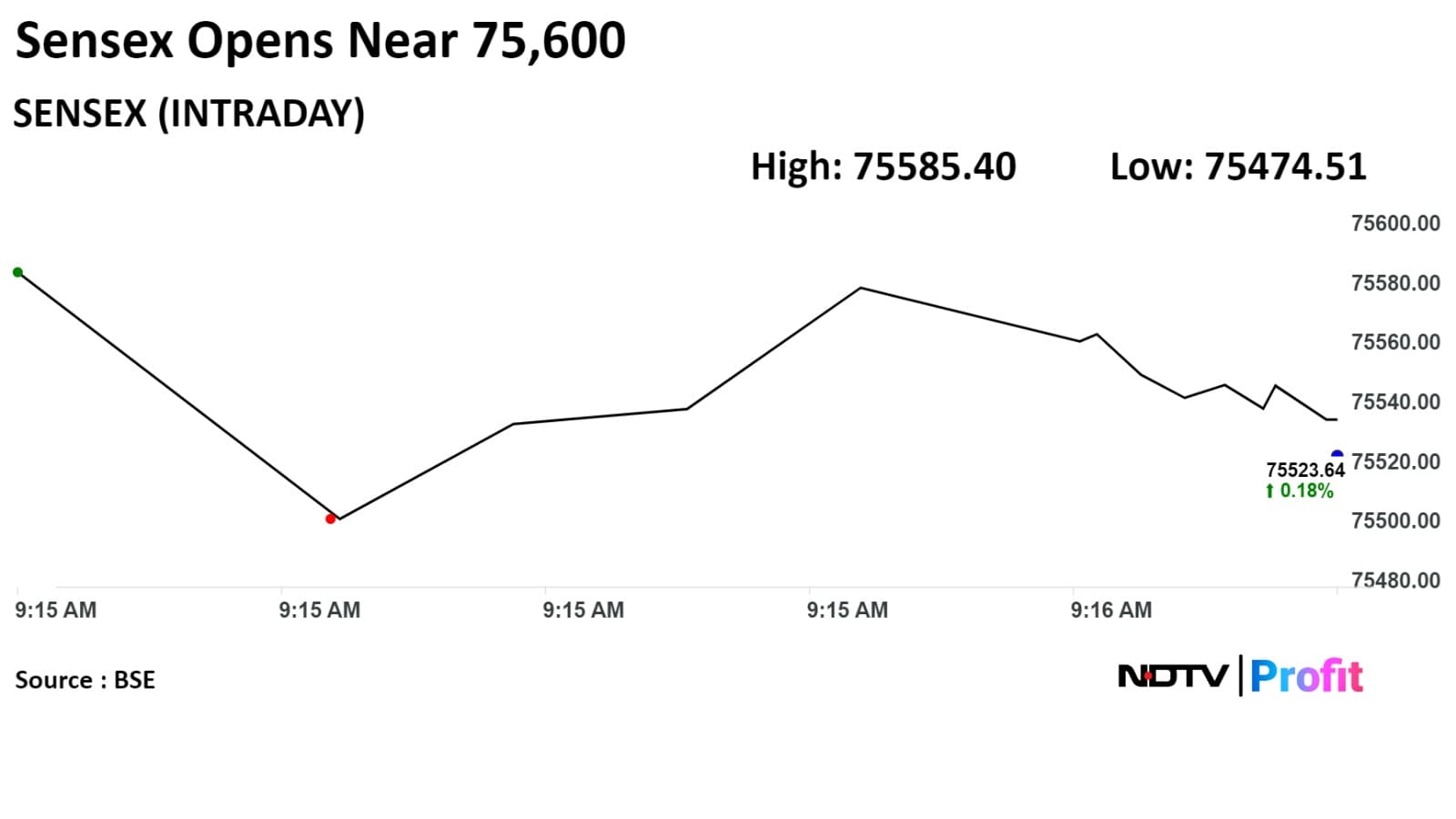

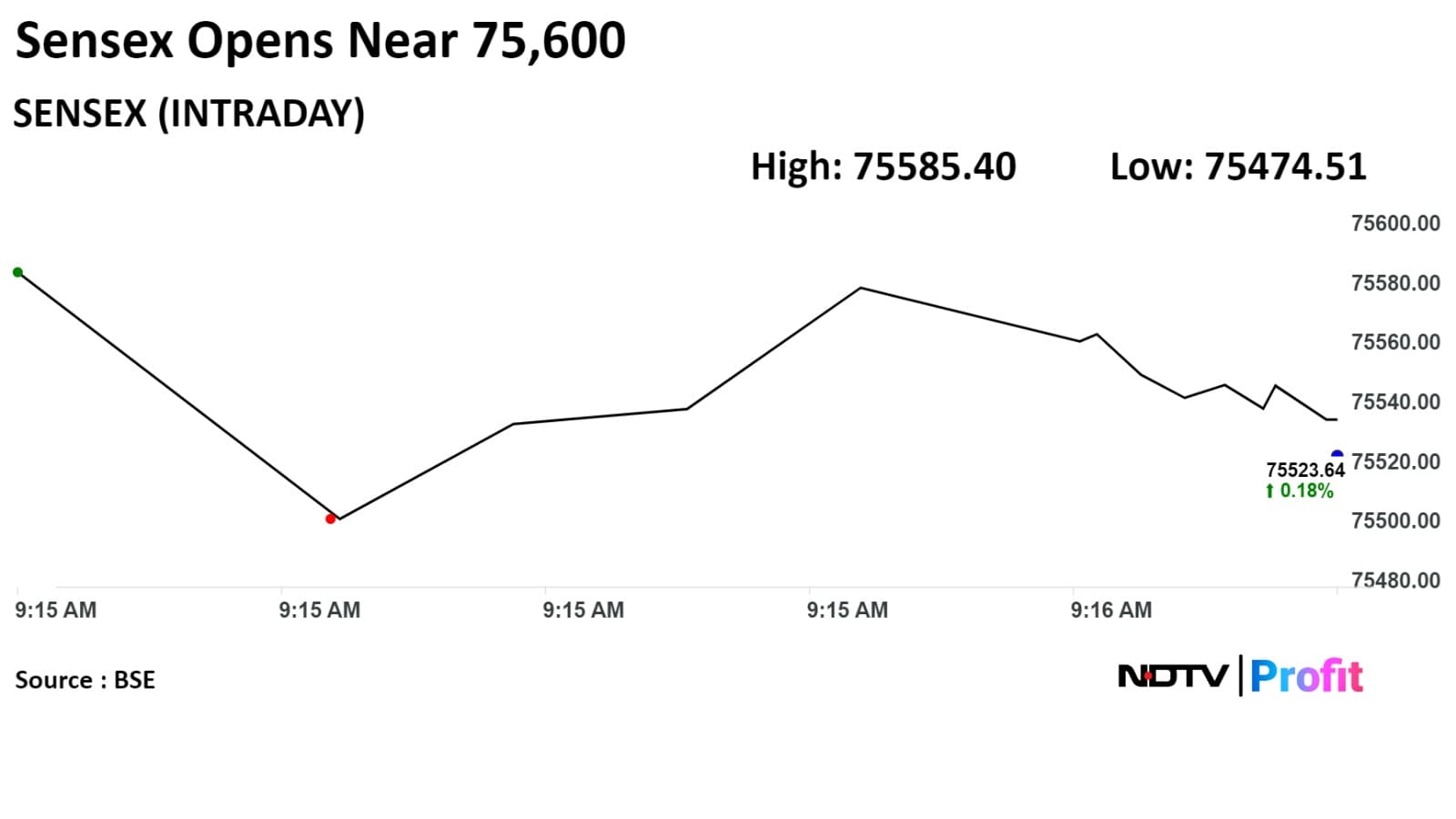

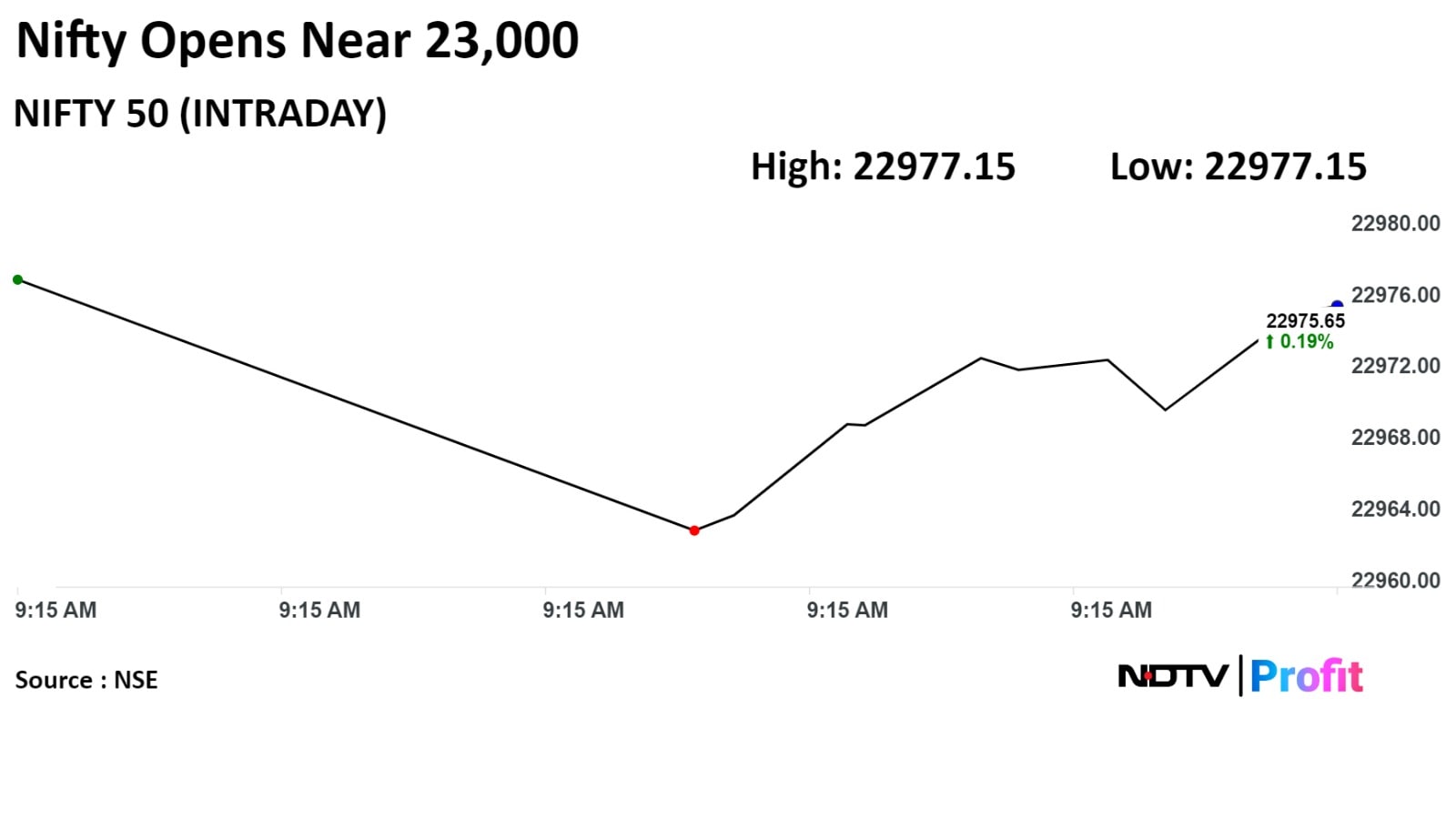

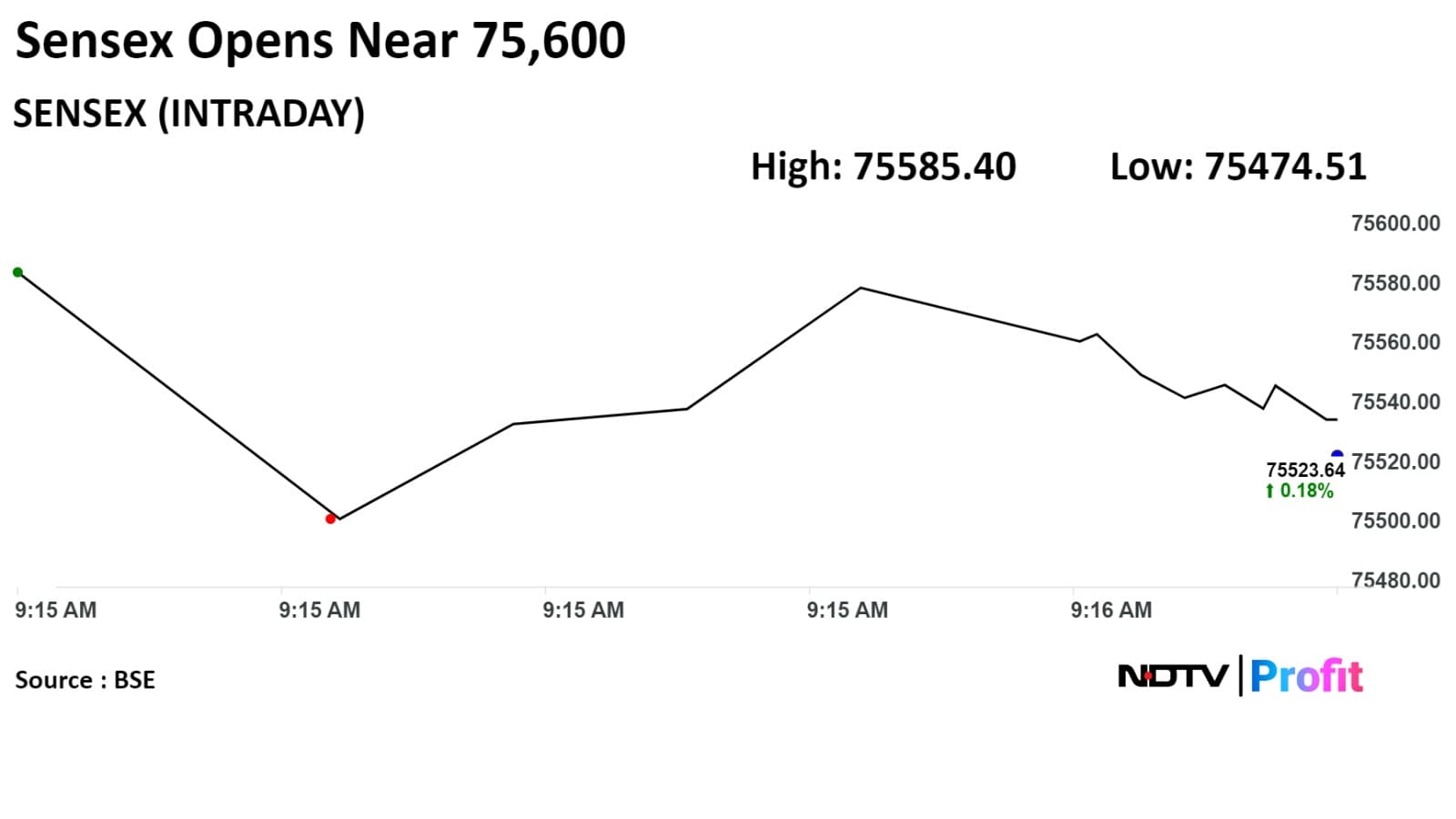

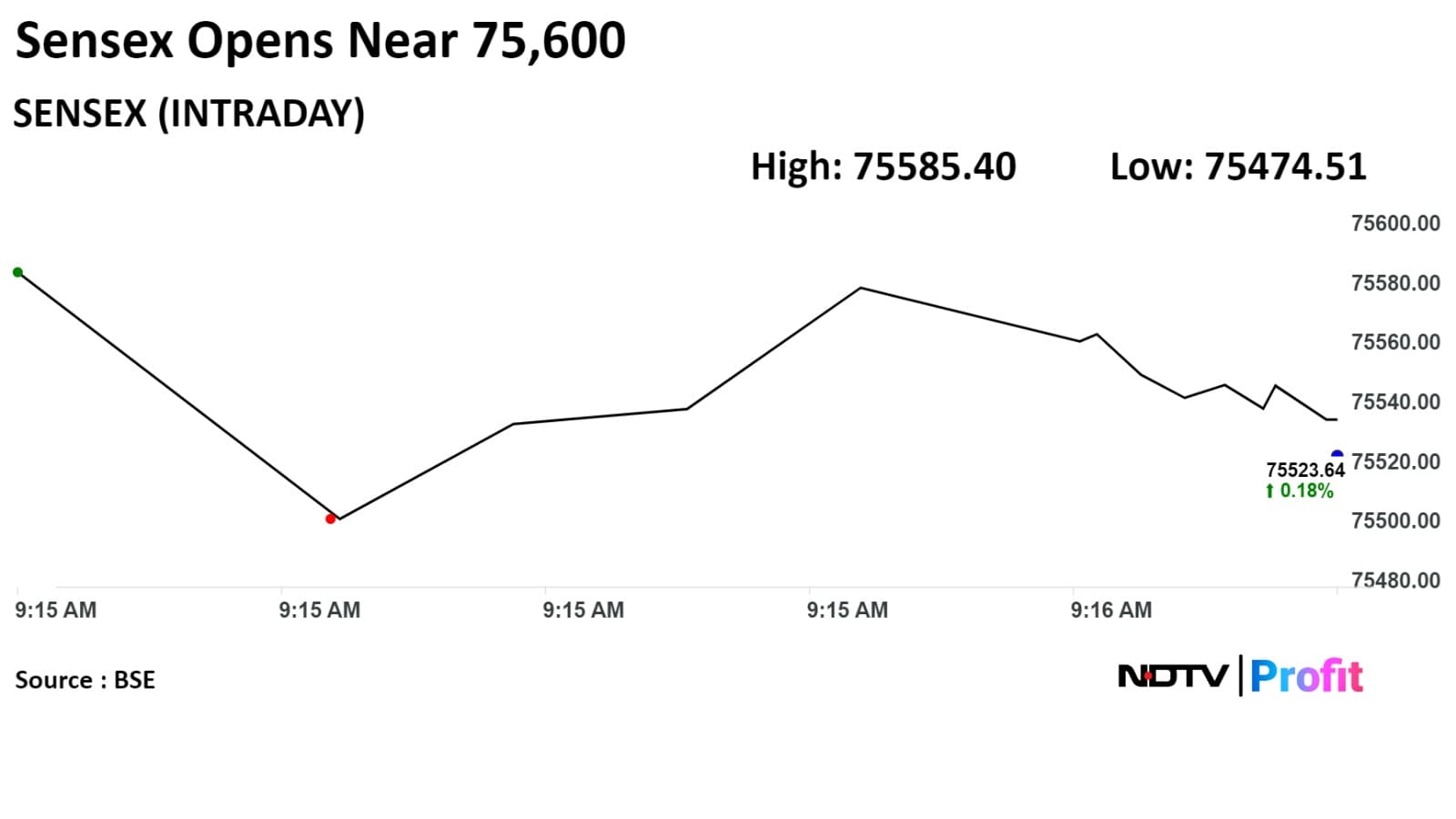

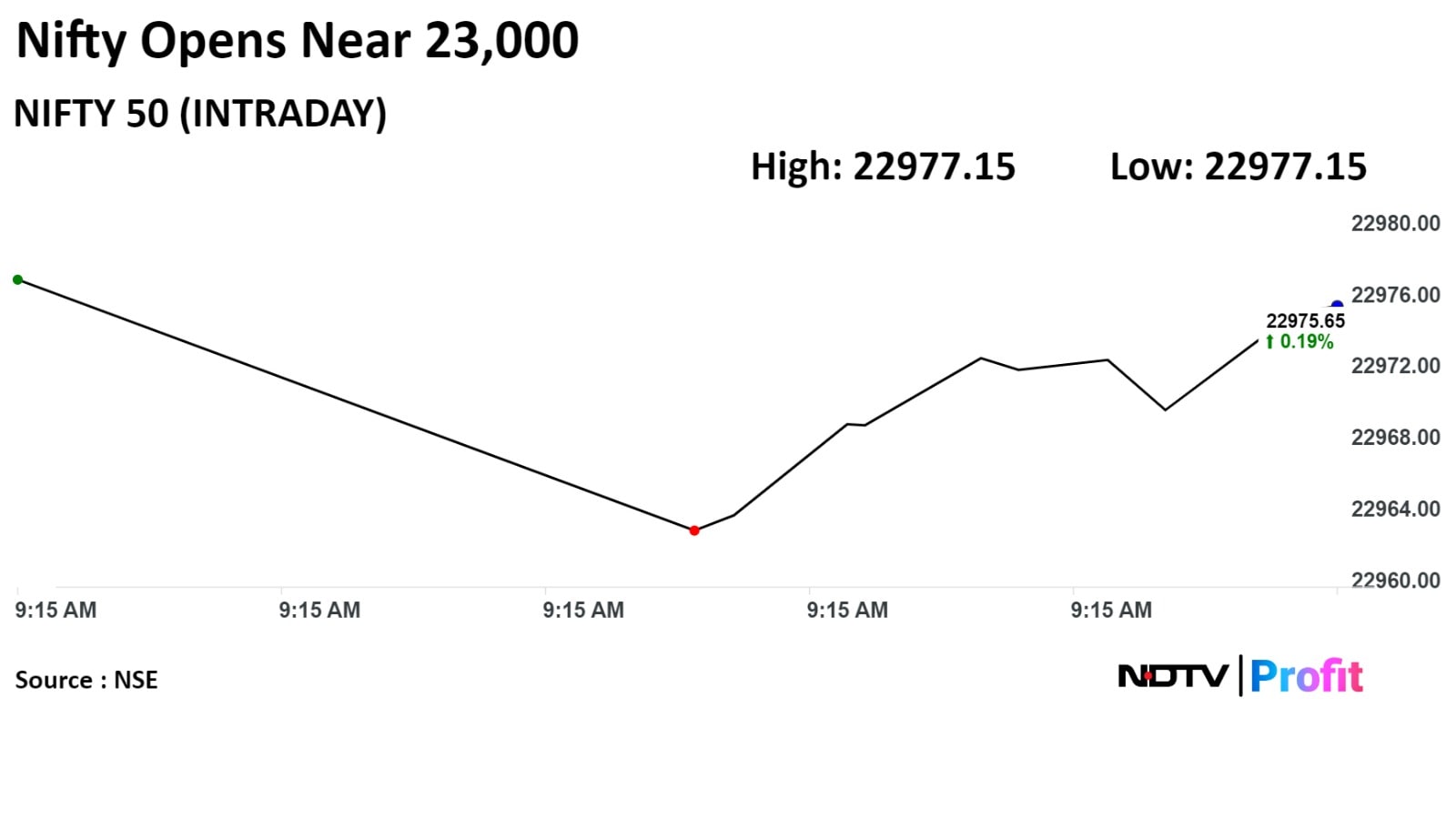

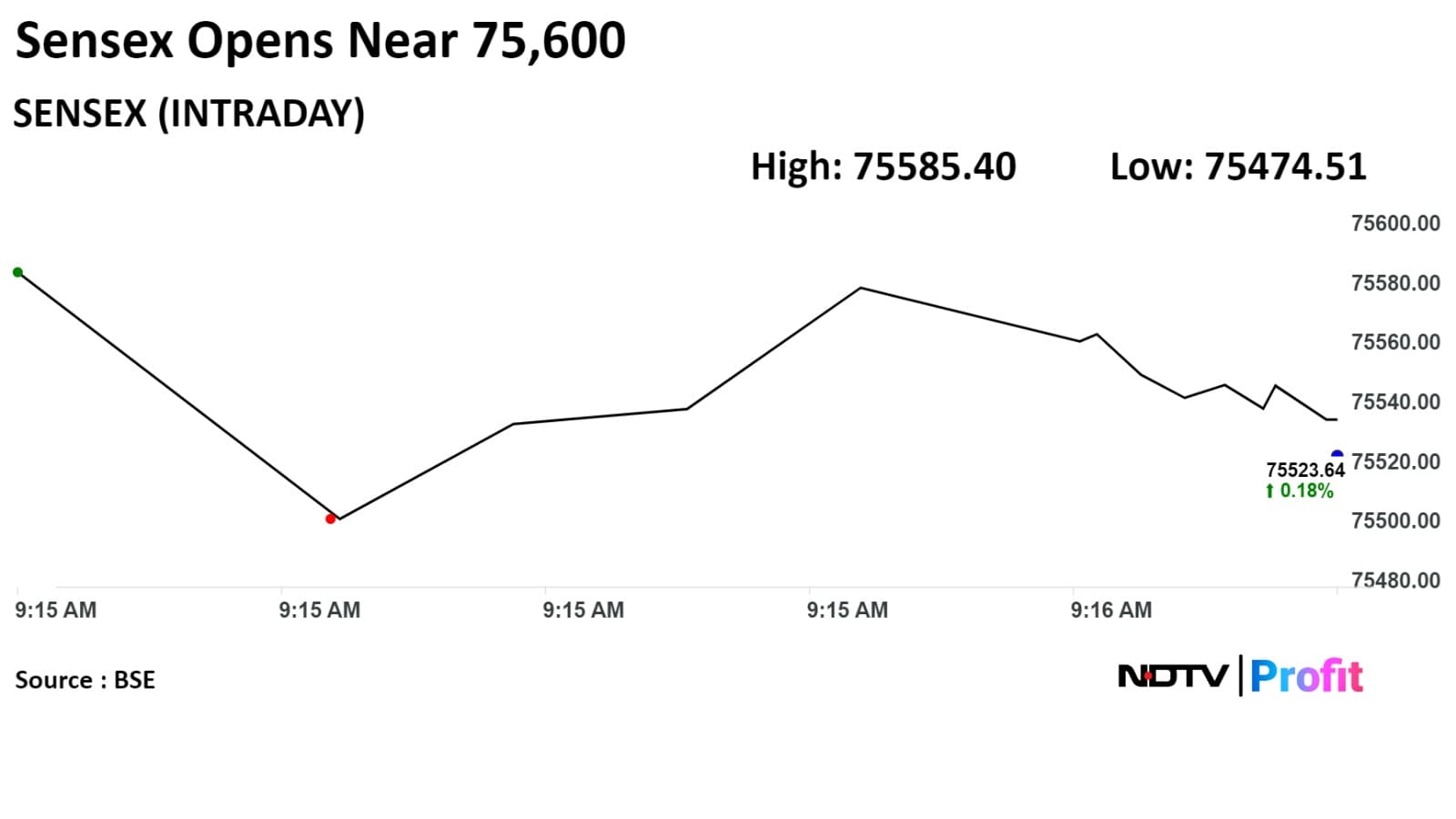

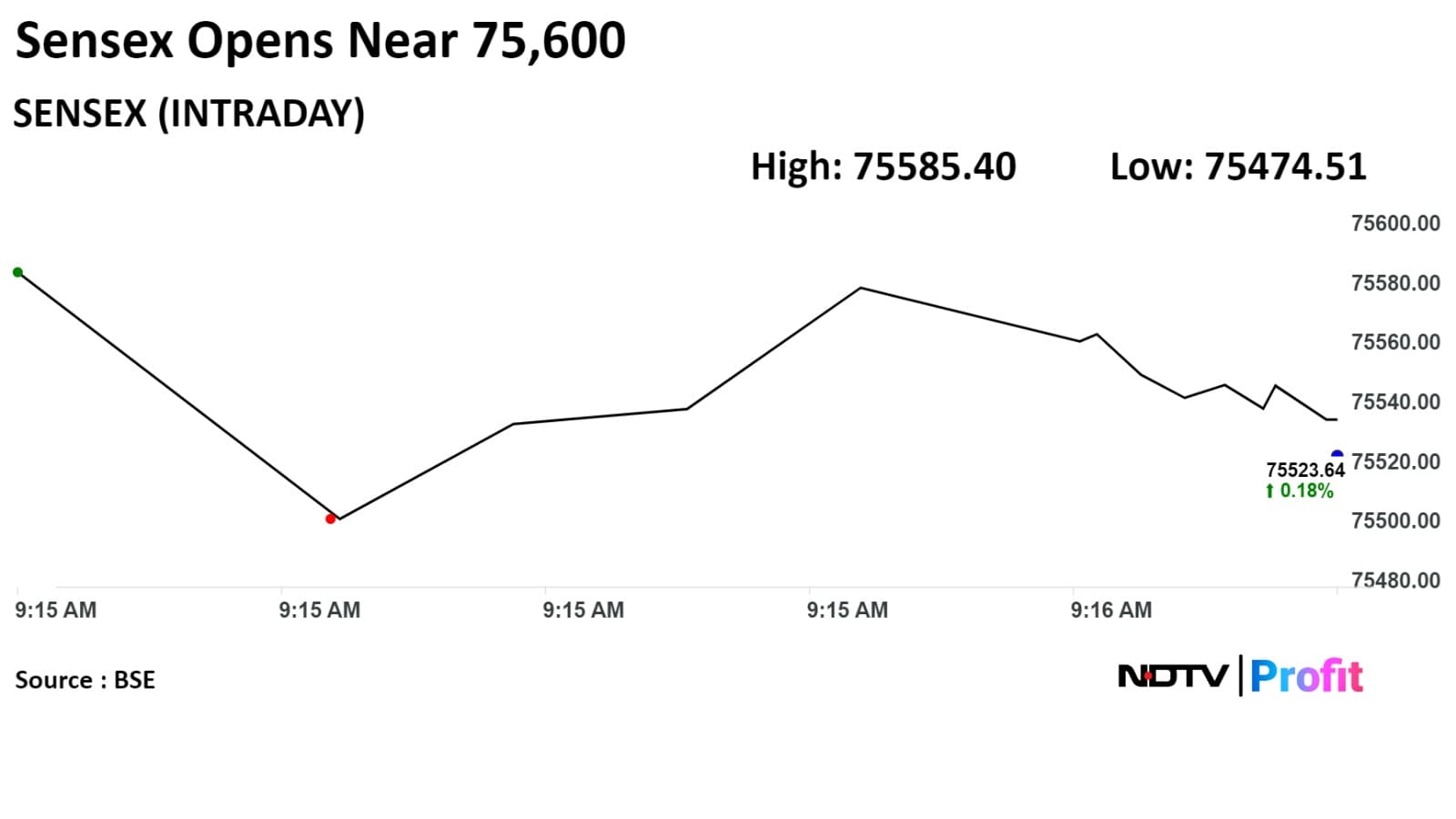

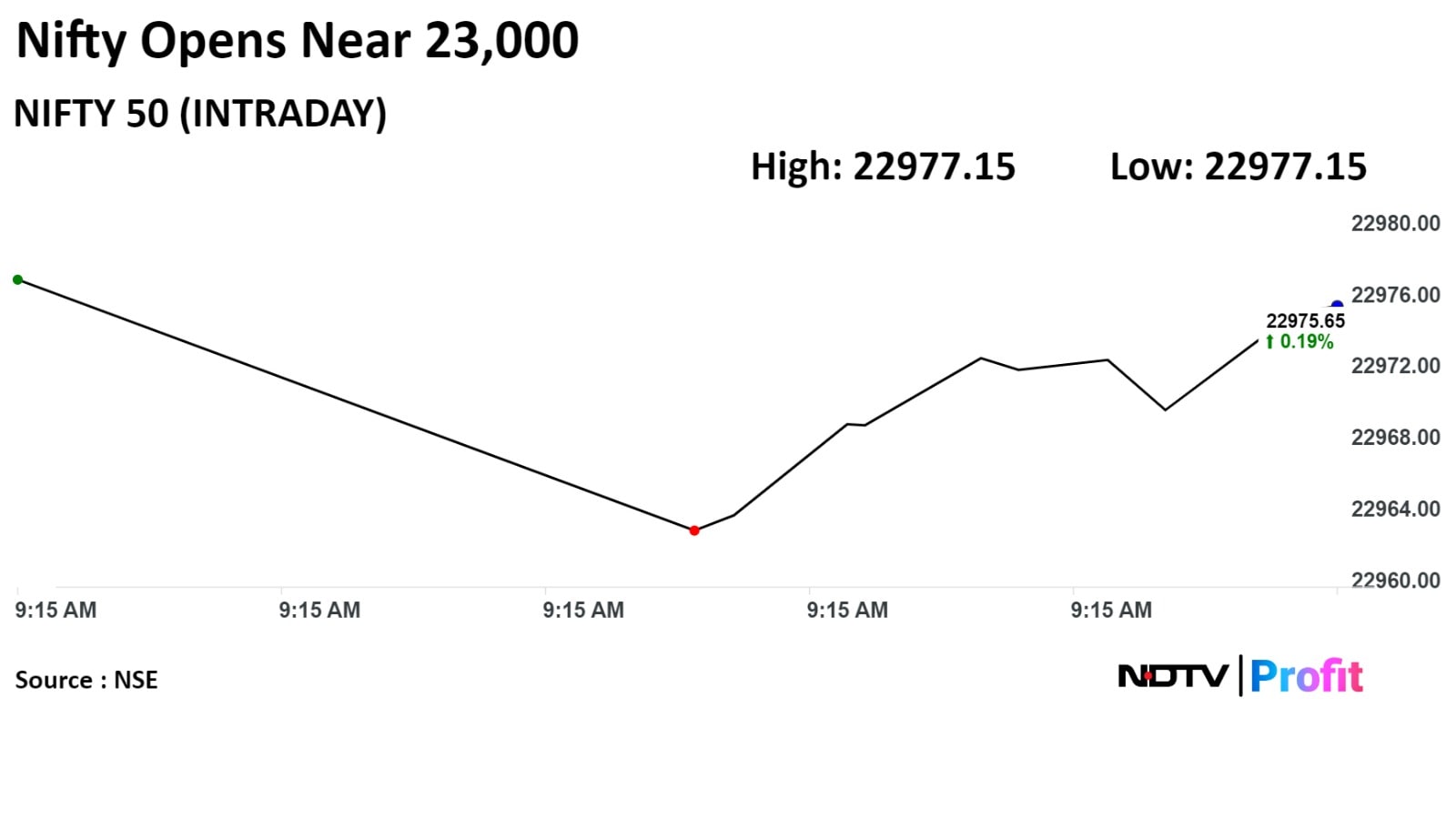

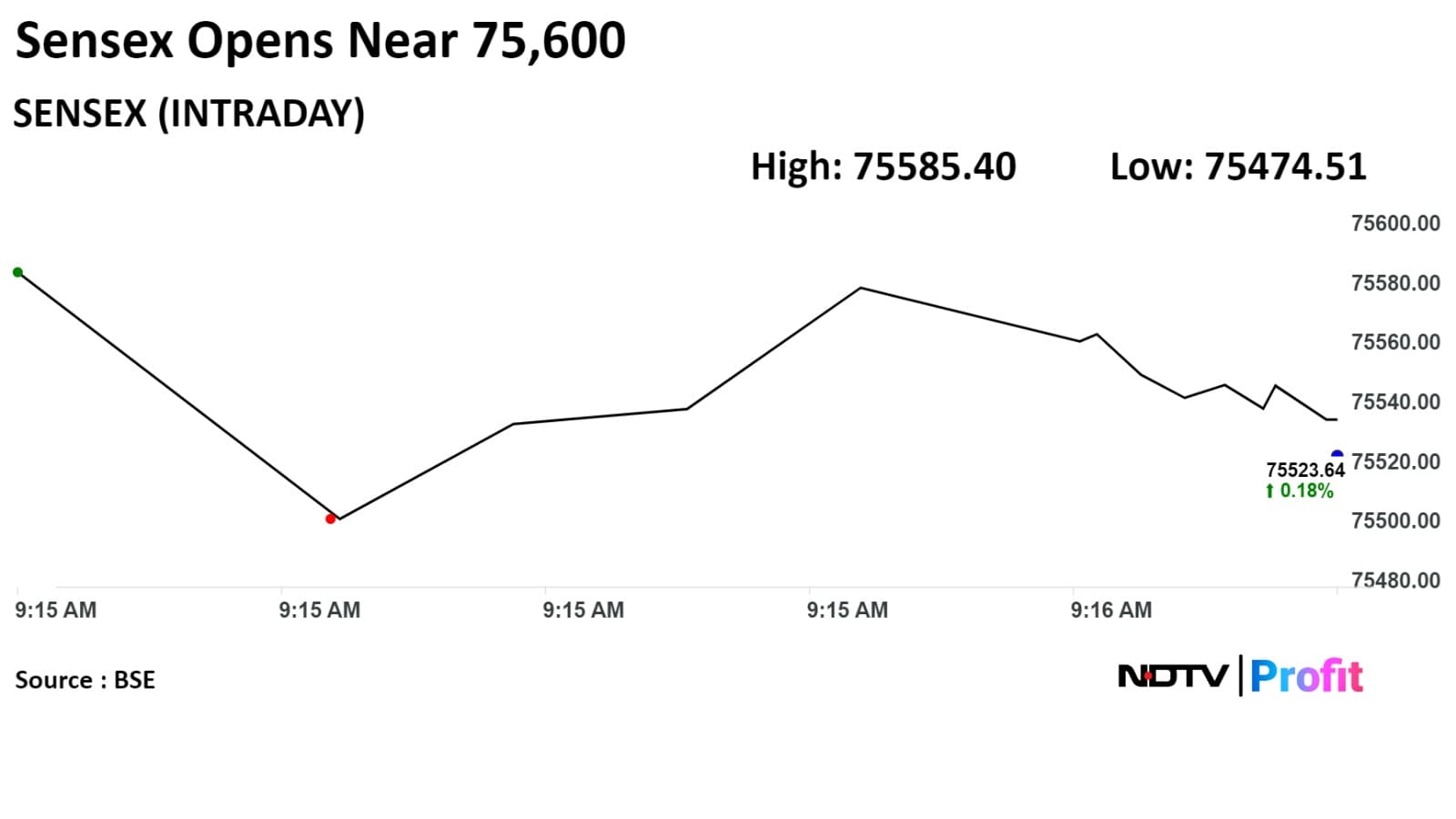

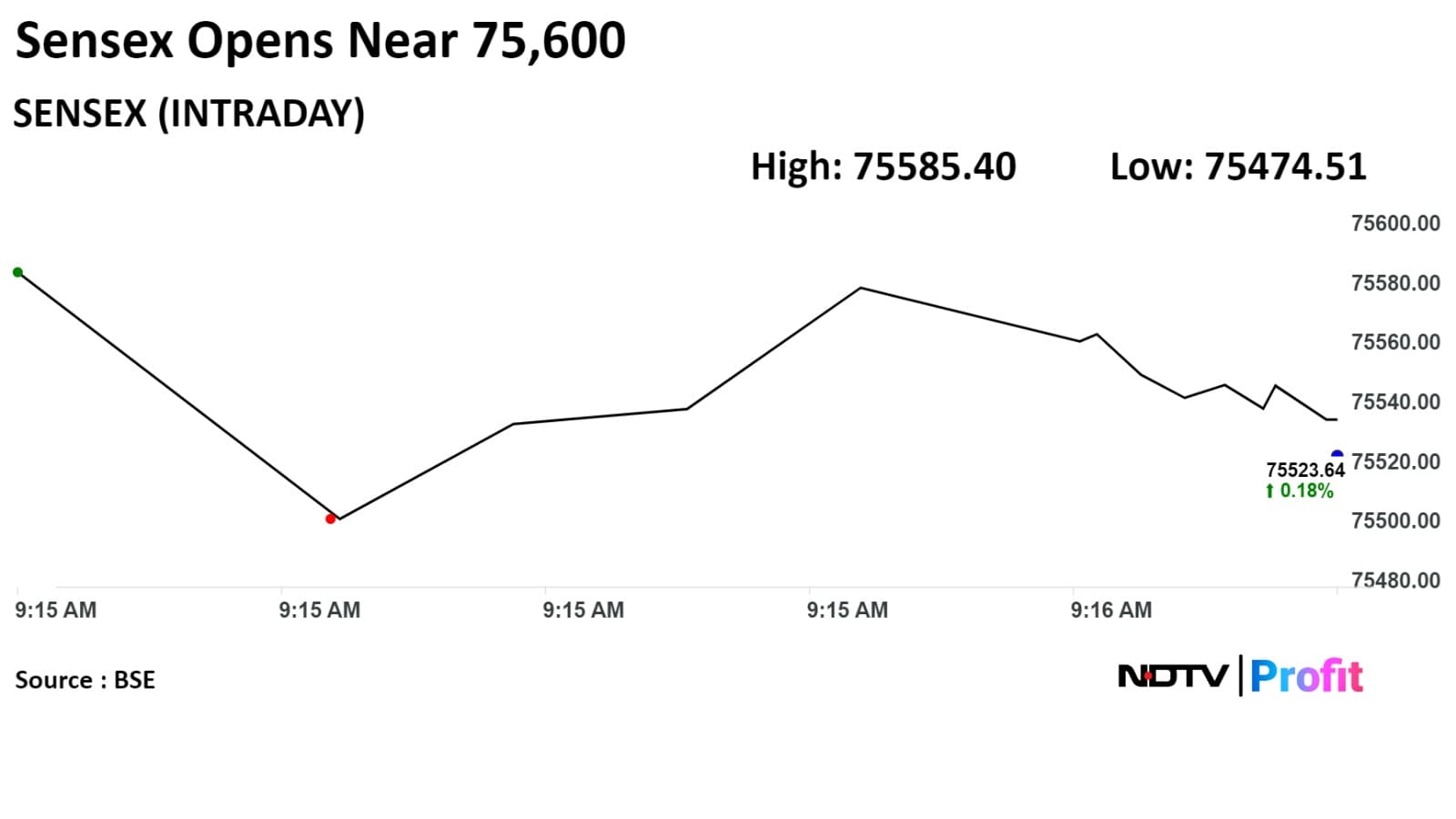

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

"A rangebound activity comes to an end on a negative note at 22,888.15 with a loss of 44.30 points. Pharma was the top performer among the sectors followed by Media while Realty and PSU banking corrected over 1%. Index up-move was mainly restricted by Broader markets as Mid and Smallcap segments witnessed a sharp profit booking correction. On the daily time frame, the Index has formed another bearish candle and with this, we hold our view of retesting a strong support of 22,780 while a level of 23,110 will be considered as immediate resistance," said Aditya Gaggar director, Progressive Shares.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

"A rangebound activity comes to an end on a negative note at 22,888.15 with a loss of 44.30 points. Pharma was the top performer among the sectors followed by Media while Realty and PSU banking corrected over 1%. Index up-move was mainly restricted by Broader markets as Mid and Smallcap segments witnessed a sharp profit booking correction. On the daily time frame, the Index has formed another bearish candle and with this, we hold our view of retesting a strong support of 22,780 while a level of 23,110 will be considered as immediate resistance," said Aditya Gaggar director, Progressive Shares.

Reliance Industries Ltd., Bharti Airtel Ltd., Infosys Ltd., ICICI Bank Ltd., NTPC Ltd. dragged the benchmark.

Asian Paints Ltd., SBI Life Insurance Co., Divi's Laboratories Ltd., Grasim Industries Ltd., HDFC Life Insurance Co. limited losses in the index.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

"A rangebound activity comes to an end on a negative note at 22,888.15 with a loss of 44.30 points. Pharma was the top performer among the sectors followed by Media while Realty and PSU banking corrected over 1%. Index up-move was mainly restricted by Broader markets as Mid and Smallcap segments witnessed a sharp profit booking correction. On the daily time frame, the Index has formed another bearish candle and with this, we hold our view of retesting a strong support of 22,780 while a level of 23,110 will be considered as immediate resistance," said Aditya Gaggar director, Progressive Shares.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

"A rangebound activity comes to an end on a negative note at 22,888.15 with a loss of 44.30 points. Pharma was the top performer among the sectors followed by Media while Realty and PSU banking corrected over 1%. Index up-move was mainly restricted by Broader markets as Mid and Smallcap segments witnessed a sharp profit booking correction. On the daily time frame, the Index has formed another bearish candle and with this, we hold our view of retesting a strong support of 22,780 while a level of 23,110 will be considered as immediate resistance," said Aditya Gaggar director, Progressive Shares.

Reliance Industries Ltd., Bharti Airtel Ltd., Infosys Ltd., ICICI Bank Ltd., NTPC Ltd. dragged the benchmark.

Asian Paints Ltd., SBI Life Insurance Co., Divi's Laboratories Ltd., Grasim Industries Ltd., HDFC Life Insurance Co. limited losses in the index.

.png)

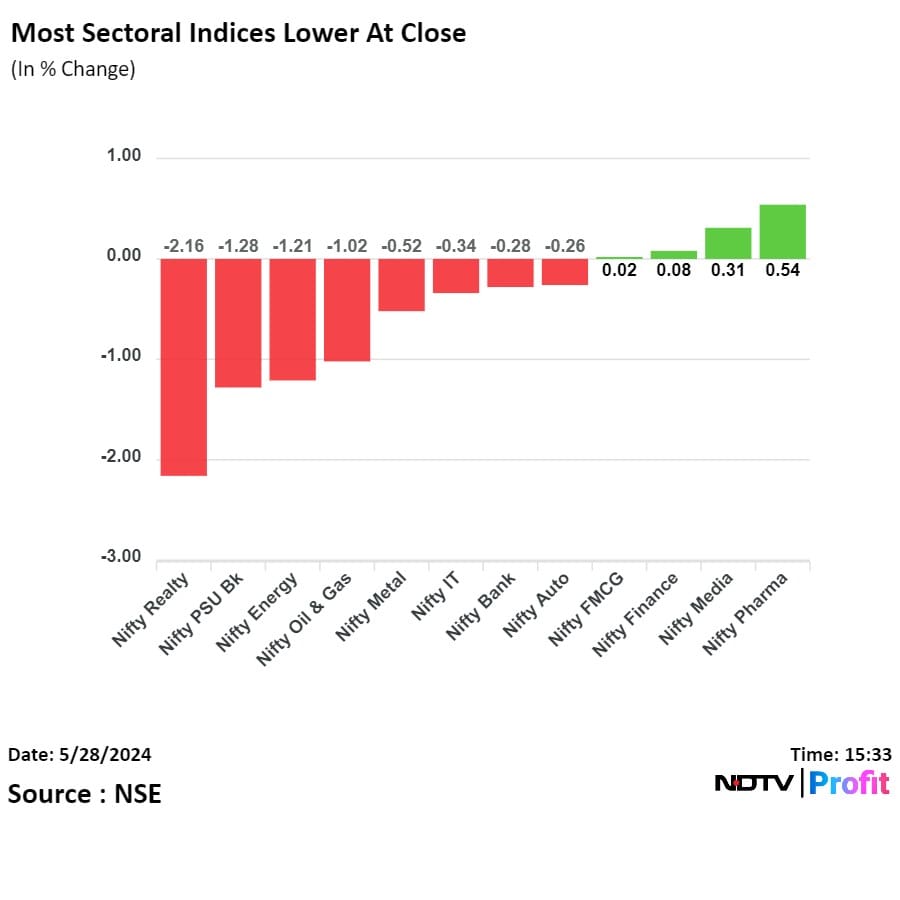

On NSE, eight sectors declined out of 12, one remained flat, and three advanced. The NSE Nifty Realty was the top loser sector, and the NSE Nifty Pharma was top gainer.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

"A rangebound activity comes to an end on a negative note at 22,888.15 with a loss of 44.30 points. Pharma was the top performer among the sectors followed by Media while Realty and PSU banking corrected over 1%. Index up-move was mainly restricted by Broader markets as Mid and Smallcap segments witnessed a sharp profit booking correction. On the daily time frame, the Index has formed another bearish candle and with this, we hold our view of retesting a strong support of 22,780 while a level of 23,110 will be considered as immediate resistance," said Aditya Gaggar director, Progressive Shares.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

"A rangebound activity comes to an end on a negative note at 22,888.15 with a loss of 44.30 points. Pharma was the top performer among the sectors followed by Media while Realty and PSU banking corrected over 1%. Index up-move was mainly restricted by Broader markets as Mid and Smallcap segments witnessed a sharp profit booking correction. On the daily time frame, the Index has formed another bearish candle and with this, we hold our view of retesting a strong support of 22,780 while a level of 23,110 will be considered as immediate resistance," said Aditya Gaggar director, Progressive Shares.

Reliance Industries Ltd., Bharti Airtel Ltd., Infosys Ltd., ICICI Bank Ltd., NTPC Ltd. dragged the benchmark.

Asian Paints Ltd., SBI Life Insurance Co., Divi's Laboratories Ltd., Grasim Industries Ltd., HDFC Life Insurance Co. limited losses in the index.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

"A rangebound activity comes to an end on a negative note at 22,888.15 with a loss of 44.30 points. Pharma was the top performer among the sectors followed by Media while Realty and PSU banking corrected over 1%. Index up-move was mainly restricted by Broader markets as Mid and Smallcap segments witnessed a sharp profit booking correction. On the daily time frame, the Index has formed another bearish candle and with this, we hold our view of retesting a strong support of 22,780 while a level of 23,110 will be considered as immediate resistance," said Aditya Gaggar director, Progressive Shares.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

India's benchmark indices ended lower for third day in a row tracking losses in shares of heavyweight Reliance Industries Ltd., and Bharti Airtel Ltd.

The NSE Nifty 50 settled 64.10 points or 0.28% lower at 22,868.35, and the S&P BSE Sensex ended 220.05 points or 0.29% down at 75,170.45.

Intraday, the NSE Nifty 50 index rose 0.29% to 22,998.55, and the S&P BSE Sensex rose 0.26% to 75,585.40.

The NSE Nifty 50index commenced the week on a jittery note, with sharp movement in the India VIX within the opening minutes on Monday. As the price action settled after the opening hour, it scaled to new life highs of 23,110, said Avdhut Bagkar technical and derivatives analyst from StoxBox.

The index is anticipated to continue to attract further bullish strength by decisively breaking out of the channel, he added.

The Asian market was narrowly mixed this morning as investors awaited a band of global inflation prints for direction. Indian market was seen opening a little changed on Tuesday as investors eagerly await the 2024 Lok Sabha election results, Bagkar said.

"A rangebound activity comes to an end on a negative note at 22,888.15 with a loss of 44.30 points. Pharma was the top performer among the sectors followed by Media while Realty and PSU banking corrected over 1%. Index up-move was mainly restricted by Broader markets as Mid and Smallcap segments witnessed a sharp profit booking correction. On the daily time frame, the Index has formed another bearish candle and with this, we hold our view of retesting a strong support of 22,780 while a level of 23,110 will be considered as immediate resistance," said Aditya Gaggar director, Progressive Shares.

Reliance Industries Ltd., Bharti Airtel Ltd., Infosys Ltd., ICICI Bank Ltd., NTPC Ltd. dragged the benchmark.

Asian Paints Ltd., SBI Life Insurance Co., Divi's Laboratories Ltd., Grasim Industries Ltd., HDFC Life Insurance Co. limited losses in the index.

.png)

On NSE, eight sectors declined out of 12, one remained flat, and three advanced. The NSE Nifty Realty was the top loser sector, and the NSE Nifty Pharma was top gainer.

Broader markets underperformed. The S&P BSE Midcap ended 0.63% lower and the S&P BSE Smallcap ended 1.09% lower.

Except S&P BSE Healthcare, all sectoral indices on the BSE ended lower. S&P BSE Realty fell the most.

Market breadth was skewed in the favour of sellers. Around 2,501 stocks declined, 1,320 rose and 124 remained unchanged on the BSE.

Imagicaa World's board approved raising up to Rs 600 crore via QIP

Source: Exchange Filing

Revenue up 4.6% at Rs 1,095 crore from Rs 1,046 crore

Net profit up 27.4% at Rs 173 crore from Rs 136 crore

Ebitda rose 10.3% to Rs 214 crore from Rs 194 crore

Margin rose 100 basis points to 19.6% from 18.6%

Board recommends final dividend of Rs 160 per share and special dividend of Rs 525 per share

Revenue up 4.6% at Rs 1,095 crore from Rs 1,046 crore

Net profit up 27.4% at Rs 173 crore from Rs 136 crore

Ebitda rose 10.3% to Rs 214 crore from Rs 194 crore

Margin rose 100 basis points to 19.6% from 18.6%

Board recommends final dividend of Rs 160 per share and special dividend of Rs 525 per share

Revenue down at Rs 643 crore from Rs 687 crore

Ebitda down 8.1% at Rs 176 crore from Rs 192 crore

Margin fell 50 basis to 27.4% from 27.9%

Net profit down 1.6% to Rs 137 crore from Rs 139 crore

Coal India is in a joint venture with BHEL incorporates subsidiary Bharat Coal Gasification and Chemicals.

Source: Exchange filing

Rail Vikas Nigam Ltd. merged as lowest bidder for order worth Rs 72.7 crore.

Source: Exchange filing

Revenue fell 0.3% to Rs 304 crore from Rs 304 crore

Ebitda fell 13.3% to Rs 78 crore from Rs 90 crore

Margin at 25.8% vs 29.7%

Net profit fell 4.8% to Rs 64 crore from Rs 67 crore

Revenue fell 0.3% to Rs 304 crore from Rs 304 crore

Ebitda fell 13.3% to Rs 78 crore from Rs 90 crore

Margin at 25.8% vs 29.7%

Net profit fell 4.8% to Rs 64 crore from Rs 67 crore

.png)

Revenue up 1.9% at Rs 623 crore from Rs 611 crore

Ebitda down 3.9% at Rs 77 crore from Rs 80 crore

Margin at 12.4% vs 13.1%

Net profit down 1% at Rs 57 crore from Rs 58 crore

Source: Exchange filing

Sterlite Technologies Ltd. has partnered with UK-based Connexin for gigabit connectivity around Nottinghamshire in the UK.

Source: Exchange filing

Power Grid Corp has started transmission operations for RIL's Jamnagar refinery effective May 5.

Source: Exchange filing

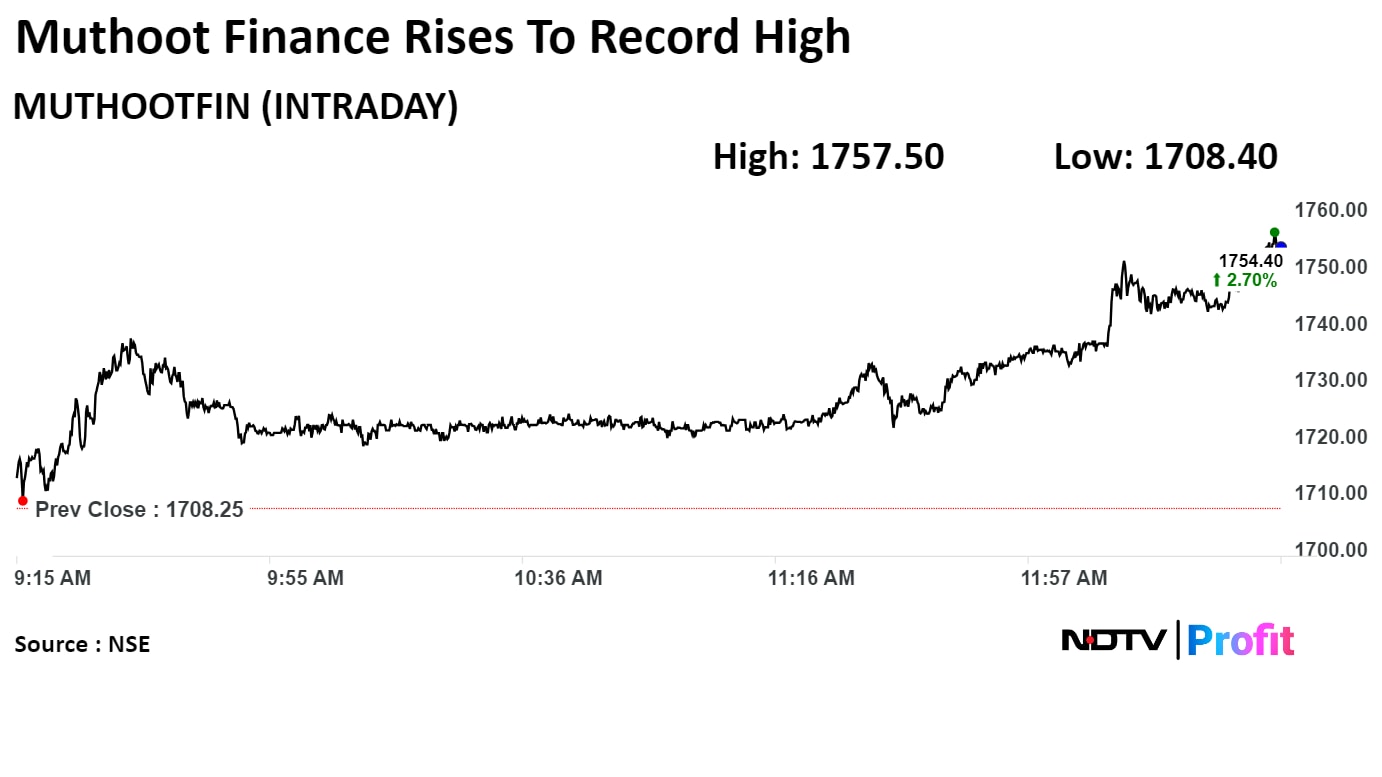

Shares of Muthoot Finance Ltd. rose 2.88% to Rs 1,757.50, the highest level since its listing on May 6, 2011. It was trading 2.75% higher at Rs 1,755.20 as of 12:40 p.m., as compared to 0.16% decline in the NSE Nifty 50 index.

The scrip gained 57.22% in 12 months, and 19.25% on year to date basis. Total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 65.40.

Out of 22 analysts tracking the company, 16 maintain a 'buy' rating, two recommend a 'hold,' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 7.1%.

Shares of Muthoot Finance Ltd. rose 2.88% to Rs 1,757.50, the highest level since its listing on May 6, 2011. It was trading 2.75% higher at Rs 1,755.20 as of 12:40 p.m., as compared to 0.16% decline in the NSE Nifty 50 index.

The scrip gained 57.22% in 12 months, and 19.25% on year to date basis. Total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 65.40.

Out of 22 analysts tracking the company, 16 maintain a 'buy' rating, two recommend a 'hold,' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 7.1%.

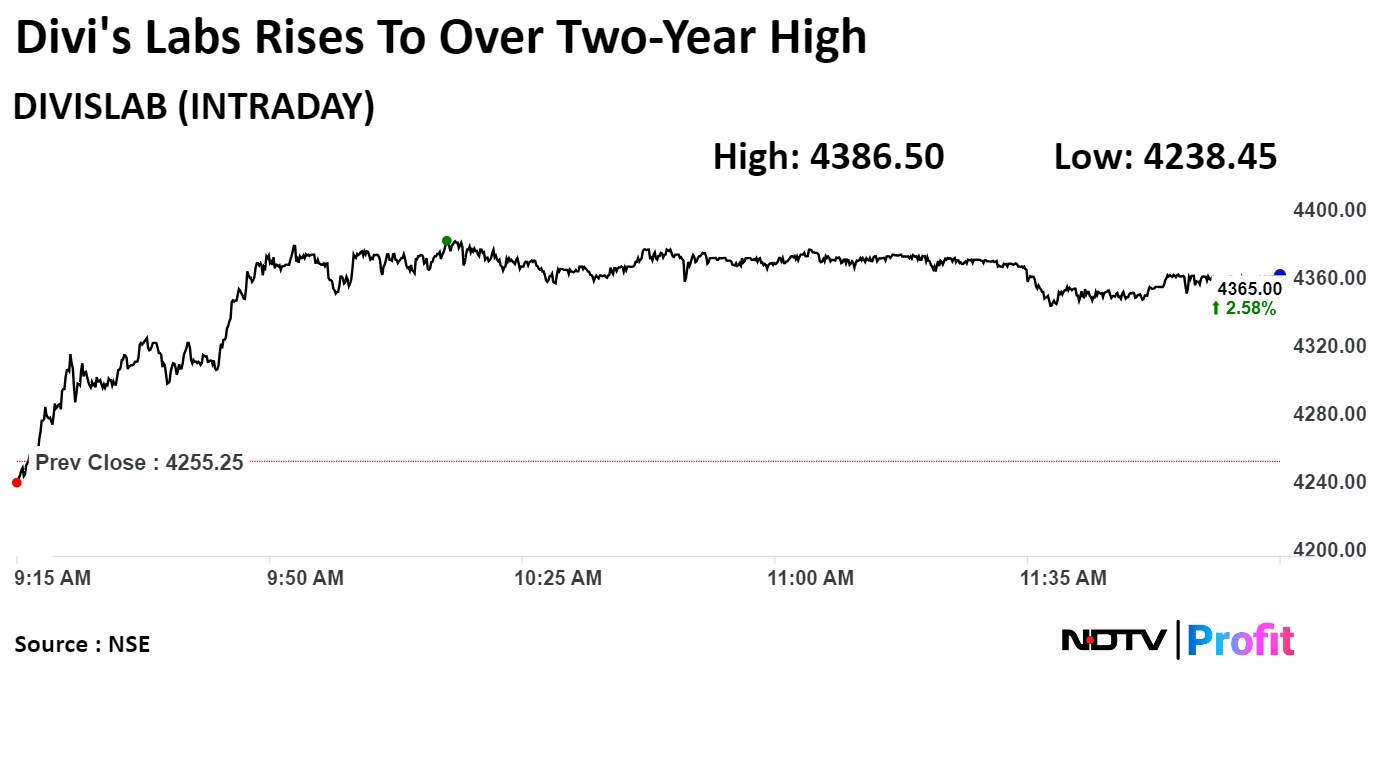

Divi's Laboratories Ltd. rose 3.08% to Rs 4,386.50, the highest level since May 23. It was trading 2.49% higher at Rs 4,361.95 as of 12:12 p.m. as compared to 0.07% advance in the NSE Nifty 50 index.

Divi's Laboratories Ltd. rose 3.08% to Rs 4,386.50, the highest level since May 23. It was trading 2.49% higher at Rs 4,361.95 as of 12:12 p.m. as compared to 0.07% advance in the NSE Nifty 50 index.

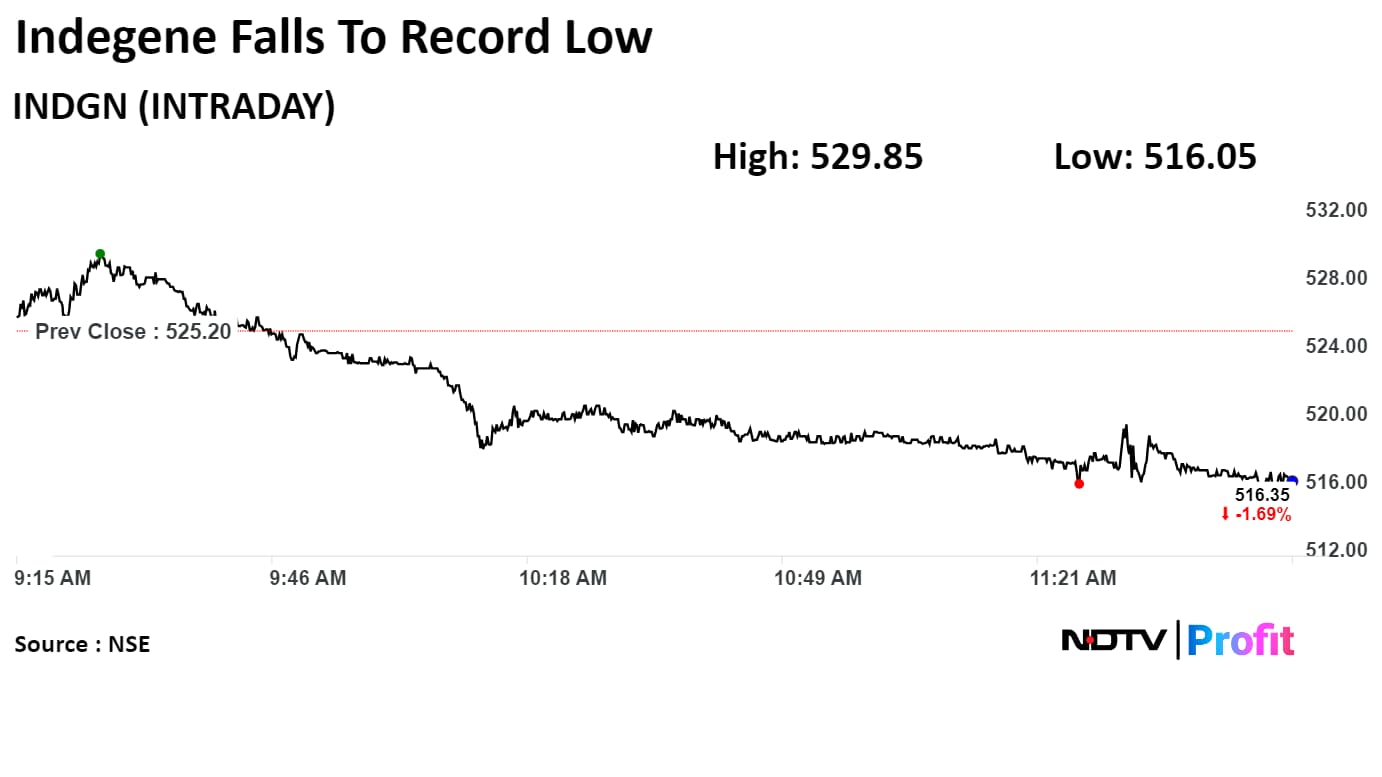

Indegene Ltd. fell 1.74% to Rs 516.05, the lowest level since its listing on May 13, 2024. It was trading 1.70% down at Rs 516.25 as of 11:55 a.m., as compared to 0.08% advance in the NSE Nifty 50 index.

Indegene Ltd. fell 1.74% to Rs 516.05, the lowest level since its listing on May 13, 2024. It was trading 1.70% down at Rs 516.25 as of 11:55 a.m., as compared to 0.08% advance in the NSE Nifty 50 index.

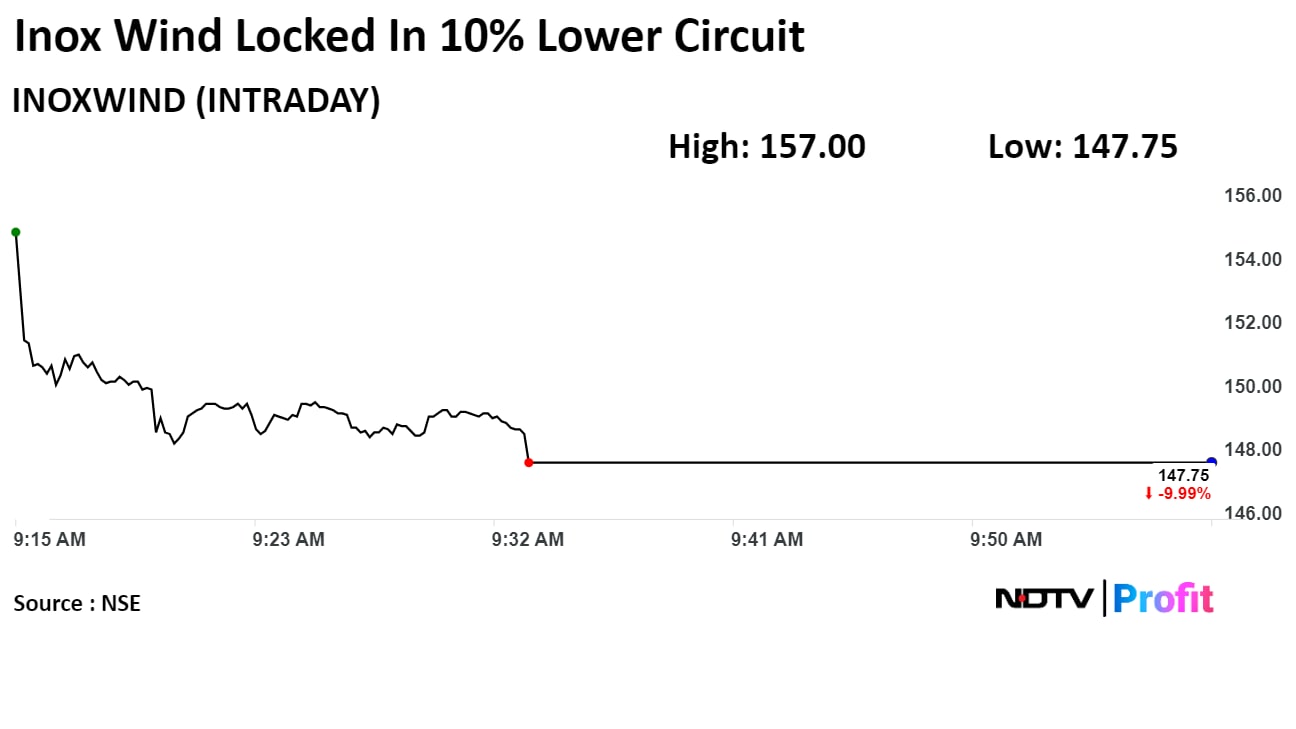

Shares of Inox Wind Ltd. were locked in a lower circuit on Tuesday after two large trades.

At least 6.03 crore shares, or 6% stake, changed hands in two trades at an average price of Rs 150 apiece, according to Bloomberg. The buyers and sellers have not been confirmed immediately.

Shares of Inox Wind Ltd. were locked in a lower circuit on Tuesday after two large trades.

At least 6.03 crore shares, or 6% stake, changed hands in two trades at an average price of Rs 150 apiece, according to Bloomberg. The buyers and sellers have not been confirmed immediately.

Shares of Inox Wind fell as much as 9.99% to hit the lower circuit of Rs 147.75 apiece on the NSE. This compares to a 0.12% advance in the benchmark Nifty 50 as of 9:55 a.m.

The stock has risen 340% in the last 12 months and 18% on a year-to-date basis. The total traded volume so far in the day stood at 72 times its 30-day average. The relative strength index was at 49.

All four analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 19.8%.

Adani Enterprises Ltd. has approved the plan to raise Rs 16,600 crore via QIP and other modes in one or more tranches.

Source: Exchange filing

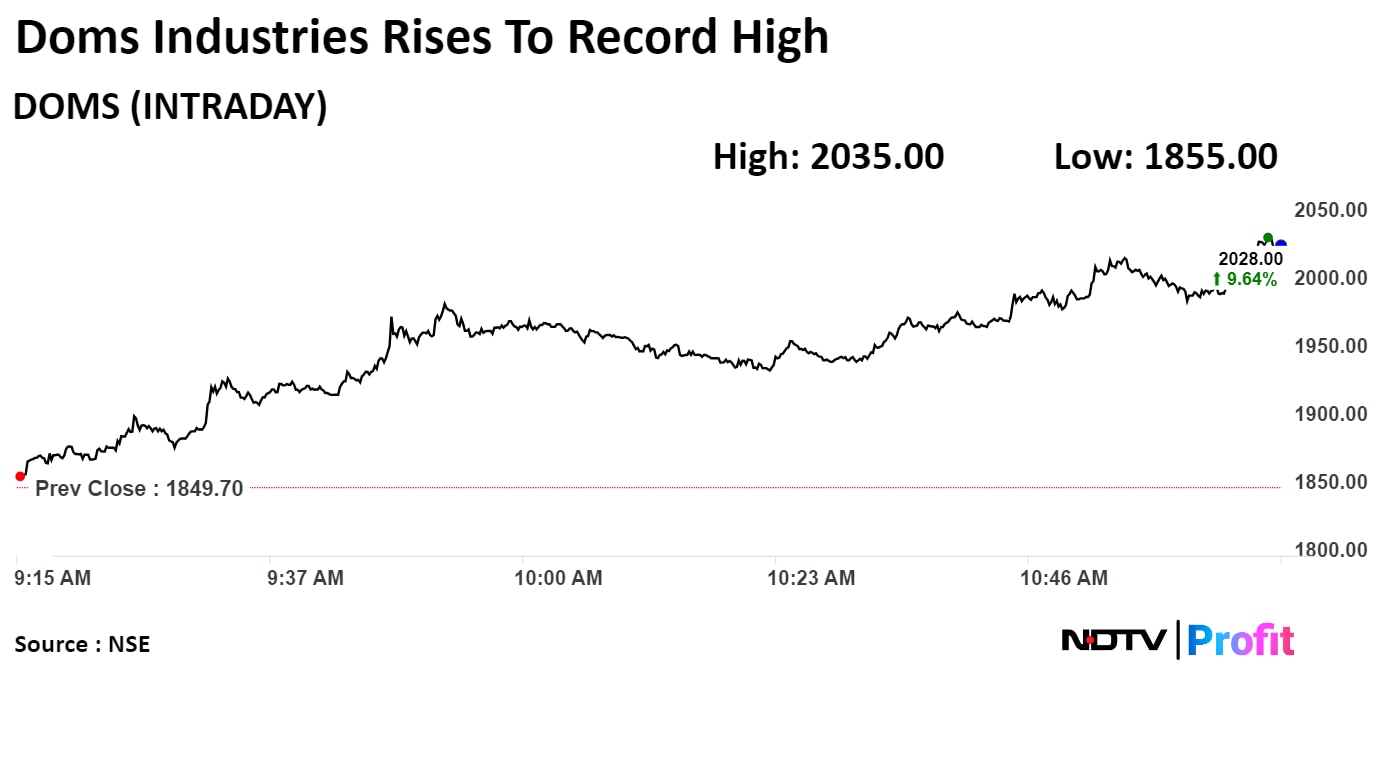

Shares of Doms Industries Ltd. rose 10.02% to Rs 2,035.00, the highest level since Dec 20, 2023. It was trading 9.84% higher at Rs 2,031.75 as of 11:12 a.m., as compared to 0.11% advance in the NSE Nifty 50 index.

The scrip gained 53.20% in over six months. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 77.91, which implied the stock is overbought.

Out of six analysts tracking the company, five maintain a 'buy' rating, one recommends a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 4.3%.

Shares of Doms Industries Ltd. rose 10.02% to Rs 2,035.00, the highest level since Dec 20, 2023. It was trading 9.84% higher at Rs 2,031.75 as of 11:12 a.m., as compared to 0.11% advance in the NSE Nifty 50 index.

The scrip gained 53.20% in over six months. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 77.91, which implied the stock is overbought.

Out of six analysts tracking the company, five maintain a 'buy' rating, one recommends a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 4.3%.

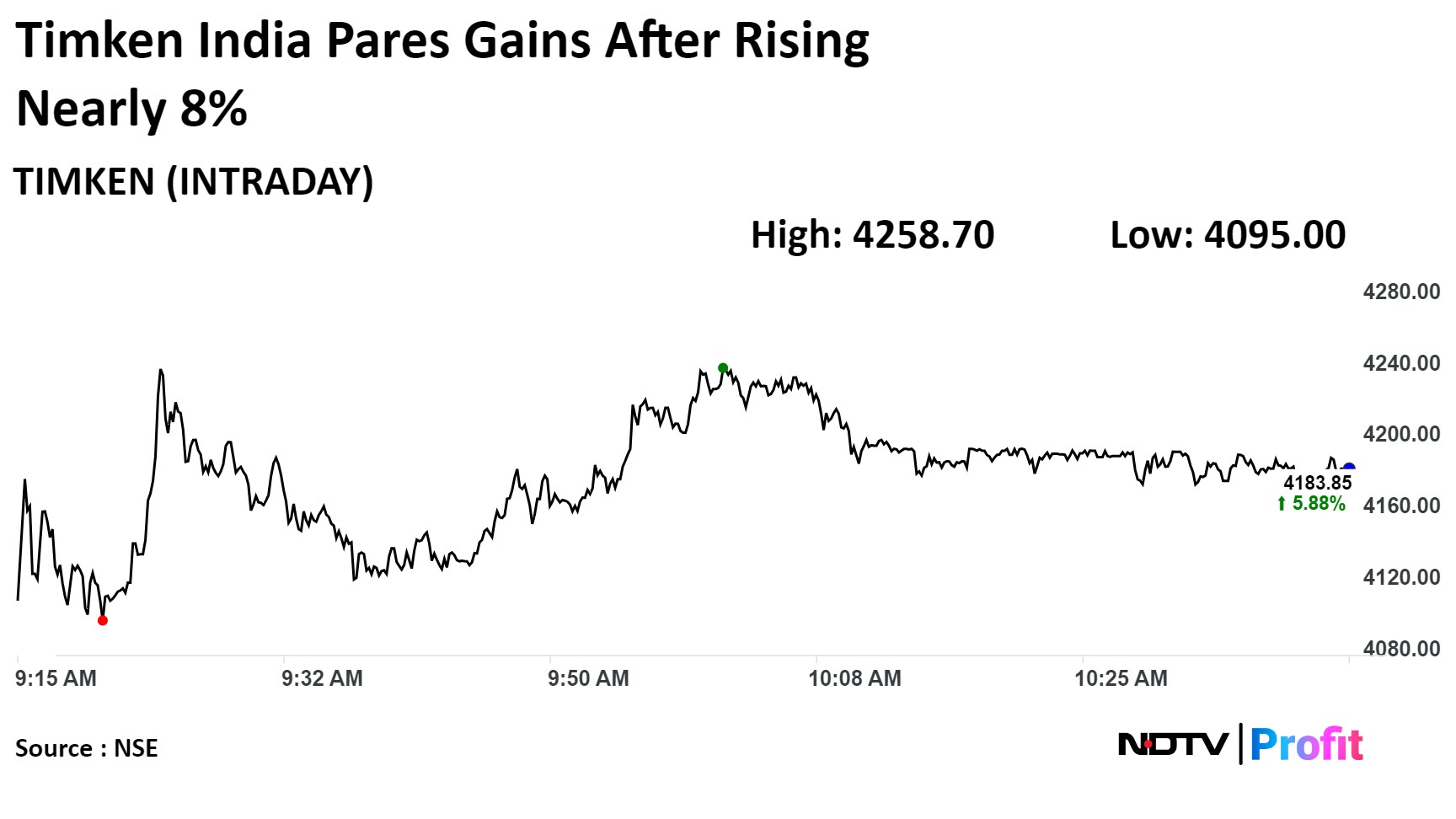

Shares of Timken India jumped nearly 8% on Tuesday after 50,00,000 shares or 6.6% stake in the company changed hands on the BSE. The buyers and sellers of this stake were not known immediately.

On the BSE, the scrip rose as much as 7.53% to Rs 4,250.45 apiece, the highest level since May 24. It pared gains to trade 5.8% higher at Rs 4,181.95 apiece, as of 10:51 a.m. This compares to a 0.16% advance in the BSE Sensex Index.

It has risen 28.55% on a year-to-date basis and 26.45% in the last 12 months. Total traded volume so far in the day stood at 81 times its 30-day average. The relative strength index was at 67.94.

Out of ten analysts tracking the company, seven maintain a 'buy' rating, one recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 16.1%.

Shares of Timken India jumped nearly 8% on Tuesday after 50,00,000 shares or 6.6% stake in the company changed hands on the BSE. The buyers and sellers of this stake were not known immediately.

On the BSE, the scrip rose as much as 7.53% to Rs 4,250.45 apiece, the highest level since May 24. It pared gains to trade 5.8% higher at Rs 4,181.95 apiece, as of 10:51 a.m. This compares to a 0.16% advance in the BSE Sensex Index.

It has risen 28.55% on a year-to-date basis and 26.45% in the last 12 months. Total traded volume so far in the day stood at 81 times its 30-day average. The relative strength index was at 67.94.

Out of ten analysts tracking the company, seven maintain a 'buy' rating, one recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 16.1%.

Bharat Heavy Electricals Ltd. is in technology transfer agreement with Bhabha Atomic Research Centre.

Agreement is for 50 kilowatt alkaline electrolyser system for hydrogen production.

Source: Exchange filing

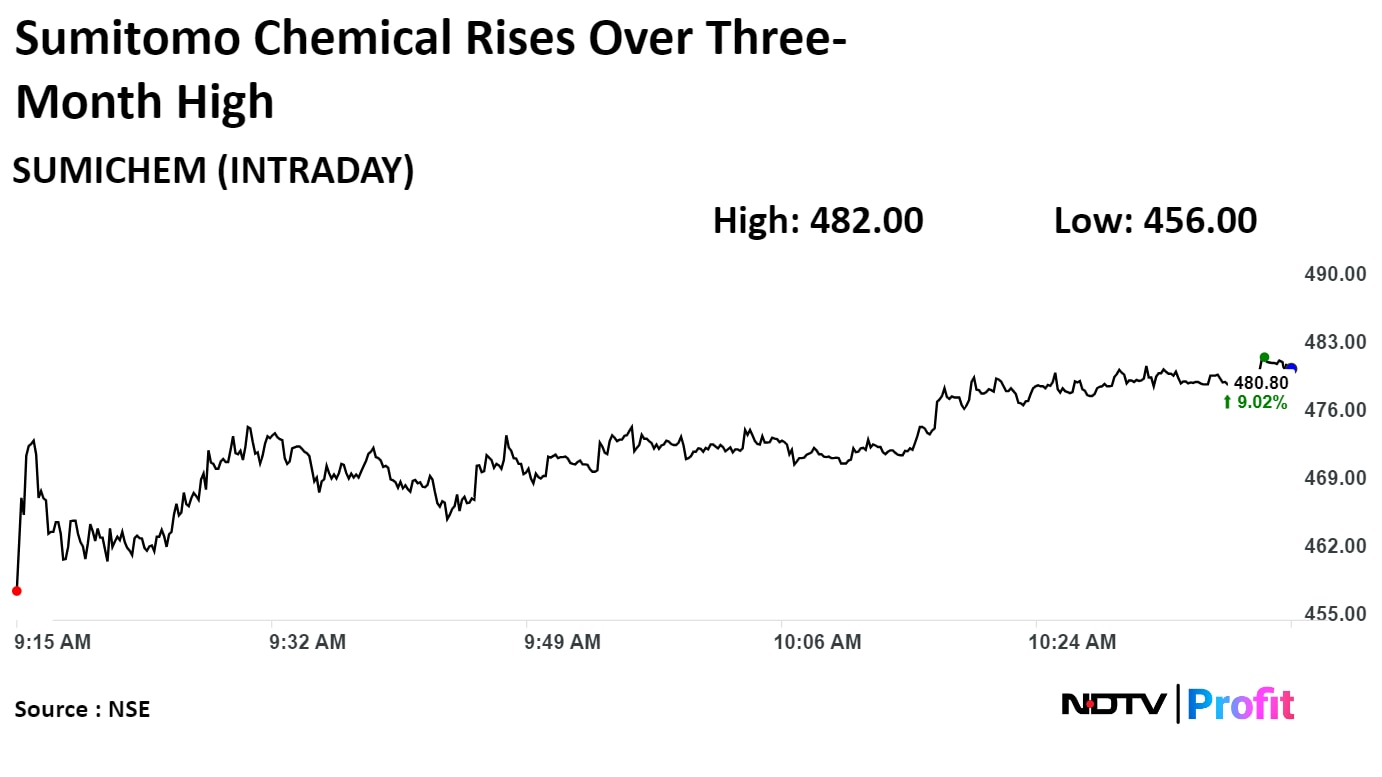

Shares of Sumitomo Chemical India Ltd. rose to their highest level in over three months after it reported higher than expected net profit.

Sumitomo Chemical India Ltd. rose 9.30% to Rs 481.15, the highest level since Feb 20. It was trading 8.83% higher at Rs 479.95 as of 10:39 a.m., as compared to 0.21% advance in the NSE Nifty 50 index.

The scrip gained 19.64% in 12 months, and 20.30% on year to date basis. Total traded volume so far in the day stood at 60 times its 30-day average. The relative strength index was at 82.16, which implied the stock is overbought.

Out of 10 analysts tracking the company, seven maintain a 'buy' rating, one recommends a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 11.6%.

Shares of Sumitomo Chemical India Ltd. rose to their highest level in over three months after it reported higher than expected net profit.

Sumitomo Chemical India Ltd. rose 9.30% to Rs 481.15, the highest level since Feb 20. It was trading 8.83% higher at Rs 479.95 as of 10:39 a.m., as compared to 0.21% advance in the NSE Nifty 50 index.

The scrip gained 19.64% in 12 months, and 20.30% on year to date basis. Total traded volume so far in the day stood at 60 times its 30-day average. The relative strength index was at 82.16, which implied the stock is overbought.

Out of 10 analysts tracking the company, seven maintain a 'buy' rating, one recommends a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 11.6%.

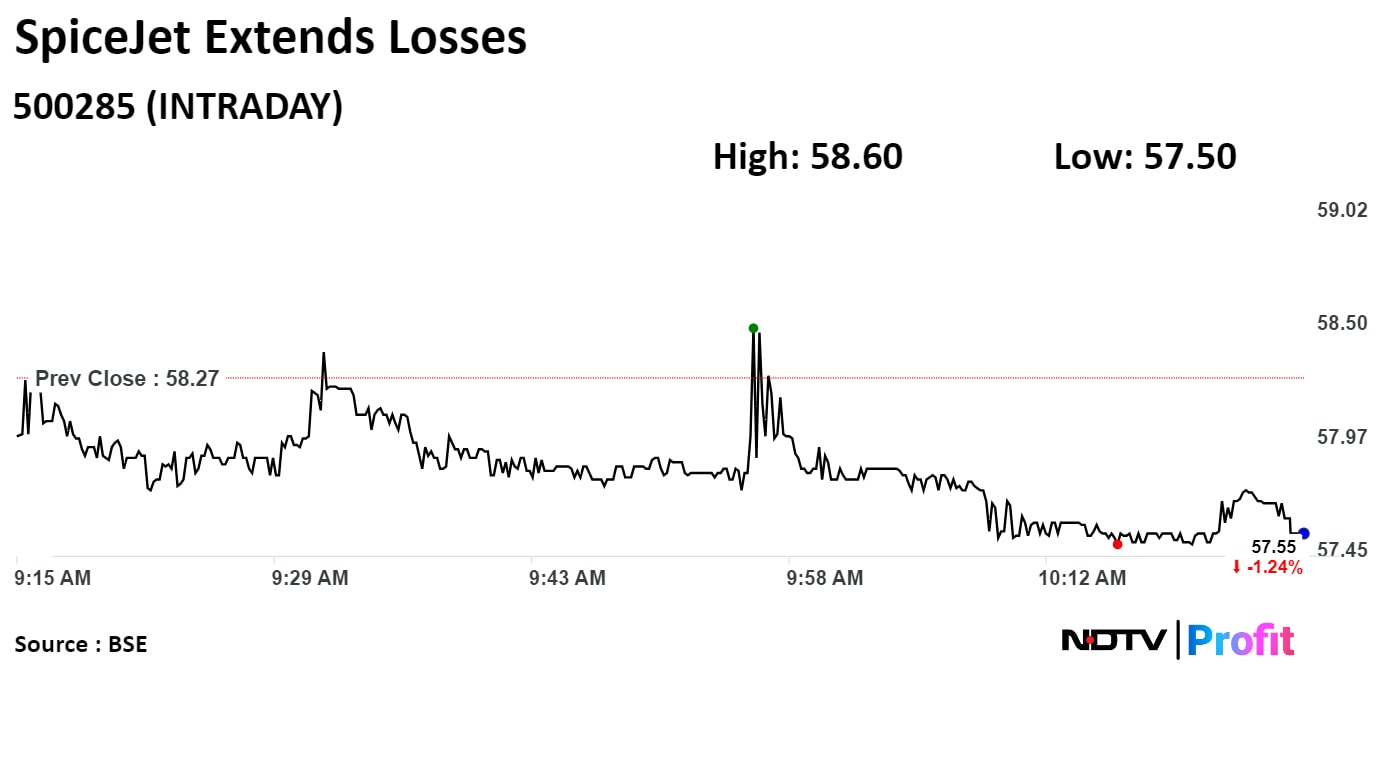

SpiceJet Ltd. has refuted claims by KAL Airways and Kalanithi Maran, and called damages claim worth Rs 1,323 crore 'baseless'.

Source: Exchange filing

SpiceJet Ltd. has refuted claims by KAL Airways and Kalanithi Maran, and called damages claim worth Rs 1,323 crore 'baseless'.

Source: Exchange filing

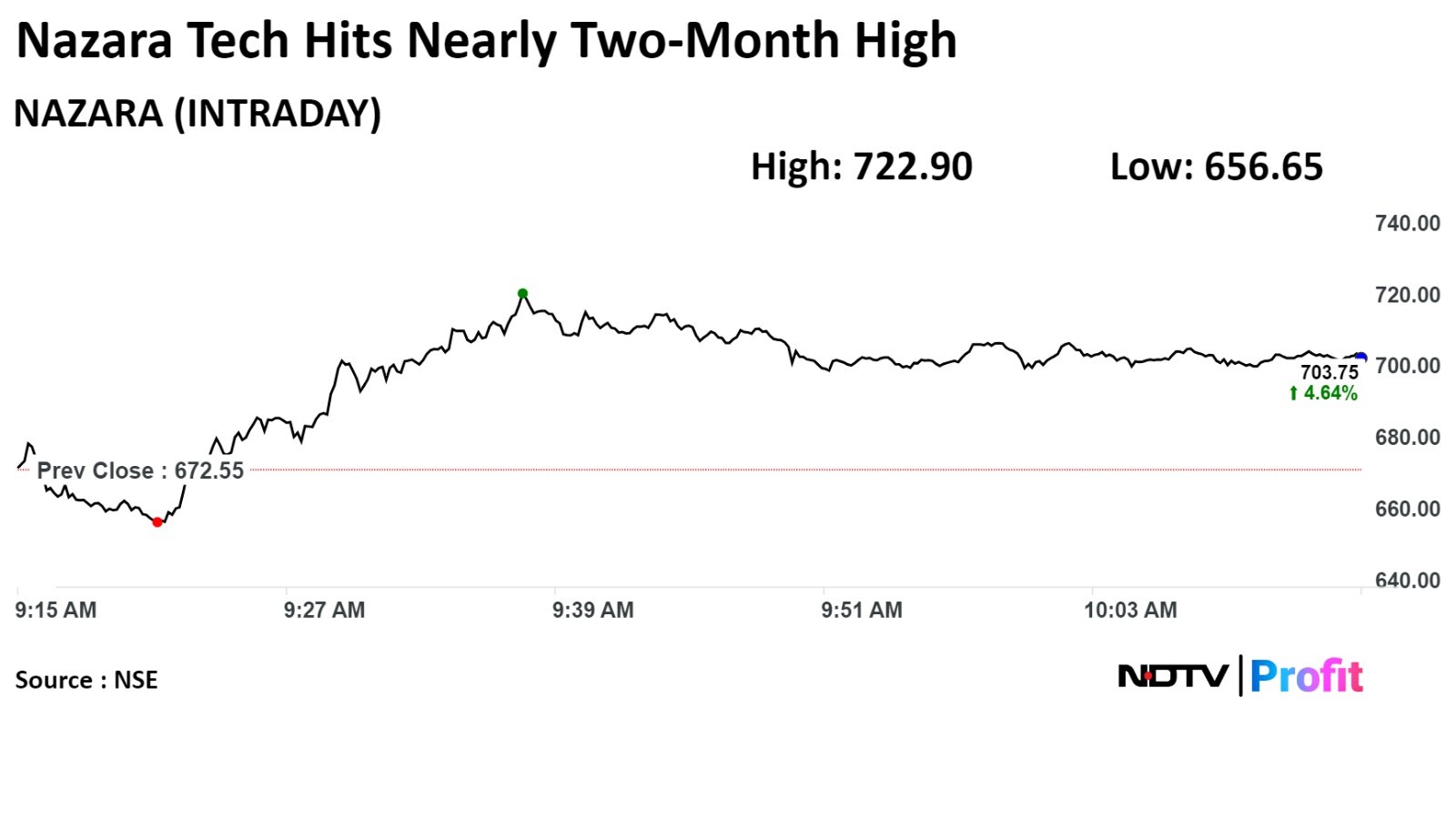

Shares of Nazara Technologies Ltd. rose to nearly two-month high after data on the exchanges on Monday showed that Plutus Wealth Management LLP has bought 48.84 lakh shares or 6.66% stake in the company at Rs 620.5 apiece.

Shares of Nazara Technologies Ltd. rose to nearly two-month high after data on the exchanges on Monday showed that Plutus Wealth Management LLP has bought 48.84 lakh shares or 6.66% stake in the company at Rs 620.5 apiece.

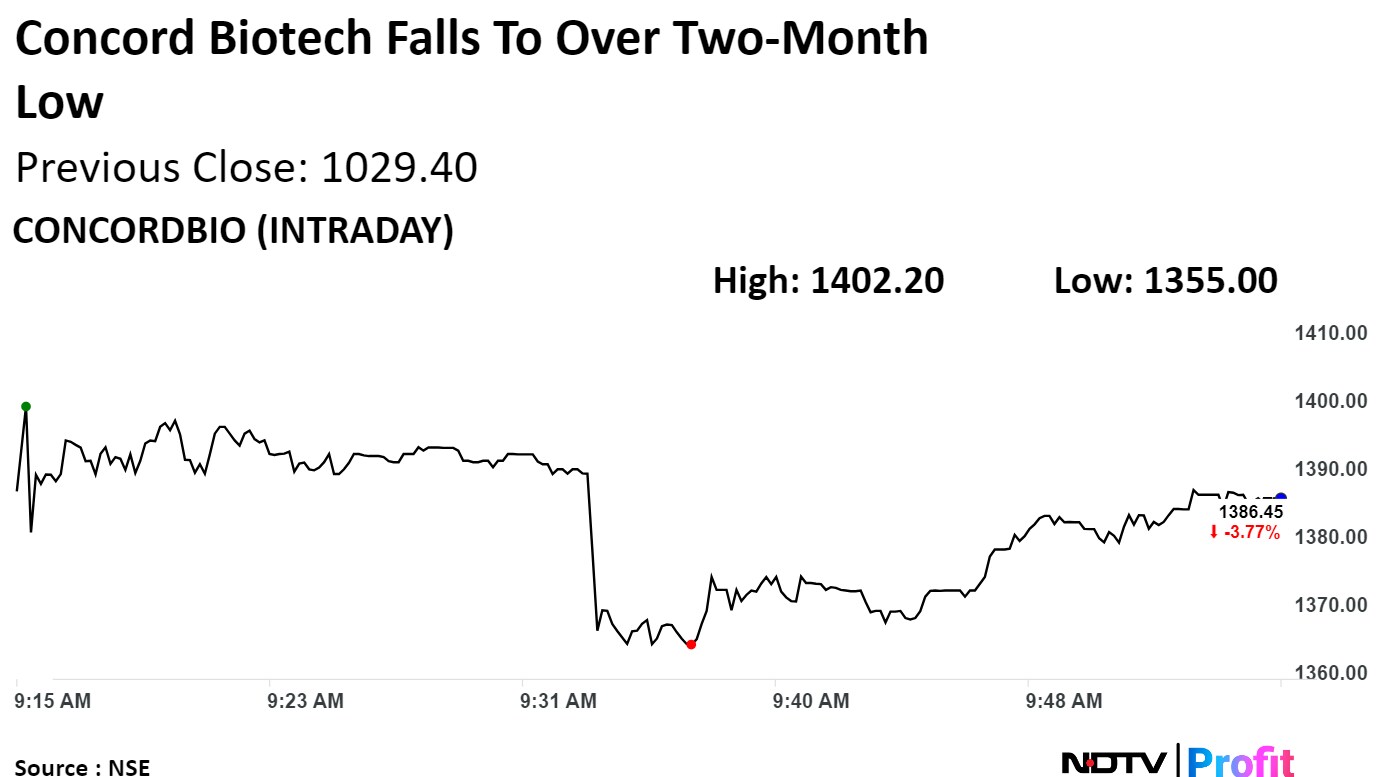

Concord Biotech Ltd. declined to over two-month low Tuesday after its 36.8 crore shares changed hands in large trade at Rs 1,400.

The total value of the large trade are Rs 515.13 crore., according to data on NSE.

The scrip fell as much as 5.95% to Rs 1,355.00 apiece, the lowest level since March 14. It was trading 3.67% lower at Rs 1,387.90 apiece, as of 10:06 a.m. This compares to a 0.10% advance in the NSE Nifty 50 Index.

It has risen 46.44% in 12 months, and declined 5.99% on year to date basis. Total traded volume so far in the day stood at 469 times its 30-day average. The relative strength index was at 30.57, which implied the stock is oversold.

Out of seven analysts tracking the company, five maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 24.7%.

Concord Biotech Ltd. declined to over two-month low Tuesday after its 36.8 crore shares changed hands in large trade at Rs 1,400.

The total value of the large trade are Rs 515.13 crore., according to data on NSE.

The scrip fell as much as 5.95% to Rs 1,355.00 apiece, the lowest level since March 14. It was trading 3.67% lower at Rs 1,387.90 apiece, as of 10:06 a.m. This compares to a 0.10% advance in the NSE Nifty 50 Index.

It has risen 46.44% in 12 months, and declined 5.99% on year to date basis. Total traded volume so far in the day stood at 469 times its 30-day average. The relative strength index was at 30.57, which implied the stock is oversold.

Out of seven analysts tracking the company, five maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 24.7%.

Shares of Natco Pharma Ltd. hit their highest level in over three months today after the company reported a higher than expected revenue and net profit in the quarter ended March.

Shares of Natco Pharma Ltd. hit their highest level in over three months today after the company reported a higher than expected revenue and net profit in the quarter ended March.

.png)

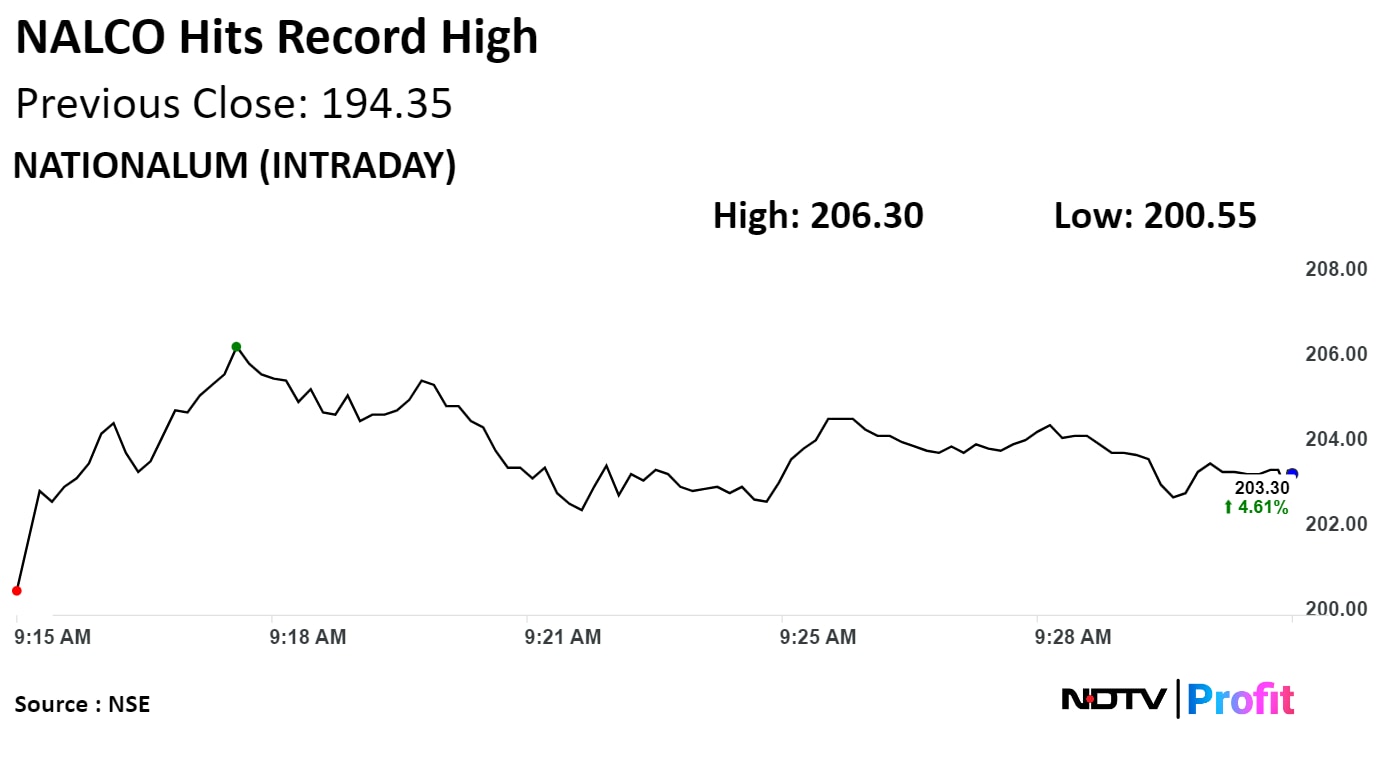

National Aluminium Co. rose 6.15% to Rs 206.30 apiece, the highest level since its listing on April 28, 1999. It was trading 4.35% higher at Rs 202.80 apiece, as of 09:34 a.m. This compares to a 0.14% advance in the NSE Nifty 50 Index.

Its consolidated net profit jumped 101.41% on the year to Rs 997 crore in January-March from Rs 495 crore.

It has risen 134.28% in 12 months, and 53.10% on year to date basis. Total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 65.97.

Out of 10 analysts tracking the company, four maintain a 'buy' rating, two recommend a 'hold,' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 23.01%.

National Aluminium Co. rose 6.15% to Rs 206.30 apiece, the highest level since its listing on April 28, 1999. It was trading 4.35% higher at Rs 202.80 apiece, as of 09:34 a.m. This compares to a 0.14% advance in the NSE Nifty 50 Index.

Its consolidated net profit jumped 101.41% on the year to Rs 997 crore in January-March from Rs 495 crore.

It has risen 134.28% in 12 months, and 53.10% on year to date basis. Total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 65.97.

Out of 10 analysts tracking the company, four maintain a 'buy' rating, two recommend a 'hold,' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 23.01%.

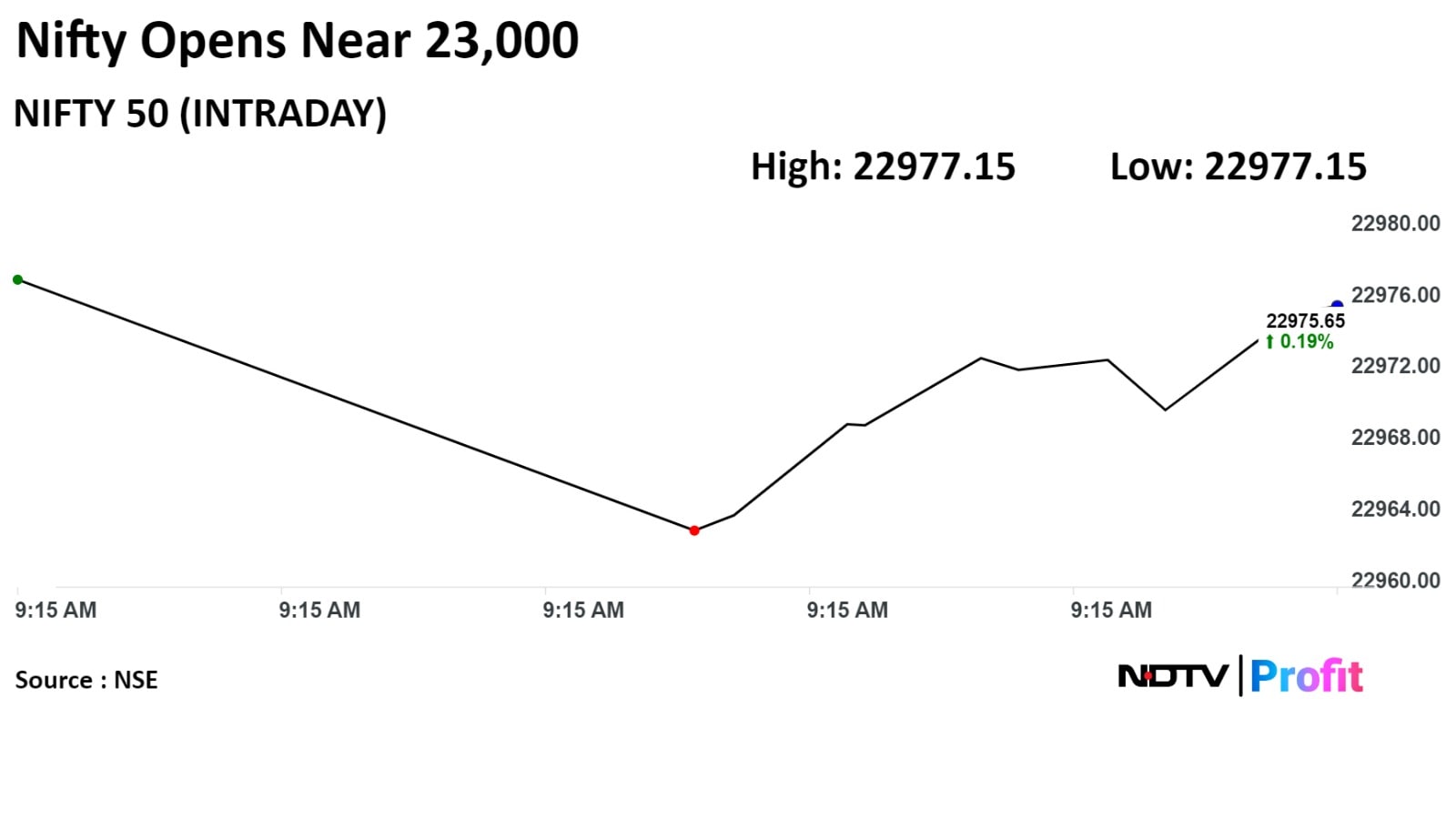

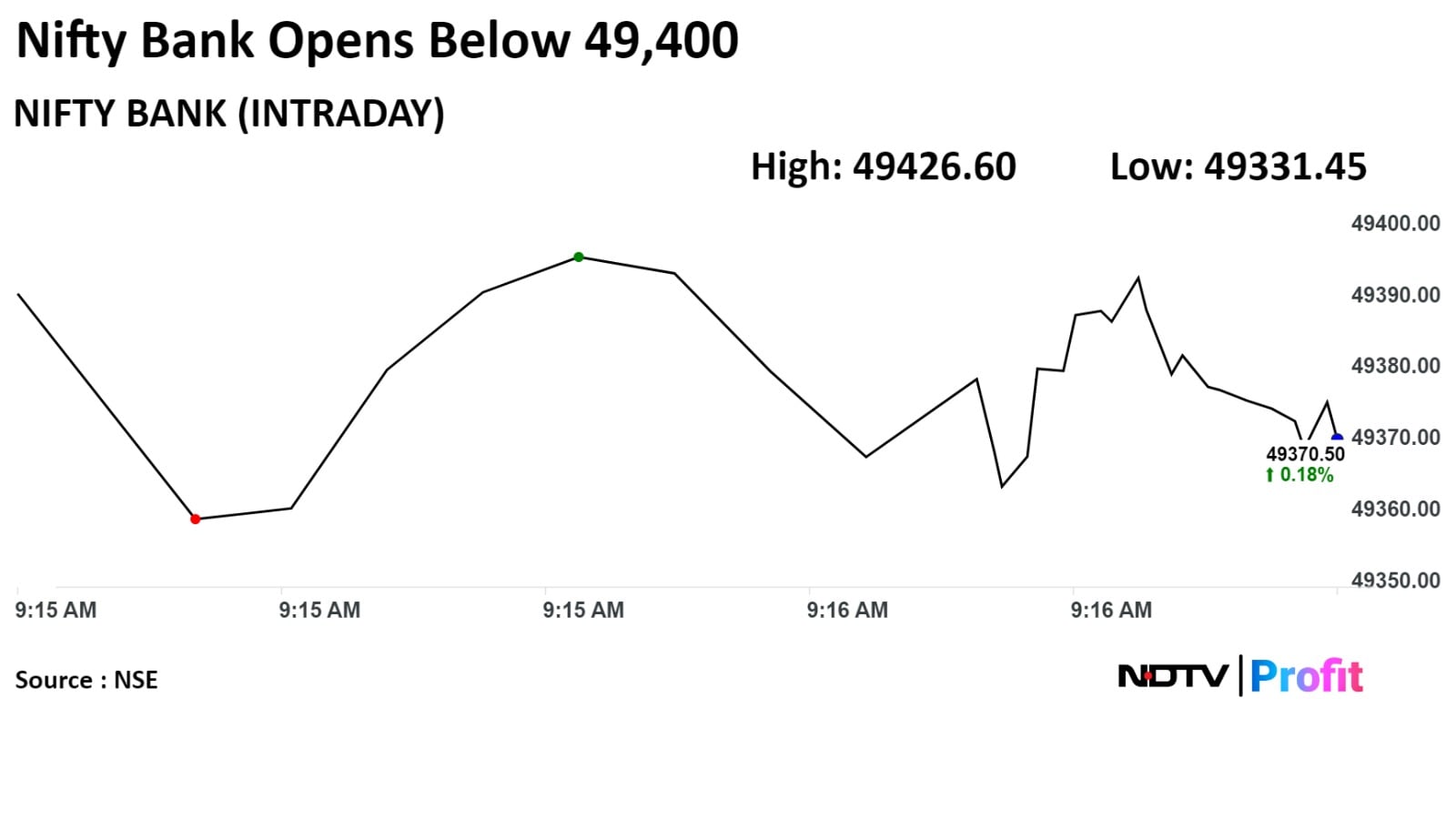

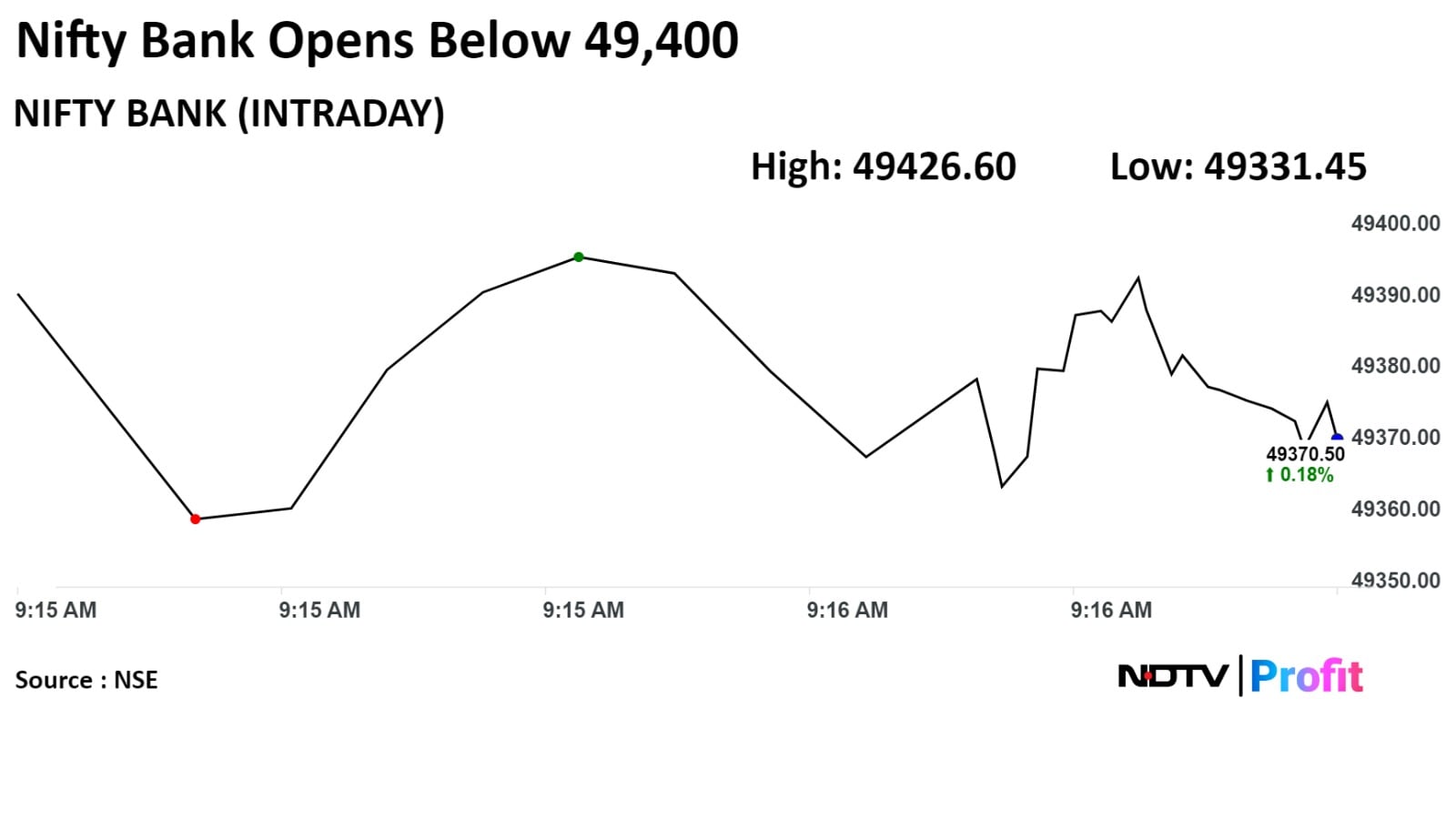

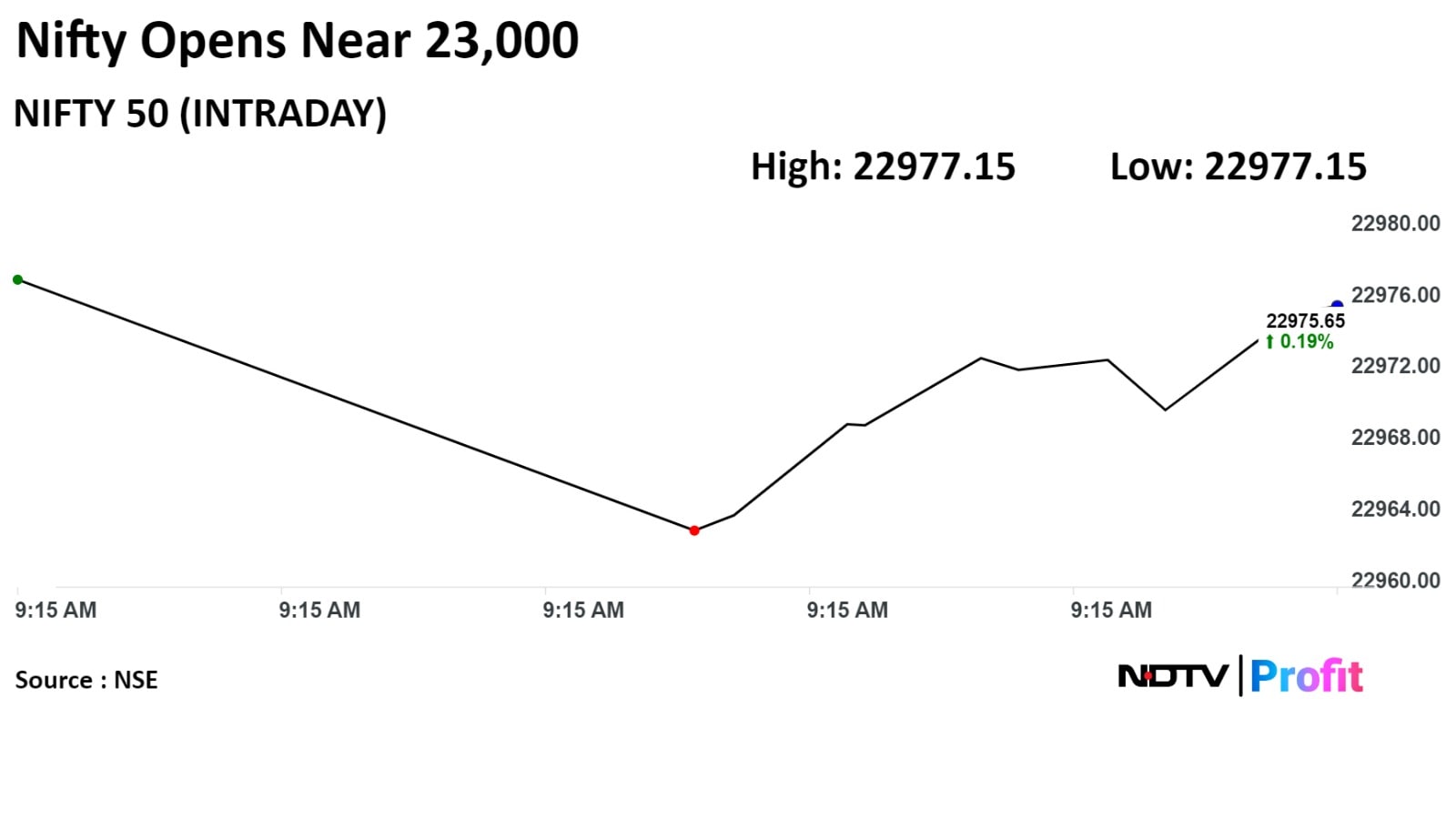

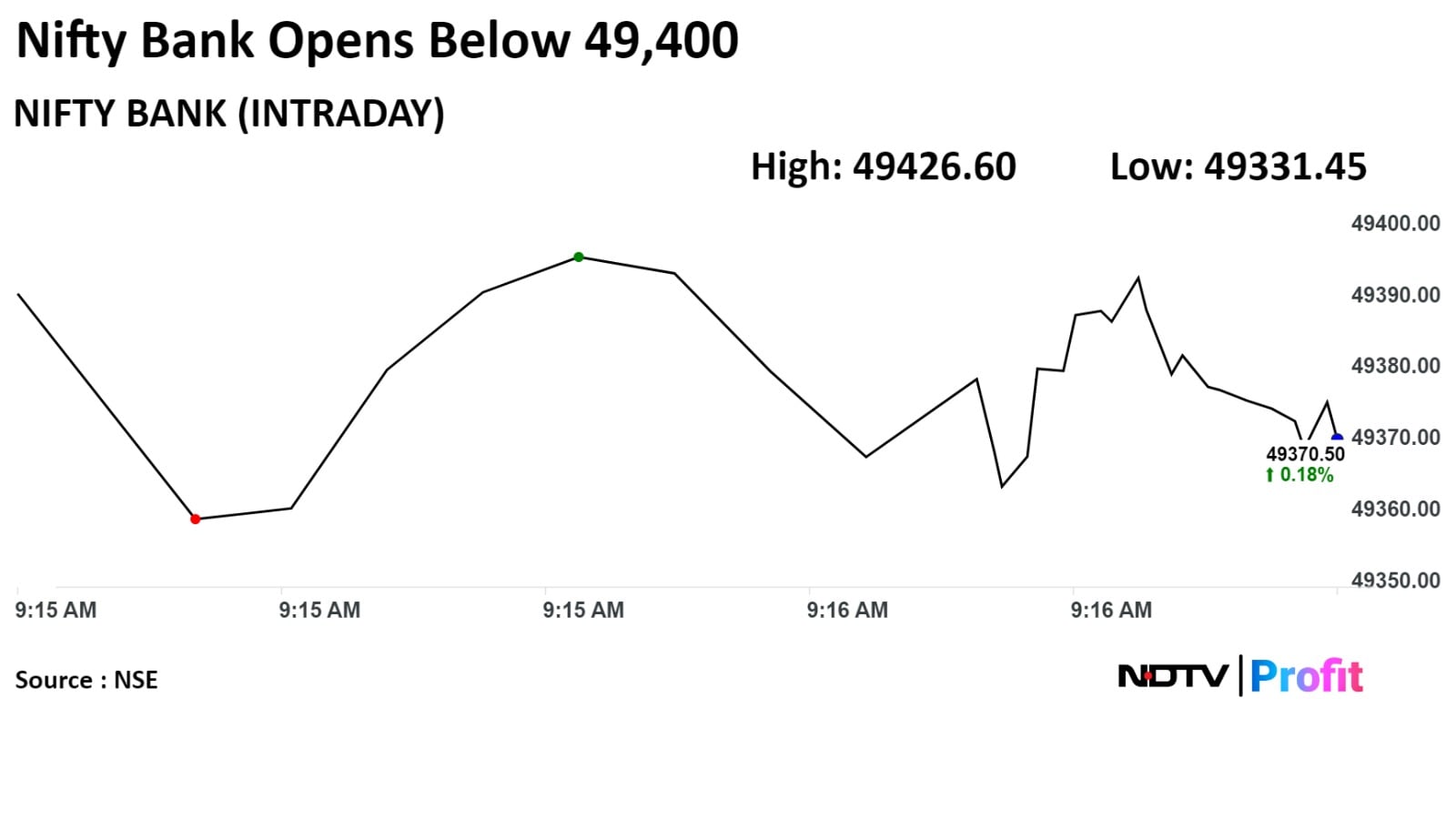

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

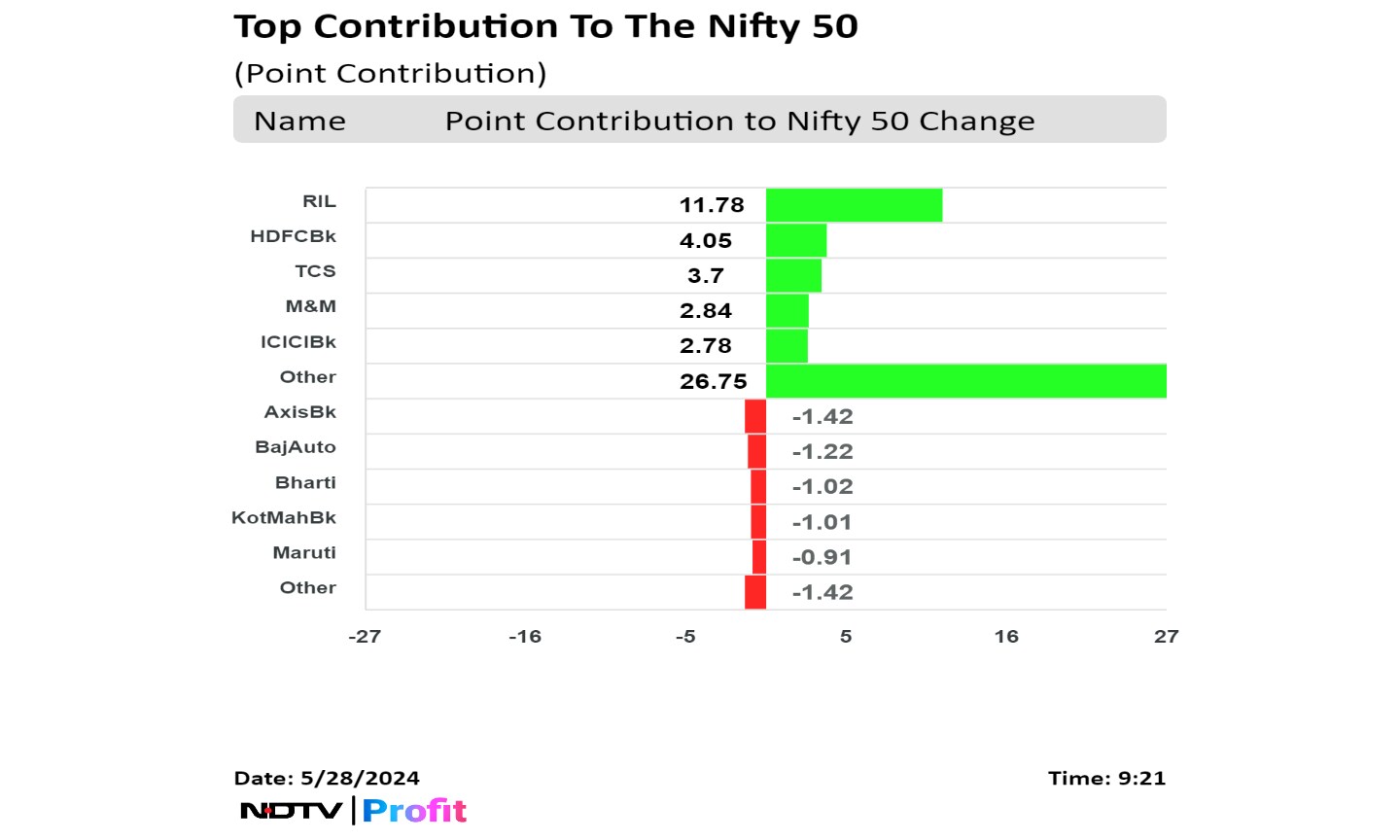

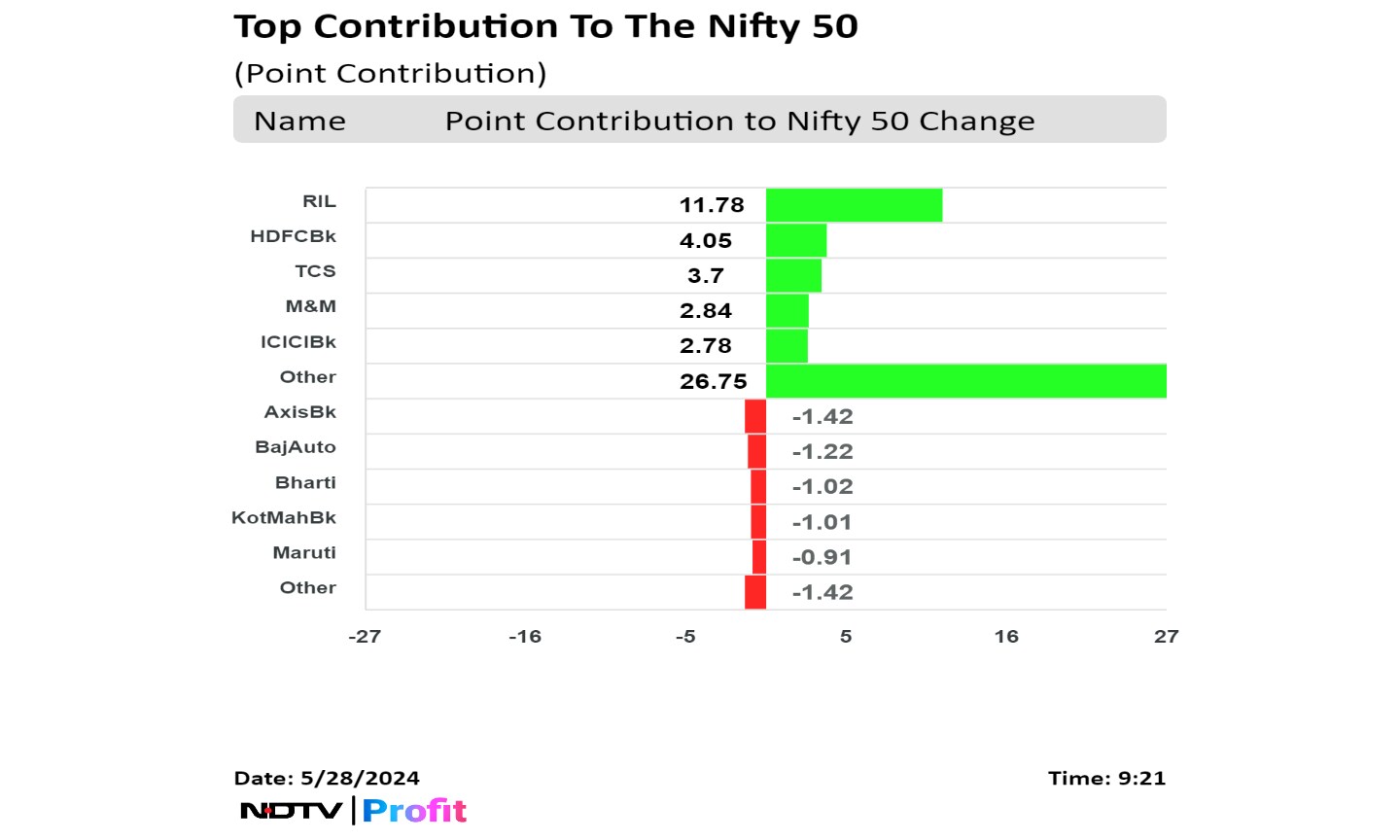

Reliance Industries Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd., Mahindra & Mahindra Ltd., and ICICI Bank Ltd added to the index.

Axis Bank Ltd., Bajaj Auto Ltd., Bharti Airtel Ltd., Kotak Mahindra Bank Ltd., and Maruti Suzuki India Ltd. weighed on the benchmark.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

Reliance Industries Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd., Mahindra & Mahindra Ltd., and ICICI Bank Ltd added to the index.

Axis Bank Ltd., Bajaj Auto Ltd., Bharti Airtel Ltd., Kotak Mahindra Bank Ltd., and Maruti Suzuki India Ltd. weighed on the benchmark.

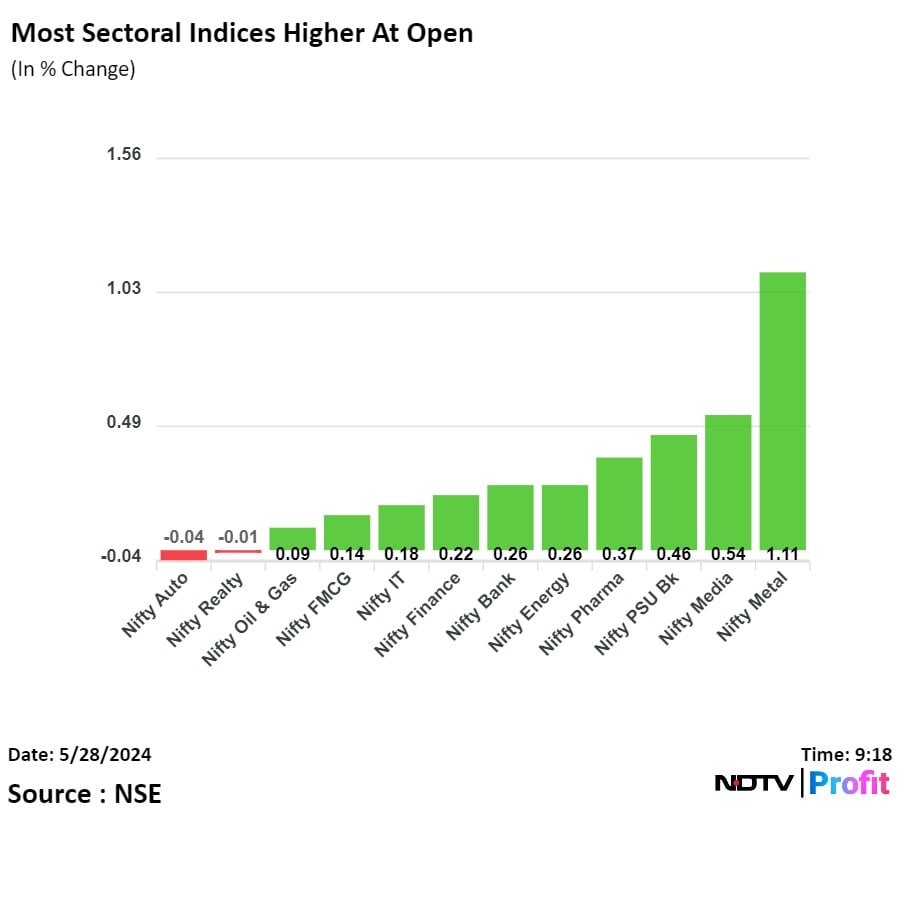

On NSE, 10 sectors advanced, one was flat, and one declined out of 12. The NSE Nifty Auto declined the most, and the NSE Nifty Metal rose the most among sectoral indices.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.

The NSE Nifty 50 scaled a new high and witnessed minor pullback from the day’s high, volatility would be high with respect to the rollover movement being the monthly expiry, said Vikas Jain, a senior research analysts at Reliance Securities.

On the higher side the resistance would be in range of 23,200- 23,400 levels being the pivot resistance and on the downside support is at 22,650 levels. RSI is overbought on the hourly charts and we expect some pullback to test the lower band of averages on multiple time frames. Highest call OI is at 23,500 strike while the downside the highest put OI is at 22,900 for the monthly expiry, Jain added.

India's benchmarks opened higher on Tuesday tracking gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd., and Mahindra & Mahindra Ltd.

As of 9:17 a.m., the NSE Nifty 50 was trading 50.85 points or 0.22% higher at 22,983.30, and the S&P BSE Sensex was trading 122.42 points or 0.16% up at 75,512.92.